Understanding Key Price Levels For Apple Stock (AAPL)

Table of Contents

Keywords: Apple stock, AAPL, Apple stock price, stock price levels, support levels, resistance levels, technical analysis, Apple stock chart, trading Apple stock, investing in Apple

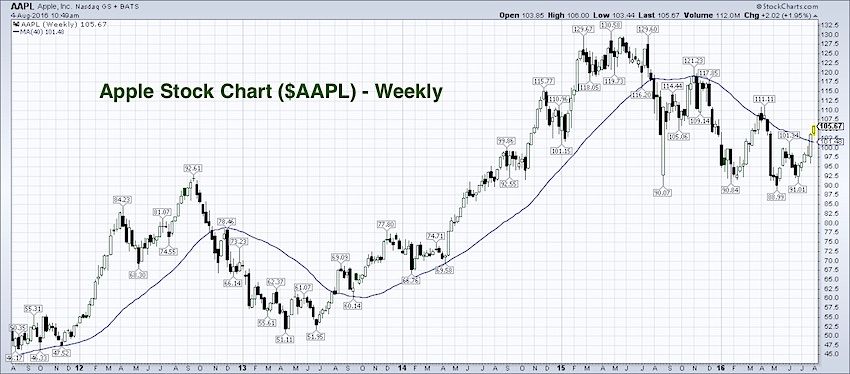

Investing in Apple stock (AAPL) can be lucrative, but understanding key price levels is crucial for maximizing returns and minimizing risk. This guide will help you identify significant support and resistance levels in the AAPL stock chart, empowering you to make informed trading decisions. We'll explore various technical analysis tools and historical price data to pinpoint these pivotal points. Mastering these levels is key to successful Apple stock trading.

Identifying Support Levels in AAPL Stock

What are Support Levels?

Support levels represent price points where buying pressure is strong enough to prevent the stock price from falling further. They act as a "floor" for the stock price. When the price approaches a support level, buyers often step in, pushing the price back up. Historically, AAPL has shown several instances of strong support levels. For example, the $130-$140 range in 2022 acted as a significant support zone, preventing a more substantial decline.

- Identifying previous lows as potential future support: Past support levels often act as future support, provided the underlying market conditions remain similar.

- Recognizing support levels based on trendlines and moving averages: Trendlines connecting swing lows and moving averages (like the 50-day or 200-day MA) can indicate strong support zones.

- The role of volume in confirming support levels: High volume during a price bounce off a support level confirms its strength. Low volume suggests weaker support.

Finding Key Support Levels for AAPL

Pinpointing support levels requires a combination of technical analysis and historical chart study.

- Using technical indicators like the moving average convergence divergence (MACD) to identify potential support: The MACD can signal potential buying opportunities when it crosses above its signal line near a support level.

- Analyzing historical price charts to pinpoint past support levels: Examining past price action is crucial. Look for areas where the price repeatedly bounced off a specific level.

- Identifying psychological support levels (e.g., round numbers like $150, $175): These round numbers often act as significant support levels due to psychological factors influencing investor behavior.

- Utilizing Fibonacci retracement levels to predict potential support: Fibonacci retracement levels can identify potential support levels based on the previous price swing's proportions.

- Examining the relationship between support levels and news events impacting Apple: Major news events, like product launches or financial reports, can influence support and resistance levels.

Recognizing Resistance Levels in AAPL Stock

What are Resistance Levels?

Resistance levels represent price points where selling pressure is strong enough to prevent the stock price from rising further. They act as a "ceiling" for the stock price. When the price approaches a resistance level, sellers often emerge, pushing the price back down. For AAPL, resistance levels have historically been seen around significant psychological price points, as well as previous highs.

- Identifying previous highs as potential future resistance: Past resistance levels frequently act as future resistance, unless there's a significant shift in market sentiment or fundamental factors.

- Recognizing resistance levels based on trendlines and moving averages: Trendlines connecting swing highs and moving averages can highlight resistance zones.

