TVA Group CEO Cites Streamers And Regulators For 30 Job Cuts

Table of Contents

The Impact of Streaming Services on TVA Group's Business Model

The rise of streaming giants like Netflix, Disney+, and Crave has profoundly reshaped the media landscape, significantly impacting TVA Group's traditional business model. This shift presents both challenges and opportunities for the company.

Increased Competition and Shifting Viewership

The dominance of streaming platforms has led to a dramatic decline in traditional television viewership and advertising revenue. This is particularly relevant for TVA Group, whose programming traditionally relied heavily on linear television advertising.

- Decline in traditional TV advertising revenue: With viewers migrating to streaming services, advertising revenue streams associated with traditional television broadcasts have shrunk considerably. This reduced income directly impacts TVA Group's financial stability.

- Loss of viewers to streaming platforms: The convenience and on-demand nature of streaming services have attracted a significant portion of TVA Group's target audience, resulting in decreased viewership of its linear channels.

- Need for TVA Group to adapt to the changing media consumption habits: TVA Group must urgently adapt its strategies to cater to the evolving preferences of viewers who increasingly consume content on-demand via streaming platforms.

- Increased investment required in streaming content creation: To compete effectively, TVA Group needs to invest heavily in producing high-quality original content for its own streaming platforms, significantly increasing production costs.

The Struggle for Content Differentiation

In the crowded streaming market, creating unique and engaging content that stands out from established giants is a major challenge for TVA Group. This competition for viewers necessitates significant investment and innovation.

- High production costs for original streaming content: Producing high-quality original content requires substantial financial resources, putting pressure on TVA Group's budget.

- Difficulty in standing out amongst established streaming giants: Competing with the established global players in the streaming market is extremely difficult, requiring significant investment in marketing and promotion.

- Need for innovative programming strategies: TVA Group needs to develop innovative programming strategies that attract and retain viewers in this highly competitive environment.

- Potential for mergers or acquisitions to increase competitiveness: Strategic mergers or acquisitions could be a viable option for TVA Group to expand its content library and enhance its competitive position.

The Role of Regulatory Changes in TVA Group's Restructuring

Beyond the challenges posed by streaming services, TVA Group is also navigating increasingly complex and stringent regulatory landscapes, impacting its operational efficiency and financial performance.

Increased Regulatory Scrutiny

Recent changes in broadcasting regulations, content restrictions, and data privacy laws have significantly increased the compliance burden on TVA Group.

- Increased compliance costs: Meeting the requirements of increasingly complex regulations incurs significant costs, reducing profitability.

- Need for regulatory expertise within the company: TVA Group needs to invest in specialized expertise to navigate and comply with the ever-changing regulatory environment.

- Potential fines or penalties for non-compliance: Failure to comply with regulations can lead to substantial fines and penalties, further impacting the company's financial health.

- Navigating complex and ever-changing regulatory landscapes: The dynamic nature of the regulatory landscape necessitates continuous monitoring and adaptation, adding further complexity to TVA Group’s operations.

Impact on Budgeting and Resource Allocation

The increased regulatory burden and reduced revenue streams have forced TVA Group to make difficult decisions regarding budget allocation and resource prioritization.

- Reduced profitability due to increased compliance costs: The added costs associated with regulatory compliance directly impact the company's profitability.

- Difficult choices between investing in content and meeting regulatory requirements: TVA Group faces a difficult trade-off between investing in new content to attract viewers and allocating resources to meet regulatory demands.

- Need to prioritize resource allocation strategically: Careful and strategic resource allocation is crucial to ensure the company's survival and future growth.

- Potential long-term impact on company growth and innovation: The constraints imposed by regulatory changes and reduced profitability could hamper TVA Group's long-term growth and innovation.

The Future of TVA Group and its Workforce

Despite the challenges, TVA Group is actively working on restructuring strategies to adapt to the changing media landscape and support its workforce.

Reorganization and Restructuring Strategies

TVA Group’s response to these challenges extends beyond the immediate job cuts.

