Warren Buffett Among Billionaires Hit Hard By Trump's Trade Policies

Table of Contents

Berkshire Hathaway's Exposure to Trump's Trade Policies

Berkshire Hathaway, Warren Buffett's investment conglomerate, felt the significant impact of Trump's trade policies. Its diverse portfolio, spanning manufacturing, retail, and transportation, made it particularly vulnerable to tariff increases and supply chain disruptions.

-

Impact on Specific Companies: Several Berkshire Hathaway subsidiaries experienced direct hits. For example, its manufacturing holdings faced increased costs due to tariffs on imported raw materials. Companies reliant on global supply chains experienced delays and increased expenses, squeezing profit margins. While precise figures for individual companies are not publicly available in full detail, the overall impact was undeniable.

-

Quantifying the Losses: While Berkshire Hathaway doesn't explicitly break down losses attributable solely to trade policies, analysts have pointed to a measurable negative impact on overall profitability during the period of heightened trade tensions. The reduced consumer spending resulting from the trade war also affected the performance of various Berkshire Hathaway subsidiaries.

-

Supply Chain Disruptions: The imposition of tariffs disrupted established supply chains, leading to delays and increased transportation costs for many Berkshire Hathaway businesses. This added a layer of complexity to operations and reduced efficiency, contributing to the overall negative impact.

-

Increased Import Costs: The increased cost of imported goods directly affected Berkshire Hathaway's businesses. This not only impacted profitability but also forced price adjustments, potentially impacting competitiveness and sales.

The Broader Impact on Billionaires and the Economy

Trump's trade policies didn't just affect Warren Buffett; many billionaires experienced declines in their net worth. The uncertainty created by the trade wars led to stock market volatility and reduced investor confidence, impacting numerous sectors.

-

Billionaire Wealth Decline: While precise figures for all billionaires affected are difficult to compile, numerous reports highlighted a broad decline in billionaire wealth during periods of heightened trade conflict. The impact varied depending on the specific investment portfolios and exposure to affected sectors.

-

Ripple Effect on the Economy: The trade policies had a cascading effect on the broader economy. Increased prices for goods, due to tariffs, led to reduced consumer spending. Uncertainty about future trade relationships caused businesses to postpone investments, leading to job losses and further economic slowdown.

-

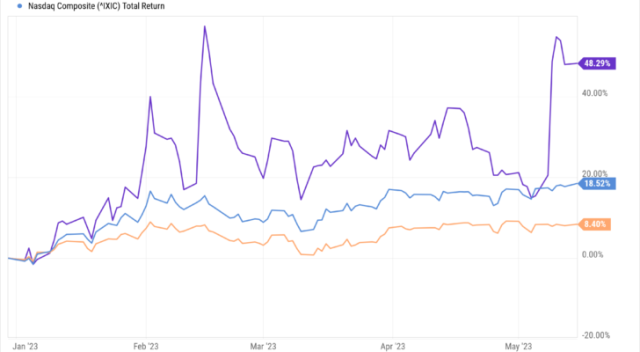

Impact on Investor Confidence and the Stock Market: The instability caused by the unpredictable trade policies eroded investor confidence. Stock market volatility increased, negatively impacting not only billionaire portfolios but also retirement accounts and everyday investors.

-

Long-Term Consequences for Global Trade: The Trump administration's trade actions strained relationships with major trading partners, raising concerns about the long-term stability of the global trading system. The damage to trust and established trade agreements could have lingering consequences for years to come.

The Role of Uncertainty in Investment Decisions

The unpredictable nature of Trump's trade policies created significant uncertainty for investors. This uncertainty played a substantial role in investment decisions and strategies.

-

Impact of Policy Uncertainty: The constant threat of new tariffs or trade disputes made long-term investment planning extremely difficult. Investors struggled to assess risks accurately, leading to more cautious and conservative investment strategies.

-

Adaptation of Investment Strategies: In response to this uncertainty, many investors, including Buffett, likely adjusted their strategies to focus on more defensive investments and reduce exposure to sectors heavily impacted by trade. Diversification became even more critical.

-

Long-Term Implications of Policy Uncertainty: The prolonged period of uncertainty likely discouraged long-term investments and hindered economic growth. Businesses hesitated to expand or make significant capital investments due to the unpredictable policy environment.

Lessons Learned from the Trump Trade Policies

The period of heightened trade tensions under the Trump administration provided several critical lessons regarding trade policy and economic stability.

-

Impact of Protectionist Policies: The experience demonstrated the potential negative consequences of protectionist trade policies, even for wealthy investors like Warren Buffett. The disruption to global supply chains and the overall economic slowdown highlighted the limitations of isolationist trade approaches.

-

Importance of International Cooperation: The episode underscored the importance of maintaining stable international trade relationships based on cooperation and predictable rules. The lack of predictability in the Trump administration's policies undermined global trade stability.

-

Significance of Risk Management: For investors, the period highlighted the importance of sophisticated risk management strategies in navigating periods of economic and political uncertainty. Diversification and hedging became crucial tools in mitigating losses.

Conclusion

This analysis reveals that Trump's trade policies significantly impacted even the most successful investors like Warren Buffett. The economic consequences were far-reaching, affecting not only billionaire wealth but also broader economic indicators and investor confidence. This period underscored the crucial importance of stable trade relationships, effective risk management, and the need for predictable economic policies for both investors and the overall global economy. To stay informed about the ongoing impacts of trade policies on the global economy and the strategies employed by leading investors like Warren Buffett, continue reading articles and analyses focusing on Trump's trade policies and their long-term effects on billionaire wealth and the broader economic landscape.

Featured Posts

-

Oilers Vs Sharks Nhl Game Predictions Betting Picks And Best Odds

May 09, 2025

Oilers Vs Sharks Nhl Game Predictions Betting Picks And Best Odds

May 09, 2025 -

Solve The Nyt Spelling Bee April 12 2025 Hints And Solutions

May 09, 2025

Solve The Nyt Spelling Bee April 12 2025 Hints And Solutions

May 09, 2025 -

Boosting Capital Market Cooperation Pakistan Sri Lanka And Bangladesh Collaborate

May 09, 2025

Boosting Capital Market Cooperation Pakistan Sri Lanka And Bangladesh Collaborate

May 09, 2025 -

Indian Stock Markets Sharp Rise Analyzing The 1400 Point Sensex And 23800 Nifty Jump

May 09, 2025

Indian Stock Markets Sharp Rise Analyzing The 1400 Point Sensex And 23800 Nifty Jump

May 09, 2025 -

Two Stocks Poised To Surpass Palantirs Value Within 3 Years

May 09, 2025

Two Stocks Poised To Surpass Palantirs Value Within 3 Years

May 09, 2025