Will Palantir Reach A $1 Trillion Valuation? Analyzing The Potential

Table of Contents

Palantir's Current Market Position and Growth Trajectory

Palantir's current market capitalization, while substantial, is still a considerable distance from the $1 trillion mark. Analyzing its recent financial performance is crucial to assessing its growth trajectory. The company generates revenue primarily from two sources: lucrative government contracts and increasingly important commercial clients. Government contracts, particularly with intelligence agencies and defense departments, have historically formed a significant portion of Palantir's revenue, providing a stable, albeit sometimes unpredictable, income stream. However, the company is actively diversifying into the commercial sector, targeting large enterprises across various industries.

- Current market capitalization compared to competitors: While Palantir's market cap is significant, it lags behind tech giants like Microsoft and Amazon. Direct comparisons with competitors like Databricks and Snowflake are more relevant, revealing Palantir's position within the data analytics space.

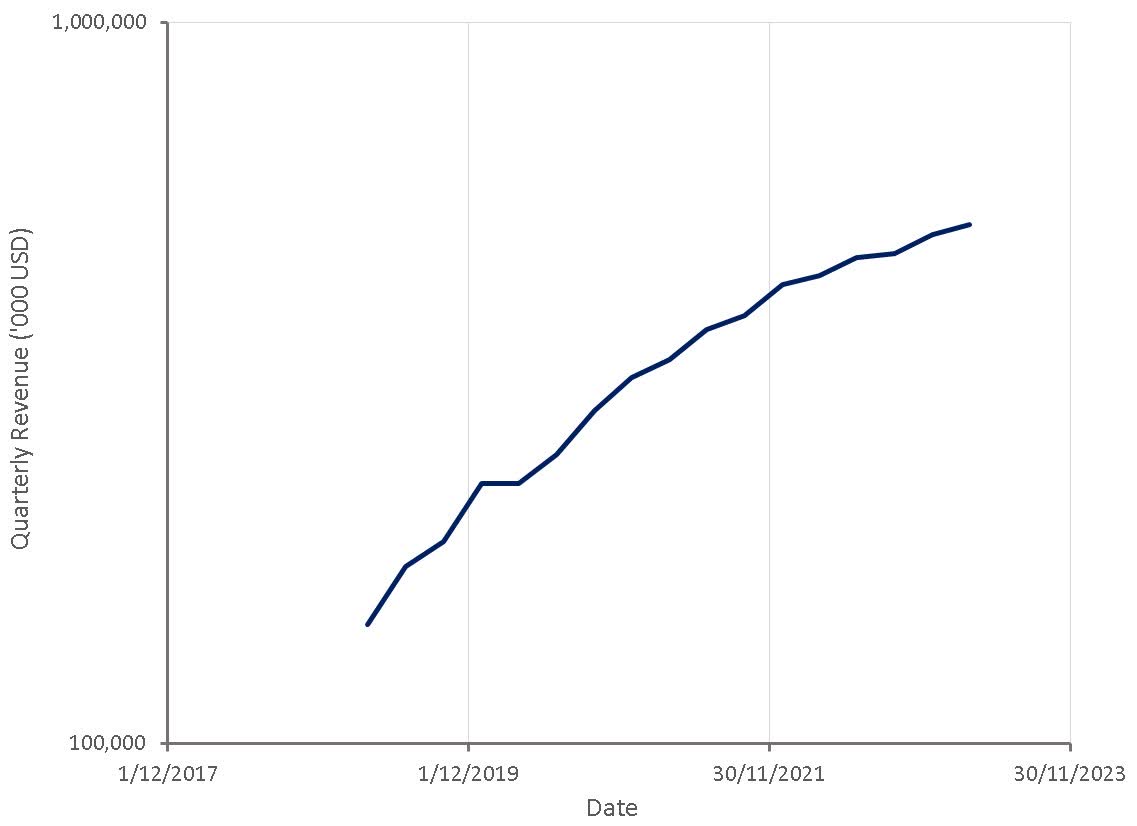

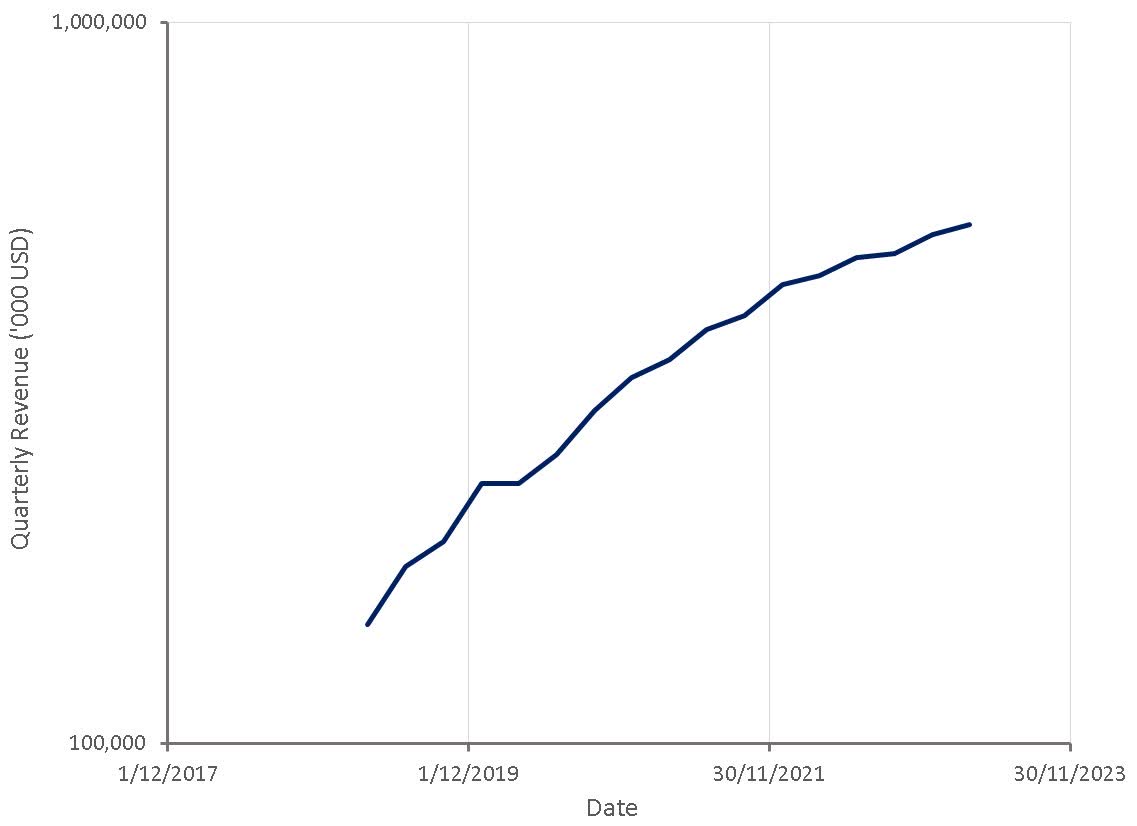

- Year-over-year revenue growth percentage: Examining Palantir's year-over-year revenue growth reveals the speed and consistency of its expansion. Consistent high growth is essential for justifying a $1 trillion valuation.

- Key contracts secured and their impact on future revenue: Large, long-term contracts, both government and commercial, significantly impact Palantir's future revenue projections. Analyzing these contracts provides insights into the company's future financial stability.

- Analysis of future growth projections from reputable financial analysts: Examining growth projections from respected financial analysts provides external validation of Palantir's potential. These projections, however, should be considered cautiously, as they inherently involve uncertainty.

Competitive Landscape and Technological Advantages

Palantir operates in a fiercely competitive landscape. Major players in data analytics and government contracting pose significant challenges. However, Palantir possesses key technological advantages, most notably its Foundry and Gotham platforms. Foundry, its commercial platform, offers a powerful data integration and analysis tool, while Gotham, its government-focused platform, caters to the unique needs of national security and intelligence agencies.

