USD Strengthens: Dollar Gains Against Major Currencies As Trump's Fed Criticism Eases

Table of Contents

Diminished Political Uncertainty Boosts Dollar Confidence

Former President Trump's frequent and often harsh criticisms of the Federal Reserve created significant market volatility and uncertainty. His public pronouncements regarding interest rate policy and the independence of the central bank injected considerable unpredictability into the financial markets. This uncertainty undermined investor confidence in the USD, leading to fluctuations in its value against other currencies.

The current calmer political climate, however, has had a markedly positive impact on investor confidence in the USD. The absence of overt political interference in monetary policy has fostered a sense of stability and predictability, making the dollar a more attractive investment.

- Reduced risk of unpredictable policy changes: The decreased likelihood of sudden shifts in economic policy significantly reduces risk for investors.

- Increased investor trust in the stability of the US economy: A more predictable political environment boosts confidence in the long-term stability of the US economy, making it a more appealing destination for investment.

- Improved outlook for foreign investment in US assets: With reduced political risk, foreign investors are more likely to allocate capital to US assets, further increasing demand for the USD.

Recent performance data reflects this trend. The EUR/USD exchange rate has fallen, indicating a strengthening dollar against the Euro. Similarly, the GBP/USD and USD/JPY exchange rates also show the USD gaining strength. (Specific numerical data would be inserted here based on current market conditions).

Federal Reserve's Monetary Policy Plays a Key Role

The Federal Reserve's current monetary policy stance is another crucial factor driving the USD's strength. The Fed's actions, including interest rate hikes and quantitative tightening, have made US assets more attractive to international investors.

- Higher interest rates attract international capital flows: Higher interest rates in the US compared to other countries incentivize foreign investors to move their capital to the US to earn higher returns, increasing demand for the USD.

- Quantitative tightening reduces the money supply, potentially controlling inflation: By reducing the money supply, the Fed aims to control inflation, fostering a more stable economic environment and boosting investor confidence in the USD's value.

- Market reaction to Fed announcements and their effect on the dollar: The market closely monitors Fed announcements. Positive statements about the economy and the central bank's ability to manage inflation often lead to an increase in the USD's value.

Financial analysts largely agree that the Fed's actions are a significant contributor to the current USD strength. (Quotes from financial analysts would be included here, properly attributed).

Global Economic Headwinds Support Safe-Haven Demand for USD

Global economic uncertainties, including geopolitical tensions, high inflation in various countries, and recessionary fears, are increasing the demand for the USD as a safe-haven currency. During times of global instability, investors often flock to assets perceived as less risky, and the US dollar frequently benefits from this "flight to safety".

- Investors seek refuge in the stability of the US dollar during times of global uncertainty: The USD's historical stability and the size of the US economy make it a preferred refuge during periods of global economic turmoil.

- Flight to safety increases demand for USD-denominated assets: This increased demand drives up the value of the dollar against other currencies.

- Comparison of USD performance to other safe-haven assets like gold: While gold is also considered a safe-haven asset, the USD's recent performance indicates that investors are increasingly favoring the dollar in the current environment. (Relevant economic data comparing USD and gold performance would be included here).

Conclusion

The recent strengthening of the USD is a multifaceted phenomenon stemming from a confluence of factors. Reduced political uncertainty surrounding the Federal Reserve, the Fed's own monetary policies, and a global economic climate that is bolstering demand for the dollar as a safe-haven asset have all played significant roles. The interplay between these elements has significantly impacted the foreign exchange market, leading to the current USD appreciation.

Call to Action: Stay informed about the ongoing developments affecting the USD's strength. Understanding the factors that influence the dollar's value is crucial for investors and businesses involved in international trade and finance. Keep monitoring the latest news and analysis to effectively navigate the fluctuations in the USD's strength and make informed decisions.

