Apple Stock Prediction: $254? Is AAPL A Buy Near $200?

Table of Contents

Apple's Recent Financial Performance and Future Projections

Analyzing Apple's financial health is crucial for any AAPL stock prediction. Let's examine its recent performance and future outlook.

Revenue Growth and Profitability

Apple's recent quarterly earnings reports paint a picture of continued, though sometimes slowing, growth.

- Q[Insert Quarter] 2024: Revenue of [Insert Revenue Figure], representing a [Insert Percentage]% year-over-year growth/decline. Net income reached [Insert Net Income Figure], resulting in an EPS of [Insert EPS Figure].

- Q[Insert Previous Quarter] 2024: Revenue of [Insert Revenue Figure], representing a [Insert Percentage]% year-over-year growth/decline. Net income was [Insert Net Income Figure], resulting in an EPS of [Insert EPS Figure].

- iPhone Sales: [Insert Data on iPhone Sales – growth or decline, comparison to previous years].

- Mac Sales: [Insert Data on Mac Sales – growth or decline, comparison to previous years].

- Services Revenue: [Insert Data on Services Revenue – growth or decline, comparison to previous years].

These figures showcase [Insert overall assessment of revenue and profit trends – e.g., consistent growth, slowing growth, areas of strength and weakness].

Analysis of Future Product Launches and Their Potential Impact

Apple's upcoming product releases will significantly impact its future financial performance and, consequently, the AAPL stock price.

- iPhone 16 (Expected Release): Analysts anticipate [Insert details about expected features and market impact]. Pre-orders and initial sales figures will be key indicators of consumer demand.

- New AR/VR Headset: The launch of Apple's rumored mixed-reality headset could disrupt the market and generate significant revenue, though its success is yet to be determined.

- Mac Pro Updates: Any significant upgrades to the Mac Pro lineup could boost sales among professional users.

These anticipated releases suggest [Insert an overall assessment of the potential impact of upcoming product launches on AAPL's stock – positive, neutral, or cautious].

Market Trends and Economic Factors Influencing AAPL Stock

Macroeconomic factors and broader market sentiment play a significant role in AAPL's stock price fluctuations.

Overall Market Sentiment and Investor Confidence

The current state of the stock market, particularly the tech sector, heavily influences investor confidence in Apple.

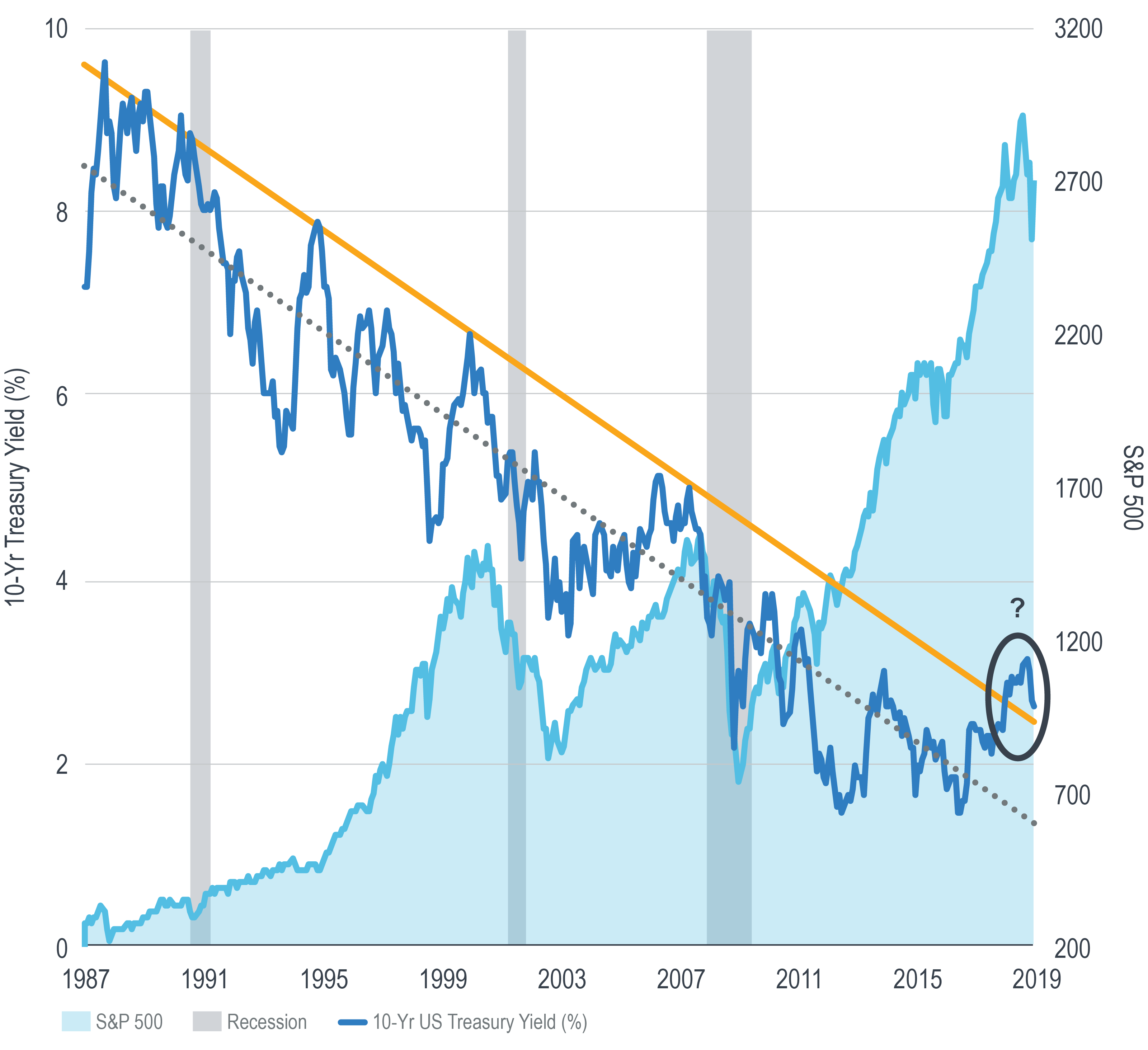

- S&P 500 and NASDAQ Performance: [Insert current performance of these indices and their impact on the tech sector].

