Alterya Acquired By Chainalysis: A Strategic Move In Blockchain Technology

Table of Contents

Synergies and Enhanced Capabilities

The Alterya acquisition by Chainalysis is more than just a merger; it's a powerful synergy of complementary technologies and expertise. This combination is poised to significantly enhance Chainalysis' existing suite of tools and services.

Improved Blockchain Investigation Tools

Alterya's strengths lie in its advanced data visualization and investigative capabilities. Integrating this technology into Chainalysis' platform will dramatically improve the speed and accuracy of blockchain investigations. This will be crucial in combating financial crime and enhancing anti-money laundering (AML) efforts.

- Faster Transaction Tracing: Alterya's technology allows for quicker identification and tracing of cryptocurrency transactions, significantly reducing investigation times.

- Improved Identification of Illicit Activities: The combined platform will offer more sophisticated algorithms for identifying suspicious patterns and activities related to financial crime, including money laundering, terrorist financing, and sanctions evasion.

- Enhanced Visualization Tools: Alterya's intuitive data visualization tools will help investigators better understand complex transaction networks, making it easier to identify key players and patterns. This improved visualization will be invaluable for blockchain investigation and cryptocurrency tracing.

Expanded Market Reach and Customer Base

The acquisition grants Chainalysis access to Alterya's existing customer base and expands its market reach into new sectors. The combined entity will offer a more comprehensive suite of blockchain analytics solutions, attracting new customers across various industries.

- Access to New Industries: The combined expertise will unlock new opportunities within sectors currently underserved by blockchain analytics, such as supply chain management and intellectual property protection.

- Expansion into New Geographical Markets: Alterya's international presence will complement Chainalysis' existing global reach, enabling expansion into new geographical markets and better serving a global client base.

- Increased Customer Loyalty: The expanded product offerings and enhanced capabilities will lead to increased customer satisfaction and loyalty, solidifying Chainalysis' position as a market leader in blockchain analytics solutions.

Strategic Implications for the Blockchain Industry

The Alterya acquisition by Chainalysis has far-reaching implications for the entire blockchain industry, signaling a significant shift in the competitive landscape.

Consolidation of the Blockchain Analytics Market

This acquisition marks a major step toward consolidation in the already competitive blockchain analytics market. It signals a strategic move to dominate the space and potentially leave other players struggling to keep pace.

- Increased Competition for Other Players: The combined strengths of Chainalysis and Alterya create a formidable competitor, increasing pressure on other blockchain analytics companies to innovate and compete.

- Potential for Further Acquisitions: This acquisition could be a precursor to further consolidation within the industry, with Chainalysis potentially acquiring other companies to strengthen its position even further.

- Industry-Shaping Impact: The move establishes a new standard for blockchain analytics capabilities and will likely influence the direction and development of the industry as a whole.

Advancements in Blockchain Security and Compliance

The combined entity will be better positioned to contribute to advancements in blockchain security and compliance, particularly concerning regulatory requirements and data privacy.

- Improved Regulatory Reporting Capabilities: The integration of Alterya's technology will enhance Chainalysis' ability to generate comprehensive and accurate regulatory reports, easing the burden of compliance for its clients.

- Enhanced Security Protocols: Combining expertise will lead to more robust security protocols, better protecting users and their data from cyber threats and malicious activities.

- Increased Transparency in Blockchain Transactions: By improving the ability to analyze and understand blockchain transactions, the combined entity can contribute to increased transparency and accountability within the blockchain ecosystem. This will be particularly valuable for KYC/AML compliance.

Financial Aspects of the Acquisition

While specific financial details may not be publicly available, the acquisition of Alterya represents a significant financial commitment by Chainalysis, reflecting its long-term strategic vision for the blockchain analytics market.

Acquisition Value and Investment Strategy

The acquisition value and the specific rationale behind Chainalysis' investment strategy remain largely undisclosed. However, it clearly demonstrates Chainalysis’ confidence in the future growth of the blockchain analytics market and the strategic value of Alterya's technology.

- Strategic Investment: This acquisition is not simply a financial investment; it's a strategic move to solidify Chainalysis' market leadership and expand its capabilities in a rapidly evolving industry.

- Return on Investment (ROI): Chainalysis undoubtedly anticipates a significant return on investment, driven by increased market share, expanded product offerings, and enhanced profitability.

Future Growth Projections and Market Outlook

The combined entity is well-positioned for substantial future growth, fueled by the increasing adoption of blockchain technology and the rising demand for robust blockchain analytics solutions.

- Market Growth: The blockchain analytics market is expected to experience significant growth in the coming years, driven by factors like increasing regulatory scrutiny and the broader adoption of cryptocurrencies and blockchain technology.

- Future Prospects: The Alterya acquisition positions Chainalysis for significant growth in several key areas, including DeFi analytics, NFT market analysis, and the provision of enterprise-grade blockchain security solutions.

Conclusion

The Alterya acquisition by Chainalysis is a landmark event in the blockchain industry, signifying a powerful consolidation of expertise and a significant strategic investment in the future of blockchain analytics. This merger will enhance blockchain investigation tools, expand market reach, and drive advancements in blockchain security and compliance. The acquisition underscores Chainalysis' commitment to its leadership position and its vision for a more transparent and secure blockchain ecosystem. Stay informed on the evolving landscape of blockchain technology and the continued impact of the Alterya acquisition by Chainalysis. Visit the Chainalysis website to learn more about their comprehensive suite of blockchain analytics solutions.

