Will XRP ETFs Disappoint Investors? Supply Headwinds And Institutional Adoption Concerns

Table of Contents

Supply Headwinds Affecting XRP ETF Performance

The success of any ETF hinges on the underlying asset's stability and liquidity. XRP, however, faces significant headwinds on the supply side that could dampen the performance of XRP ETFs.

Ripple's Ongoing Legal Battle

The SEC lawsuit against Ripple Labs significantly impacts XRP's price and investor sentiment. A negative outcome could:

- Depress ETF value: A ruling against Ripple could lead to a sharp decline in XRP's price, directly impacting the value of any launched ETFs.

- Delay ETF launches: Uncertainty surrounding the legal battle might deter ETF providers from launching products until the outcome is clear.

- Erode investor confidence: Negative news surrounding the lawsuit could scare away potential investors, reducing demand for XRP ETFs.

Data shows a strong correlation between significant legal developments in the Ripple case and XRP price volatility. For instance, positive news often leads to short-term price surges, while negative updates can trigger substantial drops. This inherent volatility presents a significant risk for ETF investors.

XRP's Tokenomics and Circulation Supply

XRP's pre-mined nature and Ripple's controlled release schedule pose further challenges.

- Potential for large sell-offs: The large existing supply of XRP presents the risk of significant sell-offs, potentially impacting price stability within an ETF framework.

- Influence of Ripple's release: Ripple's control over XRP distribution could influence market dynamics and potentially create price manipulation concerns.

Unlike cryptocurrencies with deflationary mechanisms, XRP's tokenomics could lead to increased supply pressure, affecting its long-term price trajectory and the attractiveness of XRP ETFs. Comparing XRP's supply to Bitcoin's capped supply highlights this key difference.

Market Liquidity and Trading Volume

For an ETF to function smoothly, sufficient liquidity is crucial. XRP's liquidity, while improving, still lags behind some major cryptocurrencies.

- Order book depth: The depth of XRP's order book needs to significantly improve to support large ETF trading volumes without causing significant price swings.

- Trading volume volatility: Fluctuations in XRP's trading volume could lead to price manipulation and make accurate ETF pricing challenging.

Comparing XRP's liquidity to established assets like gold or major indices traded within ETFs reveals a significant gap. This lack of robust liquidity poses a considerable risk for XRP ETF investors.

Institutional Adoption and its Influence on XRP ETF Success

Institutional adoption is a key driver of cryptocurrency price appreciation and ETF success. However, XRP faces challenges in this area.

Current Institutional Holdings of XRP

While institutional interest in XRP is growing, it remains relatively lower compared to Bitcoin or Ethereum.

- Existing institutional investments: Data on existing institutional holdings of XRP is limited compared to other major cryptocurrencies.

- Potential future adoption: Future institutional adoption hinges on regulatory clarity and the outcome of the Ripple lawsuit.

A lack of significant institutional backing currently limits the upward price pressure on XRP and the potential for XRP ETF growth.

Regulatory Uncertainty and its Impact

The regulatory landscape surrounding cryptocurrencies remains uncertain, particularly for XRP.

- SEC regulations: The SEC's stance on XRP is a major factor affecting its suitability for ETF inclusion.

- Potential regulatory hurdles: Navigating regulatory complexities could delay or even prevent the approval of XRP ETFs in certain jurisdictions.

Regulatory differences across different jurisdictions impact ETF accessibility, presenting additional complexities for investors.

Competition from Other Crypto ETFs

XRP ETFs will face stiff competition from other crypto ETFs offering exposure to more established assets like Bitcoin and Ethereum.

- Competing assets and ETFs: The market offers various crypto ETFs, each with its unique features and target audience.

- XRP's unique selling propositions: XRP's proponents emphasize its speed and low transaction costs. However, this needs to be weighed against the risks associated with its regulatory uncertainty.

Comparing XRP's market capitalization and trading volume to its competitors highlights its current relative position within the broader crypto market.

Conclusion: Weighing the Risks and Rewards of Investing in XRP ETFs

Investing in XRP ETFs presents both potential benefits, such as increased accessibility and the possibility of price appreciation, and significant risks, including legal uncertainty, supply-side issues, and regulatory hurdles. While the increased accessibility offered by ETFs is appealing, investors must carefully assess the potential for significant price volatility tied to the ongoing Ripple lawsuit and the current lack of strong institutional adoption. Thorough due diligence, portfolio diversification, and a clear understanding of your risk tolerance are essential before investing in XRP ETFs. Conduct your own research and consult with financial advisors to make informed investment decisions. Learn more about the potential of XRP ETFs and their associated risks.

