Warren Buffett's Apple Sale: Perfect Timing And Future Implications

Table of Contents

The Timing of the Sale: Was it Perfect?

The timing of Warren Buffett's Apple Sale is a subject of intense debate. To understand whether it was "perfect," we must consider several factors.

Market Conditions at the Time of the Sale

The sale coincided with a period of significant economic uncertainty.

- Rising Interest Rates: The Federal Reserve's aggressive interest rate hikes aimed to curb inflation, impacting investor sentiment towards growth stocks like Apple.

- Inflationary Pressures: High inflation eroded consumer spending power, potentially affecting Apple's product sales and future growth projections.

- Tech Sector Slowdown: The tech sector, as a whole, experienced a period of slower growth, with several companies announcing layoffs and revised earnings forecasts. This broader market trend influenced the valuation of many technology stocks, including Apple.

Berkshire Hathaway's Portfolio Diversification Strategy

Buffett is renowned for his conservative investment approach and emphasis on diversification.

- Historical Diversification: Berkshire Hathaway’s portfolio has historically been diversified across various sectors, minimizing reliance on any single stock. The Apple stake, while significant, always represented a portion of a larger, well-balanced investment strategy.

- Rebalancing the Portfolio: The sale might reflect a strategic rebalancing of Berkshire's portfolio to align with changing market conditions and emerging opportunities in other sectors.

- Profit-Taking: Given Apple's substantial run-up in price over the years, some analysts believe the sale was partly driven by the desire to secure substantial profits.

Potential Underlying Reasons for the Sale

Beyond market conditions and diversification, several other factors might have contributed to Warren Buffett's Apple Sale.

- Shifting Investment Priorities: Buffett might have identified more promising investment opportunities elsewhere, leading to a reallocation of capital.

- Internal Rebalancing: The sale could be part of an internal restructuring of Berkshire Hathaway's investment portfolio, optimizing its overall risk profile.

- Long-Term Outlook: Some speculate that the sale reflects a more cautious outlook for the tech sector's future growth, although this is purely speculative without further insight into Buffett's thinking.

Implications for Apple's Future Stock Performance

The impact of Warren Buffett's Apple Sale on Apple's future stock performance remains to be seen.

Market Reaction and Analyst Sentiment

The initial market reaction was mixed.

- Temporary Dip: Apple's stock price experienced a slight dip following the news of the sale, although the impact was relatively muted.

- Analyst Opinions: Analyst opinions varied, with some expressing concern and others maintaining a positive outlook on Apple's long-term prospects.

- Trading Volume: Increased trading volume immediately after the announcement indicates significant market interest and reaction to the news.

Apple's Long-Term Growth Prospects

Apple's future growth depends on several factors.

- Innovation: Apple's continued ability to innovate and introduce new, desirable products remains crucial for sustained growth.

- Competition: Intense competition from other tech giants poses a significant challenge to Apple's market dominance.

- Market Saturation: The increasing saturation of the smartphone market could limit Apple's future growth potential.

The Impact on Other Tech Stocks

The sale could have ripple effects throughout the tech sector.

- Investor Sentiment: The sale might have influenced investor sentiment towards other tech stocks, potentially leading to wider market adjustments.

- Correlation with other Tech Giants: Apple's performance often influences the perception of other large technology companies, leading to correlated price movements.

Implications for Berkshire Hathaway's Investment Strategy

Warren Buffett's Apple Sale has significant implications for Berkshire Hathaway's investment strategy.

Changes in Berkshire Hathaway's Portfolio Allocation

The sale alters Berkshire Hathaway's portfolio allocation.

- Sector Weights: The reduction in the tech sector's weighting necessitates a reassessment of Berkshire's overall risk profile and potential returns.

- Potential New Investments: The freed-up capital may be allocated to other promising investment opportunities identified by Buffett and his team.

- Long-Term Investment Strategy: This move highlights the dynamic nature of Berkshire Hathaway's investment strategy, reflecting adaptation to changing market circumstances.

Buffett's Shifting Investment Focus

The sale provides some insights into Buffett's potential shifts in investment focus.

- New Sectors of Interest: The sale might indicate a potential shift in focus towards other sectors considered more promising for future returns.

- Comparison to Past Decisions: The decision can be compared to past investment choices by Buffett, highlighting potential shifts in his overall market outlook.

Conclusion: Warren Buffett's Apple Sale: A Retrospective and Future Outlook

Warren Buffett's Apple Sale presents a complex picture. While the timing might seem opportune given market conditions, the decision likely reflects a combination of diversification strategies, profit-taking, and a potential reassessment of Apple's future growth prospects. The sale's impact on Apple's stock, the broader tech sector, and Berkshire Hathaway's investment strategy will unfold over time. It doesn't necessarily signal a bearish outlook for either Apple or the market as a whole, but rather highlights the dynamic nature of long-term investment strategies in a constantly evolving economic landscape. To stay abreast of further developments and analysis of this significant event, continue following financial news and expert commentary on Warren Buffett's Apple Sale and its long-term implications. Further research into Berkshire Hathaway's annual reports and Buffett's own pronouncements will offer valuable insights.

Featured Posts

-

Son Dakika Izmir Okullari Tatil Mi Degil Mi 24 Subat Valilik Karari

Apr 23, 2025

Son Dakika Izmir Okullari Tatil Mi Degil Mi 24 Subat Valilik Karari

Apr 23, 2025 -

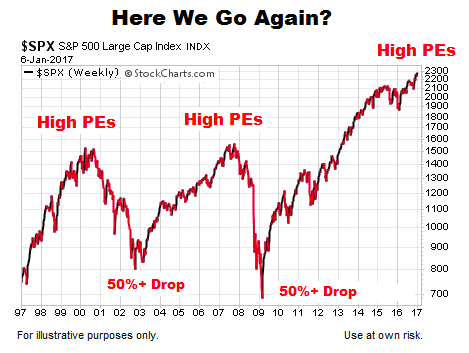

Bof As Take Are High Stock Market Valuations Cause For Concern

Apr 23, 2025

Bof As Take Are High Stock Market Valuations Cause For Concern

Apr 23, 2025 -

Pierre Poilievres Election Campaign A Case Study In Lost Momentum

Apr 23, 2025

Pierre Poilievres Election Campaign A Case Study In Lost Momentum

Apr 23, 2025 -

Reecouter Good Morning Business Lundi 24 Fevrier

Apr 23, 2025

Reecouter Good Morning Business Lundi 24 Fevrier

Apr 23, 2025 -

Five Key Economic Points From The English Language Leaders Debate

Apr 23, 2025

Five Key Economic Points From The English Language Leaders Debate

Apr 23, 2025