AAPL Stock: Analysis Of Future Price Levels And Support/Resistance

Table of Contents

Understanding Support and Resistance Levels in AAPL Stock

Support and resistance levels are crucial concepts in technical analysis. They represent price points where the stock price has historically struggled to break through. Support levels act as a floor, where buying pressure outweighs selling pressure, preventing further price declines. Resistance levels act as a ceiling, where selling pressure outweighs buying pressure, hindering upward momentum. Understanding these levels in AAPL stock is key to predicting potential future price movements.

-

Definition of support and resistance: Support is a price level where a downtrend is expected to pause due to buying pressure. Resistance is a price level where an uptrend is expected to pause due to selling pressure.

-

Identifying support and resistance on a chart: These levels can be identified using various techniques, including analyzing historical price data, identifying trendlines, and using moving averages (like the 50-day and 200-day moving averages, commonly used in AAPL stock analysis). Looking at candlestick patterns and volume can also provide further confirmation.

-

Examples of past support and resistance in AAPL's price history: Reviewing AAPL's historical charts reveals numerous instances where support and resistance levels have played a significant role in price movements. For example, a certain price point may have acted as resistance multiple times before finally being broken, leading to a significant price surge.

-

Importance of volume confirmation: The volume of trading at support and resistance levels provides valuable confirmation. High volume at a support level indicates strong buying pressure, suggesting a more robust support area. Conversely, high volume at a resistance level suggests strong selling pressure, implying a stronger resistance.

Analyzing Key Factors Influencing AAPL Stock Price

While technical analysis, including the study of AAPL support resistance, is crucial, it's essential to consider fundamental factors driving AAPL stock price. These include:

-

Impact of Apple's financial reports on the stock price: Apple's quarterly earnings reports significantly influence investor sentiment. Strong revenue growth, exceeding earnings expectations, and positive future guidance generally lead to price increases. Conversely, disappointing results can trigger significant price drops.

-

The influence of new product launches and their market reception: The launch of new iPhones, Macs, iPads, and Apple Watches, along with the performance of Apple services (like Apple Music and iCloud), significantly impact AAPL's stock price. Positive market reception and strong sales figures typically boost the stock price.

-

Analysis of the competitive landscape and its effect on AAPL's market share: Competition from companies like Samsung, Google, and Microsoft impacts AAPL's market share and, consequently, its stock price. Any significant inroads made by competitors can negatively affect investor confidence.

-

How macroeconomic conditions affect investor sentiment towards AAPL: Macroeconomic factors such as interest rate changes, inflation rates, and overall economic growth influence investor risk appetite. During periods of economic uncertainty, investors may shift towards safer investments, potentially leading to a drop in AAPL stock price.

