Berkshire Hathaway's Apple Investment: The Future After Buffett

Table of Contents

The Current State of Berkshire Hathaway's Apple Stake

Size and Significance

Berkshire Hathaway's Apple investment is truly staggering. As of [insert most recent data - e.g., Q[Quarter] 2023], the conglomerate held approximately [insert dollar amount] worth of Apple stock, representing [insert percentage]% of Berkshire's overall portfolio. This makes Apple by far one of Berkshire’s largest holdings, significantly outweighing investments in other major companies like Bank of America.

- Dollar Amount: [Insert precise dollar figure]

- Percentage of Portfolio: [Insert precise percentage]

- Comparison: Significantly larger than other Berkshire holdings such as Coca-Cola and American Express.

Performance and Returns

Berkshire Hathaway's Apple investment has delivered exceptional returns since its inception. The steady growth of Apple's stock price has significantly contributed to Berkshire's overall portfolio performance. [Insert data on specific return percentages over specific periods]. This consistent performance has solidified Apple's position as a cornerstone of Berkshire's long-term investment strategy.

- Past Returns: [Insert data with specific percentages and timeframes]

- Comparison: Outperformed many other Berkshire investments in recent years.

- Contribution to Berkshire's Performance: [Quantify the contribution of Apple to Berkshire’s overall returns].

Buffett's Viewpoint

Warren Buffett has repeatedly expressed his admiration for Apple's business model, brand loyalty, and strong fundamentals. He's described Apple as a "consumer products company" rather than a technology company, emphasizing its ability to cultivate enduring customer relationships. This viewpoint underscores his long-term investment strategy, focusing on companies with durable competitive advantages.

- Key Quotes: [Insert relevant quotes from Warren Buffett about Apple]

- Strategic Reasons: Strong brand loyalty, exceptional customer retention, robust cash flows, and innovative product development.

Potential Scenarios After Buffett's Leadership

Maintaining the Status Quo

One possible scenario is that Berkshire Hathaway's successors will maintain the current investment strategy, holding onto the substantial Apple stake. This approach would leverage the continued growth potential of Apple and maintain a significant portion of Berkshire's portfolio.

- Arguments for Maintenance: Apple's continued strong performance, consistent dividend payments, and long-term growth prospects.

- Potential Benefits: Continued high returns, maintaining portfolio diversification, and preserving a core holding.

- Likelihood: [Assess the likelihood based on current management statements and succession plans].

Partial or Complete Divestment

Alternatively, Berkshire Hathaway might decide to partially or completely divest its Apple holdings. This could be driven by several factors, including a need for diversification, changing market conditions, or a shift in investment priorities under new leadership.

- Reasons for Divestment: Potential market saturation of Apple products, emergence of stronger competitors, or a desire to invest in other promising sectors.

- Potential Impacts: A large sale could significantly impact Apple's stock price and influence market sentiment.

Strategic Adjustments

Berkshire Hathaway may choose to adjust its Apple investment strategy without completely divesting. This could involve trimming its holdings during periods of high valuations or strategically increasing its position during market dips.

- Examples of Adjustments: Selling a portion of shares to generate cash for other investments, or buying more shares during market corrections.

- Benefits and Drawbacks: Increased flexibility and responsiveness to market changes but risks missing out on potential future growth.

Impact on Apple and the Broader Market

Effect on Apple's Stock Price

Berkshire Hathaway's future decisions regarding its Apple investment will undoubtedly impact Apple's stock price. A significant sale of shares could trigger a temporary decline, while maintaining or increasing the stake could boost investor confidence.

- Scenarios: A large sale could lead to a short-term price drop, while a continued holding or buying more shares could signal confidence in Apple's future and boost its stock price.

- Analysis of Market Reactions: [Analyze historical market reactions to large sales of Apple shares].

Ripple Effects Across the Investment Landscape

The decisions made by Berkshire Hathaway concerning its Apple investment will have far-reaching consequences across the investment landscape. Other institutional investors may follow suit, influencing investment flows and potentially impacting other tech stocks.

- Potential Effects on Investor Sentiment: A large sale could signal a bearish outlook on the tech sector, influencing investor decisions.

- Imitation by Other Institutional Investors: Berkshire Hathaway's actions often serve as a benchmark for other investors, leading to a ripple effect.

