Where To Invest: Mapping The Country's Top Business Hot Spots

Table of Contents

Analyzing Key Economic Indicators for Investment Decisions

Smart investment decisions rely heavily on a thorough analysis of economic indicators. Understanding these metrics is paramount to identifying promising locations.

GDP Growth and Sectoral Performance

Examining regional GDP growth rates provides a clear picture of overall economic health. Focusing on specific sectors like technology, manufacturing, and renewable energy reveals areas of strength and potential for future growth.

- Examples of Strong Growth Regions: The technology sector in Silicon Valley consistently demonstrates high GDP growth, making it a prime investment location. Similarly, regions specializing in advanced manufacturing often exhibit strong and steady economic performance. Data sources like the Bureau of Economic Analysis (BEA) and industry-specific reports offer valuable insights.

- Industry-Specific Growth: The renewable energy sector shows tremendous promise, with regions investing heavily in wind and solar power experiencing significant economic expansion. This presents lucrative investment opportunities for businesses involved in renewable energy technologies.

Unemployment Rates and Labor Market Dynamics

A strong labor pool is a critical factor for businesses. Analyzing unemployment rates and the availability of skilled workers helps determine the suitability of a region for different types of businesses.

- Regions with Skilled Workforces: Areas with low unemployment but a high concentration of skilled workers in specific fields, such as engineering, finance, or technology, are magnets for significant investments. These regions offer access to a readily available talent pool.

- Regions with High Unemployment: While regions with high unemployment might offer cheaper labor costs, they may also pose challenges related to skill gaps and workforce training. Businesses need to assess whether this presents a manageable risk.

Infrastructure and Logistics

Efficient transportation, communication, and utility infrastructure are essential for smooth business operations. Regions with superior infrastructure significantly reduce operational costs and improve efficiency.

- Essential Infrastructure Components: Excellent road networks, modern ports and airports, reliable internet access, and a stable energy supply are critical factors to consider. These components reduce logistical bottlenecks and enhance overall efficiency.

- Coastal Regions and International Trade: Coastal regions with modern ports provide easier access to international markets, a crucial advantage for businesses involved in import/export. This opens doors to broader markets and accelerates business expansion.

Exploring Regional Investment Incentives and Government Support

Government incentives and a supportive regulatory environment can significantly impact investment decisions. Understanding these factors is vital for identifying lucrative opportunities.

Tax Breaks and Subsidies

Many regions offer tax incentives, subsidies, and grants to attract businesses and stimulate economic growth. Researching these incentives is crucial for maximizing investment returns.

- Examples of Government Incentives: State X might offer significant tax breaks for businesses investing in renewable energy infrastructure, while Region Y might provide subsidies for companies creating high-skilled jobs. Always check with the relevant government agencies for the latest information.

- Identifying Relevant Programs: Government websites and economic development agencies are excellent resources for discovering available incentives. Understanding the eligibility criteria and application processes is crucial.

Regulatory Environment and Ease of Doing Business

A streamlined regulatory environment contributes significantly to efficient business operations. Regions with transparent regulations and simplified procedures attract more investment.

- Bureaucratic Hurdles: Regions with complex bureaucratic processes and cumbersome licensing procedures can hinder business growth. Ease of doing business rankings often reflect these factors.

- Regulatory Compliance: Understanding the regulatory landscape and compliance requirements is essential for any business operating within a region. Regions with transparent regulations tend to be more attractive to investors.

Identifying Emerging Markets and Untapped Potential

Analyzing emerging industries and future trends helps identify regions with significant growth potential, offering exciting investment opportunities.

Growth Sectors and Future Trends

Sustainable technology, biotech, and advanced manufacturing are some of the sectors showing significant growth potential. Pinpointing regions specializing in these industries can reveal untapped opportunities.

- Sustainable Technology: Regions focusing on green initiatives and sustainable practices offer lucrative investment opportunities in areas such as renewable energy, sustainable agriculture, and eco-tourism.

- Biotechnology and Advanced Manufacturing: Regions with strong research institutions and skilled workforces in these fields represent highly attractive investment destinations.

Real Estate Market Analysis

Analyzing real estate prices, rental rates, and availability helps determine affordability and long-term investment potential.

- Property Values and Rental Yields: Regions experiencing population growth often see significant increases in property values, resulting in attractive returns for real estate investors.

- Growth Projections: Conducting a comprehensive market analysis, including projections for population growth and economic development, is key for informed real estate investment decisions.

Conclusion

Identifying the best places to invest requires careful consideration of economic indicators, government support, and emerging market trends. By analyzing GDP growth, labor markets, infrastructure, investment incentives, and regional growth potential, you can make well-informed decisions. Remember to conduct thorough due diligence and consult with financial advisors before making any major investment decisions. Start exploring the country's top business hot spots today and unlock lucrative investment opportunities! Find the perfect place to invest your capital and watch your business thrive.