- Potential for new hiring in different departments (e.g., technology, streaming): The company may need to shift its focus and invest in areas such as technology and streaming to remain competitive.

- Reskilling and upskilling initiatives for existing employees: Providing training and development opportunities for current employees to enhance their skills will be crucial for adapting to the changing industry.

- Focus on new revenue streams and business opportunities: Exploring new revenue streams, such as partnerships and alternative content distribution models, is critical for long-term survival.

- Long-term strategy to adapt to the changing media landscape: A comprehensive, long-term strategy is essential to navigate the evolving media landscape and maintain a competitive edge.

Support for Affected Employees

TVA Group has committed to providing support to the 30 employees affected by the layoffs.

- Severance packages and outplacement services: Providing generous severance packages and outplacement services demonstrates a commitment to supporting affected employees.

- Job search assistance and career counseling: Offering job search assistance and career counseling will help employees transition to new opportunities.

- Communication and transparency with affected employees: Open communication and transparency are crucial in managing the emotional impact of job losses.

Conclusion

The TVA Group job cuts underscore the significant challenges faced by traditional media companies in the rapidly evolving media landscape. The competitive pressure from streaming services and the increasing burden of regulatory compliance have forced difficult decisions, impacting the company's workforce. However, TVA Group's commitment to restructuring and supporting affected employees demonstrates its efforts to adapt and navigate this new era. Understanding these factors is crucial for anyone interested in the future of the Canadian media industry. Stay informed about the ongoing developments at TVA Group and the broader impact of streaming and regulatory changes on the media industry. Follow [link to TVA Group news or social media] for updates on the company's future strategies and its response to the challenges surrounding TVA Group job cuts.

