Apple Stock (AAPL): Key Price Levels To Watch In 2024

Table of Contents

Support Levels for Apple Stock (AAPL) in 2024

Identifying Key Support

A support level in technical analysis represents a price range where buying pressure is strong enough to prevent a further decline in the Apple Stock (AAPL) price. Identifying these levels is crucial for investors. Several methods can help determine key support:

- Moving Averages: Tracking 50-day and 200-day moving averages can reveal significant support areas. A break below these averages could signal a bearish trend.

- Fibonacci Retracements: This technical tool identifies potential support levels based on previous price swings. The 38.2%, 50%, and 61.8% retracement levels often act as support.

- Psychological Levels: Round numbers (e.g., $150, $160) often act as significant support due to investor psychology.

Examples of past support levels for AAPL include:

- $130 in early 2023.

- $150 during the late summer of 2023.

Macroeconomic factors influencing support levels include:

- Interest rate hikes impacting investor sentiment.

- Global economic slowdown affecting consumer spending and demand for Apple products.

Potential Implications of Breaking Support

Breaking through key support levels for Apple Stock (AAPL) can lead to:

- Accelerated price declines: A break below support can trigger further selling, leading to more significant price drops.

- Negative investor sentiment: A break in support can erode investor confidence, leading to further selling pressure.

Risk management strategies if support is broken include:

- Stop-loss orders: Setting stop-loss orders to limit potential losses.

- Diversification: Spreading investments across different assets to reduce risk.

Conversely, if support holds, it can present:

- Buying opportunities: A bounce off a strong support level can be a potential buying opportunity.

Resistance Levels for Apple Stock (AAPL) in 2024

Identifying Key Resistance

Resistance levels represent price ranges where selling pressure is strong enough to prevent further price increases in the Apple Stock (AAPL). Identifying these levels is equally crucial. Methods for identifying resistance include:

- Previous Highs: Past price peaks often act as resistance levels.

- Trendlines: Connecting higher highs on a chart creates a trendline that acts as resistance.

- Psychological Levels: Round numbers (e.g., $180, $200) can act as resistance.

Historical resistance levels for AAPL have included:

- $170 in mid-2023.

- $190 in early 2023.

Factors influencing resistance levels include:

- Strong earnings reports pushing the price higher.

- Successful new product launches boosting investor confidence.

Potential Implications of Breaking Resistance

Breaking through key resistance levels for AAPL can signal:

- Significant price appreciation: A breakout above resistance can indicate a bullish trend, potentially leading to substantial price gains.

After a breakout:

- Price targets: Technical analysis can help identify potential price targets based on various indicators.

- Volume confirmation: Increased trading volume during a breakout confirms its significance.

Catalysts for Apple Stock (AAPL) Price Movement in 2024

Product Launches and Innovations

New product releases significantly influence Apple Stock (AAPL)'s price.

- Historical impact: Past iPhone launches have often led to short-term price surges.

- Anticipated releases: New iPhones, MacBooks, and other Apple devices will influence the stock price in 2024.

Financial Performance and Earnings Reports

Apple's financial performance dictates investor sentiment.

- Analyst forecasts: Analyst predictions and the company's actual results create volatility.

- Earnings surprises: Positive or negative surprises can lead to significant price swings.

Macroeconomic Factors

Broader economic conditions affect AAPL:

