US IPO Plans For Navan: Travel Tech Firm Enlists Investment Banks

Table of Contents

Navan, a leading corporate travel management platform, is reportedly preparing for a significant US Initial Public Offering (IPO). This highly anticipated event marks a major milestone for the rapidly expanding travel technology sector and reflects strong investor confidence in Navan's innovative approach to business travel. This article delves into the key details surrounding Navan's IPO plans, including the investment banks involved and the potential implications for the company and the broader market.

Navan's Growth Trajectory and Market Positioning

Disrupting the Corporate Travel Industry

Navan is revolutionizing corporate travel management with its innovative technology. The platform offers a comprehensive solution designed to streamline and optimize the entire business travel process. This disruption is fueled by:

- AI-powered features: Intelligent search algorithms provide travelers with the best flight and hotel options, while predictive analytics anticipate potential travel disruptions and offer proactive solutions.

- Integrated booking platform: A single, user-friendly platform consolidates all aspects of travel booking, from flights and hotels to ground transportation and activities, simplifying the process for both travelers and administrators.

- Expense management tools: Seamless integration with expense reporting systems automates expense tracking and reconciliation, reducing administrative overhead and improving accuracy.

- Data analytics for cost savings: Detailed reporting and analysis tools provide valuable insights into spending patterns, allowing companies to identify areas for cost reduction and optimize their travel budgets.

These features position Navan as a leader in corporate travel management, offering superior travel technology solutions compared to traditional methods. The platform’s focus on efficiency and cost-savings makes it highly appealing to businesses of all sizes.

Financials and Investment Appeal

Navan's strong financial performance is a key driver behind its upcoming IPO. The company has demonstrated significant revenue growth and profitability, making it an attractive investment opportunity for both institutional and individual investors. Key financial indicators include:

- Revenue growth figures: Consistent year-over-year revenue growth exceeding industry averages. (Specific figures would be included here if available publicly.)

- Profitability metrics: Demonstrating strong margins and positive cash flow. (Specific figures would be included here if available publicly.)

- Market share data: Significant market share gains in the corporate travel management sector. (Specific figures would be included here if available publicly.)

These robust financials, coupled with its innovative technology and strong market position, suggest a high IPO valuation and significant investor interest.

Investment Banks and IPO Strategy

Key Players and Their Roles

Several prominent investment banks are reportedly involved in managing Navan's IPO, leveraging their expertise in navigating the complexities of the US IPO market. Their roles include:

- Names of lead underwriters: (Specific names of lead underwriters would be included here once publicly announced.) These banks will play a crucial role in pricing the offering and marketing it to potential investors.

- Their experience in tech IPOs: The selection of these banks reflects their extensive experience in successfully guiding technology companies through the IPO process, ensuring a smooth and efficient offering.

- Their role in pricing and marketing the offering: These banks will conduct thorough due diligence, assess market conditions, and develop a comprehensive marketing strategy to attract a wide range of investors.

The experience and reputation of these investment banks add further credibility to Navan's IPO and inspire confidence among investors.

Timeline and Expected Proceeds

While a precise timeline remains undisclosed, Navan's IPO is expected to occur within (Insert timeframe if available). The offering is anticipated to raise a substantial amount of capital, potentially (Insert estimated amount if available). The proceeds from the IPO are likely to be used for:

- Expansion: Further development of the platform's technology and expansion into new markets.

- Debt repayment: Reducing existing debt obligations.

- Strategic acquisitions: Acquiring complementary businesses to enhance the company's product offerings.

The successful completion of the IPO will provide Navan with significant resources to accelerate its growth strategy and solidify its position as a leader in the corporate travel management sector. The prospectus, once released, will offer more precise details on the timeline and planned use of proceeds.

Implications for the Travel Tech Sector and Investors

Market Impact of Navan's IPO

Navan's IPO is poised to have a significant ripple effect on the broader travel technology landscape. The success of the offering could:

- Increase competition: Attract further investment and competition in the corporate travel management sector, driving innovation and potentially lowering prices for businesses.

- Potential for further investment in the sector: Serve as a catalyst for further investment in promising travel technology companies, fueling growth and development.

- Market valuations: Influence the valuations of other travel technology companies, setting a benchmark for future IPOs.

The IPO is likely to enhance the visibility and attractiveness of the travel technology sector to investors.

Opportunities and Risks for Investors

Investing in Navan's IPO presents both significant opportunities and inherent risks. Potential investors should carefully consider:

- Growth potential: The substantial growth potential of the corporate travel management market and Navan's strong market position offer considerable returns.

- Market volatility: The IPO market is subject to volatility, and unforeseen events could impact the performance of Navan's stock.

- Competitive threats: Increased competition from established players and new entrants could affect Navan's market share and profitability.

- Regulatory risks: Changes in regulations affecting the travel industry could impact Navan's operations.

Thorough due diligence and a comprehensive risk assessment are essential before making any investment decisions.

Conclusion

Navan's planned US IPO represents a pivotal moment for the travel technology sector. It offers investors a unique opportunity to participate in the growth of a leading corporate travel management platform. The involvement of highly reputable investment banks underscores the company's strong financial prospects and strategic vision.