Featured Posts

-

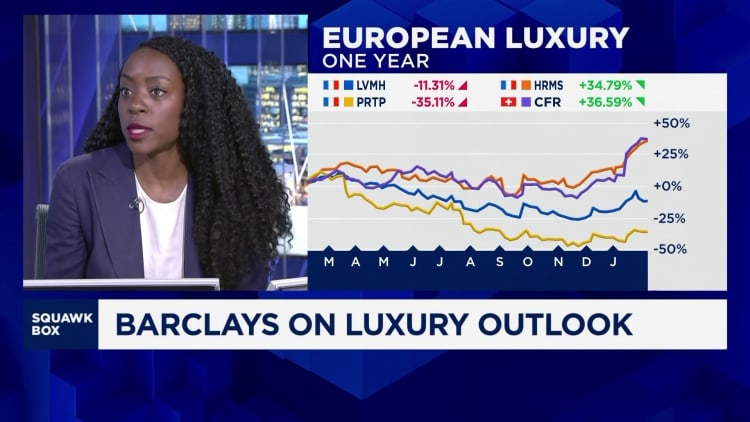

Green Spaces And Mental Well Being A Seattle Case Study From The Pandemic

May 24, 2025

Green Spaces And Mental Well Being A Seattle Case Study From The Pandemic

May 24, 2025 -

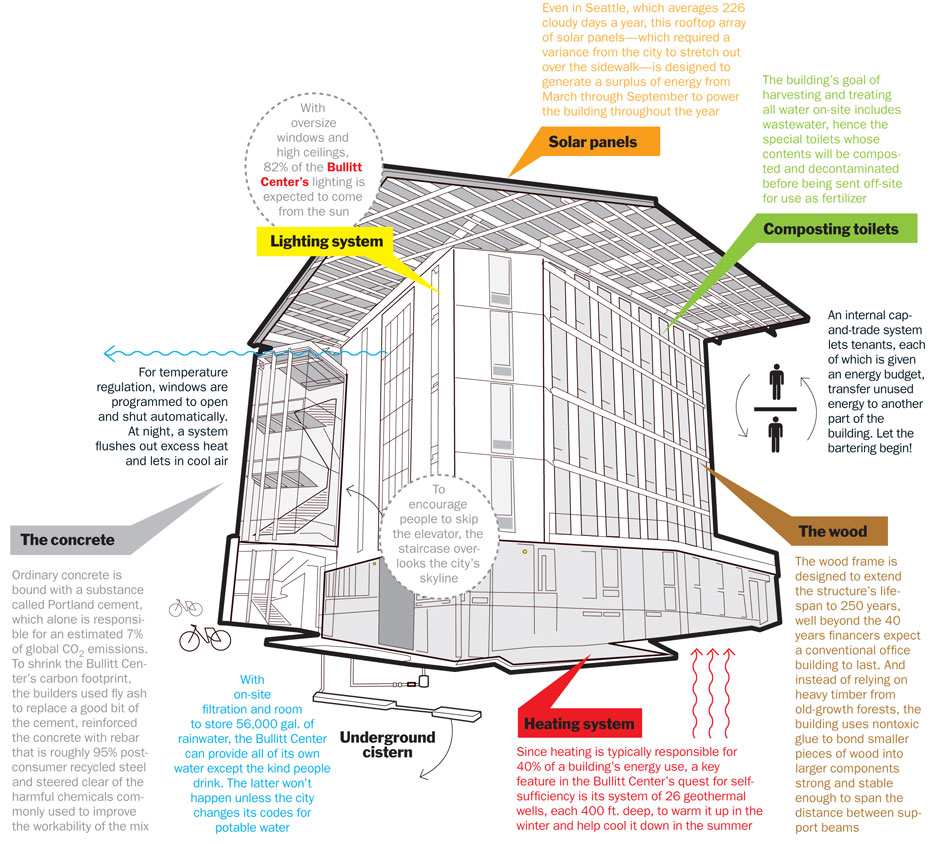

March 7 2025 Paris Economy Suffers From Luxury Goods Sector Weakness

May 24, 2025

March 7 2025 Paris Economy Suffers From Luxury Goods Sector Weakness

May 24, 2025 -

Lady Gaga And Michael Polansky At Snl Afterparty

May 24, 2025

Lady Gaga And Michael Polansky At Snl Afterparty

May 24, 2025 -

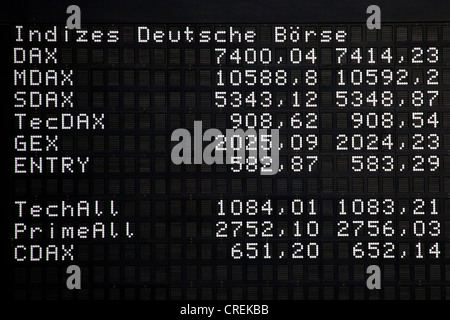

Dax Performance Frankfurt Stock Market Opens Steady Following Record

May 24, 2025

Dax Performance Frankfurt Stock Market Opens Steady Following Record

May 24, 2025 -

Eurovision Village Esc 2025 Conchita Wurst And Jj Live Concert

May 24, 2025

Eurovision Village Esc 2025 Conchita Wurst And Jj Live Concert

May 24, 2025

Latest Posts

-

Neal Mc Donoughs New Bull Riding Video A Look At The Dedication

May 24, 2025

Neal Mc Donoughs New Bull Riding Video A Look At The Dedication

May 24, 2025 -

Is Publix Open On Memorial Day 2025 Florida Store Holiday Hours

May 24, 2025

Is Publix Open On Memorial Day 2025 Florida Store Holiday Hours

May 24, 2025 -

Actor Neal Mc Donough Tackles Pro Bull Riding For The Last Rodeo

May 24, 2025

Actor Neal Mc Donough Tackles Pro Bull Riding For The Last Rodeo

May 24, 2025 -

Actor Neal Mc Donough Seen At Boises Acero Boards And Bottles

May 24, 2025

Actor Neal Mc Donough Seen At Boises Acero Boards And Bottles

May 24, 2025 -

Florida Store Hours Memorial Day 2025 Publix Walmart And More

May 24, 2025

Florida Store Hours Memorial Day 2025 Publix Walmart And More

May 24, 2025