US Tariffs Reshape Honda Production: A Canadian Advantage?

Table of Contents

The Impact of US Tariffs on Honda's US Operations

US tariffs on imported vehicles and auto parts have significantly increased Honda's production costs within the United States. These tariffs, implemented under various trade policies, have made it more expensive for Honda to import crucial components from its global network, impacting its overall competitiveness. The increased costs directly translate to reduced profit margins on vehicles manufactured in the US and sold in the US market. This situation has led to concerns about potential job losses in some US Honda plants.

- Increased costs of imported parts: Tariffs add a substantial percentage to the cost of many imported components, from engines and transmissions to smaller electronic parts.

- Reduced profit margins: Higher input costs squeeze profit margins, making US-produced Honda vehicles less profitable than those manufactured elsewhere.

- Potential job losses in US Honda plants: As production becomes less economically viable in the US, Honda may be forced to consider plant closures or reduced production levels.

- Specific Honda models affected: The impact varies by model, with vehicles containing a higher proportion of imported parts likely experiencing greater cost increases. Models like the CRV, which utilizes globally sourced components, are particularly susceptible.

Honda's Global Production Strategy and Diversification

Honda, like other global automakers, has a complex, geographically diverse manufacturing footprint. However, the US tariffs have forced a reassessment of its North American production strategy. The company is now actively exploring nearshoring—shifting production closer to its key markets to mitigate tariff impacts and shorten supply chains. This involves a significant reassessment of its global production strategy.

- Shifting production from the US to other countries: To offset the increased costs and maintain competitiveness, Honda is exploring options to shift some production to countries with more favorable tariff arrangements.

- Increased investment in plants outside the US: Expect to see increased investment in Honda’s manufacturing facilities in Mexico and Canada, regions offering proximity to the US market and potentially lower production costs.

- Focus on regional supply chains: Honda is likely to prioritize regional supply chains, reducing its dependence on imports and minimizing tariff exposure.

- Examples of Honda's diversification efforts: Honda's recent investments in its Mexican and Canadian facilities can be viewed within this context.

Canada's Potential as a Manufacturing Hub: Advantages and Challenges

Canada presents itself as an attractive alternative manufacturing location for Honda. Its strategic proximity to the US market, coupled with a skilled workforce and the benefits of the United States-Mexico-Canada Agreement (USMCA), makes it a compelling option.

- USMCA benefits for Canadian auto parts and vehicles: The USMCA ensures duty-free access to the US market for Canadian-made vehicles and parts, significantly reducing tariff-related risks for Honda.

- Canadian government incentives for automotive manufacturing: Various federal and provincial programs offer incentives to attract and retain automotive manufacturers, potentially lowering Honda's initial investment and ongoing operational costs.

- Comparison of Canadian labor costs with US and Mexican costs: While Canadian labor costs are higher than in Mexico, they are often more competitive than in some US regions, and the skilled workforce makes up for it.

- Infrastructure needs and potential investments: Canada needs to ensure it has sufficient infrastructure (including transportation and energy) to support increased automotive production. Government investment in these areas could prove crucial.

Case Studies: Specific Examples of Honda's Production Shifts

While Honda hasn't explicitly stated large-scale production shifts solely due to tariffs, analyzing their investment announcements and production patterns reveals a subtle shift. For example, increased investment in their Canadian plants suggests a strategic response to the changing landscape. Tracking the production location of specific models over time offers concrete evidence of this adjustment.

- Specific model shifts in production location: Closely monitoring which Honda models are now produced in Canada versus the US provides insights into the impact of tariffs on production decisions.

- Investment announcements in Canadian plants: New investments in Canadian facilities should be viewed as a direct indicator of a shift in production priorities.

- Changes in supply chain sourcing: A change towards sourcing more parts from within North America (including Canada) would directly show the effects of tariff avoidance strategies.

- Impact on employment in different regions: Analyzing employment numbers in Honda's US and Canadian plants over time provides a measure of the tangible impact of these production changes.

Conclusion: US Tariffs, Honda's Future, and the Canadian Opportunity

In conclusion, US tariffs are undeniably impacting Honda's North American production strategy, pushing the company to diversify its manufacturing footprint. Canada, with its strategic location, skilled workforce, and favorable trade agreements, is well-positioned to benefit from this realignment. The USMCA plays a crucial role in mitigating risks associated with tariff changes. Further research and analysis are needed to fully understand the long-term implications of US tariffs on Honda's production and the resulting opportunities for Canada. Explore the evolving landscape of US tariffs and their effect on Honda production strategies to fully grasp the potential Canadian advantage.

