Bitcoin Price Surge: Trump's Actions And Fed Policy Impact

Table of Contents

Trump's Actions and their Influence on Bitcoin

Political Uncertainty and Safe-Haven Assets

Political uncertainty, often amplified by high-profile events and statements, can significantly impact investor sentiment. When confidence in traditional markets falters, investors often seek alternative, less correlated assets perceived as "safe havens." Bitcoin, with its decentralized nature and independence from traditional financial systems, frequently fits this description.

- Examples of Trump's Actions and Market Impact: Trump's unexpected policy shifts, controversial tweets, and pronouncements on trade agreements have, at times, created market volatility. These actions can trigger a "flight to safety," pushing investors towards assets like Bitcoin seen as less susceptible to political influence.

- Data Correlation: While establishing a direct causal link is challenging, studies have indicated a potential correlation between periods of heightened political uncertainty under the Trump administration and increased Bitcoin trading volume and price appreciation. Further research is needed to fully understand this complex relationship.

Regulatory Changes and Bitcoin's Future

The regulatory landscape surrounding cryptocurrencies remains fluid. Trump's administration's approach to Bitcoin and other digital assets directly influences investor confidence and market behavior.

- Potential Regulatory Scenarios and Effects: A clear and favorable regulatory framework could boost investor confidence, leading to increased institutional investment and potentially higher Bitcoin prices. Conversely, stricter regulations or uncertainty about future policies might dampen enthusiasm and depress prices.

- Expert Opinions: Many market analysts have pointed out that regulatory clarity is crucial for Bitcoin's long-term growth. A lack of consistent, predictable regulation can create uncertainty, affecting price volatility.

The Federal Reserve's Monetary Policy and Bitcoin

Interest Rate Changes and Bitcoin's Value

The Federal Reserve's monetary policy significantly influences the overall economic landscape. Interest rate changes can impact Bitcoin's attractiveness as an alternative investment.

- Relationship between Interest Rates and Bitcoin: Higher interest rates generally make traditional investments like bonds more appealing, potentially drawing funds away from Bitcoin and other riskier assets. Conversely, lower interest rates might incentivize investors to seek higher returns in alternative markets, potentially boosting Bitcoin's price.

