Voice Recognition: Revolutionizing HMRC Call Service

Table of Contents

Enhanced Customer Experience Through Voice Recognition

Voice recognition offers a transformative solution to the persistent challenges faced by HMRC callers. By leveraging the power of speech recognition, the entire process becomes more intuitive and efficient.

Reduced Wait Times

Imagine calling HMRC and instantly being connected to the right department without navigating endless automated menus. This is the reality voice recognition makes possible. The technology allows callers to state their query verbally, and sophisticated algorithms instantly direct them to the appropriate agent or information source.

- Faster resolution of queries: Reduced wait times translate directly to quicker answers and solutions.

- Improved customer satisfaction scores (CSAT): A smoother, more efficient experience leads to happier taxpayers. Studies show a strong correlation between faster service and higher CSAT scores. For example, one study showed that a 10% reduction in wait times resulted in a 5% increase in customer satisfaction.

- Increased efficiency in handling calls: Agents can focus on resolving issues rather than navigating callers through complex menus.

24/7 Availability and Accessibility

Voice recognition systems don't need to sleep. They can operate around the clock, providing 24/7 access to HMRC services. This is particularly beneficial for individuals who work unconventional hours or those with disabilities who may find it challenging to navigate traditional phone systems.

- Improved service availability: Taxpayers can access support whenever they need it, regardless of time zone or personal schedule.

- Increased accessibility for a diverse customer base: 24/7 availability enhances inclusivity by removing time-related barriers to accessing services.

- Reduced reliance on human agents during peak hours: Automated systems can handle a higher volume of calls during busy periods, reducing wait times for all callers and minimizing the pressure on human agents. Integration with text-to-speech and screen readers further enhances accessibility for visually impaired individuals.

Streamlined Operations and Increased Efficiency for HMRC

The benefits of voice recognition extend far beyond improved customer experience. The technology offers significant advantages for HMRC's internal operations as well.

Automated Data Entry and Processing

Voice recognition can automatically capture and process taxpayer information, dramatically reducing manual data entry. This minimizes errors and frees up valuable staff time for more complex tasks.

- Reduced administrative burden: Automation eliminates the time-consuming task of manual data entry.

- Improved data accuracy: Automated data entry significantly reduces the risk of human error, leading to more accurate records.

- Faster processing of tax returns and payments: Streamlined data processing leads to faster processing times and quicker refunds or payment confirmations. Integration with existing HMRC systems can further enhance this process by ensuring seamless data flow.

Cost Savings and Resource Optimization

By automating many aspects of the call service, voice recognition helps optimize resource allocation and reduces operational costs.

- Lower staffing costs: The ability to handle a larger volume of calls with fewer agents results in significant cost savings.

- Optimized resource allocation: Staff can focus on more complex and value-added tasks, maximizing their productivity.

- Improved return on investment (ROI): The initial investment in voice recognition technology quickly pays for itself through increased efficiency and cost savings. Estimates suggest that companies can achieve ROI within the first year or two of implementation, depending on the scale of deployment.

Security and Data Privacy Considerations in Voice Recognition Implementation

Implementing voice recognition requires a strong focus on security and data privacy to protect sensitive taxpayer information.

Data Encryption and Secure Storage

Protecting taxpayer data is paramount. Robust security measures are essential to mitigate risks.

- Data encryption protocols: All voice data should be encrypted both in transit and at rest, using industry-standard encryption methods.

- Secure data storage: Data must be stored in secure, controlled environments with access restrictions to authorized personnel only.

- Compliance with data privacy regulations: HMRC must ensure full compliance with relevant data privacy regulations, such as GDPR. Regular security audits and penetration testing are critical to maintain a high level of data security.

Authentication and Fraud Prevention

Voice recognition can play a crucial role in verifying caller identity and preventing fraudulent activities.

- Biometric authentication methods: Voice biometrics can be used to verify caller identity, providing a secure and convenient authentication method.

- Multi-factor authentication: Combining voice recognition with other authentication methods, such as one-time passwords (OTPs), enhances security.

- Fraud detection systems: Integrating voice recognition with advanced fraud detection systems can help identify and prevent fraudulent calls. Machine learning algorithms can be trained to detect anomalies and suspicious patterns in voice data, further enhancing security.

Conclusion

Voice recognition technology offers a compelling solution for modernizing HMRC's call service. The benefits are clear: improved customer experience through reduced wait times and 24/7 availability; increased efficiency for HMRC through automated data entry and cost savings; and enhanced security through robust data protection and authentication measures. Implementing speech recognition and voice-activated services is not merely an upgrade; it’s a strategic investment in better service delivery for both taxpayers and HMRC staff.