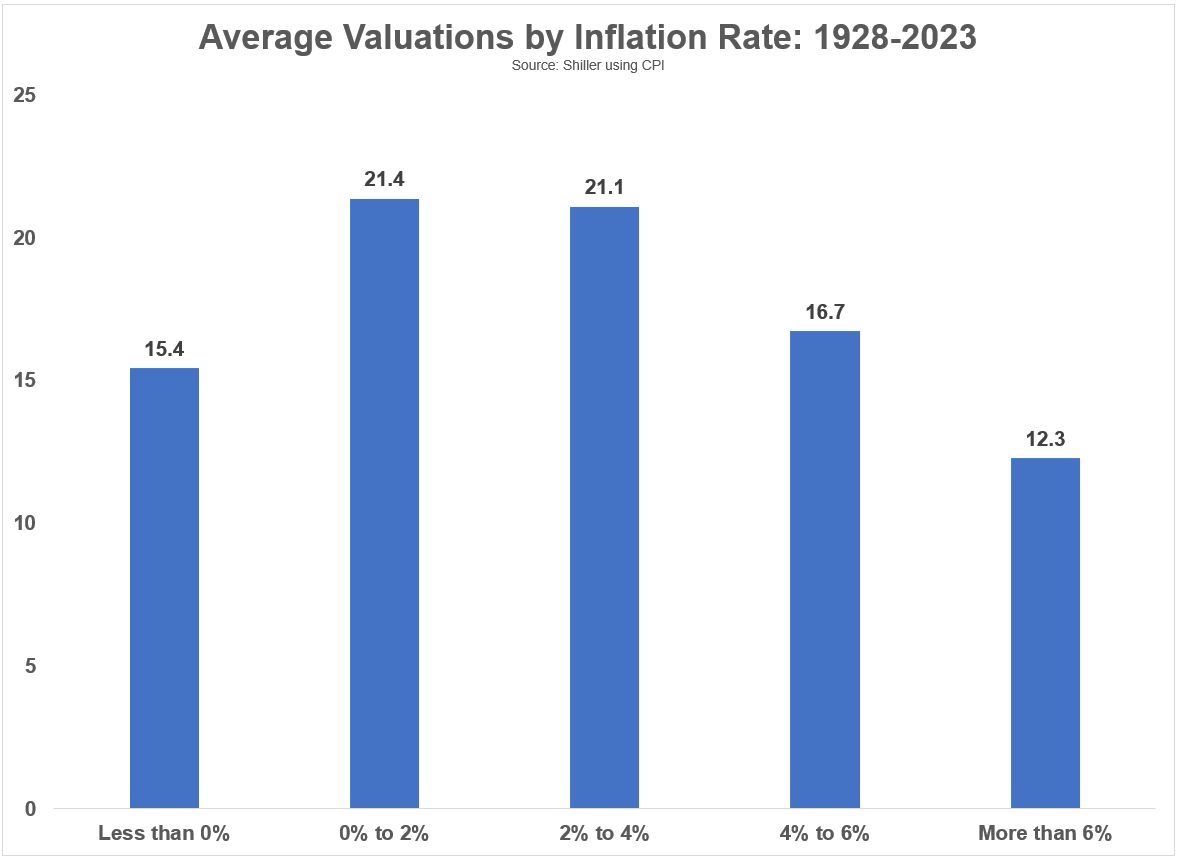

- Interest rate changes: Higher interest rates can negatively impact investor sentiment and stock valuations.

- Global economic growth: A strong global economy positively impacts Apple's sales and profits.

Conclusion

Monitoring key support and resistance levels for Apple Stock (AAPL) in 2024 is critical for informed investment decisions. Potential catalysts, such as product launches, earnings reports, and macroeconomic conditions, will significantly influence the stock's price. Remember, this analysis is not financial advice. Conduct thorough research and consult a financial advisor before investing in Apple Stock (AAPL) or any other security. Stay informed about crucial Apple Stock (AAPL) price levels in 2024 and make strategic investment decisions.

Featured Posts

-

Herstel Op Beurzen Na Uitstel Trump Alle Aex Fondsen In De Plus

May 24, 2025

Herstel Op Beurzen Na Uitstel Trump Alle Aex Fondsen In De Plus

May 24, 2025 -

Is A Wall Street Comeback A Threat To The German Daxs Recent Success

May 24, 2025

Is A Wall Street Comeback A Threat To The German Daxs Recent Success

May 24, 2025 -

Yevrobachennya Scho Stalosya Z Peremozhtsyami Za Ostanni 10 Rokiv

May 24, 2025

Yevrobachennya Scho Stalosya Z Peremozhtsyami Za Ostanni 10 Rokiv

May 24, 2025 -

Demna At Gucci A New Era For The Italian House

May 24, 2025

Demna At Gucci A New Era For The Italian House

May 24, 2025 -

Princess Road Closed Live Updates On Pedestrian Accident And Emergency Response

May 24, 2025

Princess Road Closed Live Updates On Pedestrian Accident And Emergency Response

May 24, 2025

Latest Posts

-

Understanding The Controversy Surrounding Thames Waters Executive Bonuses

May 24, 2025

Understanding The Controversy Surrounding Thames Waters Executive Bonuses

May 24, 2025 -

Are Elevated Stock Market Valuations Justified Bof As Take

May 24, 2025

Are Elevated Stock Market Valuations Justified Bof As Take

May 24, 2025 -

Thames Waters Executive Bonuses A Look At The Financial Implications

May 24, 2025

Thames Waters Executive Bonuses A Look At The Financial Implications

May 24, 2025 -

Bof A Reassures Investors Understanding Current Stock Market Valuations

May 24, 2025

Bof A Reassures Investors Understanding Current Stock Market Valuations

May 24, 2025 -

Addressing Investor Concerns Bof A On Stretched Stock Market Valuations

May 24, 2025

Addressing Investor Concerns Bof A On Stretched Stock Market Valuations

May 24, 2025