Conclusion: The Uncertain Future of Berkshire Hathaway's Apple Investment

The future of Berkshire Hathaway's Apple investment remains uncertain, presenting a variety of potential scenarios. Maintaining the status quo, partial divestment, or strategic adjustments are all possibilities, each carrying significant implications for both companies and the broader market. The immense size of the investment and the legacy of Warren Buffett make this a pivotal moment in the financial world. It is crucial to continue following the developments regarding Berkshire Hathaway's Apple holdings and its post-Buffett investment strategy to fully understand the future of this landmark partnership. Keep a close eye on Berkshire Hathaway's Apple holdings, the future of Apple investment, and the evolving post-Buffett investment strategy.

Featured Posts

-

Umfjoellun Um Fyrstu 100 Rafutgafu Porsche Macan

May 24, 2025

Umfjoellun Um Fyrstu 100 Rafutgafu Porsche Macan

May 24, 2025 -

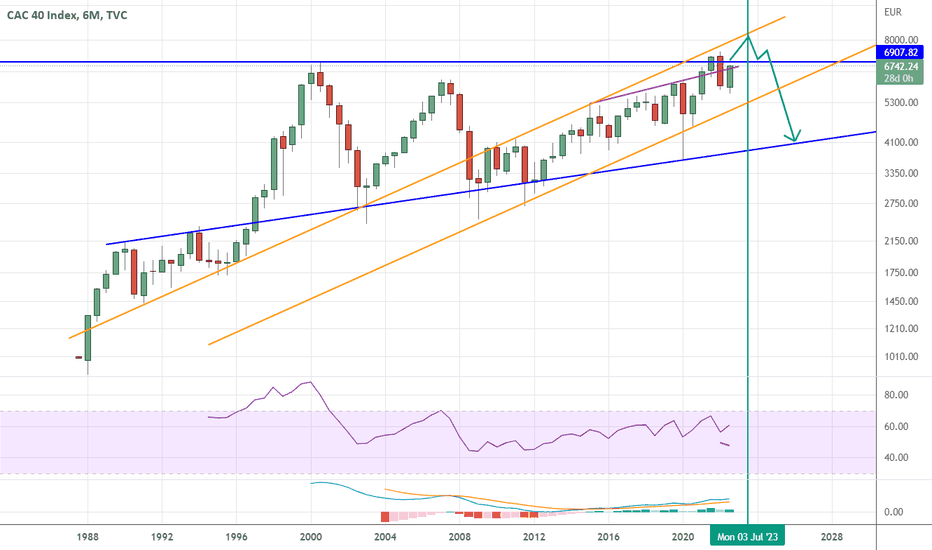

Slight Cac 40 Dip At Weeks End Remains Steady Overall March 7 2025

May 24, 2025

Slight Cac 40 Dip At Weeks End Remains Steady Overall March 7 2025

May 24, 2025 -

Lyubov I Ilya Ilich Vzglyad Gazety Trud Na Ego Romanticheskie Gryozy

May 24, 2025

