Amsterdam Stock Exchange: 7% Drop As Trade War Fears Escalate

Table of Contents

Escalating Trade War Fears as the Primary Catalyst

The AEX's sharp decline is directly linked to escalating trade tensions between global powers. The recent imposition of new tariffs, coupled with increasingly aggressive rhetoric from political leaders, has created a climate of profound economic uncertainty. This uncertainty is a major catalyst for the significant drop in the AEX index. The impact of trade wars extends far beyond simple tariff increases; they erode investor confidence, disrupting supply chains and hindering future economic growth.

- Recent tariff announcements impacting Dutch exports: New tariffs on Dutch agricultural products and technology exports to key trading partners have directly impacted the profitability of several AEX-listed companies.

- Statements from key political figures exacerbating anxieties: Statements from leading political figures suggesting further escalation of trade disputes have significantly heightened investor apprehension and triggered a sell-off in the stock market.

- Impact on specific sectors heavily reliant on international trade: Sectors such as technology, agriculture, and manufacturing, which are heavily reliant on international trade, have been particularly hard hit by the escalating trade war, causing ripple effects throughout the AEX.

- Analysis of investor sentiment based on market indicators: Market indicators such as the VIX volatility index show a sharp increase, reflecting the heightened anxiety and uncertainty within the market.

Impact on Key Sectors of the Amsterdam Stock Exchange

The 7% drop in the AEX wasn't uniform across all sectors. Certain industries felt the impact more acutely than others. This sectoral variation reflects the differing degrees of reliance on international trade and exposure to global economic fluctuations. Understanding these sector-specific impacts is vital for investors seeking to navigate this volatile period.

- Performance analysis of specific sectors (e.g., technology, financials, energy): The technology sector, given its global supply chains, experienced a significant decline. Financials also felt the pressure due to increased uncertainty affecting lending and investment decisions. The energy sector, while showing some resilience, was still affected by the broader market downturn.

- Explanation of the disproportionate impact on certain companies: Companies with significant exposure to the US or Chinese markets were particularly affected. The impact varied depending on each company's specific business model and geographic diversification.

- Discussion of any specific company announcements contributing to the decline: Several AEX-listed companies issued statements revising their earnings forecasts downward, further contributing to the overall market downturn.

Investor Response and Market Volatility

The 7% drop in the AEX triggered a strong investor response, characterized by increased market volatility and shifts in investment strategies. Understanding these reactions is crucial for interpreting current market sentiment and anticipating future movements.

- Analysis of trading volume before, during, and after the drop: Trading volume spiked significantly during the downturn, reflecting intense selling pressure and a flight to safety by many investors.

- Discussion of investor flight to safety (e.g., gold, bonds): Investors sought refuge in safer assets like gold and government bonds, demonstrating a clear risk-off sentiment within the market.

- Expert opinions on the short-term and long-term market outlook: Many analysts anticipate continued volatility in the short term, but express optimism about the long-term prospects of the Dutch economy and the AEX, provided trade tensions ease.

Potential Long-Term Implications for the Dutch Economy

The AEX decline and the broader trade war uncertainty have far-reaching implications for the Dutch economy. While the Netherlands boasts a diversified economy, its export-oriented nature makes it vulnerable to global trade shocks.

- Potential impact on Dutch GDP growth: The ongoing trade war could negatively impact Dutch GDP growth in the near term, although the extent of the impact remains uncertain.

- Government response and potential policy changes: The Dutch government is likely to implement measures to mitigate the negative impacts on the economy, potentially including fiscal stimulus and support for affected industries.

- Assessment of economic resilience and recovery prospects: The long-term impact depends largely on the resolution of trade disputes and the overall global economic environment. The Dutch economy's inherent strengths and diversification should aid in a recovery.

Strategies for Navigating Market Uncertainty

The current market volatility underscores the need for prudent investment strategies. Diversification and a long-term perspective are key to mitigating risks.

- Importance of portfolio diversification: Diversification across different asset classes and geographic regions is crucial to reduce exposure to specific risks.

- Strategies for mitigating risk during times of volatility: Investors may consider reducing overall market exposure or employing hedging strategies to protect against further declines.

- Advice on long-term investment approaches: Maintaining a long-term investment horizon and avoiding impulsive reactions to short-term market fluctuations is advisable.

Comparison to Global Market Reactions

The AEX's decline mirrored similar trends in other major global stock markets, highlighting the interconnected nature of the global economy and the pervasive impact of trade war fears.

