Universal Credit Refund Eligibility: DWP Payments After £5 Billion In Cuts

Table of Contents

Understanding Universal Credit Refund Eligibility

A Universal Credit refund might be applicable if the DWP has made an error in calculating your payments. This could lead to an overpayment that you are not obligated to repay, or an underpayment that you are entitled to a refund for. Several scenarios could lead to a potential refund:

- Incorrect calculation of income or expenses: The DWP may have miscalculated your income, resulting in a lower payment than you're entitled to. Similarly, errors in calculating housing costs or childcare expenses can impact your overall award.

- Failure to report a change in circumstances: Life changes, such as a change in employment status, moving house, or a change in family circumstances, must be reported to the DWP. Failure to do so can lead to incorrect payments and potential entitlement to a refund if you subsequently report the change.

- Errors in the application process: Mistakes during the initial application, such as providing incorrect information or missing crucial details, can affect your Universal Credit award.

- Changes to the Universal Credit system impacting eligibility: Changes to the Universal Credit system itself, particularly following the recent cuts, might affect your eligibility retrospectively. It's important to understand how these changes impact your specific situation.

- Discrepancies in housing benefit calculations: If you receive housing benefits as part of your Universal Credit, inaccuracies in these calculations are a common reason for underpayment.

Identifying potential errors requires careful examination of your Universal Credit award. Regularly checking your online payment statements is crucial. Look for inconsistencies in reported income, expenses, and the final calculated amount. Comparing your award to your own records will help highlight any discrepancies.

How to Claim a Universal Credit Refund

Claiming a Universal Credit refund involves several key steps:

- Gathering necessary documentation: Collect all relevant documents, including payslips, bank statements, proof of housing costs (rent agreements, mortgage statements), childcare bills, and any other evidence supporting your claim. The more comprehensive your evidence, the stronger your case.

- Contacting the DWP: You can contact the DWP through various channels: their online portal, by phone, or by sending a formal letter. Keep records of all communication, including dates, times, and names of individuals you speak with.

- Completing the necessary forms: The DWP will likely require you to complete specific forms to outline your claim. Ensure accuracy and completeness to avoid delays.

- Keeping records of all communications: Maintain a detailed record of all correspondence with the DWP, including emails, letters, and notes from phone calls. This documentation is vital if your claim is rejected and you need to appeal.

For relevant DWP forms and resources, visit the official government website (link to be inserted here – replace with actual link). Clear and concise communication is key; ensure you clearly articulate the reasons for your refund request and provide sufficient evidence to support your claims.

Appealing a DWP Decision

If your initial Universal Credit refund claim is rejected, you have the right to appeal. The appeals process involves:

- Understanding the timeframe for appeals: There are strict deadlines for submitting appeals. Missing these deadlines can jeopardize your case.

- Gathering additional supporting evidence: You might need to gather additional evidence to strengthen your appeal. This may include expert opinion or witness statements.

- Knowing who to contact regarding the appeal: The first step is typically a Mandatory Reconsideration of the initial decision.

- Seeking independent advice: Organizations like Citizens Advice and Law Centres offer free, impartial advice on benefits appeals. Seeking professional help, particularly for complex cases, is highly recommended.

Further review or a tribunal hearing might be necessary depending on the outcome of the mandatory reconsideration. Maintaining meticulous records throughout the entire appeal process is crucial, as it forms the basis of your appeal.

Seeking Support and Advice

Navigating the complexities of Universal Credit and appealing DWP decisions can be challenging. Seeking assistance from organizations like Citizens Advice (link to be inserted here – replace with actual link) or other benefit advice services is strongly recommended. These organizations offer invaluable support and guidance to claimants. If your claim is complex or involves significant sums of money, seeking professional legal advice may be necessary.

Conclusion

Understanding Universal Credit refund eligibility requires careful monitoring of your payments, a thorough understanding of the claim process, and knowledge of the appeals system. Regular checks of your payment statements are vital to identify potential errors promptly. Remember to keep detailed records of all communications and gather sufficient supporting evidence for your claim or appeal. Don't hesitate to seek help from organizations like Citizens Advice if you need assistance. If you suspect you may be entitled to a Universal Credit refund due to the recent cuts or any other reason, don't delay. Take action today by reviewing your payments, gathering your evidence, and contacting the DWP or a relevant support organization to begin the Universal Credit refund claim process. Don't let potential overpayments go unaddressed; secure your entitlement to the financial support you deserve.

