65 Hudson's Bay Properties Generate High Leasing Interest

Table of Contents

Prime Locations Driving Demand

A primary driver of the high leasing interest in these 65 Hudson's Bay properties is their strategic locations. These properties are not randomly scattered; they're situated in highly desirable areas across major Canadian cities, maximizing their appeal to potential tenants. The presence in key commercial hubs translates directly into high visibility and accessibility, attracting a broad range of businesses.

- High-Foot Traffic Areas: Many properties are located in areas with consistently high pedestrian traffic, ensuring maximum exposure for retail tenants. Think bustling city centers and vibrant shopping districts.

- Proximity to Public Transportation: Convenient access to public transit is a significant draw for both employees and customers, making these properties highly attractive. This reduces commuting times and improves overall accessibility.

- Accessibility to Key Demographics: Hudson's Bay strategically targets locations with access to the desired customer demographics for its tenants. This ensures businesses can reach their target market effectively.

- Thriving Commercial Districts: The properties are situated within established and thriving commercial districts, benefiting from the synergistic effects of neighboring businesses and increased consumer activity. Key cities like Toronto, Vancouver, and Calgary house several of these prime locations.

Diverse Property Types Attract Various Tenants

The portfolio's strength lies not only in its location but also in its diversity. The 65 properties encompass a range of property types, catering to a wide array of tenant needs and business models. This diversity is a key factor in attracting a broader spectrum of businesses and maximizing occupancy rates.

- Retail Spaces: Many properties offer prime retail spaces ideal for flagship stores, boutiques, and other retail establishments seeking high-visibility locations.

- Modern Office Spaces: The portfolio includes modern, updated office spaces perfectly suited for tech companies, startups, and other businesses requiring efficient and well-equipped work environments.

- Mixed-Use Developments: Some properties offer mixed-use developments, combining residential and commercial spaces. This integrated approach creates vibrant communities and attracts a diverse tenant base.

Modern Amenities and Renovations Enhance Appeal

Hudson's Bay's commitment to modernizing its properties has significantly contributed to the increased leasing interest. Significant investments in renovations and upgrades have resulted in properties boasting state-of-the-art amenities, attracting discerning tenants who value comfort, efficiency, and sustainability.

- Attractive Building Exteriours and Common Areas: Modern aesthetics and well-maintained common areas create a positive first impression and enhance the overall tenant experience.

- State-of-the-Art Technology and Security Systems: Upgraded technology and robust security systems provide tenants with peace of mind and a competitive edge.

- Sustainable Building Practices and LEED Certifications: Many properties incorporate sustainable building practices, appealing to environmentally conscious businesses and investors. LEED certifications further enhance their appeal.

- Accessibility Features: Modern accessibility features ensure inclusivity and cater to the needs of a diverse tenant base.

Strong Economic Outlook Boosts Investor Confidence

The high leasing interest isn't occurring in a vacuum. It's fueled by a positive economic outlook and strong investor confidence in the Canadian commercial real estate market. Factors like low vacancy rates and strong rental growth further contribute to the appeal of these Hudson's Bay properties.

- Growing Economy Attracting New Businesses: A growing economy naturally attracts new businesses, increasing the demand for commercial spaces.

- Increased Consumer Spending Driving Retail Demand: Increased consumer spending boosts retail sales, making retail spaces within Hudson's Bay properties even more desirable.

- Stable Investment Environment Attracting Long-Term Leases: The stable investment climate encourages long-term leases, providing both landlords and tenants with security and predictability.

Hudson's Bay's Strategic Leasing Initiatives

Hudson's Bay's proactive approach to leasing management plays a crucial role in maintaining high occupancy rates. The company employs several strategic initiatives to attract and retain tenants, fostering strong relationships and ensuring a mutually beneficial partnership.

- Competitive Lease Rates and Flexible Terms: Competitive pricing and flexible lease terms cater to a wider range of tenants and their specific needs.

- Proactive Tenant Support and Relationship Management: Hudson's Bay prioritizes strong tenant relationships, providing support and fostering a collaborative environment.

- Investment in Property Marketing and Outreach: Targeted marketing and outreach efforts ensure that potential tenants are aware of the available leasing opportunities.

High Leasing Interest in Hudson's Bay Properties: A Promising Future

The high leasing interest in these 65 Hudson's Bay properties is a result of a confluence of factors: prime locations, diverse property types, modern amenities, a positive economic climate, and a strategic leasing approach by Hudson's Bay. This strong performance underscores the health of the Canadian commercial real estate market and signals a promising future for both Hudson's Bay and its tenants. Explore Hudson's Bay leasing opportunities today and find your ideal commercial space! [Link to Hudson's Bay commercial real estate website]