Lyubov I Ilya Ilich Vzglyad Gazety Trud Na Ego Romanticheskie Gryozy

May 24, 2025 -

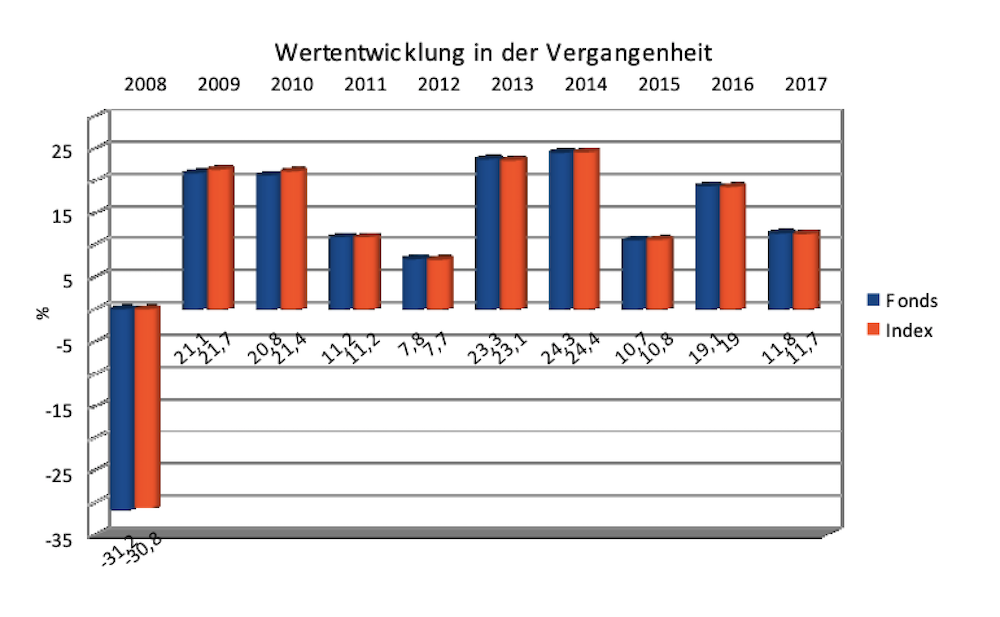

Amundi Dow Jones Industrial Average Ucits Etf Understanding Net Asset Value Nav

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Understanding Net Asset Value Nav

May 24, 2025 -

Amsterdam Stock Market Three Days Of Significant Losses Totaling 11

May 24, 2025

Amsterdam Stock Market Three Days Of Significant Losses Totaling 11

May 24, 2025

Latest Posts

-

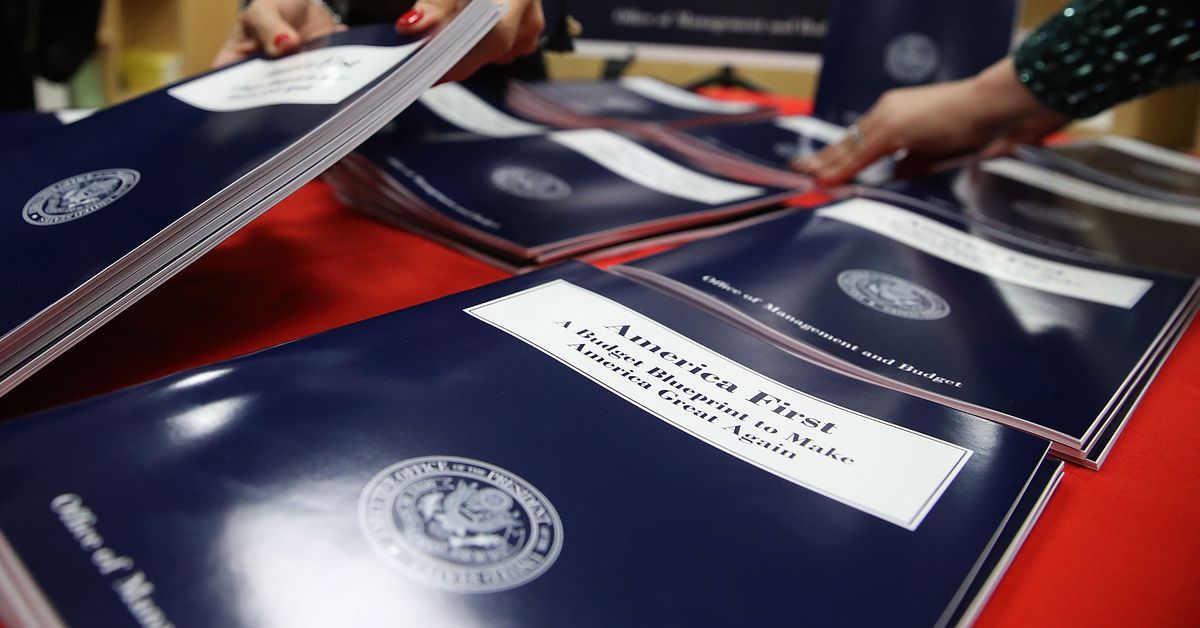

Preserving History The Fight To Save Museum Programs From Budget Cuts

May 24, 2025

Preserving History The Fight To Save Museum Programs From Budget Cuts

May 24, 2025 -

Museum Funding Crisis The Aftermath Of Trumps Budget Decisions

May 24, 2025

Museum Funding Crisis The Aftermath Of Trumps Budget Decisions

May 24, 2025 -

Analyzing The Impact Of Federal Funding Cuts On Museum Operations

May 24, 2025

Analyzing The Impact Of Federal Funding Cuts On Museum Operations

May 24, 2025 -

The Long Term Effects Of Reduced Funding On Us Museum Programs

May 24, 2025

The Long Term Effects Of Reduced Funding On Us Museum Programs

May 24, 2025 -

Are Museum Programs Sustainable After Trumps Funding Cuts

May 24, 2025

Are Museum Programs Sustainable After Trumps Funding Cuts

May 24, 2025