Amundi Dow Jones Industrial Average UCITS ETF: A Deep Dive Into Net Asset Value

Table of Contents

What is the Amundi Dow Jones Industrial Average UCITS ETF?

The Amundi Dow Jones Industrial Average UCITS ETF is designed to track the performance of the iconic Dow Jones Industrial Average (DJIA). This index comprises 30 of the largest and most influential publicly traded companies in the United States, representing a broad cross-section of the American economy. Investing in this ETF offers investors:

- Investment Objective: To provide a cost-effective way to gain exposure to the performance of the DJIA.

- UCITS Compliance: The ETF is compliant with the Undertakings for Collective Investment in Transferable Securities (UCITS) directive, meaning it meets specific regulatory standards for investor protection within the European Union.

- Diversification: By investing in 30 large-cap US companies, the ETF offers inherent diversification within a single investment.

- Low Expense Ratio: Amundi typically maintains a competitive expense ratio, meaning a lower cost for investors relative to the fund's assets.

While the specific ticker symbol may vary depending on the exchange, it's easily identifiable through major brokerage platforms and financial data providers. The investment strategy hinges on passively tracking the DJIA, aiming for a return that closely mirrors the index's performance.

How is the NAV of the Amundi Dow Jones Industrial Average UCITS ETF Calculated?

The Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is calculated daily, typically at the close of the market. This calculation reflects the current market value of the ETF's underlying assets, which are the 30 stocks that make up the Dow Jones Industrial Average. The process involves:

- Determining Market Prices: The closing market price of each of the 30 DJIA components is obtained from the relevant exchange.

- Weighting by Holdings: Each stock's market price is weighted according to its proportion within the ETF's holdings, reflecting the index's composition.

- Summing the Values: The weighted market values of all 30 stocks are summed to arrive at the total asset value.

- Accounting for Liabilities: Any expenses, liabilities, or other deductions are subtracted from the total asset value.

- Dividing by Shares Outstanding: The resulting net asset value is then divided by the total number of outstanding ETF shares to arrive at the NAV per share.

Dividends received from the underlying DJIA components and any corporate actions (like stock splits) are also factored into the NAV calculation.

Factors Affecting the Amundi Dow Jones Industrial Average UCITS ETF's NAV:

Several factors can influence the daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF:

