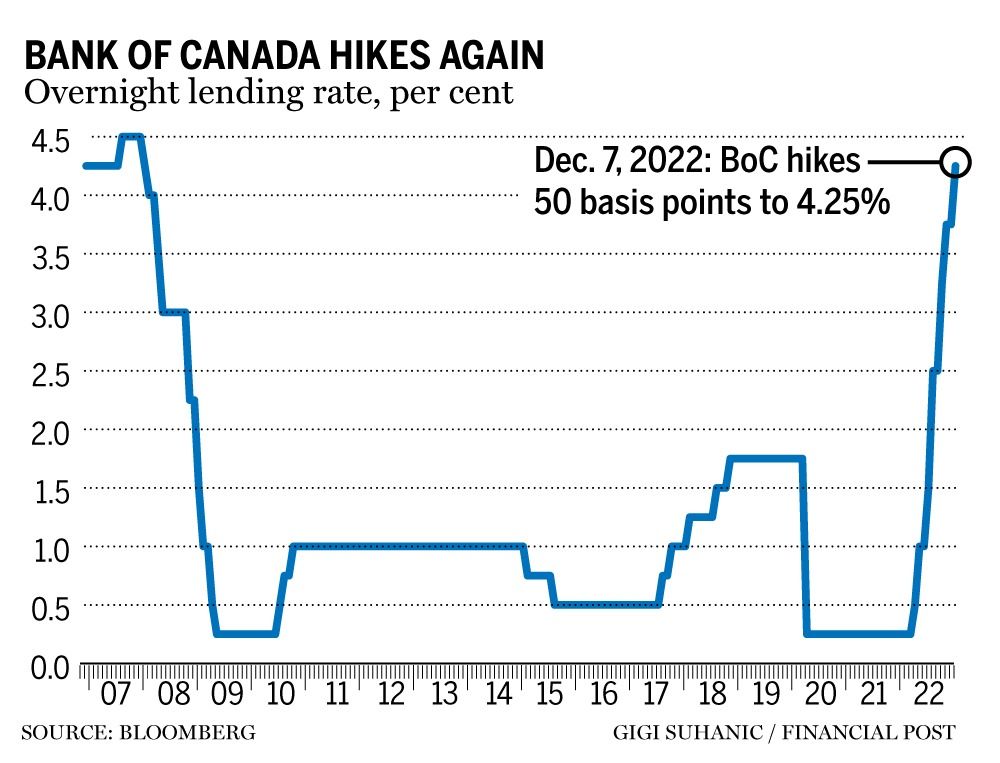

Bank Of Canada Rate Cuts: Economists Predict Renewed Cuts Amidst Tariff Job Losses

Table of Contents

Economists' Predictions for Further Bank of Canada Rate Cuts

A growing consensus among leading economists points towards further Bank of Canada rate cuts in the coming months. Many prominent financial institutions, including RBC Economics and TD Economics, forecast at least one, if not two, additional rate reductions before the end of the year. These predictions vary slightly in timing and magnitude, with some suggesting a 25-basis-point cut while others anticipate a more aggressive 50-basis-point reduction. The overall expectation is for a continued easing of monetary policy by the Bank of Canada, reflecting a darkening economic outlook.

Reasons Behind the Predicted Rate Cuts:

Several interconnected factors are driving these predictions for lower interest rates:

-

Weakening Economic Growth: Trade uncertainties stemming from ongoing tariff disputes are significantly dampening economic growth in Canada. Businesses are delaying investment decisions, and consumer confidence is wavering.

-

Rising Unemployment Linked to Tariff-Related Job Losses: The impact of tariffs is directly translating into job losses across various sectors, particularly in manufacturing and agriculture. Rising unemployment further weakens consumer spending and overall economic activity.

-

Low Inflation Rates Providing Room for Monetary Easing: With inflation remaining comfortably below the Bank of Canada's target of 2%, there is ample room for monetary easing without triggering significant inflationary pressures. Lower interest rates aim to stimulate the economy without overheating it.

-

Global Economic Slowdown Impacting Canada: The global economic slowdown is further exacerbating Canada's economic challenges. Reduced global demand for Canadian goods and services is contributing to the weakening economic climate.

