Warren Buffett's Canadian Successor: A Billionaire Without Berkshire Hathaway Shares

Table of Contents

Identifying the Canadian Billionaire:

For the purpose of this article, we will examine the investment strategies and success of Lawrence Stroll, a Canadian billionaire with a net worth exceeding $3 billion. Stroll's primary focus lies in building long-term value, mirroring Buffett's renowned approach. He isn't known for quick trades or speculative ventures; instead, he focuses on identifying undervalued assets and nurturing their growth over extended periods. This long-term value investing strategy showcases remarkable similarities to Warren Buffett's approach.

- Successful Investments: Stroll's significant investments include a substantial stake in Aston Martin Lagonda Global Holdings plc, a luxury car manufacturer. This highlights his acumen in recognizing potential in established brands undergoing transformation. He also made significant investments in the fashion and luxury goods industries.

- Company and Market Position: While not running a company of Berkshire Hathaway's scale, Stroll's influence extends across various sectors through strategic investments and board positions. His investment decisions often shape the trajectory of the companies he invests in.

- Investment Style: Stroll's investment style centers on thorough due diligence, focusing on identifying companies with strong underlying fundamentals and significant growth potential. He prioritizes long-term value creation over short-term market fluctuations, mirroring Buffett's patient approach.

Comparing Investment Strategies: Buffett vs. the Canadian Billionaire

Both Warren Buffett and Lawrence Stroll share a remarkable similarity in their investment philosophies. While their portfolios differ significantly in scope, the underlying principles remain remarkably consistent.

- Long-Term Holdings: Both prioritize long-term holdings, eschewing the allure of short-term gains. Their investments are not seen as quick trades but as partnerships with enduring value.

- Understanding Business Fundamentals: Both emphasize the importance of deeply understanding a company's business model, financial health, and competitive landscape before committing to an investment. This fundamental analysis is the cornerstone of their approach.

- Patience and Discipline: Both exemplify remarkable patience and discipline in their investment approach. They're not swayed by market volatility or short-term pressures, waiting for the right opportunities and holding onto assets through market fluctuations.

- Contrarian Approach: Both demonstrate a contrarian approach, often capitalizing on market downturns to acquire undervalued assets. They actively seek out opportunities that others might overlook.

Analyzing Success Factors Beyond Berkshire Hathaway

Stroll's success transcends the unique opportunities associated with Berkshire Hathaway's size and established network. Several factors contribute to his remarkable financial achievements.

- Industry Expertise: Stroll possesses deep industry expertise, particularly in the automotive and luxury goods sectors. This specialized knowledge grants him a significant advantage in identifying promising investment opportunities.

- Strategic Partnerships: He has a proven ability to forge strategic partnerships and collaborations, leveraging synergies to enhance the value of his investments.

- Effective Risk Management: Stroll demonstrates effective risk management strategies, diversifying his portfolio and carefully assessing potential downsides before making significant investments.

- Strong Management Teams: He recognizes the importance of strong management teams in driving company growth and success, actively seeking out and supporting companies with capable leadership.

Lessons for Aspiring Investors

Stroll's success offers invaluable lessons for aspiring investors:

- Long-Term Vision: Cultivate a long-term perspective in your investment strategies, avoiding the temptation of short-term gains.

- Thorough Due Diligence: Conduct rigorous due diligence before making any investment decision, thoroughly researching companies and their fundamentals.

- Patient and Disciplined Approach: Develop patience and discipline in your investment approach, resisting the urge to panic sell during market downturns.

- Networking: Build a strong network of contacts within your chosen industries, gaining valuable insights and opportunities.

Conclusion

While Lawrence Stroll may not be a direct successor to Warren Buffett at Berkshire Hathaway, he embodies many of the same principles that have made Buffett a legendary investor. Their shared focus on long-term value investing, fundamental analysis, and patient decision-making highlights the enduring power of these strategies. Stroll’s unique success story, built outside the context of Berkshire Hathaway, provides valuable lessons in wealth creation and offers a compelling model for aspiring investors.

Learn more about successful investment strategies by exploring the life and career of this fascinating Warren Buffett's Canadian Successor. Discover how their approach to wealth creation can inspire your own investment journey. Research their investment history and learn from their successes and challenges to build your own path toward financial success.