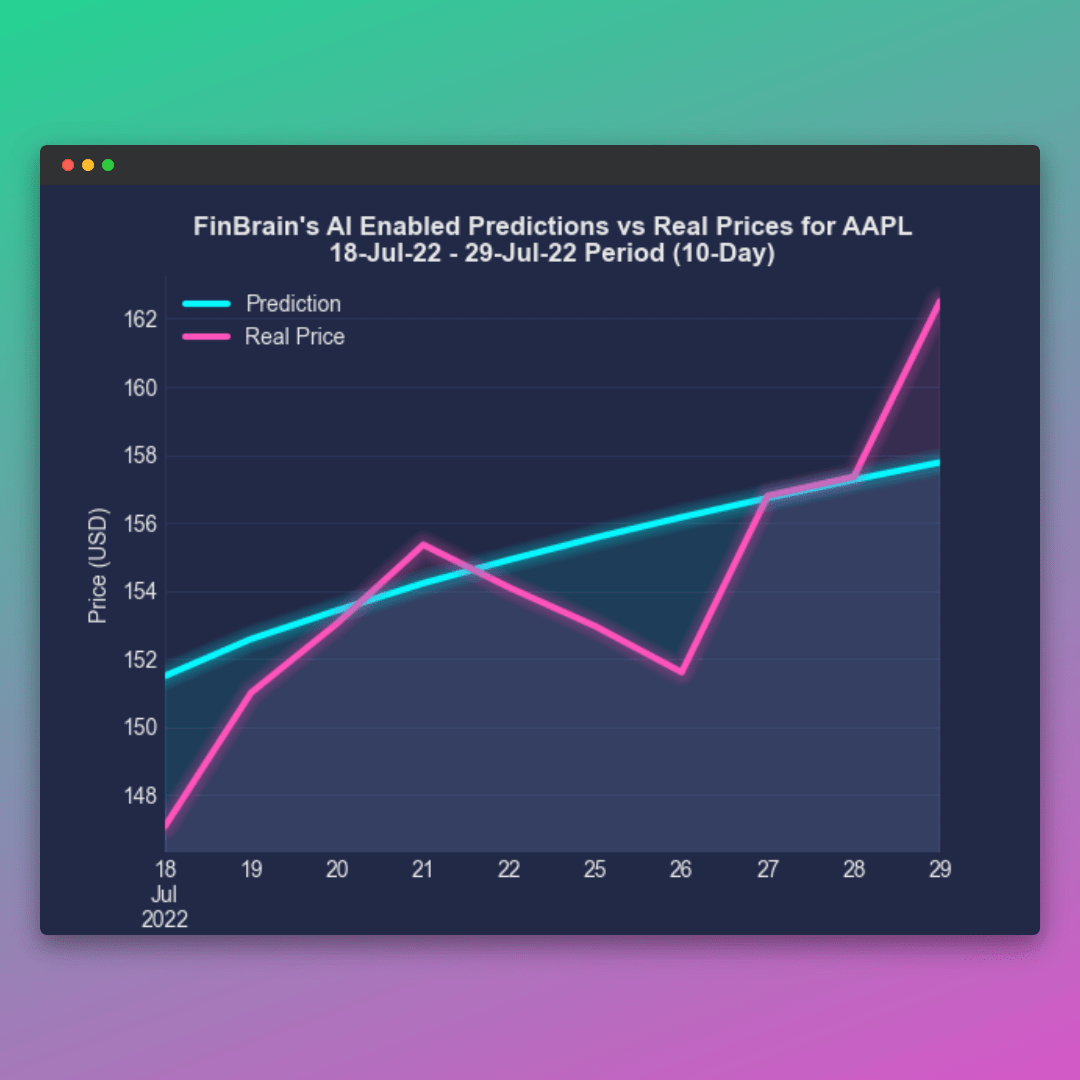

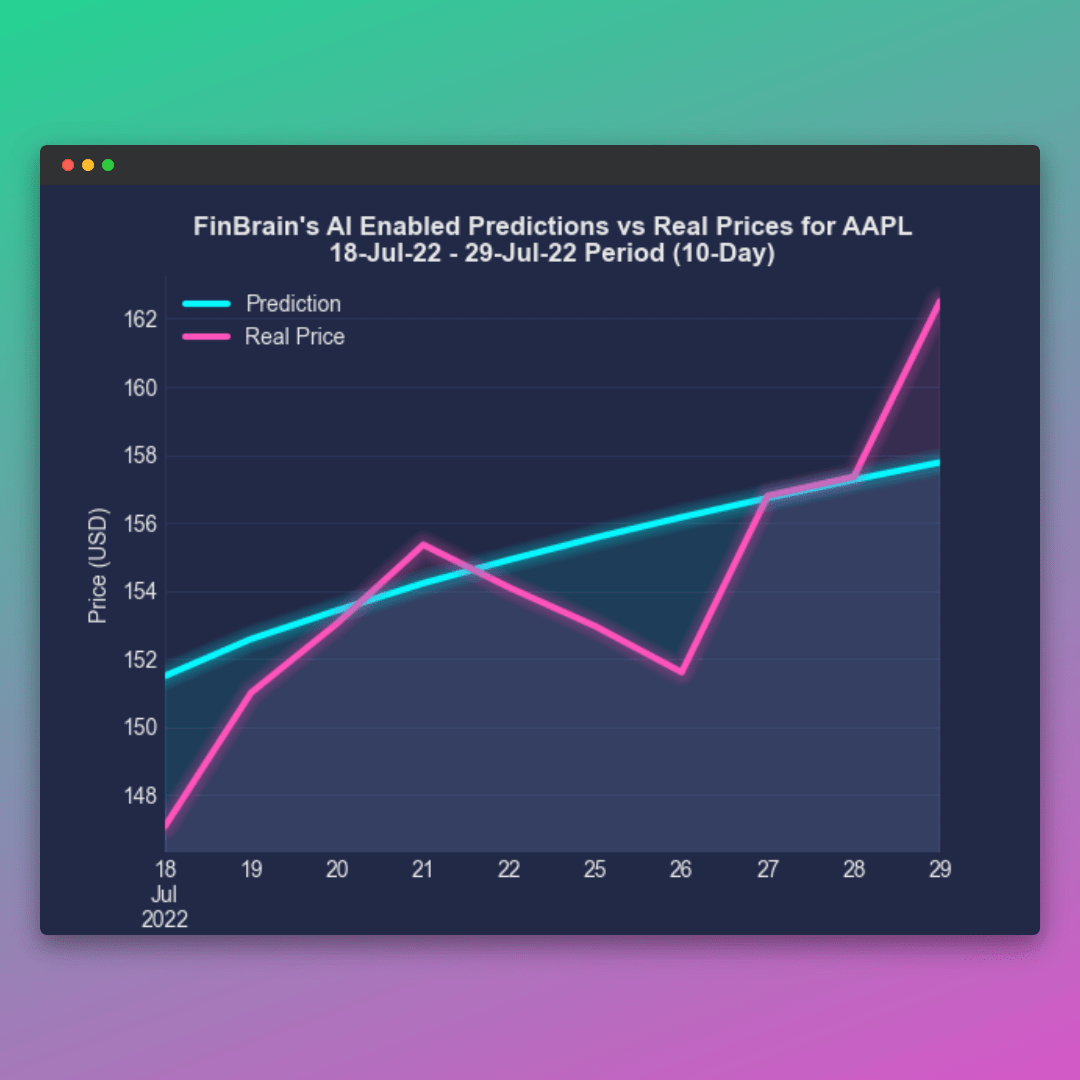

Predicting Future Price Levels for AAPL Stock

Based on the analysis of AAPL support and resistance levels and other influencing factors, we can formulate potential scenarios for future price levels. It's crucial to remember this is not financial advice, but rather an analysis based on currently available data and should be used with your own research.

-

Potential upward price targets based on overcoming resistance levels: If AAPL successfully breaks through significant resistance levels accompanied by strong volume, it could signal a sustained upward trend, leading to higher price targets.

-

Possible downward price movements if support levels are broken: A break below key support levels with high volume could indicate a weakening of the underlying trend, potentially leading to further price declines.

-

Scenarios based on various factors (e.g., strong earnings, weak consumer demand): Different market conditions will yield varied outcomes. Strong earnings reports combined with positive product launches could significantly push the price upwards. Conversely, weak consumer demand or negative economic news could lead to downward pressure.

-

Disclaimer: This is not financial advice. Conduct your own thorough research before making any investment decisions.

Using Technical Indicators to Enhance Predictions

Technical indicators like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and various moving averages can provide further insights. For example, an RSI reading above 70 might suggest overbought conditions, while an RSI below 30 could signal oversold conditions, providing potential entry and exit points in AAPL stock trading. These indicators, when used in conjunction with support and resistance analysis, can enhance the accuracy of price predictions.

Conclusion

