Amundi DJIA UCITS ETF: A Deep Dive Into Net Asset Value

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the value of an ETF's underlying assets per share. Think of it as the net worth of the ETF, calculated by subtracting liabilities from the total value of its assets. For the Amundi DJIA UCITS ETF, the NAV reflects the value of the holdings that mirror the Dow Jones Industrial Average (DJIA). This calculation is performed daily, usually at the market close, providing a snapshot of the ETF's current worth. The Amundi DJIA UCITS ETF NAV is directly influenced by the performance of the 30 constituent companies of the DJIA.

- NAV reflects the ETF's underlying asset value. It represents the intrinsic worth of the ETF, not just its market price.

- Calculated daily, usually at market close. This provides a consistent measure of the ETF's value.

- Represents the value of the ETF's holdings per share. This allows for easy comparison across different investment periods.

- Influenced by the performance of the DJIA components. The performance of the underlying stocks directly impacts the NAV.

Factors Affecting Amundi DJIA UCITS ETF NAV

Several factors influence the daily and overall fluctuations in the Amundi DJIA UCITS ETF NAV. Understanding these factors is key to interpreting NAV changes and making informed investment decisions.

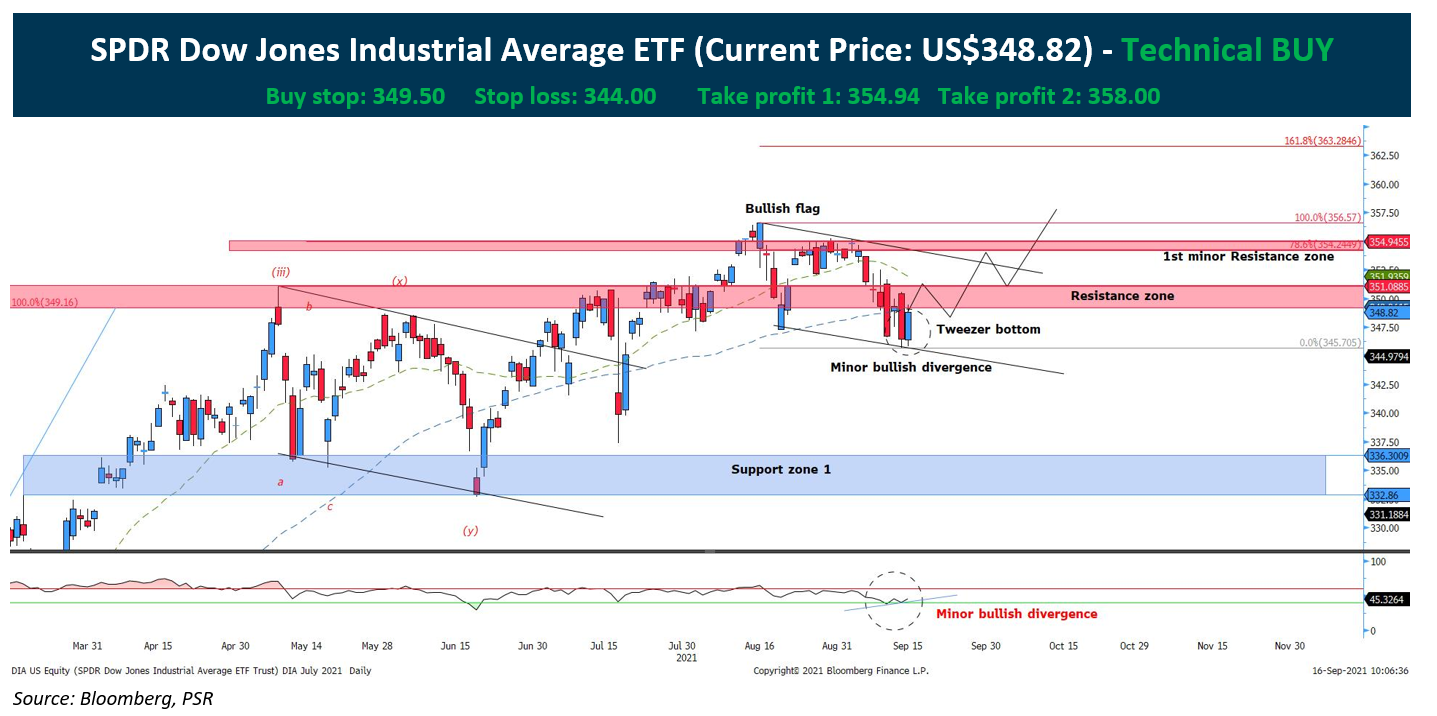

- Dow Jones Industrial Average performance: The primary driver of the Amundi DJIA UCITS ETF NAV is the performance of the DJIA itself. Positive movement in the DJIA generally leads to an increase in the NAV, while negative movement results in a decrease. Market sentiment, economic news, and individual company performance all contribute to DJIA fluctuations.