Featured Posts

-

Uk Student Visa Restrictions Impact On Pakistani Students And Asylum Seekers

May 09, 2025

Uk Student Visa Restrictions Impact On Pakistani Students And Asylum Seekers

May 09, 2025 -

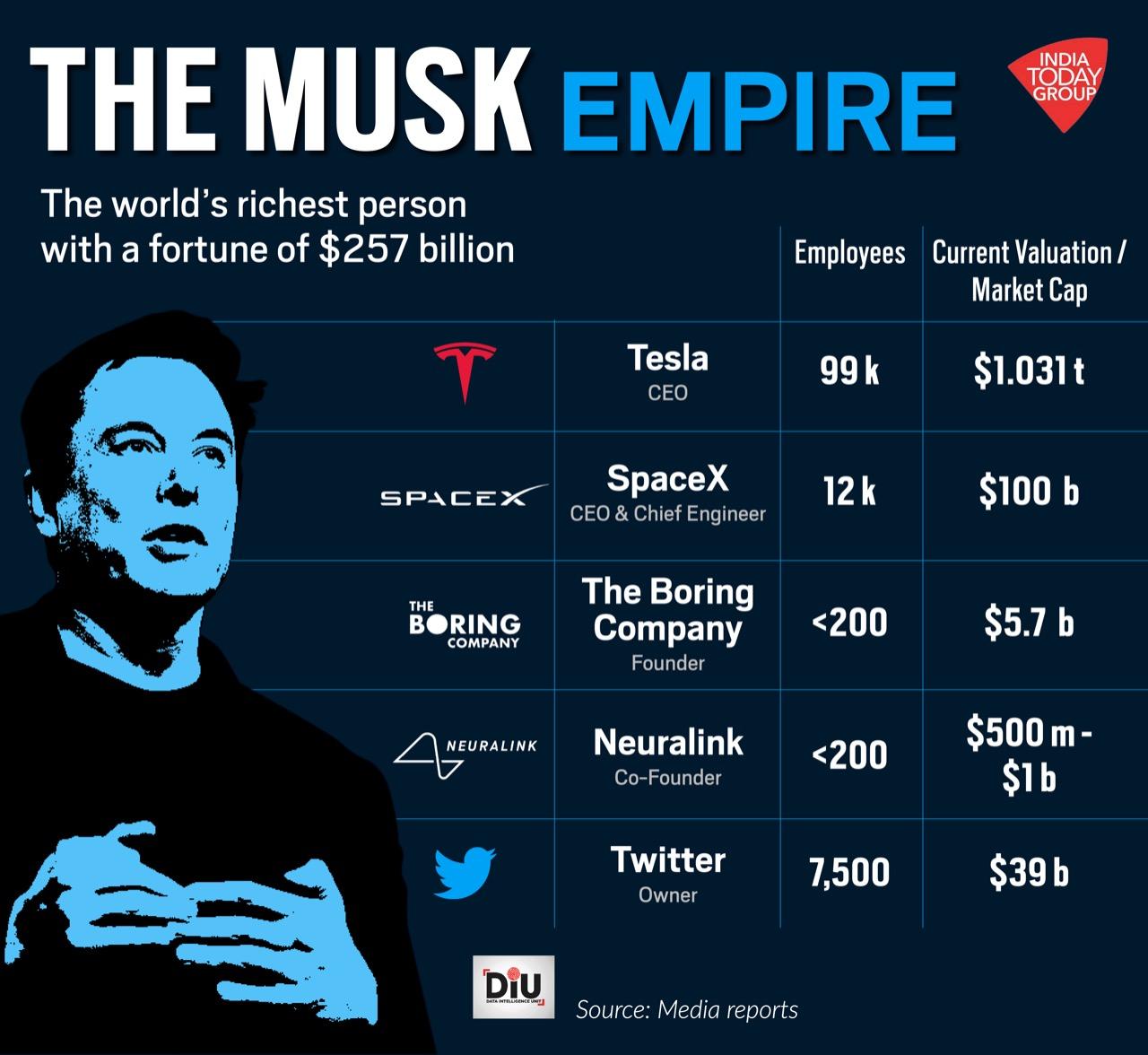

Elon Musk Net Worth The Influence Of Us Politics On Tesla And Space X

May 09, 2025

Elon Musk Net Worth The Influence Of Us Politics On Tesla And Space X

May 09, 2025 -

Dakota Johnsons Role Selection Chris Martins Potential Influence

May 09, 2025

Dakota Johnsons Role Selection Chris Martins Potential Influence

May 09, 2025 -

Aocs Fact Check On Fox News A Critical Examination Of Pirros Statements

May 09, 2025

Aocs Fact Check On Fox News A Critical Examination Of Pirros Statements

May 09, 2025 -

Nc Daycare Suspension What Parents Need To Know

May 09, 2025

Nc Daycare Suspension What Parents Need To Know

May 09, 2025