Featured Posts

-

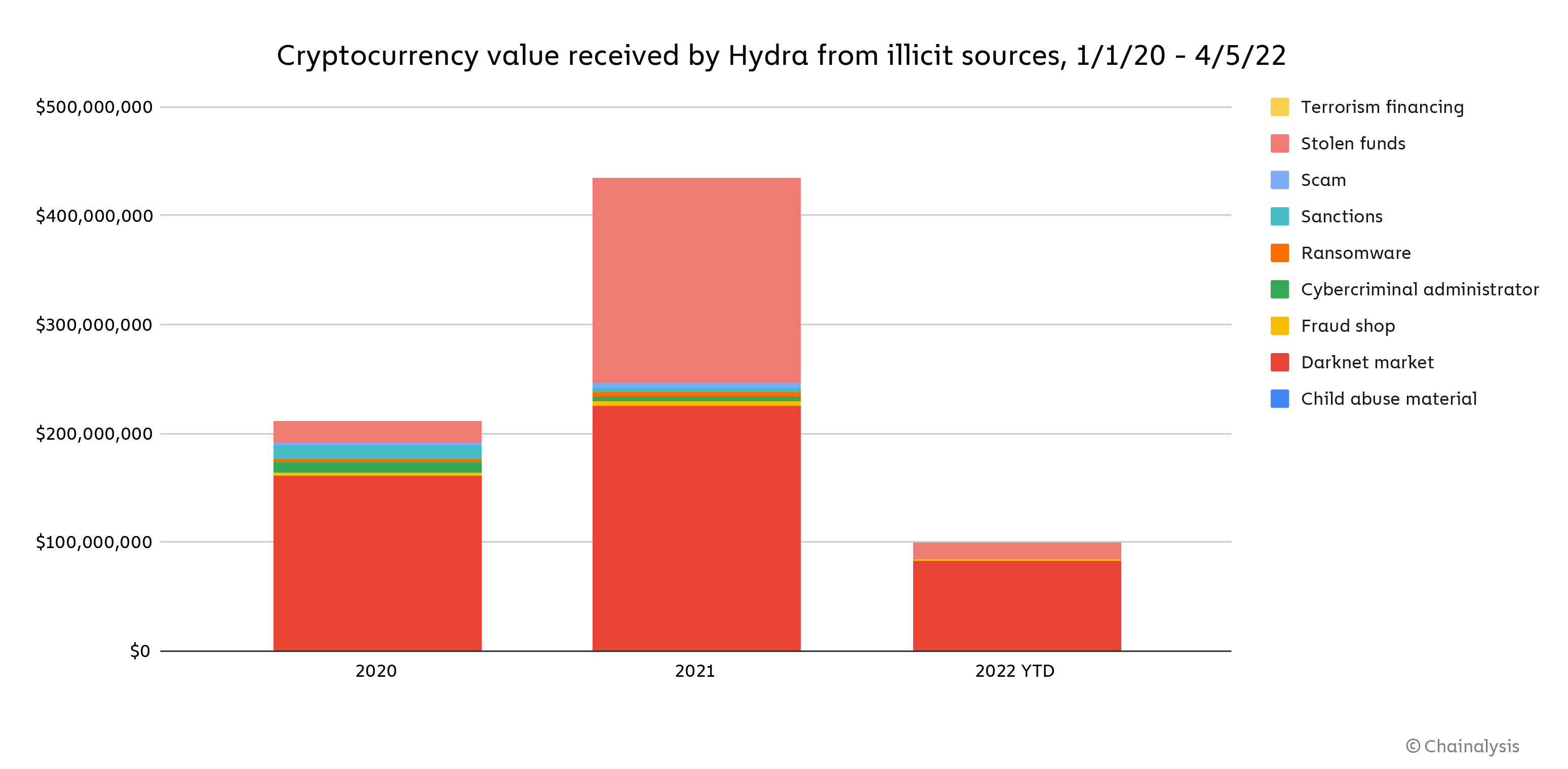

Chainalysis Bolsters Ai Capabilities Through Alterya Acquisition

Apr 24, 2025

Chainalysis Bolsters Ai Capabilities Through Alterya Acquisition

Apr 24, 2025 -

Quentin Tarantino Zasto Odbija Gledati Ovaj Film S Johnom Travoltom

Apr 24, 2025

Quentin Tarantino Zasto Odbija Gledati Ovaj Film S Johnom Travoltom

Apr 24, 2025 -

East Palestines Lingering Threat Toxic Chemicals Remain In Buildings Months After Derailment

Apr 24, 2025

East Palestines Lingering Threat Toxic Chemicals Remain In Buildings Months After Derailment

Apr 24, 2025 -

Trump Administration Signals Openness To Harvard Negotiation After Lawsuit

Apr 24, 2025

Trump Administration Signals Openness To Harvard Negotiation After Lawsuit

Apr 24, 2025 -

How Trumps Trade Policies And The Fed Are Affecting Bitcoin Btc Prices

Apr 24, 2025

How Trumps Trade Policies And The Fed Are Affecting Bitcoin Btc Prices

Apr 24, 2025

Latest Posts

-

Young Thugs Reaction To Not Like U Name Drop Post Prison Release

May 10, 2025

Young Thugs Reaction To Not Like U Name Drop Post Prison Release

May 10, 2025 -

The Back Outside Album Updates On Young Thugs Highly Anticipated Project

May 10, 2025

The Back Outside Album Updates On Young Thugs Highly Anticipated Project

May 10, 2025 -

Young Thugs Back Outside Album Anticipation Builds For The New Release

May 10, 2025

Young Thugs Back Outside Album Anticipation Builds For The New Release

May 10, 2025 -

Mariah The Scientists Burning Blue Track By Track Analysis

May 10, 2025

Mariah The Scientists Burning Blue Track By Track Analysis

May 10, 2025 -

Is Young Thugs Back Outside Album Coming Soon A Look At The Rollout

May 10, 2025

Is Young Thugs Back Outside Album Coming Soon A Look At The Rollout

May 10, 2025