Featured Posts

-

Dyshime Te Medha Rreth Arsenali Pas Ndeshjes Me Psg Uefa Heton Shkelje Te Rregullores

May 08, 2025

Dyshime Te Medha Rreth Arsenali Pas Ndeshjes Me Psg Uefa Heton Shkelje Te Rregullores

May 08, 2025 -

Wall Street Predicts 110 Growth For This Black Rock Etf In 2025

May 08, 2025

Wall Street Predicts 110 Growth For This Black Rock Etf In 2025

May 08, 2025 -

Your March 2024 Ps Plus Premium And Extra Games Lineup

May 08, 2025

Your March 2024 Ps Plus Premium And Extra Games Lineup

May 08, 2025 -

Trade War And Crypto A Winning Strategy For Investors

May 08, 2025

Trade War And Crypto A Winning Strategy For Investors

May 08, 2025 -

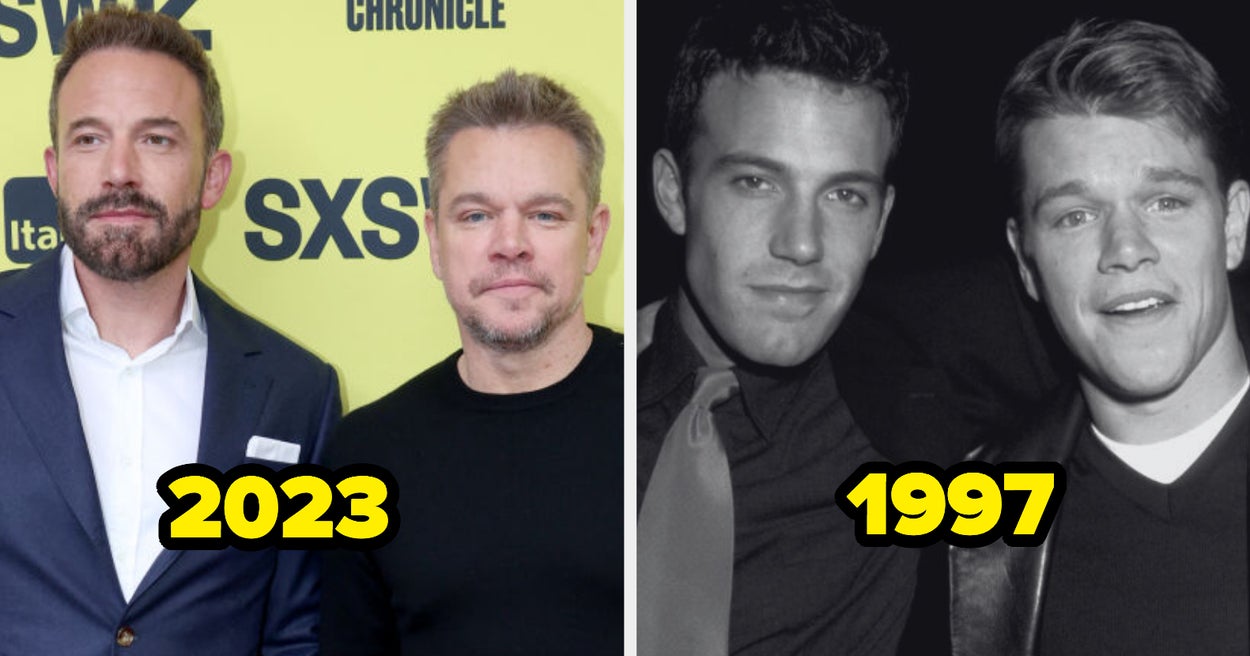

Ben Afflecks High Praise For Matt Damons Calculated Role Choices

May 08, 2025

Ben Afflecks High Praise For Matt Damons Calculated Role Choices

May 08, 2025