Featured Posts

-

Judge Abrego Garcia Condemns Stonewalling Tactics In Us Courts

Apr 24, 2025

Judge Abrego Garcia Condemns Stonewalling Tactics In Us Courts

Apr 24, 2025 -

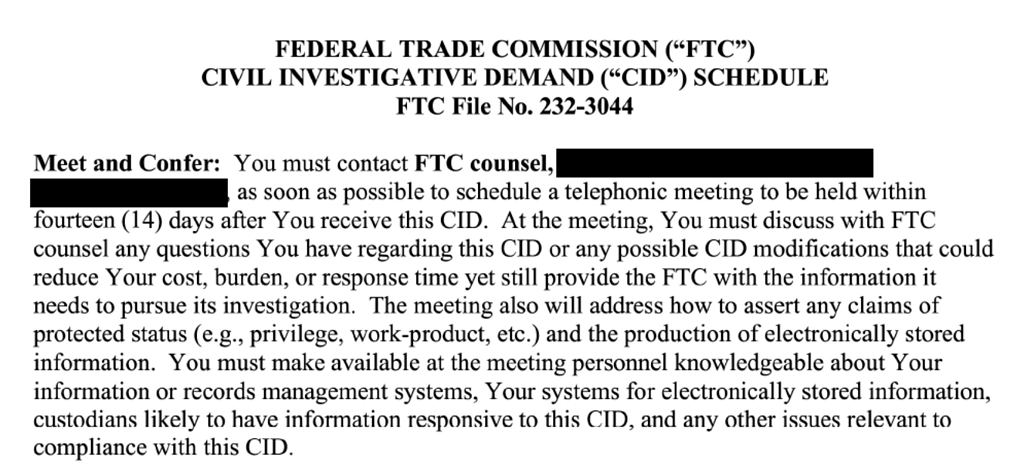

Chat Gpts Developer Open Ai Faces Ftc Investigation A Deep Dive

Apr 24, 2025

Chat Gpts Developer Open Ai Faces Ftc Investigation A Deep Dive

Apr 24, 2025 -

Metas Future Under The Shadow Of The Trump Administration

Apr 24, 2025

Metas Future Under The Shadow Of The Trump Administration

Apr 24, 2025 -

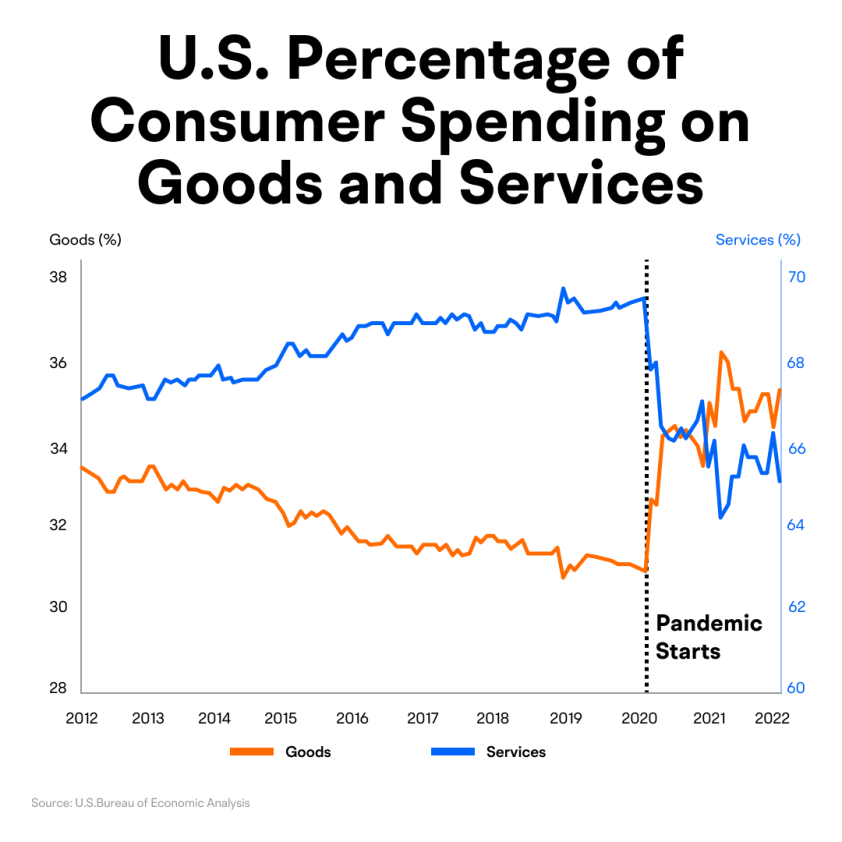

Consumer Spending Slowdown Impact On Credit Card Companies

Apr 24, 2025

Consumer Spending Slowdown Impact On Credit Card Companies

Apr 24, 2025 -

Cantors 3 Billion Crypto Spac Deal Tether And Soft Bank Involvement

Apr 24, 2025

Cantors 3 Billion Crypto Spac Deal Tether And Soft Bank Involvement

Apr 24, 2025

Latest Posts

-

Credit Suisse To Pay Whistleblowers 150 Million A Landmark Settlement

May 10, 2025

Credit Suisse To Pay Whistleblowers 150 Million A Landmark Settlement

May 10, 2025 -

Credit Suisse Whistleblower Case A 150 Million Settlement

May 10, 2025

Credit Suisse Whistleblower Case A 150 Million Settlement

May 10, 2025 -

Credit Suisse Whistleblower Payout Up To 150 Million

May 10, 2025

Credit Suisse Whistleblower Payout Up To 150 Million

May 10, 2025 -

Regulatory Changes Sought By Indian Insurers For Bond Forwards

May 10, 2025

Regulatory Changes Sought By Indian Insurers For Bond Forwards

May 10, 2025 -

Should Investors Worry About Current Stock Market Valuations Bof As Answer

May 10, 2025

Should Investors Worry About Current Stock Market Valuations Bof As Answer

May 10, 2025