Understanding support and resistance levels is essential for navigating the complexities of AAPL stock price predictions. By analyzing these levels alongside key fundamental factors and technical indicators like RSI and MACD for AAPL, investors can develop a more comprehensive understanding of potential future price movements. While this analysis offers potential scenarios, it's crucial to remember that thorough independent research and consideration of personal risk tolerance are paramount before making any investment decisions regarding AAPL stock or any other security. Stay informed about AAPL stock and its future price movements by regularly reviewing support and resistance levels and conducting your own in-depth analysis.

Featured Posts

-

10 Let Pobediteley Evrovideniya Togda I Seychas

May 24, 2025

10 Let Pobediteley Evrovideniya Togda I Seychas

May 24, 2025 -

Sse Reduces Investment 3 Billion Cut Reflects Economic Slowdown

May 24, 2025

Sse Reduces Investment 3 Billion Cut Reflects Economic Slowdown

May 24, 2025 -

Avrupa Borsalarinda Duesues Stoxx Europe 600 Ve Dax 40 In 16 Nisan 2025 Performansi

May 24, 2025

Avrupa Borsalarinda Duesues Stoxx Europe 600 Ve Dax 40 In 16 Nisan 2025 Performansi

May 24, 2025 -

Bbc Radio 1 Big Weekend 2025 Tickets Line Up Dates And Booking Information

May 24, 2025

Bbc Radio 1 Big Weekend 2025 Tickets Line Up Dates And Booking Information

May 24, 2025 -

I Know You D Kill Joy Crookes Latest Single Explored

May 24, 2025

I Know You D Kill Joy Crookes Latest Single Explored

May 24, 2025

Latest Posts

-

Understanding The Controversy Surrounding Thames Waters Executive Bonuses

May 24, 2025

Understanding The Controversy Surrounding Thames Waters Executive Bonuses

May 24, 2025 -

Are Elevated Stock Market Valuations Justified Bof As Take

May 24, 2025

Are Elevated Stock Market Valuations Justified Bof As Take

May 24, 2025 -

Thames Waters Executive Bonuses A Look At The Financial Implications

May 24, 2025

Thames Waters Executive Bonuses A Look At The Financial Implications

May 24, 2025 -

Bof A Reassures Investors Understanding Current Stock Market Valuations

May 24, 2025

Bof A Reassures Investors Understanding Current Stock Market Valuations

May 24, 2025 -

Addressing Investor Concerns Bof A On Stretched Stock Market Valuations

May 24, 2025

Addressing Investor Concerns Bof A On Stretched Stock Market Valuations

May 24, 2025