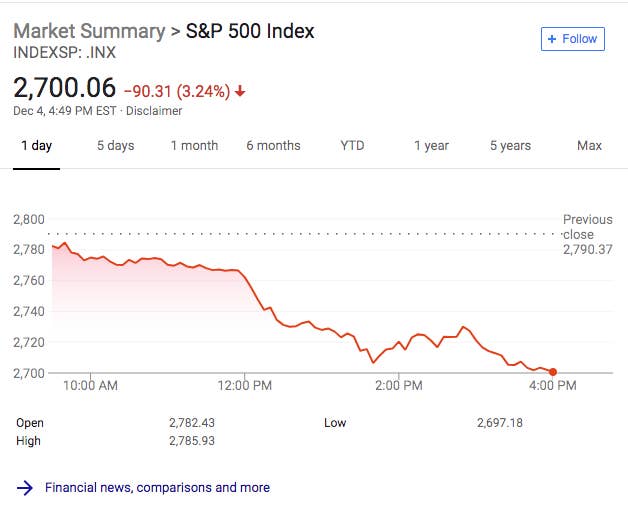

- Performance of other major stock exchanges (e.g., Dow Jones, FTSE 100): Major indices like the Dow Jones and FTSE 100 also experienced significant declines, reflecting the global nature of the trade war's impact.

- Analysis of global market correlations: High correlations between various global stock markets underscore their shared vulnerability to global economic shocks.

- Discussion of the interconnected nature of the global economy: The interconnected nature of the global economy amplifies the impact of events like trade wars, making it crucial for investors to monitor global trends.

Expert Opinions and Future Outlook

Financial analysts offer a mixed outlook on the AEX’s future, acknowledging both the challenges posed by trade tensions and the underlying strength of the Dutch economy.

- Expert predictions for the short-term and long-term future: Analysts anticipate short-term volatility but express varying degrees of optimism regarding long-term growth, depending on the resolution of global trade disputes.

- Analysis of potential recovery scenarios: Recovery scenarios are contingent upon de-escalation of trade tensions and supportive government policies.

- Identification of potential catalysts for future market movements: Further developments in trade negotiations, global economic data, and corporate earnings announcements will be key catalysts for future market movements.

Conclusion

The 7% drop in the Amsterdam Stock Exchange underscores the significant impact of escalating trade war fears on global markets and the Dutch economy. The decline reflects investor anxiety and uncertainty, impacting key sectors within the AEX. Strategic responses from investors and policymakers are crucial.

Call to Action: Understanding the dynamics of the Amsterdam Stock Exchange and its susceptibility to global events is crucial for informed investment decisions. Stay informed about developments in the Amsterdam Stock Exchange and global trade to make sound investment choices during this period of market volatility. Continue to monitor the Amsterdam Stock Exchange and global market trends for further updates and analysis.

Featured Posts

-

Amundi Dow Jones Industrial Average Ucits Etf Dist Nav Explained

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Dist Nav Explained

May 24, 2025 -

Esc 2025 Conchita Wurst And Jjs Collaborative Eurovision Village Show

May 24, 2025

Esc 2025 Conchita Wurst And Jjs Collaborative Eurovision Village Show

May 24, 2025 -

Traffic Alert M62 Westbound Closure For Resurfacing Manchester To Warrington

May 24, 2025

Traffic Alert M62 Westbound Closure For Resurfacing Manchester To Warrington

May 24, 2025 -

Trumps Tariff Increase Sends Amsterdam Stock Exchange Down 2

May 24, 2025

Trumps Tariff Increase Sends Amsterdam Stock Exchange Down 2

May 24, 2025 -

Lvmh Shares Plunge 8 2 Q1 Sales Disappoint

May 24, 2025

Lvmh Shares Plunge 8 2 Q1 Sales Disappoint

May 24, 2025

Latest Posts

-

Mia Farrow On Trump Imprisonment Necessary After Venezuelan Deportation Controversy

May 24, 2025

Mia Farrow On Trump Imprisonment Necessary After Venezuelan Deportation Controversy

May 24, 2025 -

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025 -

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025 -

Sinatras Four Marriages An Examination Of His Romantic Life

May 24, 2025

Sinatras Four Marriages An Examination Of His Romantic Life

May 24, 2025 -

Farrow Seeks Trumps Incarceration Focus On Venezuelan Deportations

May 24, 2025

Farrow Seeks Trumps Incarceration Focus On Venezuelan Deportations

May 24, 2025