US-China Trade Deal Spurs Bitcoin Investment: Market Analysis

Table of Contents

The US-China Trade War and Global Market Uncertainty

The US-China trade war, with its escalating tariffs and retaliatory measures, created a period of significant global market uncertainty. Investor anxiety soared as the prospect of a protracted trade conflict threatened to disrupt supply chains, stifle economic growth, and destabilize international relations. This uncertainty led many investors to seek alternative assets to mitigate risk and diversify their portfolios. Traditional assets like stocks and bonds experienced periods of decline, prompting a search for more resilient investment opportunities.

- Increased market volatility: Trade tariffs introduced significant unpredictability, leading to sharp swings in stock prices and other traditional asset classes.

- Decline in traditional asset performance: Investors witnessed reduced returns in traditionally safe investments like government bonds, highlighting the need for diversification.

- Search for diversification and alternative investment opportunities: The uncertainty pushed investors towards assets perceived as less correlated with traditional markets, driving interest in alternatives like Bitcoin.

Bitcoin as a Safe Haven Asset

Bitcoin, with its decentralized nature and limited supply, has increasingly been viewed as a potential safe haven asset. Unlike traditional currencies controlled by governments, Bitcoin's value isn't tied to the fortunes of any single nation or its economic policies. Its decentralized structure makes it resistant to many of the factors that can negatively impact fiat currencies during times of geopolitical turmoil. This characteristic made it particularly attractive to investors seeking refuge from the uncertainty generated by the US-China trade tensions. Furthermore, the potential for long-term appreciation, driven by increased adoption and institutional interest, added to its allure.

- Decentralized nature: Bitcoin operates independently of government control, making it less susceptible to the effects of trade wars and sanctions.

- Limited supply: Bitcoin's capped supply of 21 million coins creates inherent scarcity, potentially driving long-term price appreciation.

- Increased adoption and institutional interest: Growing acceptance by institutional investors adds credibility and further fuels price increases.

Analyzing the Correlation Between Trade Deal Developments and Bitcoin Price

Examining Bitcoin's price movements alongside major US-China trade deal announcements reveals a compelling correlation. Positive developments, such as the signing of a phase-one trade deal, often coincided with periods of increased Bitcoin investment and price appreciation. Conversely, periods of heightened trade tensions and negative news frequently led to price dips. However, it's crucial to acknowledge that Bitcoin's price is influenced by numerous factors beyond trade relations, including regulatory developments, technological advancements, and market sentiment.

- Examples of Bitcoin price spikes/dips correlated with specific trade deal events: Detailed analysis of historical price data can demonstrate this correlation, showcasing instances where positive/negative trade news significantly affected Bitcoin's value.

- Correlation analysis: Statistical analysis can quantify the strength of the relationship between trade deal developments and Bitcoin price movements.

- Discussion of confounding factors: Acknowledging other factors influencing Bitcoin's price ensures a comprehensive and nuanced understanding of the market dynamics.

The Future of Bitcoin Investment in the Context of US-China Relations

The evolving relationship between the US and China will undoubtedly continue to shape the global economic landscape and influence cryptocurrency markets. Future trade agreements or disputes could significantly impact Bitcoin investment. A period of increased cooperation might reduce geopolitical uncertainty, potentially lessening Bitcoin's appeal as a safe haven asset. Conversely, escalating tensions could drive renewed interest in Bitcoin as a hedge against market volatility. Regulatory changes in either country also present significant potential for market shifts.

- Potential impact of future trade agreements or disputes: Future trade deal outcomes will play a critical role in determining market sentiment and the flow of investment into Bitcoin.

- Predictions for Bitcoin's price based on different geopolitical scenarios: Speculating on potential price movements under various geopolitical scenarios helps investors assess the risks and rewards of Bitcoin investment.

- Discussion of regulatory changes and their potential influence: Changes in cryptocurrency regulation in either the US or China could dramatically impact Bitcoin's price and market adoption.

US-China Trade Deal Impacts on Bitcoin Investment – Key Takeaways and Call to Action

Our analysis reveals a strong correlation between US-China trade deal developments and Bitcoin investment. Understanding the interplay between geopolitical factors and cryptocurrency markets is crucial for investors seeking to navigate this complex landscape. While Bitcoin's potential as a safe haven asset is evident, careful analysis and thorough risk assessment are paramount before investing in this volatile market.

To make informed decisions, stay updated on US-China trade relations and their potential impact on your Bitcoin investment strategy. Further research into cryptocurrency market analysis and geopolitical risk management will enhance your understanding and empower you to make well-informed investment choices. Explore resources focusing on US-China trade deal implications for Bitcoin to refine your approach and navigate the market with confidence.

