Berkshire Hathaway And Apple: Will Buffett's Departure Impact Apple Stock?

Table of Contents

Buffett's Influence on Apple's Investment Strategy

Buffett's investment philosophy, centered on identifying undervalued companies with strong fundamentals and durable competitive advantages, aligns perfectly with Apple's business model. His approach focuses on long-term value creation, a strategy that mirrors Apple's consistent delivery of innovative products and services.

Berkshire Hathaway's investment in Apple began gradually but has grown to become a cornerstone of its portfolio. The returns have been substantial, significantly boosting Berkshire Hathaway's overall performance and solidifying Apple's position as a blue-chip stock.

- Key Decisions: Buffett's gradual accumulation of Apple shares, rather than a single massive purchase, showcases his patient investment style. His unwavering confidence in Apple’s long-term prospects is evident in Berkshire Hathaway's continued holding.

- Portfolio Percentage: Apple currently represents a significant percentage of Berkshire Hathaway's overall portfolio, highlighting the importance of this investment to the conglomerate's success. This substantial stake demonstrates the trust placed in Apple’s continued growth.

- Brand Impact: Buffett's endorsement of Apple lent significant credibility to the company, boosting investor confidence and reinforcing its strong brand image. This endorsement extended beyond financial circles, impacting consumer perception positively.

Berkshire Hathaway's Succession Plan and its Potential Impact on Apple

Berkshire Hathaway's succession plan is a complex matter, with several individuals poised to inherit investment responsibilities. While the exact details remain confidential, the likely successors possess their own investment philosophies, which may differ from Buffett's approach. This potential shift in investment strategy is a key factor impacting future investment decisions related to Apple.

- Potential Strategy Shifts: Post-Buffett, Berkshire Hathaway could adopt a more diversified investment approach, potentially reducing its concentration in any single stock, including Apple. Alternatively, a continuation of the current strategy is also possible.

- Apple's Core Holding Status: Whether Apple will remain a core holding in the Berkshire Hathaway portfolio post-Buffett remains a significant question. The successor's assessment of Apple's long-term prospects will play a crucial role in this decision.

- Divestment or Increased Investment: Scenarios range from a gradual divestment to potentially even increased investment in Apple, depending on the evolving market conditions and the new leadership's assessment of Apple's future growth prospects.

Apple's Intrinsic Value and Future Growth Prospects

Independent of Berkshire Hathaway's investment, Apple boasts a strong market position, robust financial health, and significant future growth potential. Its innovative product pipeline, substantial market share, and global brand recognition are key factors contributing to this positive outlook.

- Innovation and Competition: Apple's continued focus on innovation, particularly in areas such as augmented reality, artificial intelligence, and services, positions it favorably against competitors. Maintaining this innovative edge is crucial for continued success.

- Financial Performance: Apple's consistent revenue growth, high profit margins, and strong cash flow provide a solid financial foundation for continued expansion and shareholder returns.

- External Factors: Geopolitical instability and global supply chain disruptions could pose challenges. However, Apple’s diversified manufacturing and global reach provide some resilience to these risks.

Market Sentiment and Investor Reactions

Market reaction to any changes in Berkshire Hathaway's Apple holdings will be significant. Short-term volatility is likely, but the long-term impact will depend on several factors, including Apple’s own performance and the market's overall sentiment.

- Investor Confidence: Any significant reduction in Berkshire Hathaway’s Apple stake could negatively impact investor confidence, potentially triggering sell-offs. However, Apple's strong fundamentals could mitigate this.

- Buying Opportunities: Market fluctuations present potential buying opportunities for investors with a long-term perspective. A dip in Apple’s stock price due to a perceived change in Berkshire Hathaway's strategy might be seen as an attractive entry point for some.

- Media and Analyst Influence: Media coverage and analyst predictions will significantly influence market sentiment. Objective analysis, separating speculation from factual information, is crucial for informed investment decisions.

Conclusion

While Warren Buffett's influence on Berkshire Hathaway and its investment in Apple is undeniable, the company's future success is not solely dependent on him. Apple's strong fundamentals and growth prospects suggest a positive outlook, regardless of changes in Berkshire Hathaway's holdings. The succession plan at Berkshire Hathaway will play a critical role, and careful analysis of their future investment strategy is necessary to fully assess potential impacts on Apple's stock.

Call to Action: Stay informed about Berkshire Hathaway's succession planning and Apple's financial performance to make well-informed investment decisions regarding Berkshire Hathaway and Apple stock. Continue to monitor developments concerning Berkshire Hathaway and Apple to understand the evolving relationship and potential impact on your investment strategies.