Featured Posts

-

Fox News Faces Defamation Lawsuit From Ray Epps Over January 6th Reporting

Apr 26, 2025

Fox News Faces Defamation Lawsuit From Ray Epps Over January 6th Reporting

Apr 26, 2025 -

Sinners How Cinematography Showcases The Mississippi Deltas Expansiveness

Apr 26, 2025

Sinners How Cinematography Showcases The Mississippi Deltas Expansiveness

Apr 26, 2025 -

From Scatological Data To Engaging Podcast The Power Of Ai

Apr 26, 2025

From Scatological Data To Engaging Podcast The Power Of Ai

Apr 26, 2025 -

Shedeur Sanders Nike Loyalty Following In Deion Sanders Footsteps

Apr 26, 2025

Shedeur Sanders Nike Loyalty Following In Deion Sanders Footsteps

Apr 26, 2025 -

California Governor Newsom Addresses Intra Party Criticism Toxic Democrats And Judgmental Politics

Apr 26, 2025

California Governor Newsom Addresses Intra Party Criticism Toxic Democrats And Judgmental Politics

Apr 26, 2025

Latest Posts

-

Regulatory Changes Sought By Indian Insurers For Bond Forwards

May 10, 2025

Regulatory Changes Sought By Indian Insurers For Bond Forwards

May 10, 2025 -

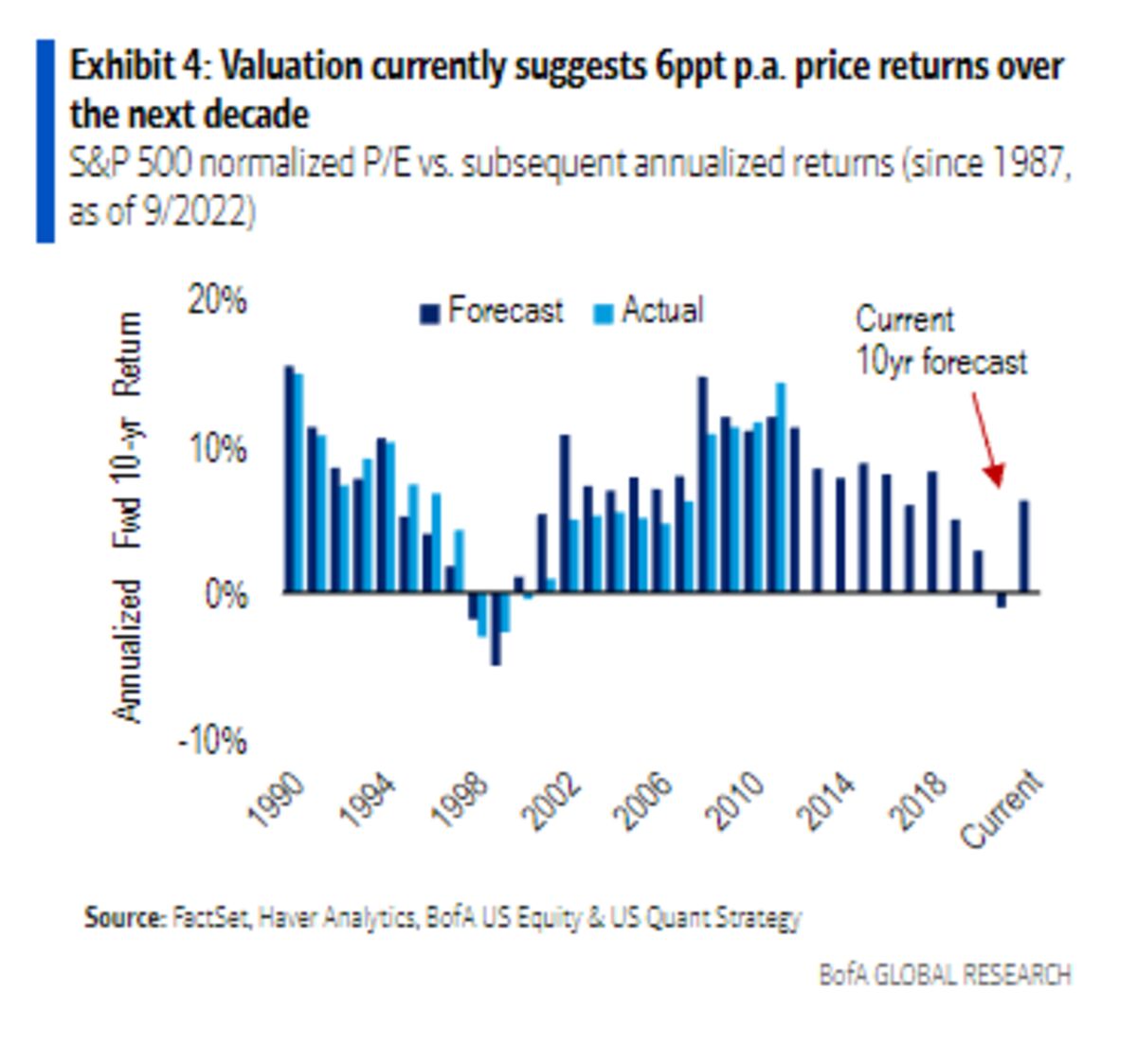

Should Investors Worry About Current Stock Market Valuations Bof As Answer

May 10, 2025

Should Investors Worry About Current Stock Market Valuations Bof As Answer

May 10, 2025 -

Indian Insurance Sector Seeks Simplification Of Bond Forward Regulations

May 10, 2025

Indian Insurance Sector Seeks Simplification Of Bond Forward Regulations

May 10, 2025 -

Call For Regulatory Reform Indian Insurers And Bond Forwards

May 10, 2025

Call For Regulatory Reform Indian Insurers And Bond Forwards

May 10, 2025 -

Indian Insurers Seek Regulatory Easing On Bond Forwards

May 10, 2025

Indian Insurers Seek Regulatory Easing On Bond Forwards

May 10, 2025