- Direct competitors and their market share: Companies like Databricks, Snowflake, and even established tech giants like Google and Microsoft represent significant competition. Analyzing their market share highlights Palantir's relative position and the intensity of competition.

- Palantir's unique selling propositions (USPs): Palantir's ability to integrate vast and disparate datasets, coupled with its intuitive user interface, presents a unique value proposition that differentiates it from competitors.

- Analysis of the barriers to entry in the market: The high cost of developing comparable data analytics platforms, coupled with the specialized expertise required, creates significant barriers to entry for new competitors.

- Assessment of potential disruptive technologies: The rapid pace of technological advancements means that new, disruptive technologies could emerge, posing a threat to Palantir's current dominance.

Challenges and Risks to a $1 Trillion Valuation

The path to a $1 trillion valuation is fraught with challenges. Palantir's dependence on government contracts, while historically beneficial, introduces significant geopolitical risks. Economic downturns could also impact spending by commercial clients, reducing revenue streams. Furthermore, concerns surrounding data privacy and security pose considerable operational risks.

- Dependence on government contracts: A significant portion of Palantir's revenue stems from government contracts, making it vulnerable to shifts in government priorities and funding.

- Competition from established tech giants: The intense competition from established tech giants with vast resources presents a significant hurdle to continued market share growth.

- Data security and privacy concerns: The sensitive nature of the data Palantir handles requires robust security measures to mitigate the risks associated with data breaches.

- Economic recession risks and their influence: Economic downturns can significantly impact both government and commercial spending, potentially hindering Palantir's growth.

Potential Catalysts for a $1 Trillion Valuation

Several potential catalysts could accelerate Palantir's growth and propel it towards a $1 trillion valuation. Expansion into new markets, strategic acquisitions, and successful product launches could all significantly impact its trajectory.

- Successful penetration of new markets: Expanding into new markets like healthcare and finance can unlock significant growth opportunities.

- Strategic partnerships with major corporations: Forming strategic alliances with major corporations can expand Palantir's reach and accelerate its adoption.

- Successful product launches and upgrades: Continuously innovating and releasing new products and upgrades keeps Palantir competitive and attracts new clients.

- Technological breakthroughs and innovations: Significant advancements in Palantir's technology could dramatically improve its offerings and enhance its competitive advantage.

Conclusion

Whether Palantir reaches a $1 trillion valuation is a complex question with no easy answer. While its technological advantages and impressive growth trajectory are compelling, significant challenges remain. Its dependence on government contracts, intense competition, and the inherent risks associated with data handling all pose substantial hurdles. However, successful expansion into new markets, strategic acquisitions, and continued technological innovation could be powerful catalysts. Ultimately, further research and continuous monitoring of Palantir's financial reports and market activity are crucial for investors interested in the "Palantir $1 Trillion Valuation" question. Stay informed and continue to analyze the evolving landscape of this powerful data analytics company.

Featured Posts

-

Investing In Palantir A Comprehensive Guide

May 09, 2025

Investing In Palantir A Comprehensive Guide

May 09, 2025 -

Epstein Records Concealment Allegation Senate Democrats Target Pam Bondi

May 09, 2025

Epstein Records Concealment Allegation Senate Democrats Target Pam Bondi

May 09, 2025 -

Franko Polskoe Partnerstvo Detali Novogo Oboronnogo Soglasheniya I Ego Posledstviya

May 09, 2025

Franko Polskoe Partnerstvo Detali Novogo Oboronnogo Soglasheniya I Ego Posledstviya

May 09, 2025 -

Increased Eu Action On Us Tariffs A French Ministers Perspective

May 09, 2025

Increased Eu Action On Us Tariffs A French Ministers Perspective

May 09, 2025 -

West Bengal Madhyamik Exam 2025 Merit List Announcement

May 09, 2025

West Bengal Madhyamik Exam 2025 Merit List Announcement

May 09, 2025