Apple Stock (AAPL): Where Will The Price Go Next? Important Levels To Consider

Table of Contents

Analyzing Apple's Recent Performance and Fundamental Factors

To accurately predict the future price of AAPL stock, a thorough examination of its fundamental strength is necessary. This involves scrutinizing financial health, product innovation, and the broader macroeconomic environment.

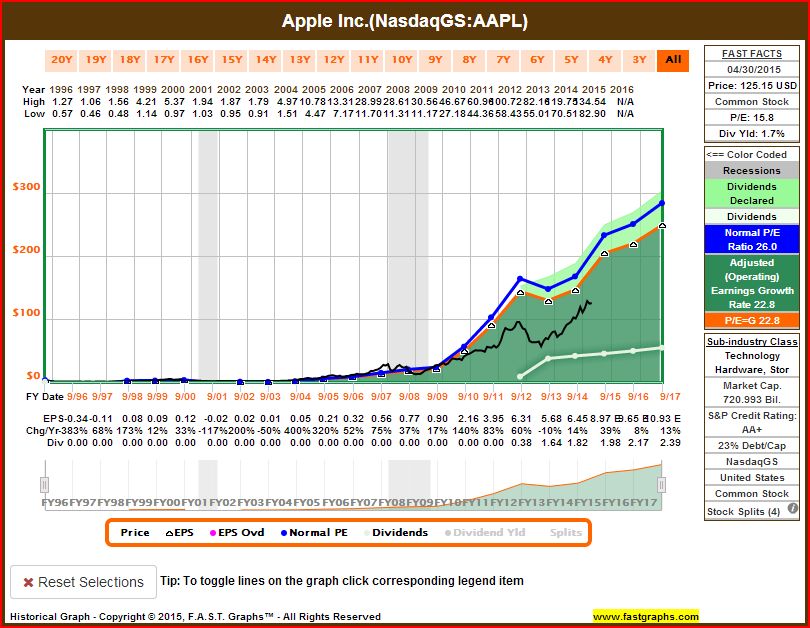

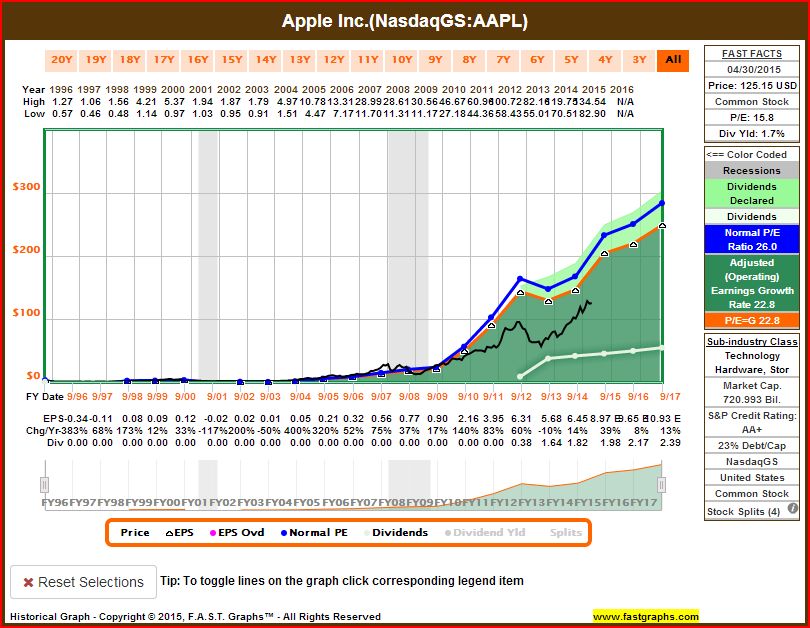

Financial Health and Earnings Reports

Apple’s recent financial reports reveal a company in a strong position. Analyzing key metrics offers valuable insight into potential future performance.

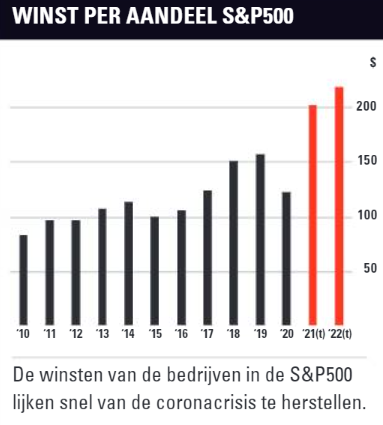

- EPS (Earnings Per Share): Consistent growth in EPS signifies increasing profitability and investor confidence. Comparing this with previous quarters and competitor performance (like Microsoft or Google) paints a complete picture.

- Revenue Growth Rate: Sustained revenue growth is vital for AAPL's continued success. A slowing growth rate might signal market saturation or increased competition, potentially impacting investor sentiment.

- Profit Margins: Healthy profit margins indicate efficient operations and pricing power. Declining margins might suggest increasing pressure on costs or pricing.

