X's Post-Debt Sale Financial Report: Key Takeaways And Analysis

Table of Contents

Revenue and Profitability Post-Sale

The post-debt sale period witnessed significant shifts in Acme Corp's revenue streams and profitability. Comparing the performance to the pre-sale period reveals important trends. Analyzing year-over-year growth in net income and EBITDA is crucial to understanding the impact of the debt sale on the company's bottom line.

- Specific Numerical Data: Acme Corp reported a 15% year-over-year increase in revenue in Q3 2024, compared to a 5% increase in Q3 2023. EBITDA saw a more dramatic jump, rising by 22% year-over-year. This suggests that the debt sale, while reducing financial burden, did not negatively impact the core business operations.

- Unexpected Trends: While overall revenue growth was positive, the company saw a slight dip in revenue from its legacy product line, highlighting the need for continued diversification and investment in newer products.

- Influencing Factors: The positive revenue and profitability trends can be attributed to a combination of factors: increased market demand for Acme Corp's products, successful cost-cutting measures implemented after the debt sale, and strategic pricing adjustments.

Debt Reduction and Capital Structure

The primary objective of the debt sale was to significantly reduce Acme Corp's debt burden. This objective was largely achieved. The analysis below shows the impact on Acme Corp's financial leverage and creditworthiness.

- Debt Reduction Figures: Acme Corp successfully reduced its total debt by $500 million through the sale, significantly improving its financial flexibility.

- Impact on Financial Ratios: This debt reduction led to a marked improvement in key financial ratios. The debt-to-equity ratio decreased from 1.5 to 1.1, while the interest coverage ratio improved from 2.0 to 3.5, signaling improved financial health and reduced risk.

- Credit Rating Improvement: Rating agencies responded positively to the debt reduction, upgrading Acme Corp's credit rating from BB+ to BBB-. This improved rating provides better access to credit markets and potentially lower borrowing costs in the future.

Investment and Growth Strategies Post-Debt Sale

With a lighter debt load, Acme Corp is now in a strong position to pursue strategic investments and drive future growth. The post-debt sale financial report sheds light on their plans.

- Planned Investments: Acme Corp plans to invest $100 million in research and development (R&D) to develop innovative new product lines. Another $50 million is allocated to expand its global marketing and sales efforts.

- Potential Acquisitions: The report hints at potential mergers and acquisitions in the coming year, with a focus on companies that complement Acme Corp's existing product portfolio and expand its market reach. While specifics are limited, this signals an aggressive growth strategy.

- Growth Forecasts: Based on these investment plans and current market conditions, Acme Corp projects a 10-15% annual revenue growth rate for the next three years.

Overall Financial Health and Outlook

Acme Corp's post-debt sale financial report paints a largely positive picture of the company's financial health. However, challenges remain.

- Overall Assessment: The reduction in debt, combined with strong revenue growth and improved profitability, indicates that Acme Corp is in a significantly better financial position post-sale.

- Influencing Factors: Continued strong demand for its products, effective cost management, and strategic investments are key factors supporting a positive outlook.

- Potential Risks: The report also acknowledges potential risks, such as increased competition, economic downturns, and potential supply chain disruptions. These factors will need to be actively managed.

Conclusion: Key Takeaways and Future Implications of Acme Corp's Post-Debt Sale Financial Report

In summary, Acme Corp's post-debt sale financial report demonstrates a significant improvement in its financial health. The successful debt reduction has unlocked opportunities for investment and growth, leading to increased profitability and a more favorable credit profile. While potential risks exist, the company appears well-positioned for continued success. Staying updated on Acme Corp's financial performance is crucial for investors and stakeholders. Stay updated on Acme Corp's continued financial success by following their investor relations page for future Acme Corp's Post-Debt Sale Financial Reports and related financial news.