- Currency exchange rates (if applicable): If the ETF holds assets denominated in currencies other than the base currency of the ETF, exchange rate fluctuations can impact the NAV. This is especially relevant for globally diversified ETFs. For example, if the ETF holds US dollar-denominated assets and the dollar strengthens against the Euro, the NAV might increase (for Euro-based investors).

- Dividend payouts from DJIA components: When companies in the DJIA pay dividends, the ETF receives these payments, which are then typically reinvested or distributed to shareholders. Dividend distributions can have a slight impact on the NAV, although the impact is usually small compared to market movements.

- Management fees and expenses: The ETF’s management fees and other operating expenses are deducted from the assets, slightly reducing the NAV over time. These fees are typically small but should be considered when analyzing long-term performance.

How to Access Amundi DJIA UCITS ETF NAV Information

Accessing the Amundi DJIA UCITS ETF NAV is straightforward. Real-time and historical data are readily available through various sources:

- Amundi's official website: The Amundi website is the primary source for official NAV data. You’ll likely find it under the ETF's specific product page.

- Financial news websites and data providers (e.g., Bloomberg, Yahoo Finance): Many financial websites offer real-time and historical ETF data, including NAV information. Simply search for the ETF's ticker symbol.

- Brokerage platforms: If you hold the Amundi DJIA UCITS ETF through a brokerage account, the NAV will typically be displayed on your account statement and portfolio summary.

- ETF data aggregators: Several specialized websites aggregate ETF data from various sources, providing a convenient centralized location to find NAV and other key information.

Using NAV to Make Informed Investment Decisions

The Amundi DJIA UCITS ETF NAV is a valuable tool for making informed investment decisions. By monitoring NAV changes, investors can effectively track performance and potentially identify opportunities.

- Track performance against benchmarks: Compare the NAV's performance against the DJIA index to assess the ETF's tracking efficiency.

- Compare with other similar ETFs: Use the NAV to compare the Amundi DJIA UCITS ETF’s performance against other ETFs tracking the same or similar indices.

- Assess the overall health of the investment: Consistent monitoring of the NAV provides insights into the overall health and performance of your investment.

- Identify potential buy or sell opportunities: While not the sole factor, significant changes in the NAV relative to the ETF's share price might signal potential buying or selling opportunities (although this requires a more detailed analysis).

Conclusion

Understanding the Net Asset Value of the Amundi DJIA UCITS ETF is crucial for any investor seeking exposure to the Dow Jones Industrial Average. By monitoring the NAV and understanding the factors that influence it, investors can make more informed decisions and track their investment's performance effectively. Regularly check the Amundi DJIA UCITS ETF NAV to stay updated and optimize your investment strategy. Remember to always conduct thorough research before investing and consider seeking professional financial advice. Learn more about Amundi DJIA UCITS ETF NAV today!

Featured Posts

-

Kyle Walkers Night Out Annie Kilner Spotted On Solo Errands

May 24, 2025

Kyle Walkers Night Out Annie Kilner Spotted On Solo Errands

May 24, 2025 -

Country Living On A Budget Securing Your Dream Home For Under 1 Million

May 24, 2025

Country Living On A Budget Securing Your Dream Home For Under 1 Million

May 24, 2025 -

Social Media Storm Annie Kilners Posts On Alleged Walker Poisoning

May 24, 2025

Social Media Storm Annie Kilners Posts On Alleged Walker Poisoning

May 24, 2025 -

Innokentiy Smoktunovskiy Dokumentalniy Film K Stoletiyu So Dnya Rozhdeniya

May 24, 2025

Innokentiy Smoktunovskiy Dokumentalniy Film K Stoletiyu So Dnya Rozhdeniya

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf A Nav Deep Dive

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf A Nav Deep Dive

May 24, 2025

Latest Posts

-

Amsterdam Stock Market Three Days Of Significant Losses Totaling 11

May 24, 2025

Amsterdam Stock Market Three Days Of Significant Losses Totaling 11

May 24, 2025 -

Dazi E Mercati L Unione Europea Pronta A Reagire Alla Crisi

May 24, 2025

Dazi E Mercati L Unione Europea Pronta A Reagire Alla Crisi

May 24, 2025 -

Dutch Stocks Continue Downturn As Trade War With Us Heats Up

May 24, 2025

Dutch Stocks Continue Downturn As Trade War With Us Heats Up

May 24, 2025 -

Le Borse Crollano A Causa Dei Dazi La Risposta Decisa Della Ue

May 24, 2025

Le Borse Crollano A Causa Dei Dazi La Risposta Decisa Della Ue

May 24, 2025 -

Guerra Dei Dazi Impatto Sulle Borse Europee E Reazioni Ue

May 24, 2025

Guerra Dei Dazi Impatto Sulle Borse Europee E Reazioni Ue

May 24, 2025