Explore the potential of voice recognition for your organization. Embrace the future of HMRC call services with voice recognition technology and discover how this innovative approach can transform service delivery, ensuring a more efficient and satisfying experience for everyone involved. [Link to relevant resources or contact information]

Featured Posts

-

Jennifer Lawrence Potvrdene Je Dvojnasobnou Matkou

May 20, 2025

Jennifer Lawrence Potvrdene Je Dvojnasobnou Matkou

May 20, 2025 -

Chinas Orbital Supercomputer A Technological Milestone

May 20, 2025

Chinas Orbital Supercomputer A Technological Milestone

May 20, 2025 -

The Cliff Richard Musical A Collaboration Between Matt Lucas And David Walliams And Its Setback

May 20, 2025

The Cliff Richard Musical A Collaboration Between Matt Lucas And David Walliams And Its Setback

May 20, 2025 -

Aghatha Krysty Rwayat Jdydt Bwastt Aldhkae Alastnaey

May 20, 2025

Aghatha Krysty Rwayat Jdydt Bwastt Aldhkae Alastnaey

May 20, 2025 -

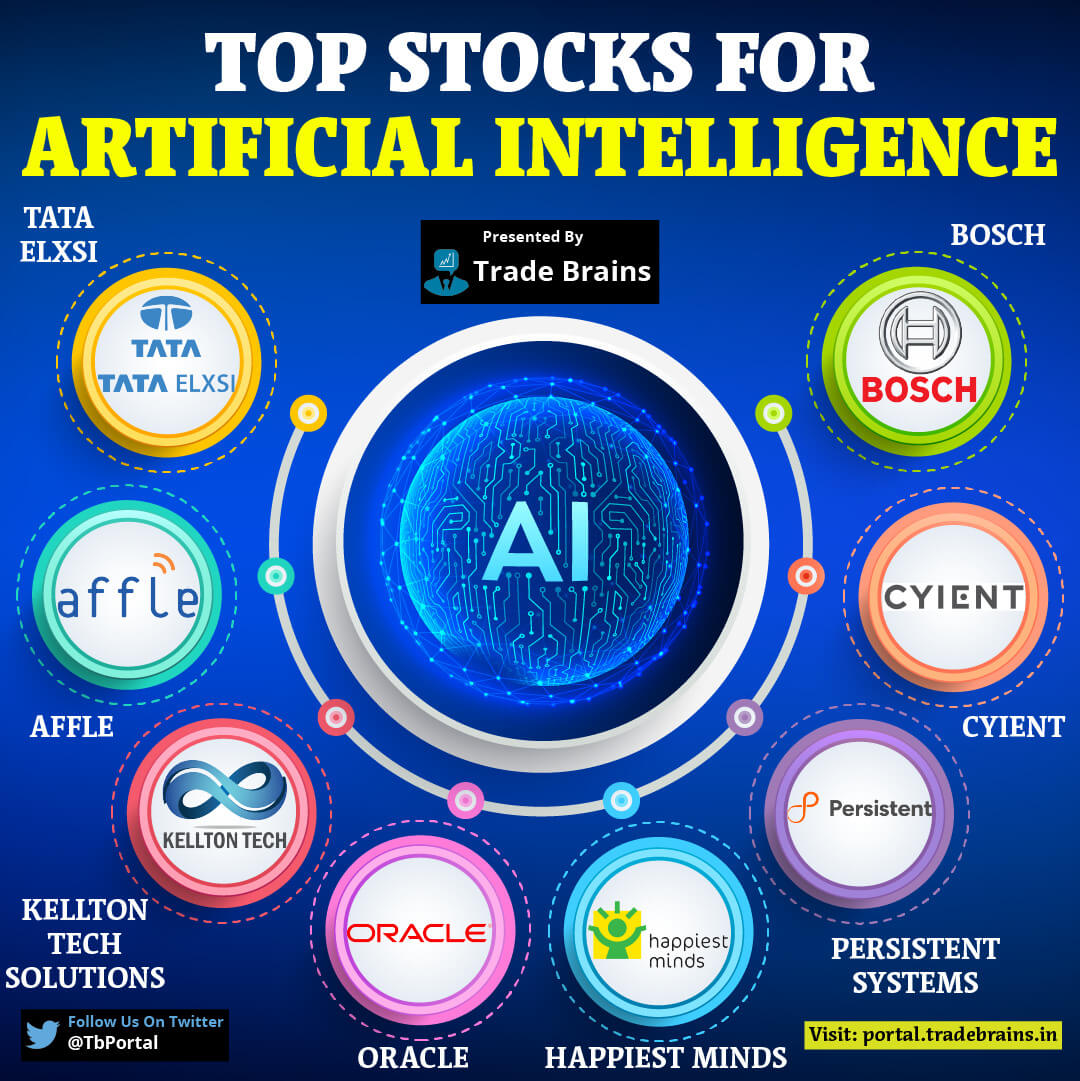

12 Promising Ai Stocks Insights From Reddit

May 20, 2025

12 Promising Ai Stocks Insights From Reddit

May 20, 2025