Warren Buffett's Apple Exit: A Masterclass In Timing And Investment Strategy

Table of Contents

H2: The Scale of the Apple Investment Reduction

Berkshire Hathaway's reduction of its Apple holdings was substantial, signifying a notable shift in the company's investment portfolio. While details surrounding the exact timing and specific amounts of shares sold can vary depending on SEC filings and news reports, the overall reduction represented a significant percentage decrease in their previously massive Apple investment. This move had a noticeable impact on both Berkshire Hathaway's bottom line and the price of Apple stock, causing ripples across the market. To put it in perspective, compare the current holdings to the peak of Berkshire's Apple investment – the difference reveals the substantial nature of this strategic adjustment.

- Specific numbers of shares sold: While the exact figures fluctuate with each quarterly report, the overall reduction amounted to [Insert approximate number of shares sold based on recent reports].

- Dollar value of the sale: The approximate dollar value of the shares sold was in the range of [Insert approximate dollar value based on recent reports].

- Percentage change in Berkshire's Apple ownership: Berkshire Hathaway's ownership percentage in Apple decreased by approximately [Insert approximate percentage based on recent reports].

H2: Potential Reasons Behind the Apple Exit Strategy

Several factors could have contributed to Warren Buffett's decision to reduce Berkshire Hathaway's Apple stake. Analyzing these possibilities provides insight into the complexities of long-term investment strategies.

H3: Market Timing and Valuation Concerns

One potential explanation is that Buffett, known for his value investing approach, perceived Apple's stock as overvalued. After a period of significant growth, Apple's valuation might have surpassed his assessment of its intrinsic value. Several macroeconomic indicators, such as rising interest rates or concerns about global economic growth, could have influenced this assessment.

- Relevant market conditions: [Mention specific market conditions at the time of the sale, such as interest rate hikes, inflation, or recessionary fears].

- Future growth concerns: [Discuss potential concerns about slowing iPhone sales or increased competition in other Apple product sectors].

- P/E Ratio Analysis: [Analyze Apple's P/E ratio at the time of the sale in comparison to historical values or competitors like Microsoft or Google].

H3: Portfolio Diversification

Buffett's decision could also be interpreted as part of a broader portfolio diversification strategy. While Apple had been a cornerstone investment for Berkshire Hathaway, maintaining such a large concentration in a single stock, however successful, presents inherent risk. Reducing the Apple stake allows for the reallocation of capital to other sectors, potentially mitigating overall portfolio risk.

- Other significant investments: Berkshire Hathaway maintains significant stakes in diverse sectors, including [Mention examples such as banking, insurance, and energy].

- Benefits of diversification: Diversification aims to reduce the impact of poor performance in one sector by spreading risk across different asset classes and industries.

- Sectoral contrast: Apple’s position in the technology sector is contrasted with Berkshire's investments in more traditional sectors, fostering resilience against market fluctuations within specific industries.

H3: Shifting Market Landscape

The ever-evolving technological landscape and the emergence of fierce competitors might have also played a role. New technologies and disruptive innovations constantly reshape the market, affecting the competitive advantage of even established giants like Apple.

- Specific competitors: The rise of competitors such as [Mention specific competitors like Samsung, Google, or other tech companies] in various product categories presents challenges to Apple's market dominance.

- Technological advancements: Advancements in areas such as [Mention specific technological areas like AI, VR/AR, or electric vehicles] are transforming the tech landscape and could impact Apple's future growth.

- Economic climate impact: Changes in consumer spending habits due to macroeconomic factors could affect the demand for Apple products.

H2: Lessons for Investors from Warren Buffett's Apple Exit

Warren Buffett's decision to trim Berkshire Hathaway's Apple stake offers crucial lessons for individual investors:

H3: Importance of Long-Term Vision

Even the most successful long-term investments require periodic review and adjustment based on changing market dynamics and company performance. A long-term horizon doesn't preclude the need for timely adaptations.

H3: The Significance of Valuation

Regularly assessing the valuation of your investments is paramount. Understanding intrinsic value versus market price is crucial in making informed decisions, even with seemingly solid companies.

H3: The Role of Diversification

A well-diversified portfolio is essential for mitigating risk. Concentrating heavily in any single investment, regardless of its past performance, exposes you to potentially significant losses.

- Key takeaway summary: Maintain a long-term perspective, regularly assess valuations, diversify your investments, and remain adaptable to market changes.