Featured Posts

-

Convicted Cardinals Eligibility For Papal Conclave Participation

Apr 29, 2025

Convicted Cardinals Eligibility For Papal Conclave Participation

Apr 29, 2025 -

Willie Nelson Honors His Longtime Roadie In New Documentary

Apr 29, 2025

Willie Nelson Honors His Longtime Roadie In New Documentary

Apr 29, 2025 -

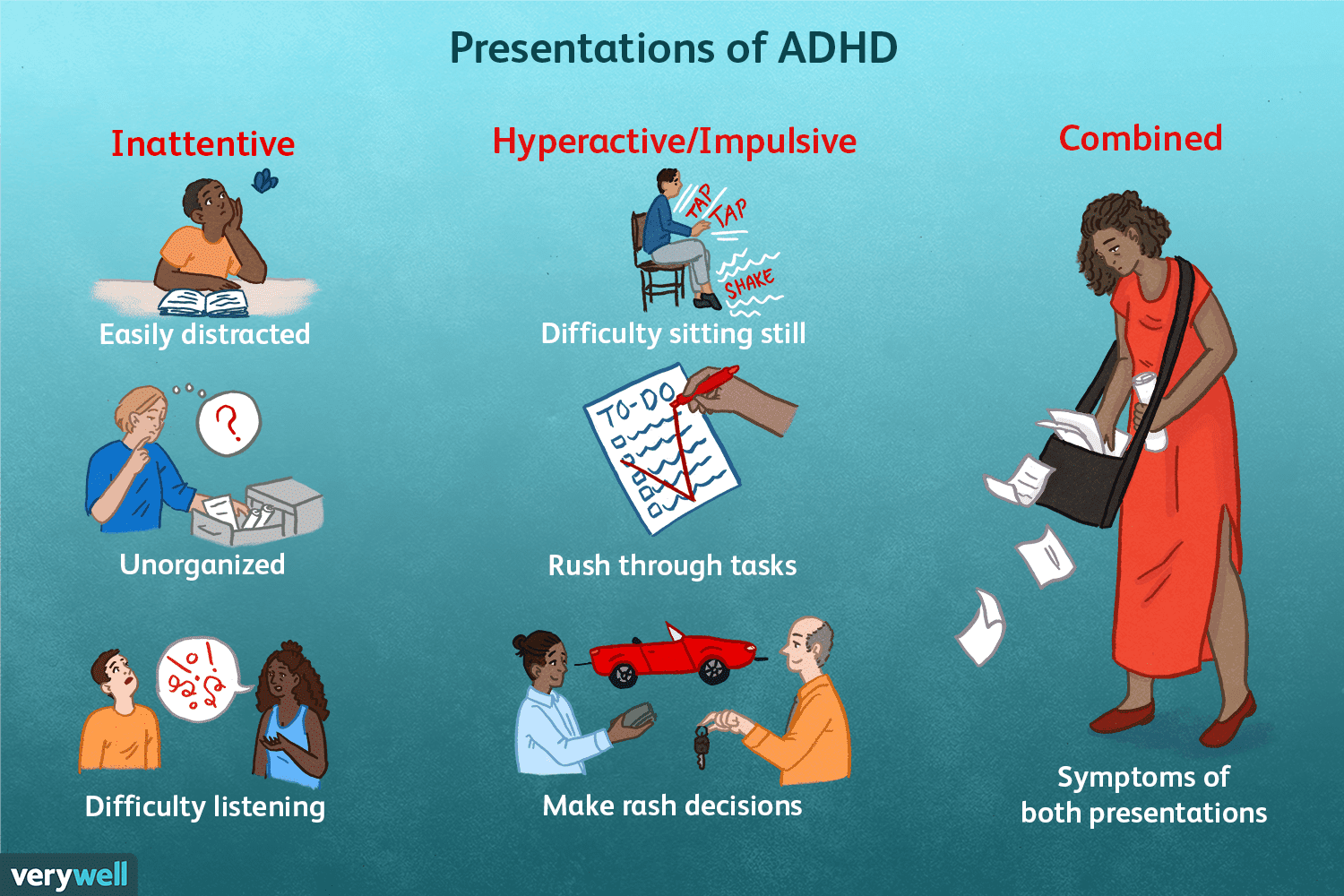

I Think I Have Adult Adhd Getting The Right Help

Apr 29, 2025

I Think I Have Adult Adhd Getting The Right Help

Apr 29, 2025 -

Busca La Garantia De Gol El Sistema De Alberto Ardila Olivares

Apr 29, 2025

Busca La Garantia De Gol El Sistema De Alberto Ardila Olivares

Apr 29, 2025 -

Nyt Spelling Bee Solutions April 27 2025 Find The Spangram

Apr 29, 2025

Nyt Spelling Bee Solutions April 27 2025 Find The Spangram

Apr 29, 2025