Featured Posts

-

Pakstan Jely Dstawyzat Awr Gdagry Myn Mlwth Tyn Khwatyn Grftar

May 08, 2025

Pakstan Jely Dstawyzat Awr Gdagry Myn Mlwth Tyn Khwatyn Grftar

May 08, 2025 -

Gjranwalh Wlyme Ky Tqryb Myn Dl Ka Dwrh Dlha Jan Bhq

May 08, 2025

Gjranwalh Wlyme Ky Tqryb Myn Dl Ka Dwrh Dlha Jan Bhq

May 08, 2025 -

Poor Batting Performance Angels Suffer 13 More Strikeouts Lose To Twins

May 08, 2025

Poor Batting Performance Angels Suffer 13 More Strikeouts Lose To Twins

May 08, 2025 -

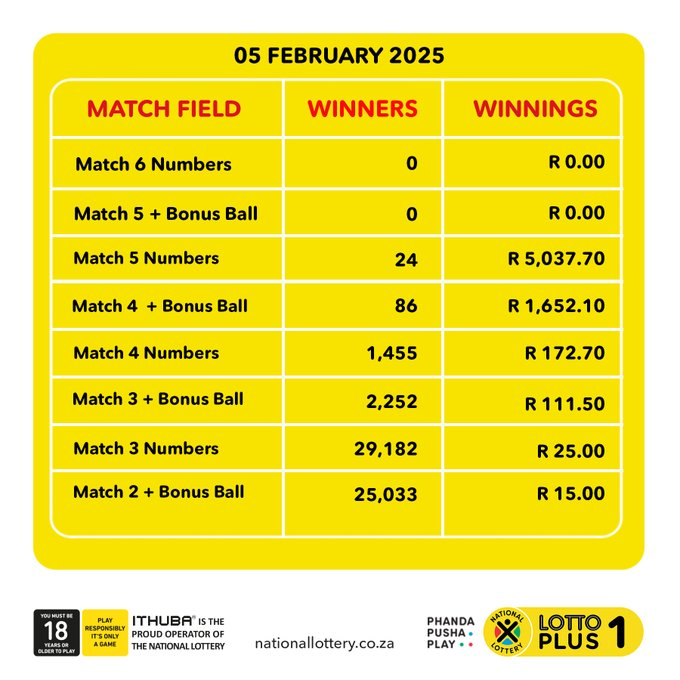

Where To Find The Latest Lotto Lotto Plus 1 And Lotto Plus 2 Numbers

May 08, 2025

Where To Find The Latest Lotto Lotto Plus 1 And Lotto Plus 2 Numbers

May 08, 2025 -

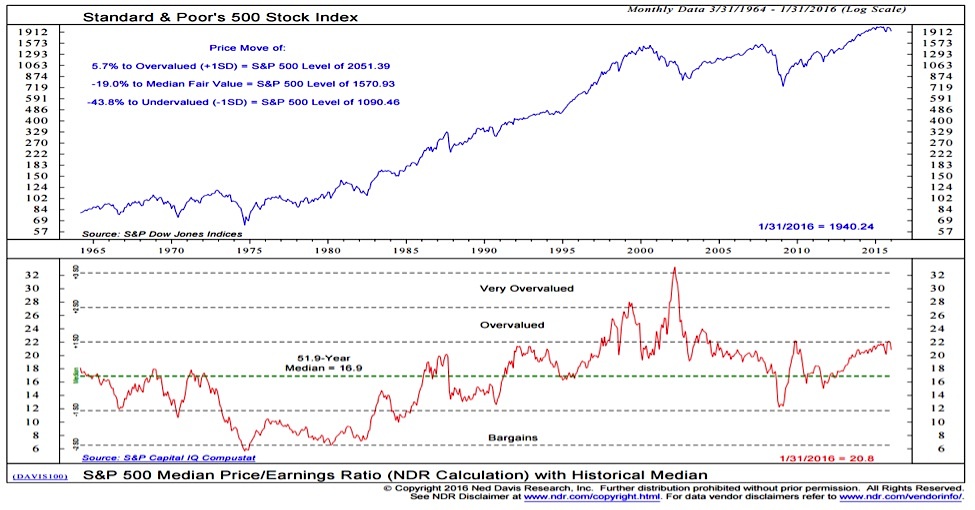

Bof A Reassures Investors Why Current Stock Market Valuations Are Not A Threat

May 08, 2025

Bof A Reassures Investors Why Current Stock Market Valuations Are Not A Threat

May 08, 2025