Amundi DJIA UCITS ETF: A Deep Dive Into Net Asset Value (NAV)

Table of Contents

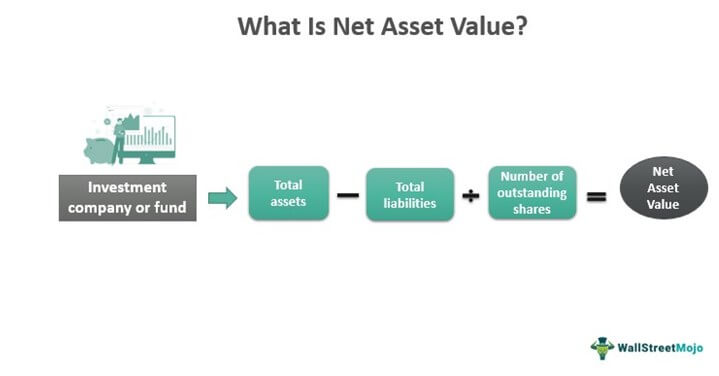

What is Net Asset Value (NAV) and How is it Calculated?

Net Asset Value (NAV) represents the underlying net asset value of each share in an ETF. It's essentially the total value of the ETF's assets minus its liabilities, divided by the number of outstanding shares. For the Amundi DJIA UCITS ETF, this means calculating the total value of its holdings in the 30 companies that make up the DJIA, plus any cash reserves, and subtracting any liabilities such as management fees and expenses.

The calculation is straightforward:

Total Assets (Market Value of Holdings + Cash) – Total Liabilities = NAV

The NAV is calculated daily, reflecting the closing market prices of the DJIA components. This daily calculation is crucial because the ETF's price should closely track its NAV. Discrepancies might indicate opportunities or risks. Several factors influence the daily NAV calculation:

- Market Fluctuations: Changes in the prices of the DJIA constituent stocks directly impact the NAV. A rising DJIA generally leads to a higher NAV, and vice-versa.

- Dividends Received: Dividends paid by the underlying DJIA companies are added to the ETF's assets, increasing the NAV.

- ETF Expenses: Management fees and other operating expenses reduce the ETF's assets, thus affecting the NAV.

Amundi DJIA UCITS ETF: NAV's Role in Investment Decisions

Daily NAV fluctuations directly impact your returns when investing in the Amundi DJIA UCITS ETF. When you buy or sell shares, the transaction price is usually based on the NAV at the time of the trade, although a small premium or discount might exist.

Comparing the ETF's market price to its NAV is insightful:

- Premium: If the market price is higher than the NAV, the ETF is trading at a premium. This might indicate high demand.

- Discount: If the market price is lower than the NAV, the ETF is trading at a discount, potentially offering a buying opportunity.

Monitoring the NAV over the long term allows you to track your investment's performance and assess the effectiveness of your investment strategy. Consistent monitoring of the Amundi DJIA UCITS ETF NAV allows for informed decisions regarding buy, hold, or sell strategies.

Factors Influencing Amundi DJIA UCITS ETF NAV

Several key factors influence the Amundi DJIA UCITS ETF NAV:

- DJIA Performance: The primary driver of the NAV is the performance of the Dow Jones Industrial Average itself. Strong DJIA performance directly translates to a higher NAV.

- Currency Fluctuations: Since the ETF might hold assets denominated in currencies other than your base currency, exchange rate movements can affect the NAV.

- Dividend Distributions: Dividends received from DJIA companies increase the ETF's assets and consequently its NAV.

- Management Fees and Expenses: These fees are deducted from the ETF's assets, impacting the NAV negatively.

Where to Find Amundi DJIA UCITS ETF NAV Information

Reliable sources for accessing real-time and historical Amundi DJIA UCITS ETF NAV data include:

- Amundi Website: The official Amundi website is the most reliable source for official NAV data.

- Financial News Websites: Reputable financial news websites often provide real-time ETF pricing and NAV information.

- Brokerage Platforms: Most online brokerage platforms display the NAV alongside the current market price of the ETF.

Regularly checking the NAV is crucial for monitoring your investment's performance and making informed decisions. Note that slight discrepancies between different sources might exist due to reporting lags or data processing differences; always prioritize official sources for accurate information.

Conclusion: Mastering Amundi DJIA UCITS ETF NAV for Informed Investing

Understanding the Amundi DJIA UCITS ETF NAV is fundamental for successful investing. By regularly monitoring the NAV, comparing it to the market price, and understanding the factors influencing it, you can make more informed investment decisions. Mastering Amundi DJIA UCITS ETF NAV tracking allows you to assess your investment's performance and adjust your strategy as needed. Further research into the Amundi DJIA UCITS ETF and its NAV, combined with your own risk tolerance and investment goals, will help you determine if investing in this ETF is right for you. Consider learning more about Amundi DJIA UCITS ETF NAV and how to utilize this key metric to potentially invest in Amundi DJIA UCITS ETF effectively.

Featured Posts

-

The Hunger Games Prequel Ralph Fiennes Potential As Coriolanus Snow Sparks Debate

May 25, 2025

The Hunger Games Prequel Ralph Fiennes Potential As Coriolanus Snow Sparks Debate

May 25, 2025 -

Ardisson Tacle Baffie Lui Peut Etre Moi Non

May 25, 2025

Ardisson Tacle Baffie Lui Peut Etre Moi Non

May 25, 2025 -

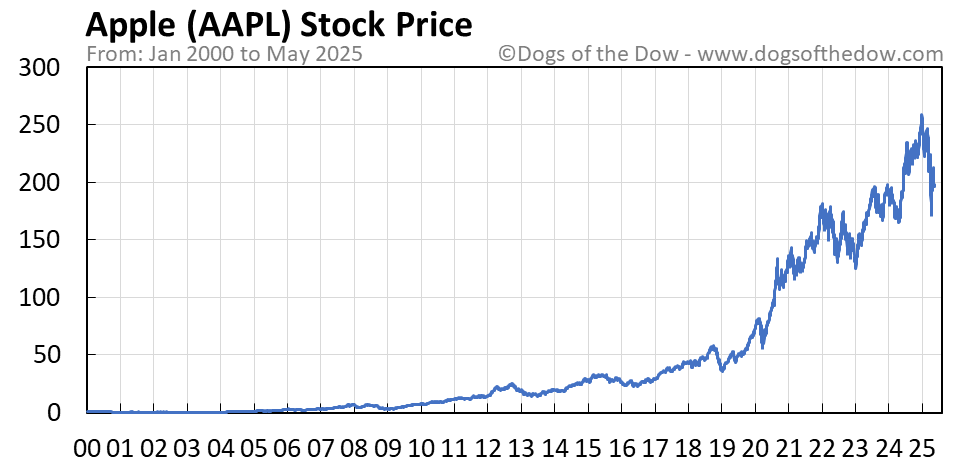

Forecasting Apple Stock Aapl Price Important Levels To Consider

May 25, 2025

Forecasting Apple Stock Aapl Price Important Levels To Consider

May 25, 2025 -

Global Trade And Tariffs A G7 Perspective

May 25, 2025

Global Trade And Tariffs A G7 Perspective

May 25, 2025 -

Understanding Key Price Levels For Apple Stock Aapl

May 25, 2025

Understanding Key Price Levels For Apple Stock Aapl

May 25, 2025