Featured Posts

-

Jean Marsh A Career Retrospective Following Her Passing At Age 90

May 17, 2025

Jean Marsh A Career Retrospective Following Her Passing At Age 90

May 17, 2025 -

Ancaman Militer Houthi Sasaran Dubai Dan Abu Dhabi

May 17, 2025

Ancaman Militer Houthi Sasaran Dubai Dan Abu Dhabi

May 17, 2025 -

Investing In The Future Of Transportation Ubers Autonomous Vehicle Technology And Etf Opportunities

May 17, 2025

Investing In The Future Of Transportation Ubers Autonomous Vehicle Technology And Etf Opportunities

May 17, 2025 -

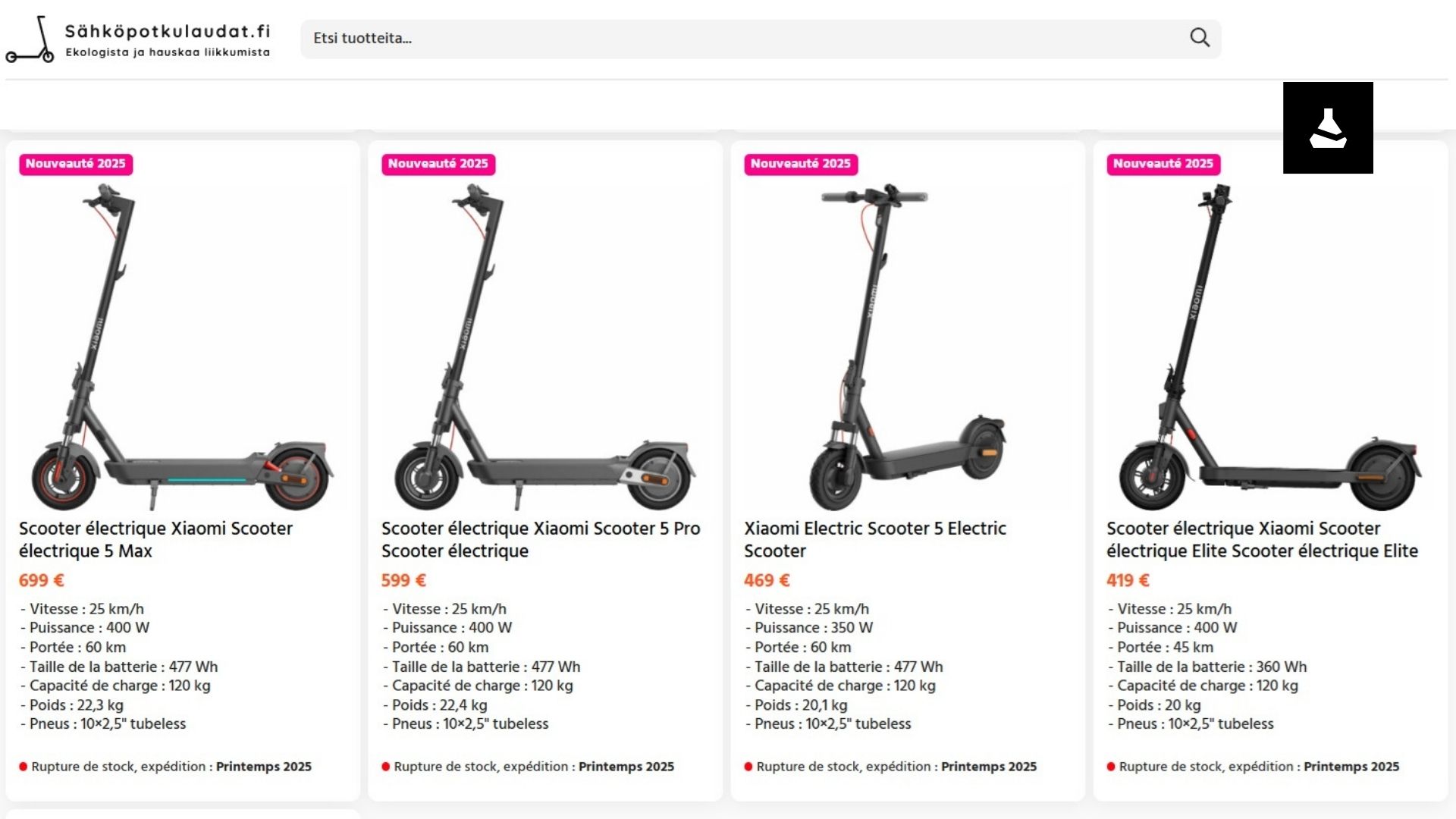

Nouvelles Trottinettes Xiaomi Scooter 5 5 Pro Et 5 Max Tout Savoir

May 17, 2025

Nouvelles Trottinettes Xiaomi Scooter 5 5 Pro Et 5 Max Tout Savoir

May 17, 2025 -

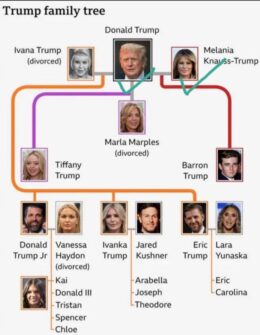

Tracing The Trump Family Tree From Ancestry To Present Day

May 17, 2025

Tracing The Trump Family Tree From Ancestry To Present Day

May 17, 2025