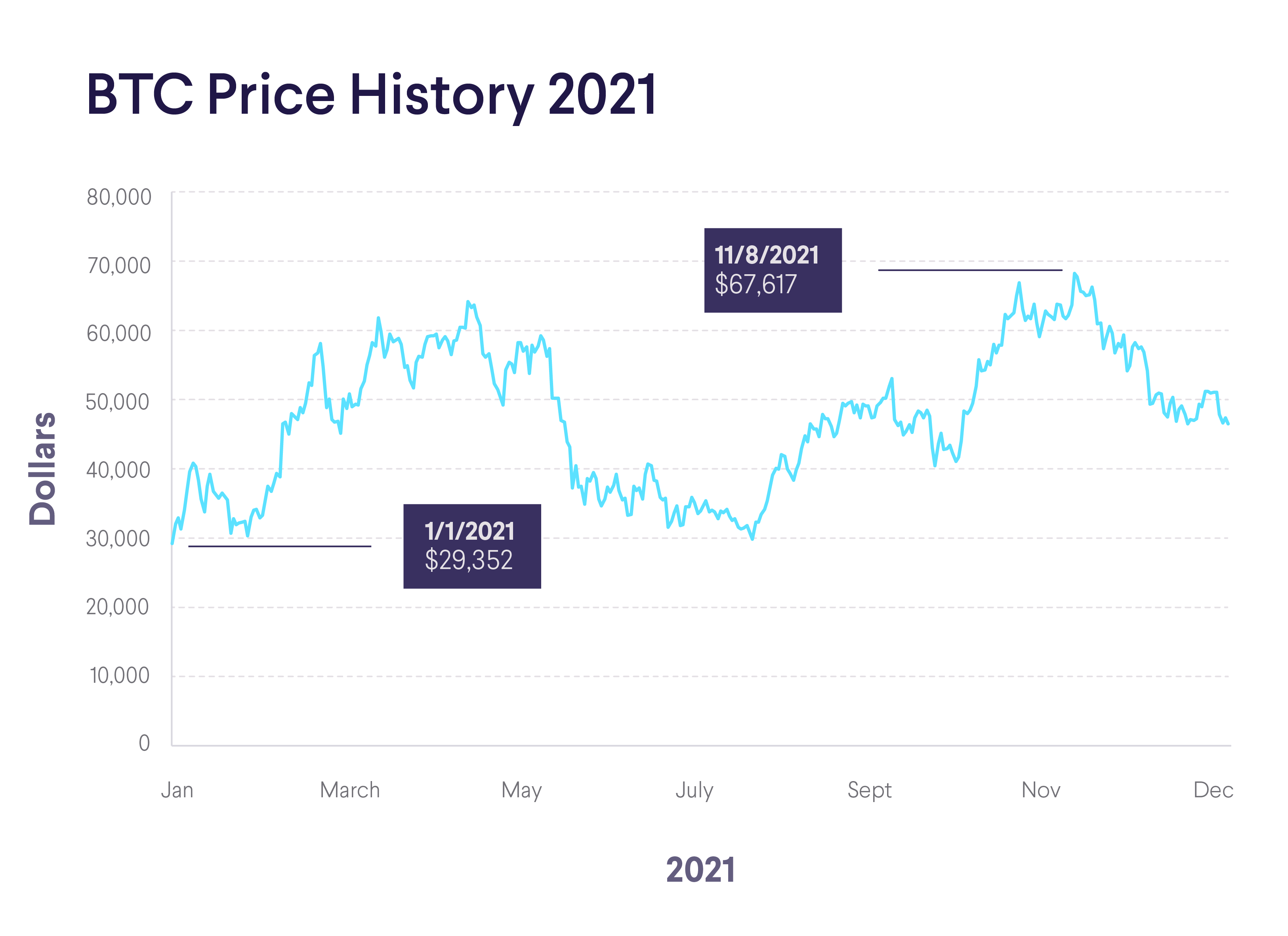

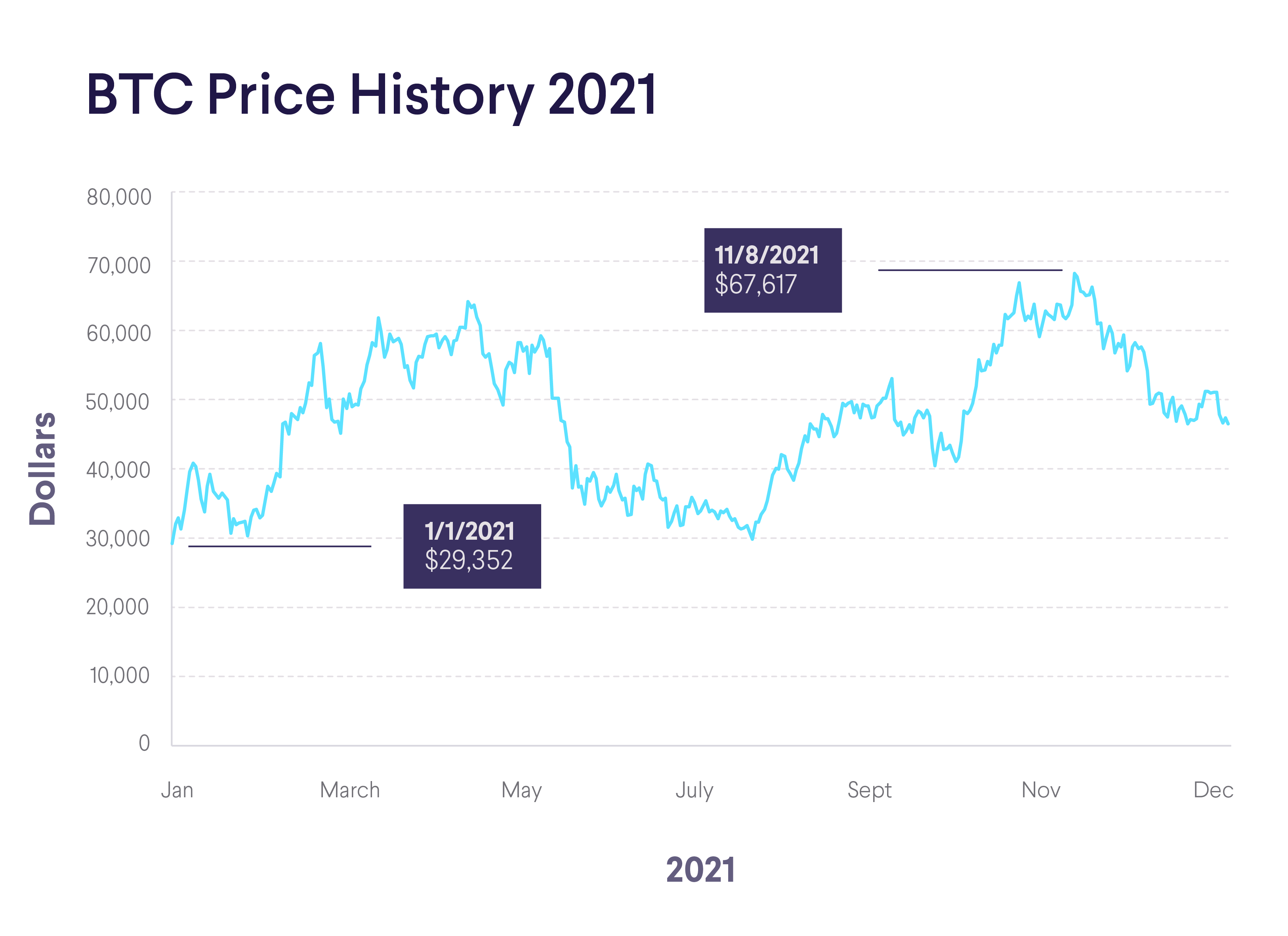

- Economic Data and Charts: Analyzing historical data on interest rate changes and Bitcoin's price movements reveals a complex, often indirect relationship. Charts demonstrating this correlation can help visualize the interplay between these factors.