Featured Posts

-

More Than Bmw And Porsche Examining Western Automakers Struggles In China

Apr 28, 2025

More Than Bmw And Porsche Examining Western Automakers Struggles In China

Apr 28, 2025 -

Richard Jeffersons Espn Promotion Nba Finals Analyst Role Still Uncertain

Apr 28, 2025

Richard Jeffersons Espn Promotion Nba Finals Analyst Role Still Uncertain

Apr 28, 2025 -

Upcoming Memoir From Cassidy Hutchinson Insights From A Key January 6th Witness

Apr 28, 2025

Upcoming Memoir From Cassidy Hutchinson Insights From A Key January 6th Witness

Apr 28, 2025 -

Triston Casas Demotion Highlights Red Sox Lineup Adjustments

Apr 28, 2025

Triston Casas Demotion Highlights Red Sox Lineup Adjustments

Apr 28, 2025 -

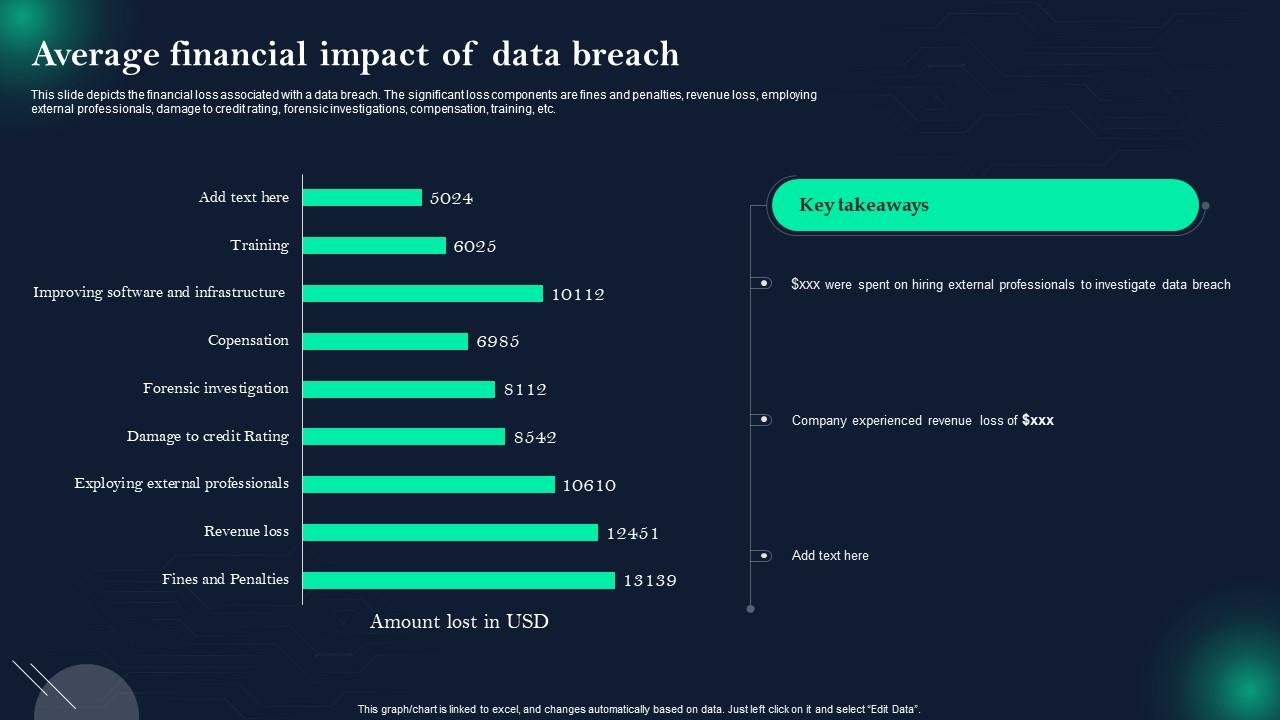

Significant Office365 Data Breach Results In Millions Of Dollars In Losses

Apr 28, 2025

Significant Office365 Data Breach Results In Millions Of Dollars In Losses

Apr 28, 2025

Latest Posts

-

Muellers Home Goodbye Bayern Munich Clinch Bundesliga

May 12, 2025

Muellers Home Goodbye Bayern Munich Clinch Bundesliga

May 12, 2025 -

Bayern Munich Secure Bundesliga Thomas Muellers Final Home Match

May 12, 2025

Bayern Munich Secure Bundesliga Thomas Muellers Final Home Match

May 12, 2025 -

Bundesliga Celebration Bayern Munichs Home Win And Muellers Farewell

May 12, 2025

Bundesliga Celebration Bayern Munichs Home Win And Muellers Farewell

May 12, 2025 -

Bundesliga Absteiger 2023 24 Bochum Und Holstein Kiel Leipzig Entgeht Cl

May 12, 2025

Bundesliga Absteiger 2023 24 Bochum Und Holstein Kiel Leipzig Entgeht Cl

May 12, 2025 -

Bochum Und Holstein Kiel Abstieg Besiegelt Leipzig Scheitert In Der Champions League Qualifikation

May 12, 2025

Bochum Und Holstein Kiel Abstieg Besiegelt Leipzig Scheitert In Der Champions League Qualifikation

May 12, 2025