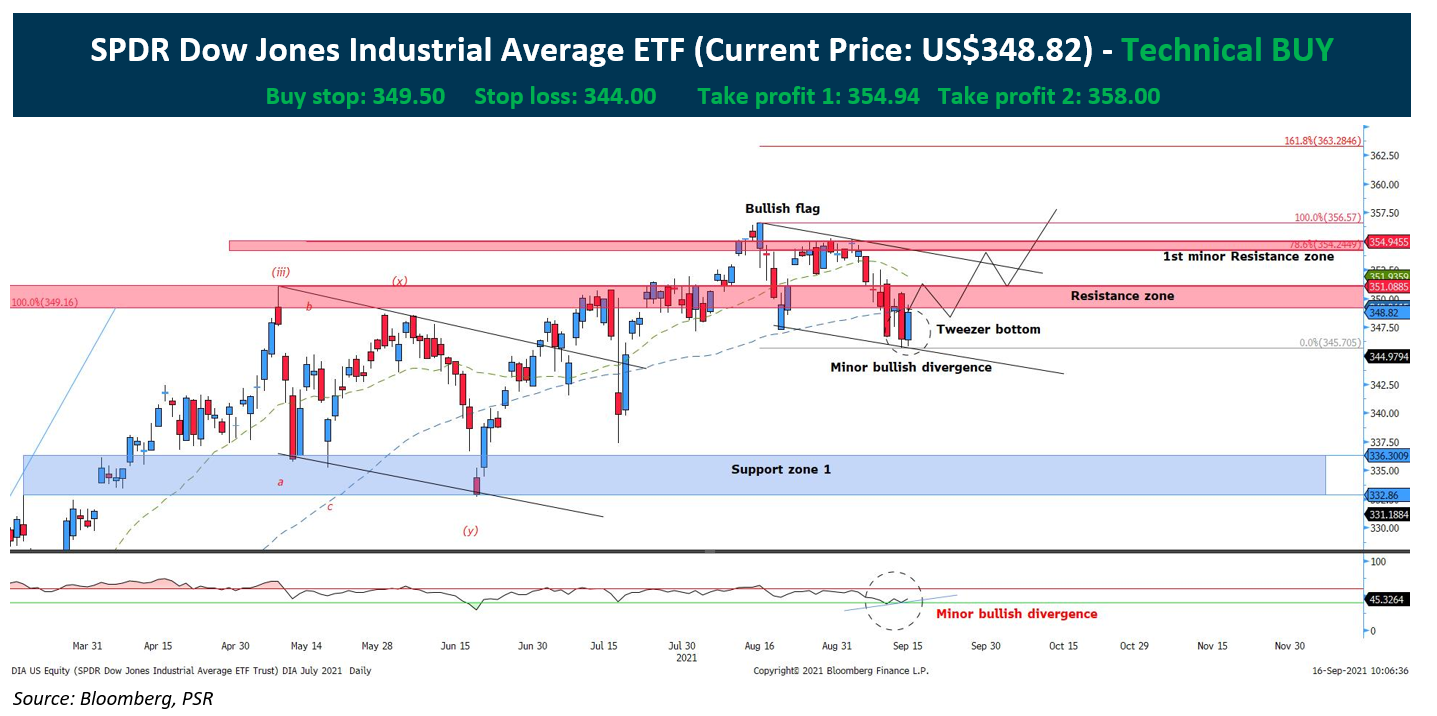

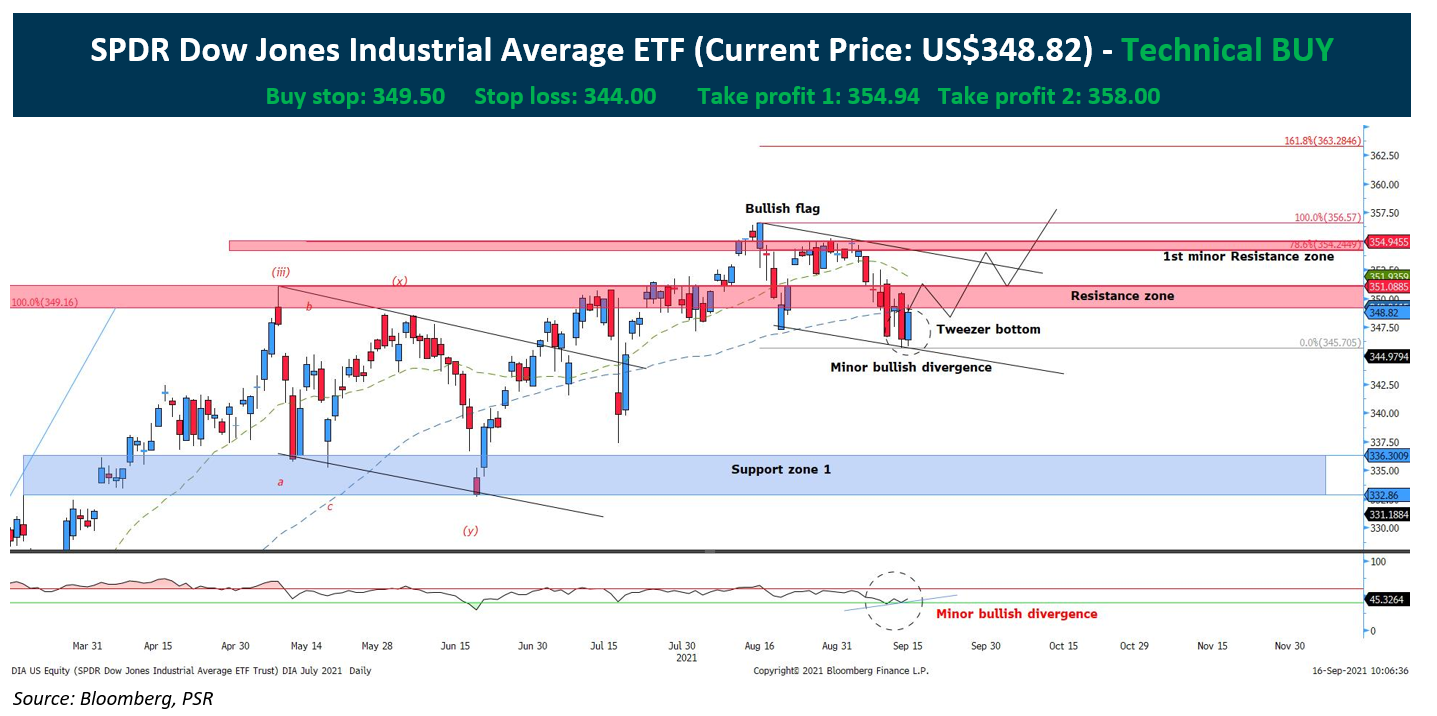

- Market Fluctuations: Broad market movements, whether upward or downward trends, significantly impact the NAV. Increased market volatility often translates to greater NAV fluctuations.

- Individual Stock Performance: The performance of individual stocks within the DJIA directly affects the ETF's NAV. A strong performance by one or more components will generally increase the NAV, and vice-versa.

- Currency Exchange Rates: While the DJIA is denominated in USD, investors outside the US might see fluctuations in their local currency equivalent of the NAV due to exchange rate changes.