Call to Action: Stay informed about the latest developments surrounding the Navan IPO and explore investment opportunities in this dynamic sector of the travel industry. Learn more about the Navan Initial Public Offering and its potential impact on the future of business travel. Keep an eye on news related to the Navan IPO to make informed decisions.

Featured Posts

-

Crisi Sanremo Bucci E La Regione Liguria Trovano Una Soluzione

May 14, 2025

Crisi Sanremo Bucci E La Regione Liguria Trovano Una Soluzione

May 14, 2025 -

First Look At Vince Vaughn In Netflixs Upcoming Comedy Nonna

May 14, 2025

First Look At Vince Vaughn In Netflixs Upcoming Comedy Nonna

May 14, 2025 -

Maya Jama Stunning In White Shorts And Vest At Ksi Event

May 14, 2025

Maya Jama Stunning In White Shorts And Vest At Ksi Event

May 14, 2025 -

Measuring Gender Euphoria A Key To Better Transgender Mental Healthcare On Transgender Day Of Visibility

May 14, 2025

Measuring Gender Euphoria A Key To Better Transgender Mental Healthcare On Transgender Day Of Visibility

May 14, 2025 -

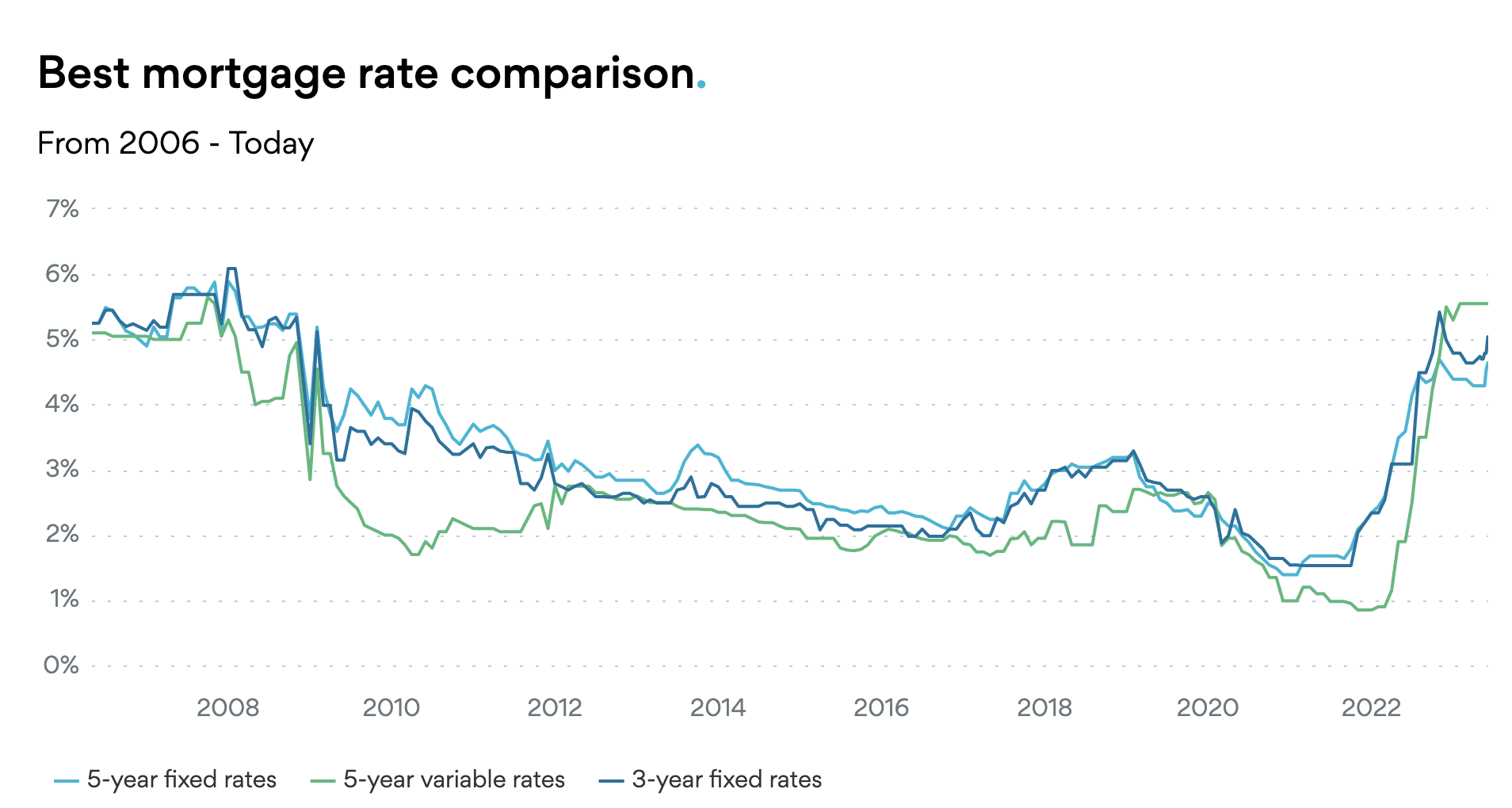

Will The Bank Of Canada Cut Rates Again Economists Weigh In On Tariff Impacts

May 14, 2025

Will The Bank Of Canada Cut Rates Again Economists Weigh In On Tariff Impacts

May 14, 2025