These financial metrics directly influence investor sentiment and can significantly impact AAPL stock price movements. Positive trends generally lead to bullish sentiment, while negative trends can trigger selling pressure.

Product Innovation and Market Share

Apple's continued success hinges on its ability to innovate and maintain its dominant market share. The introduction of new products and features directly affects revenue streams and investor confidence.

- New Product Launches: The iPhone, iPad, Mac, and wearables continue to drive significant revenue. New iterations and features are crucial for sustained growth. The success of new products like the Vision Pro headset will be critical to future price movements.

- Market Share: Maintaining or growing market share in key sectors like smartphones and wearables is vital for long-term growth. Increased competition from Android devices or other tech companies could put pressure on AAPL's market position.

- Services Revenue: The growing importance of Apple's services ecosystem, including Apple Music, iCloud, and the App Store, provides a more stable revenue stream that helps buffer against fluctuations in hardware sales. The growth rate of this segment is a significant indicator for future price performance.

Macroeconomic Factors and Industry Trends

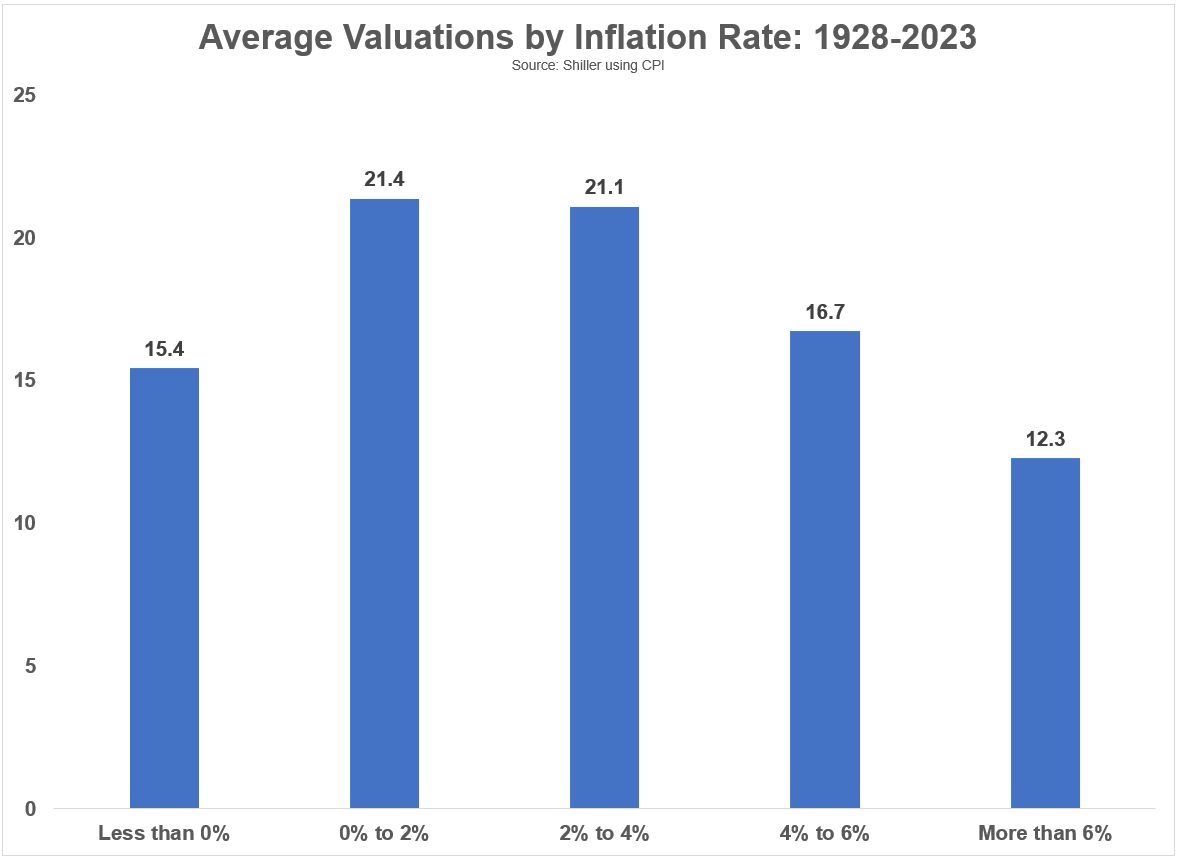

External factors significantly impact AAPL stock price. Global economic conditions, interest rates, and inflation all play a crucial role.

- Inflation and Interest Rates: High inflation and rising interest rates can negatively affect consumer spending, potentially impacting demand for Apple products and slowing revenue growth.

- Global Economic Conditions: Recessions or geopolitical instability can impact consumer confidence and investment decisions, potentially dampening AAPL stock price.

- Tech Sector Performance: The overall performance of the tech sector influences investor sentiment towards individual tech stocks like AAPL. A strong tech sector generally supports higher AAPL stock prices.

Identifying Key Support and Resistance Levels for AAPL Stock

Technical analysis plays a vital role in identifying potential support and resistance levels for AAPL stock. These levels represent price points where buying or selling pressure is anticipated.