3. Conclusion

Warren Buffett's Apple exit serves as a compelling case study in investment strategy, emphasizing the importance of market timing and valuation. By understanding the potential reasons behind this decision—market conditions, portfolio diversification, and the shifting technological landscape—investors can gain valuable insights for managing their own portfolios. This event underscores the need for continuous monitoring, adapting to market changes, and maintaining a balanced approach to risk management. Take this opportunity to critically evaluate your own investment portfolio and consider adjusting your strategies based on the lessons learned from Warren Buffett’s Apple exit. Remember, informed decision-making and long-term planning are crucial for navigating the complexities of the stock market. Further research into Buffett's investment philosophy will undoubtedly yield additional valuable perspectives.

Featured Posts

-

Die 50 2025 Alle Teilnehmer Sendetermine Stream And Mehr

Apr 23, 2025

Die 50 2025 Alle Teilnehmer Sendetermine Stream And Mehr

Apr 23, 2025 -

Calendario Laboral 16 5 Millones De Espanoles Disfrutaran Del Puente De Abril

Apr 23, 2025

Calendario Laboral 16 5 Millones De Espanoles Disfrutaran Del Puente De Abril

Apr 23, 2025 -

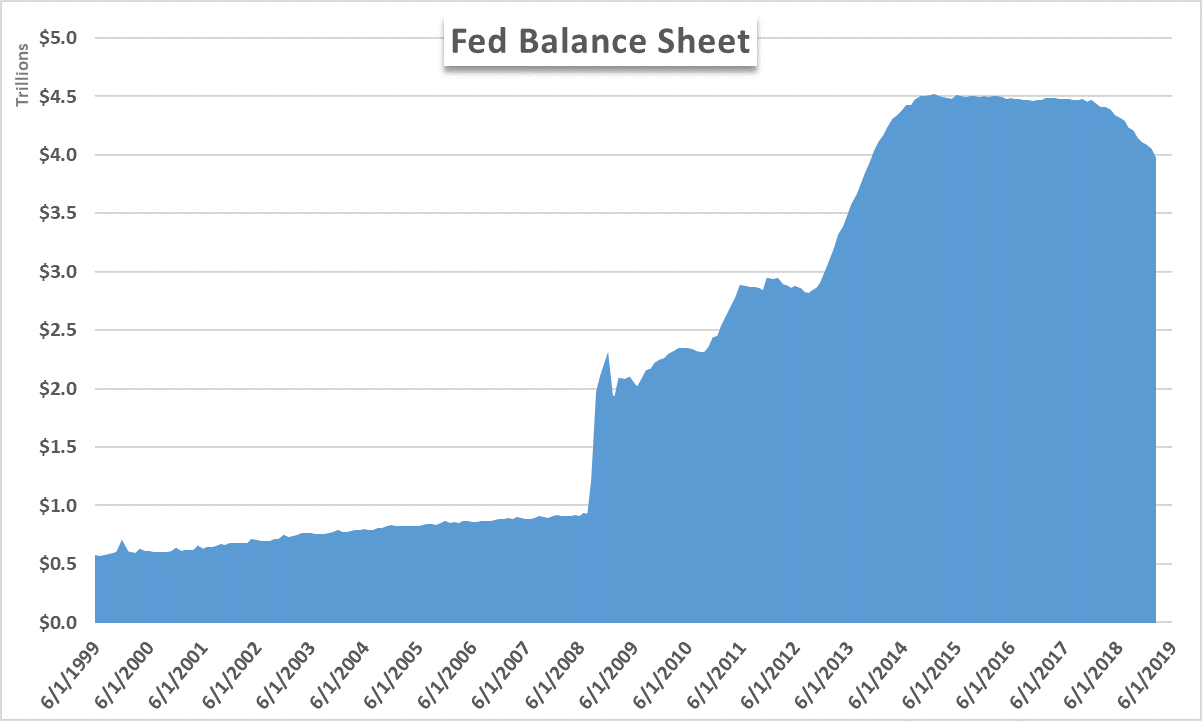

Smaller Qe A More Targeted Approach For The Bank Of England

Apr 23, 2025

Smaller Qe A More Targeted Approach For The Bank Of England

Apr 23, 2025 -

At And T Slams Broadcoms V Mware Price Hike A 1 050 Increase

Apr 23, 2025

At And T Slams Broadcoms V Mware Price Hike A 1 050 Increase

Apr 23, 2025 -

Depozite Bancare Cu Dobanzi Mari Martie 2024 Compara Si Alege Cea Mai Buna Oferta

Apr 23, 2025

Depozite Bancare Cu Dobanzi Mari Martie 2024 Compara Si Alege Cea Mai Buna Oferta

Apr 23, 2025