Featured Posts

-

Krypto The Superdog Takes Center Stage In New Superman Preview

May 08, 2025

Krypto The Superdog Takes Center Stage In New Superman Preview

May 08, 2025 -

Dbs On Environmental Reform A Period Of Grace For Major Polluters

May 08, 2025

Dbs On Environmental Reform A Period Of Grace For Major Polluters

May 08, 2025 -

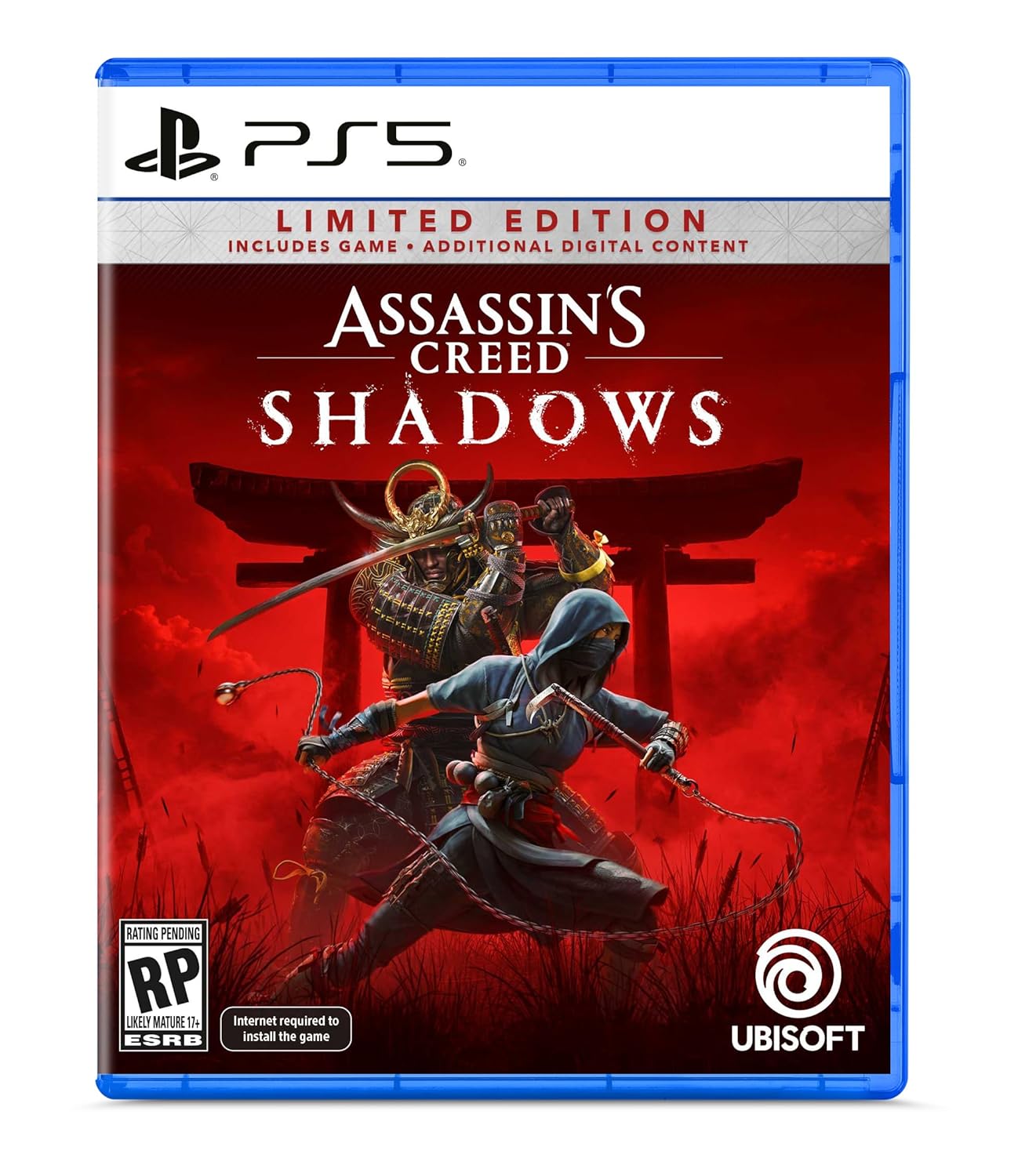

Elevated Visuals Assassins Creed Shadows On The Ps 5 Pro With Ray Tracing

May 08, 2025

Elevated Visuals Assassins Creed Shadows On The Ps 5 Pro With Ray Tracing

May 08, 2025 -

Historia E Transferimit Te Neymar Ceku Arabishtja Dhe Roli I Agjentit

May 08, 2025

Historia E Transferimit Te Neymar Ceku Arabishtja Dhe Roli I Agjentit

May 08, 2025 -

Xrp Price Prediction Can Xrp Rise Further After A 400 Surge

May 08, 2025

Xrp Price Prediction Can Xrp Rise Further After A 400 Surge

May 08, 2025