The Impact of Tariffs on Canadian Employment

The imposition of tariffs has had a measurable negative effect on Canadian employment. Industries heavily reliant on exports, like manufacturing and agriculture, have been particularly hard hit. While precise figures are difficult to isolate due to other contributing economic factors, numerous reports indicate significant job losses directly attributable to reduced export opportunities and increased input costs. This job displacement has a ripple effect, reducing consumer spending and contributing to a broader economic slowdown.

Sectors Hardest Hit by Tariff-Related Job Losses:

Specific sectors feeling the brunt of tariff-related job losses include:

-

Manufacturing: Canadian manufacturers face increased competition from foreign producers, who may benefit from lower tariffs in their respective markets. This translates to lower production, factory closures, and job losses.

-

Agriculture: The agricultural sector is severely impacted by retaliatory tariffs on Canadian agricultural exports. Farmers face reduced demand for their products, leading to decreased income and potential job losses across the agricultural value chain.

-

Forest Products: Canada's forestry industry is also feeling the impact of trade disputes, with reduced demand for lumber and other wood products affecting employment in logging, processing, and manufacturing.

The Effectiveness of Bank of Canada Rate Cuts in Addressing Job Losses

While Bank of Canada rate cuts can stimulate economic activity by making borrowing cheaper for businesses and consumers, their effectiveness in directly addressing tariff-related job losses is debated. Lower interest rates can encourage investment and consumer spending, potentially leading to job creation in certain sectors. However, the impact may be limited to industries sensitive to interest rate changes, and it might not effectively revive sectors directly impacted by trade restrictions. There is also a risk that rate cuts, if too aggressive, could lead to uncontrolled inflation.

Potential Alternatives to Rate Cuts:

To supplement or even replace rate cuts, alternative policy approaches should be considered:

-

Government Spending on Infrastructure Projects: Investing in infrastructure can directly create jobs and stimulate economic growth through increased demand for goods and services.

-

Tax Incentives for Businesses and Job Creation: Tax breaks and incentives for businesses can encourage investment, expansion, and the creation of new jobs.

-

Targeted Support for Affected Industries: Government assistance programs, such as wage subsidies or retraining initiatives, can specifically target industries heavily impacted by tariffs.

Conclusion: Navigating the Challenges of Bank of Canada Rate Cuts

Economists widely predict further Bank of Canada rate cuts in response to the weakening economy and rising unemployment linked to tariff-related job losses. While rate cuts can stimulate economic activity, their effectiveness in addressing the specific challenges posed by trade disputes is not guaranteed. Alternative policy options, such as increased government spending and targeted industry support, should be considered to complement monetary policy adjustments. Staying informed about upcoming Bank of Canada announcements and the evolving Canadian economic landscape is crucial for individuals and businesses alike. To stay updated, follow reputable financial news sources and subscribe to relevant economic updates. Understanding the implications of Bank of Canada rate cuts is vital for navigating the current economic climate effectively.

Featured Posts

-

George Straits Dairy Queen Visit Photo With Employee Goes Viral

May 14, 2025

George Straits Dairy Queen Visit Photo With Employee Goes Viral

May 14, 2025 -

Disneys Live Action Remakes Is Snow Whites 169 Million Underperformance A Sign Of Trouble

May 14, 2025

Disneys Live Action Remakes Is Snow Whites 169 Million Underperformance A Sign Of Trouble