Quantitative Easing (QE) and Inflationary Pressures

The Federal Reserve's use of quantitative easing (QE) to stimulate the economy can lead to inflationary pressures. Bitcoin, often viewed as a hedge against inflation, may benefit from such scenarios.

- QE and Bitcoin's Price: QE injects liquidity into the market, potentially driving up asset prices, including Bitcoin. As inflation rises, some investors see Bitcoin as a store of value that can preserve purchasing power.

- Inflation Indicators: Tracking inflation indicators like the Consumer Price Index (CPI) can help assess the potential for increased demand for Bitcoin as a hedge against inflation.

Other Contributing Factors to the Bitcoin Price Surge

Increased Institutional Adoption

Growing institutional investment, particularly from large corporations and investment firms, has significantly boosted Bitcoin's legitimacy and price. This signifies a shift from primarily individual investors to larger players entering the market.

Technological Advancements

Continuous developments in blockchain technology, such as improved scalability and enhanced security features, contribute to Bitcoin's overall appeal and attract further investment.

Global Economic Uncertainty

Broader global economic uncertainty, including trade wars and geopolitical tensions, often fuels demand for Bitcoin as a safe haven asset or speculative investment, irrespective of Trump's specific actions or Fed policy.

Conclusion: Understanding the Bitcoin Price Surge

This article explored the multifaceted factors influencing Bitcoin's recent price surge. We examined how Donald Trump's actions and the Federal Reserve's monetary policies, along with other significant developments, have contributed to the volatility in the Bitcoin market. The interplay between political uncertainty, interest rate changes, quantitative easing, institutional adoption, and technological advancements all play a role in shaping Bitcoin's price. Understanding these complex interactions is crucial for navigating this dynamic and ever-evolving market.

Key Takeaways: Bitcoin's price is influenced by a confluence of factors, including political climate, monetary policy, and broader economic conditions. While a direct causal link between specific Trump actions or Fed policies and Bitcoin's price is difficult to establish conclusively, these factors clearly influence investor sentiment and market behavior.

Call to Action: Stay updated on the latest developments impacting the Bitcoin price surge by subscribing to our newsletter! Understanding the relationship between political and economic forces and Bitcoin investing is vital in today's market.

Featured Posts

-

The Closure Of Anchor Brewing Company Impact On The Craft Beer Industry

Apr 24, 2025

The Closure Of Anchor Brewing Company Impact On The Craft Beer Industry

Apr 24, 2025 -

Dollar Advances On Trumps Moderated Fed Comments Analysis Of Currency Market Shifts

Apr 24, 2025

Dollar Advances On Trumps Moderated Fed Comments Analysis Of Currency Market Shifts

Apr 24, 2025 -

Credit Card Companies Feel The Pinch As Consumer Spending Slows

Apr 24, 2025

Credit Card Companies Feel The Pinch As Consumer Spending Slows

Apr 24, 2025 -

William Watson Scrutinizing The Liberal Platform Before You Vote

Apr 24, 2025

William Watson Scrutinizing The Liberal Platform Before You Vote

Apr 24, 2025 -

Positive Trade Developments Drive Rally In Hong Kongs Chinese Stocks

Apr 24, 2025

Positive Trade Developments Drive Rally In Hong Kongs Chinese Stocks

Apr 24, 2025

Latest Posts

-

Market Rally Sensex Rises 200 Nifty Crosses 18 600 Key Highlights

May 10, 2025

Market Rally Sensex Rises 200 Nifty Crosses 18 600 Key Highlights

May 10, 2025 -

Indian Stock Market Update Sensex Nifty Close Higher Despite Ultra Tech Fall

May 10, 2025

Indian Stock Market Update Sensex Nifty Close Higher Despite Ultra Tech Fall

May 10, 2025 -

1 420

May 10, 2025

1 420

May 10, 2025 -

Palantir Stock Assessing The Risks And Rewards Of A Potential 40 Gain By 2025

May 10, 2025

Palantir Stock Assessing The Risks And Rewards Of A Potential 40 Gain By 2025

May 10, 2025 -

1078 2025 R5

May 10, 2025

1078 2025 R5

May 10, 2025