Why is Understanding the NAV of the Amundi Dow Jones Industrial Average UCITS ETF Important?

Understanding the NAV of the Amundi Dow Jones Industrial Average UCITS ETF is essential for several reasons:

- Performance Assessment: Tracking the NAV over time allows investors to gauge the ETF's performance and compare it to their investment goals.

- Buying and Selling: The NAV is a key factor considered when buying or selling shares of the ETF. Investors typically aim to buy low and sell high, relative to the NAV.

- Benchmark Comparison: Comparing the ETF's NAV to the actual DJIA index helps assess how effectively the ETF tracks its benchmark.

- Tax Reporting: NAV information is crucial for accurate tax reporting, especially for determining capital gains or losses at the time of sale. This is vital for investment decisions and overall financial planning.

Where to Find the NAV of the Amundi Dow Jones Industrial Average UCITS ETF?

The daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF is readily available through several sources:

- Amundi's Website: The official Amundi website is a primary source for up-to-date NAV information.

- Financial News Sources: Major financial news websites and data providers typically list the NAV of actively traded ETFs like this one.

- Brokerage Platforms: If you hold the ETF through a brokerage account, the NAV will typically be displayed on your account statement or platform.

It's important to note that there might be slight discrepancies between the NAV and the actual market price of the ETF shares at any given time. This difference is usually minor and reflects the trading dynamics of the market.

Conclusion: Mastering Net Asset Value in the Amundi Dow Jones Industrial Average UCITS ETF

Understanding the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is paramount for making informed investment decisions. We've explored how the NAV is calculated, the factors that influence it, and its importance in assessing performance, buying and selling strategies, and tax reporting. By regularly monitoring the NAV and understanding its implications, you can enhance your investment strategy and optimize your returns. Learn more about the Amundi Dow Jones Industrial Average UCITS ETF and its Net Asset Value to make informed investment decisions.

Featured Posts

-

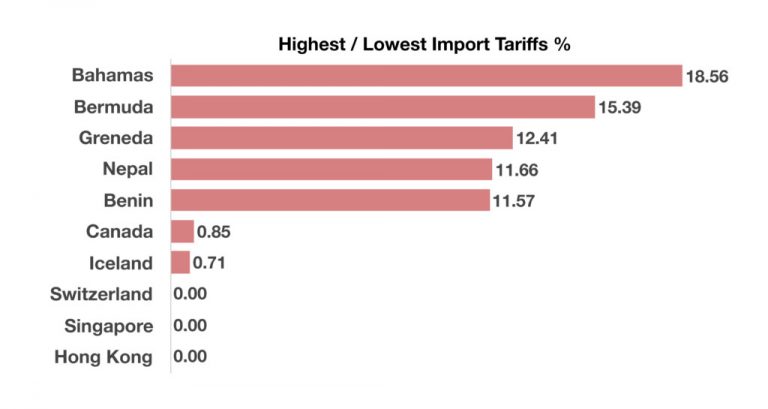

Import Duties Usa Impact On Clothing Prices

May 24, 2025

Import Duties Usa Impact On Clothing Prices

May 24, 2025 -

Demna Gvasalia And Gucci A Partnership Explained

May 24, 2025

Demna Gvasalia And Gucci A Partnership Explained

May 24, 2025 -

Escape To The Country Making The Move Successfully

May 24, 2025

Escape To The Country Making The Move Successfully

May 24, 2025 -

M6 Closure Latest News And Travel Disruptions Due To Accident

May 24, 2025

M6 Closure Latest News And Travel Disruptions Due To Accident

May 24, 2025 -

Analyzing The Glastonbury 2025 Lineup Charli Xcx Neil Young And Beyond

May 24, 2025

Analyzing The Glastonbury 2025 Lineup Charli Xcx Neil Young And Beyond

May 24, 2025

Latest Posts

-

Amsterdam Stock Market Three Days Of Significant Losses Totaling 11

May 24, 2025

Amsterdam Stock Market Three Days Of Significant Losses Totaling 11

May 24, 2025 -

Dazi E Mercati L Unione Europea Pronta A Reagire Alla Crisi

May 24, 2025

Dazi E Mercati L Unione Europea Pronta A Reagire Alla Crisi

May 24, 2025 -

Dutch Stocks Continue Downturn As Trade War With Us Heats Up

May 24, 2025

Dutch Stocks Continue Downturn As Trade War With Us Heats Up

May 24, 2025 -

Le Borse Crollano A Causa Dei Dazi La Risposta Decisa Della Ue

May 24, 2025

Le Borse Crollano A Causa Dei Dazi La Risposta Decisa Della Ue

May 24, 2025 -

Guerra Dei Dazi Impatto Sulle Borse Europee E Reazioni Ue

May 24, 2025

Guerra Dei Dazi Impatto Sulle Borse Europee E Reazioni Ue

May 24, 2025