May 14, 2025 -

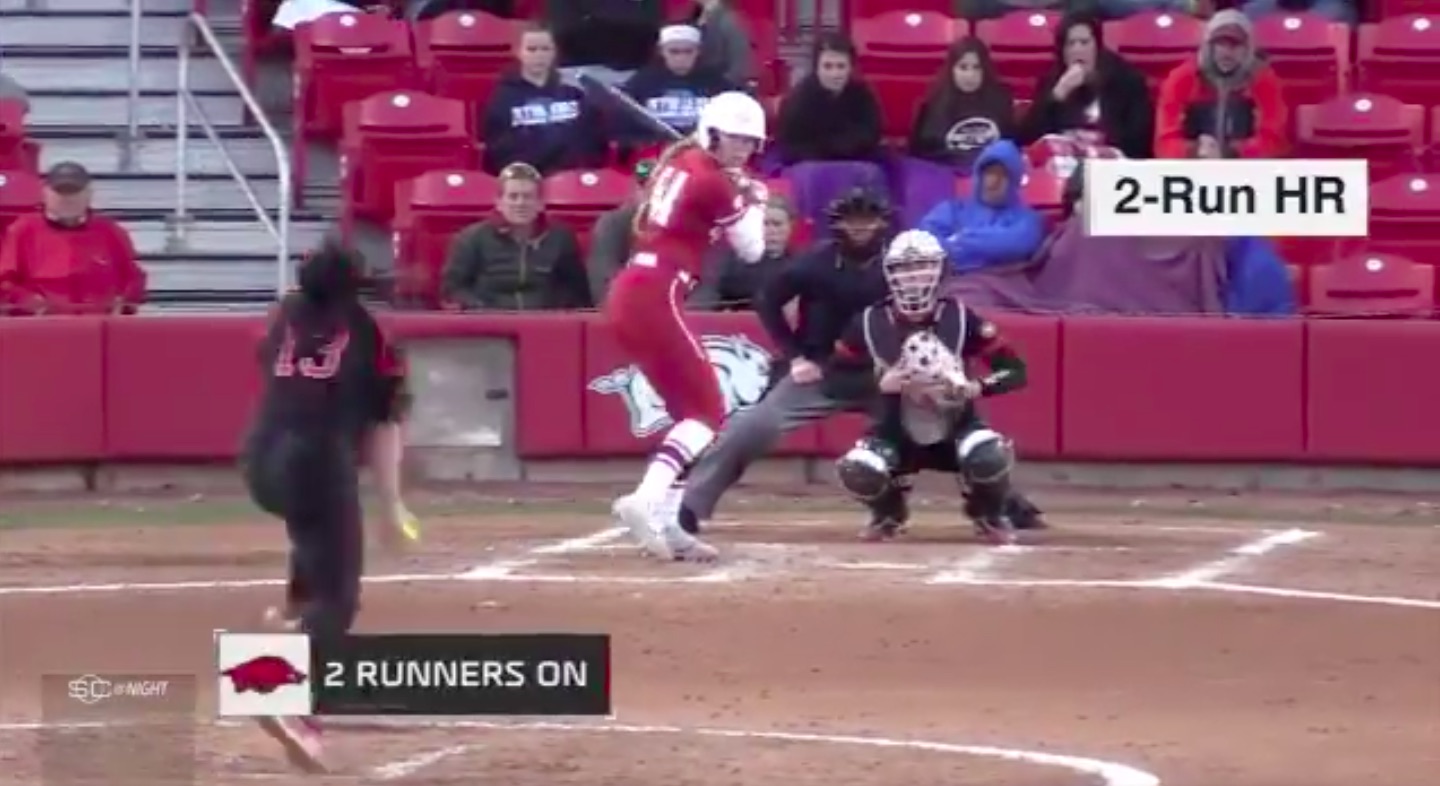

Arkansas Softball Players Historic Power A New Era In College Softball

May 14, 2025

Arkansas Softball Players Historic Power A New Era In College Softball

May 14, 2025 -

Snow White Spain Event Rachel Zegler Present Gal Gadot Absent

May 14, 2025

Snow White Spain Event Rachel Zegler Present Gal Gadot Absent

May 14, 2025 -

Expat Exodus To Canada A Growing Economic Trend

May 14, 2025

Expat Exodus To Canada A Growing Economic Trend

May 14, 2025

Latest Posts

-

Trade Wars And Tech Ipos A Cautious Market Response

May 14, 2025

Trade Wars And Tech Ipos A Cautious Market Response

May 14, 2025 -

Shop Kendra Scotts Snow White Collection Find Disney Inspired Jewelry Under 100

May 14, 2025

Shop Kendra Scotts Snow White Collection Find Disney Inspired Jewelry Under 100

May 14, 2025 -

Snow White Spain Event Rachel Zegler Present Gal Gadot Absent

May 14, 2025

Snow White Spain Event Rachel Zegler Present Gal Gadot Absent

May 14, 2025 -

Tech Firms Delay Ipos Tariff Uncertainty Creates Headwinds

May 14, 2025

Tech Firms Delay Ipos Tariff Uncertainty Creates Headwinds

May 14, 2025 -

Disney Snow White Jewelry Kendra Scott Collection With Budget Friendly Options

May 14, 2025

Disney Snow White Jewelry Kendra Scott Collection With Budget Friendly Options

May 14, 2025