Technical Analysis of AAPL Charts

Technical indicators help identify these crucial levels:

- Moving Averages: 20-day and 50-day moving averages can indicate short-term and intermediate-term trends. Breaks above or below these averages can signal shifts in momentum.

- RSI (Relative Strength Index): RSI helps gauge the strength of price movements. Overbought conditions (RSI above 70) might suggest a potential pullback, while oversold conditions (RSI below 30) could indicate a buying opportunity.

- Support and Resistance Levels: These are identified by analyzing historical price charts, pinpointing areas where previous price reversals occurred. These levels serve as potential areas for price bounces or breakdowns.

(Include relevant charts and graphs illustrating these levels here)

Psychological Levels and Market Sentiment

Psychological levels, often round numbers, significantly impact investor behavior.

- Round Numbers: Price levels like $150, $175, $200 often act as psychological support or resistance levels. Investors tend to react strongly to these points, leading to increased buying or selling pressure.

- Market Sentiment: Positive news or strong earnings reports can shift psychological levels upward, while negative news or economic uncertainty might push them lower.

Potential Scenarios for Apple Stock Price in the Near Future

Considering both fundamental and technical analysis, several scenarios emerge for AAPL's near-future price movements.

Bullish Scenario

A bullish scenario sees Apple exceeding expectations and leading to a price increase.

- Strong Product Launches: Highly successful new products and features driving strong revenue growth.

- Positive Economic Conditions: A robust global economy and healthy consumer spending.

- Positive Investor Sentiment: Continued strong investor confidence in Apple's future.

- Potential Price Target: A move above $200, potentially reaching $225 or higher.

Bearish Scenario

A bearish scenario might result in a price decrease due to various factors.

- Increased Competition: Strong competition from Android devices eroding Apple's market share.

- Economic Downturn: A global recession or economic slowdown impacting consumer spending.

- Negative Investor Sentiment: A loss of confidence in Apple's growth prospects.

- Potential Price Target: A drop below $150, potentially testing lower support levels.

Neutral Scenario

A neutral scenario sees Apple maintaining its current market position and price range.

- Moderate Growth: Steady revenue growth and product innovation, but no significant breakthroughs.

- Stable Economic Conditions: Neither significant economic boom nor recession.

- Stable Investor Sentiment: Neither excessive bullishness nor bearishness.

- Potential Price Range: Consolidation between $160 and $180.

Conclusion

Predicting the future price of Apple stock (AAPL) requires careful consideration of both fundamental and technical factors. Identifying key support and resistance levels, as outlined above, provides valuable insights for informed investment decisions. While a bullish scenario is possible given Apple's strong fundamentals, economic uncertainty and increased competition present potential risks. Remember that this analysis should not be considered financial advice. Before making any investment decisions regarding AAPL stock, conduct thorough due diligence and consider consulting a financial advisor. Stay informed about relevant news and market trends to make the most informed choices regarding your Apple stock (AAPL) investments.

Featured Posts

-

Analyse Snelle Marktverandering Europese Aandelen Een Vergelijking Met Wall Street

May 24, 2025

Analyse Snelle Marktverandering Europese Aandelen Een Vergelijking Met Wall Street

May 24, 2025 -

Lady Gaga Hand In Hand With Fiance Michael Polansky At Snl Afterparty

May 24, 2025

Lady Gaga Hand In Hand With Fiance Michael Polansky At Snl Afterparty

May 24, 2025 -

Sundays Demonstration Assessing The National Rallys Show Of Support For Le Pen

May 24, 2025

Sundays Demonstration Assessing The National Rallys Show Of Support For Le Pen

May 24, 2025 -

Amerikaanse Beurs In De Rode Cijfers Aex Toont Veerkracht

May 24, 2025

Amerikaanse Beurs In De Rode Cijfers Aex Toont Veerkracht

May 24, 2025 -

Strengthening Ties Bangladesh And Europe Collaborate For Economic Growth

May 24, 2025

Strengthening Ties Bangladesh And Europe Collaborate For Economic Growth

May 24, 2025

Latest Posts

-

Understanding The Controversy Surrounding Thames Waters Executive Bonuses

May 24, 2025

Understanding The Controversy Surrounding Thames Waters Executive Bonuses

May 24, 2025 -

Are Elevated Stock Market Valuations Justified Bof As Take

May 24, 2025

Are Elevated Stock Market Valuations Justified Bof As Take

May 24, 2025 -

Thames Waters Executive Bonuses A Look At The Financial Implications

May 24, 2025

Thames Waters Executive Bonuses A Look At The Financial Implications

May 24, 2025 -

Bof A Reassures Investors Understanding Current Stock Market Valuations

May 24, 2025

Bof A Reassures Investors Understanding Current Stock Market Valuations

May 24, 2025 -

Addressing Investor Concerns Bof A On Stretched Stock Market Valuations

May 24, 2025

Addressing Investor Concerns Bof A On Stretched Stock Market Valuations

May 24, 2025