Featured Posts

-

Thames Water Executive Bonus Outrage And The Publics Response

May 24, 2025

Thames Water Executive Bonus Outrage And The Publics Response

May 24, 2025 -

Amsterdam Residents Take Legal Action Against City Over Tik Tok Fueled Crowds At Popular Snack Bar

May 24, 2025

Amsterdam Residents Take Legal Action Against City Over Tik Tok Fueled Crowds At Popular Snack Bar

May 24, 2025 -

Ai Stuwt Relx Groei Ondanks Zwakke Economie Voorspellingen Tot 2025

May 24, 2025

Ai Stuwt Relx Groei Ondanks Zwakke Economie Voorspellingen Tot 2025

May 24, 2025 -

Demna Gvasalias Appointment At Gucci A New Era In Fashion

May 24, 2025

Demna Gvasalias Appointment At Gucci A New Era In Fashion

May 24, 2025 -

Amundi Msci World Ii Ucits Etf Dist A Deep Dive Into Net Asset Value Nav

May 24, 2025

Amundi Msci World Ii Ucits Etf Dist A Deep Dive Into Net Asset Value Nav

May 24, 2025

Latest Posts

-

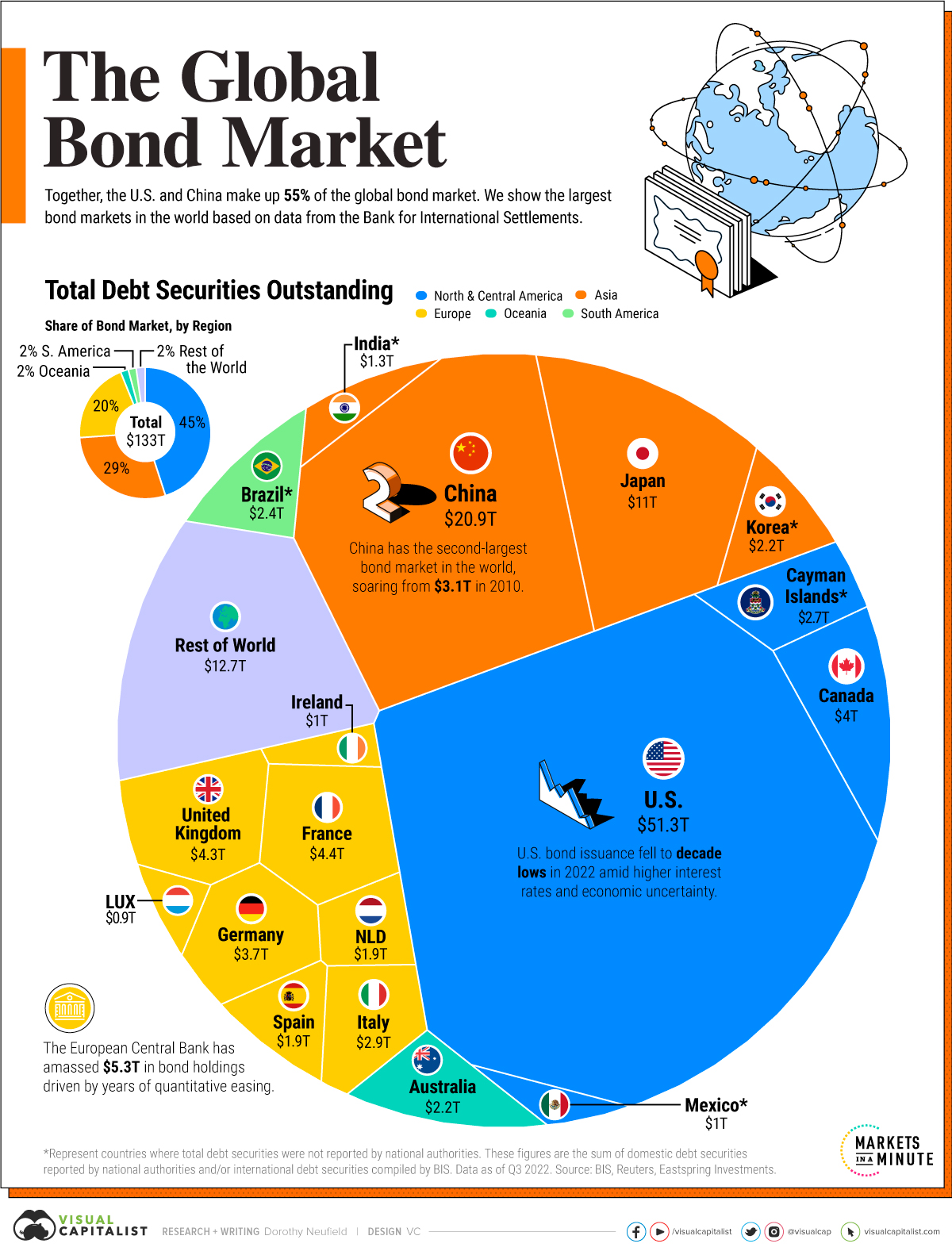

The Posthaste Impact Unrest In The Global Bond Market And Its Global Consequences

May 24, 2025

The Posthaste Impact Unrest In The Global Bond Market And Its Global Consequences

May 24, 2025 -

Bitcoin Hits Record High Amidst Positive Us Regulatory Outlook

May 24, 2025

Bitcoin Hits Record High Amidst Positive Us Regulatory Outlook

May 24, 2025 -

Is The Worlds Largest Bond Market In Trouble A Posthaste Perspective

May 24, 2025

Is The Worlds Largest Bond Market In Trouble A Posthaste Perspective

May 24, 2025 -

Tva Group Ceo Cites Streamers And Regulators For 30 Job Cuts

May 24, 2025

Tva Group Ceo Cites Streamers And Regulators For 30 Job Cuts

May 24, 2025 -

Posthaste Warning The Worlds Largest Bond Market Faces Trouble

May 24, 2025

Posthaste Warning The Worlds Largest Bond Market Faces Trouble

May 24, 2025