- Inflation and Interest Rates: Rising inflation and interest rates can impact consumer spending and potentially reduce investor appetite for riskier assets like tech stocks.

- Investor Sentiment towards Tech Stocks: [Insert overall assessment of investor sentiment towards tech stocks – positive, negative, or cautious].

Geopolitical Risks and Supply Chain Issues

External factors, including geopolitical instability and supply chain disruptions, pose potential risks to Apple's stock price.

- US-China Relations: Strained relations between the US and China could impact Apple's manufacturing and supply chain.

- Global Economic Uncertainty: Recessions or economic slowdowns in major markets can significantly impact Apple's sales.

- Supply Chain Disruptions: Any unforeseen disruptions, such as natural disasters or geopolitical events, could impact Apple's production and availability of products.

Competitive Landscape and Apple's Market Position

Apple operates in a competitive market, and understanding its competitive positioning is essential for any AAPL stock prediction.

Analysis of Key Competitors and Their Impact

Samsung and Google are among Apple's primary competitors, constantly vying for market share.

- Samsung's Galaxy Smartphones: Samsung continues to be a major rival in the smartphone market, offering competitive products at various price points.

- Google's Pixel Smartphones and Android Ecosystem: Google's Android operating system poses a challenge to Apple's iOS ecosystem, offering consumers alternatives.

These competitors' actions and innovations can influence Apple's market share and, consequently, its stock price.

Apple's Competitive Advantages and Strengths

Apple possesses several strengths that help it maintain a strong market position.

- Strong Brand Loyalty: Apple enjoys remarkable brand loyalty, with many consumers remaining committed to its ecosystem.

- Innovative Products: Apple consistently releases innovative products that set industry trends.

- Robust Ecosystem: The integration of Apple's devices and services creates a highly attractive and user-friendly ecosystem.

Expert Opinions and Analyst Ratings for AAPL

Analyst predictions provide valuable insights but should be considered alongside other factors.

Summary of Analyst Predictions and Price Targets

Many analysts offer price targets for AAPL, with some predicting a significant rise.

- Analyst Firm A: Price target of $[Insert Price Target]

- Analyst Firm B: Price target of $[Insert Price Target]

- Analyst Firm C: Price target of $[Insert Price Target] (Including those predicting $254)

These varying predictions highlight the uncertainty inherent in stock market forecasting.

Considering the Consensus View and Divergent Opinions

While some analysts are bullish on AAPL reaching $254, others express more cautious views. Understanding these differing opinions helps form a balanced perspective. [Summarize the overall sentiment: bullish, bearish, or neutral].

Conclusion: Apple Stock Prediction: Should You Buy AAPL Near $200?

Predicting Apple stock's future price is inherently challenging, but analyzing its financial strength, market positioning, competitive landscape, and expert opinions gives us valuable insights. While the $254 price target is ambitious, the potential for growth is certainly there. However, economic uncertainties, intense competition, and unforeseen events could impact AAPL's performance.

Therefore, while the potential for AAPL to reach $254 exists, thorough research considering the factors discussed above is crucial before making any investment decisions regarding Apple stock. Continue your due diligence to determine if AAPL is the right investment for your portfolio. Remember to consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

Financing Your Escape To The Country Practical Tips

May 24, 2025

Financing Your Escape To The Country Practical Tips

May 24, 2025 -

Sadie Sink And Mia Farrow A Broadway Moment

May 24, 2025

Sadie Sink And Mia Farrow A Broadway Moment

May 24, 2025 -

Sinatras Four Marriages An Examination Of His Romantic Life

May 24, 2025

Sinatras Four Marriages An Examination Of His Romantic Life

May 24, 2025 -

Escape To The Country Making The Move To Rural Bliss

May 24, 2025

Escape To The Country Making The Move To Rural Bliss

May 24, 2025 -

Stijgende Kapitaalmarktrentes Euro Boven 1 08

May 24, 2025

Stijgende Kapitaalmarktrentes Euro Boven 1 08

May 24, 2025

Latest Posts

-

South Africa Reacts Exploring Other Options For Cyril Ramaphosa At The White House

May 24, 2025

South Africa Reacts Exploring Other Options For Cyril Ramaphosa At The White House

May 24, 2025 -

Ramaphosas Calm Response Alternative Actions In The White House Ambush

May 24, 2025

Ramaphosas Calm Response Alternative Actions In The White House Ambush

May 24, 2025 -

Newark Airport Chaos Trump Era Air Traffic Control Plan Blamed

May 24, 2025

Newark Airport Chaos Trump Era Air Traffic Control Plan Blamed

May 24, 2025 -

Market Movers Today Bonds Dow Futures And Bitcoin Real Time Updates

May 24, 2025

Market Movers Today Bonds Dow Futures And Bitcoin Real Time Updates

May 24, 2025 -

Stock Market News Analysis Of Todays Bond Market Decline And Bitcoin Surge

May 24, 2025

Stock Market News Analysis Of Todays Bond Market Decline And Bitcoin Surge

May 24, 2025