- The role of volume in confirming resistance levels: High volume during a price rejection at a resistance level confirms its strength. Low volume suggests weaker resistance.

Locating Key Resistance Levels for AAPL

Finding key resistance levels requires careful analysis of historical data and technical indicators.

- Using technical indicators like relative strength index (RSI) to identify potential resistance: An RSI above 70 often suggests overbought conditions, hinting at potential resistance.

- Analyzing historical price charts to pinpoint past resistance levels: Examining past price action helps identify consistent areas of price rejection.

- Identifying psychological resistance levels (e.g., round numbers like $200, $250): Round numbers frequently act as strong resistance due to investor psychology.

- Utilizing Fibonacci retracement levels to predict potential resistance: Fibonacci retracement levels can project potential resistance areas based on the previous price swing's proportions.

- Examining the relationship between resistance levels and news events impacting Apple: Major news events can influence resistance levels, either strengthening or weakening them.

Using Technical Analysis for AAPL Stock Price Prediction

Technical analysis involves studying past market data (price and volume) to predict future price movements. While it doesn't predict the future with certainty, it provides valuable insights. For AAPL, combining technical analysis with fundamental analysis is crucial.

- Importance of combining technical analysis with fundamental analysis: Technical analysis should complement fundamental analysis (examining Apple's financials and business prospects).

- Using candlestick patterns to predict price movements: Candlestick patterns (e.g., hammer, engulfing patterns) can signal potential price reversals.

- The significance of volume analysis in confirming price trends: High volume during price breakouts or breakdowns confirms the strength of the trend.

- Emphasis on risk management when using technical analysis for trading: Always use stop-loss orders to limit potential losses.

Conclusion:

Successfully navigating the Apple stock (AAPL) market requires a thorough understanding of key price levels. By identifying and analyzing support and resistance levels using technical analysis tools, you can significantly improve your trading strategy and make more informed investment decisions. Remember to always combine technical analysis with fundamental analysis and practice proper risk management. Start mastering these key price levels for Apple stock (AAPL) today and take control of your investments!

Featured Posts

-

Apples Stock Price A 254 Target Is It Time To Buy At 200

May 25, 2025

Apples Stock Price A 254 Target Is It Time To Buy At 200

May 25, 2025 -

Faiz Indiriminin Avrupa Borsalari Uezerindeki Etkisi

May 25, 2025

Faiz Indiriminin Avrupa Borsalari Uezerindeki Etkisi

May 25, 2025 -

2025 Memorial Day Flights Find The Least Crowded Days

May 25, 2025

2025 Memorial Day Flights Find The Least Crowded Days

May 25, 2025 -

10 Rokiv Peremog Yevrobachennya Doli Ta Kar Yeri Zirok

May 25, 2025

10 Rokiv Peremog Yevrobachennya Doli Ta Kar Yeri Zirok

May 25, 2025 -

Philips Annual General Meeting Of Shareholders Key Highlights

May 25, 2025

Philips Annual General Meeting Of Shareholders Key Highlights

May 25, 2025

Latest Posts

-

Bof As View Why Current Stock Market Valuations Arent A Worry

May 25, 2025

Bof As View Why Current Stock Market Valuations Arent A Worry

May 25, 2025 -

Thames Water Assessing The Impact Of Executive Bonuses

May 25, 2025

Thames Water Assessing The Impact Of Executive Bonuses

May 25, 2025 -

The Thames Water Case Executive Bonuses And Corporate Responsibility

May 25, 2025

The Thames Water Case Executive Bonuses And Corporate Responsibility

May 25, 2025 -

The Thames Water Bonus Scandal Examining The Facts

May 25, 2025

The Thames Water Bonus Scandal Examining The Facts

May 25, 2025 -

Thames Water Executive Compensation A Critical Analysis

May 25, 2025

Thames Water Executive Compensation A Critical Analysis

May 25, 2025