Positive Trade Developments Drive Rally In Hong Kong's Chinese Stocks

Table of Contents

Improved US-China Trade Relations Boost Investor Confidence

The easing of US-China trade tensions has played a pivotal role in boosting investor confidence and fueling the rally in Hong Kong Chinese stocks. The reduction in trade friction has created a more predictable and stable environment for Chinese companies operating in the global market. Specific trade agreements and policy changes have directly impacted Hong Kong-listed firms.

- Reduced tariffs on specific goods: Lower tariffs have reduced costs for Chinese exporters, improving profitability and boosting their stock prices.

- Increased market access for Chinese companies: Improved access to foreign markets allows Chinese companies to expand their businesses and generate higher revenues.

- Improved predictability in trade policies: The decreased uncertainty surrounding trade relations has encouraged investors to increase their exposure to Chinese assets.

- Positive statements from government officials: Reassuring statements from both US and Chinese officials regarding future cooperation have further strengthened investor confidence.

These positive developments have significantly improved the market sentiment surrounding China stocks, leading to increased investor confidence and a surge in trading activity. The end of the US-China trade war era has undeniably unlocked significant potential for growth.

Stronger-than-Expected Economic Data Fuels Growth Expectations

China's robust economic performance, exceeding many initial expectations, has further fueled the rally in Hong Kong Chinese stocks. Positive economic indicators point towards continued growth and increased profitability for Chinese companies.

- Increased consumer spending impacting retail sectors: Stronger-than-anticipated consumer spending has significantly benefited retail and consumer goods companies listed in Hong Kong.

- Booming industrial production driving manufacturing stocks: High industrial production levels have led to increased demand for raw materials and boosted the performance of manufacturing stocks.

- Positive government forecasts for future economic growth: The Chinese government's optimistic outlook for continued economic growth reinforces investor confidence and encourages further investment.

These positive economic indicators, including strong GDP growth, robust industrial production, and healthy consumer spending, all contribute to a more positive market outlook for China's economy and subsequently, for Hong Kong-listed Chinese companies.

Specific Sectors Leading the Rally in Hong Kong Chinese Stocks

The rally in Hong Kong Chinese stocks isn't uniform; certain sectors have significantly outperformed others.

- Technology sector benefiting from increased domestic demand and global expansion: Chinese technology companies, particularly those focusing on artificial intelligence and 5G technology, have seen substantial gains driven by both strong domestic demand and expanding global market share.

- Energy sector boosted by higher commodity prices and increased infrastructure projects: The energy sector has benefited from increased commodity prices and the Chinese government's ongoing massive infrastructure investment projects.

- Financial sector benefiting from improved economic outlook and increased lending activity: The improved economic outlook and increased lending activity have contributed to strong performance within the financial sector.

Identifying these high-performing stock market sectors – technology stocks, energy stocks, and financial stocks – is crucial for investors looking to capitalize on the current market conditions. Understanding sector performance is key to making informed investment decisions.

Analyzing Investor Sentiment and Future Outlook for Hong Kong Chinese Stocks

Investor sentiment towards Hong Kong-listed Chinese stocks is currently very positive. However, it's crucial to acknowledge potential risks.

- Increased foreign investment in Hong Kong Chinese stocks: The rally has attracted significant foreign investment, further driving up stock prices.

- Potential risks associated with geopolitical instability: Geopolitical uncertainties remain a potential risk that could impact future performance.

- Long-term growth potential of Chinese companies: Despite the risks, the long-term growth potential of many Chinese companies remains substantial.

While the market outlook appears positive, a thorough risk assessment is essential. Investors should carefully consider both the opportunities and challenges before making investment decisions. Understanding future projections and long-term investment strategies is crucial for navigating this dynamic market.

Conclusion: Navigating the Rally in Hong Kong's Chinese Stocks

The recent surge in Hong Kong-listed Chinese stocks is primarily driven by positive trade developments, stronger-than-expected economic data, and strong performance in specific sectors. While the current investor sentiment is bullish, it's crucial to remember that investing in any market involves risks. Geopolitical uncertainties and regulatory changes could potentially impact future performance. To capitalize on the growth of Hong Kong Chinese stocks, conduct thorough research and consult with a financial advisor to develop a personalized investment strategy aligned with your risk tolerance and financial goals. Learn more about investing in Hong Kong Chinese stocks and explore the opportunities in the Hong Kong Chinese stock market today.

Featured Posts

-

John Travoltas Heartfelt Tribute Photo Marks Late Son Jetts Birthday

Apr 24, 2025

John Travoltas Heartfelt Tribute Photo Marks Late Son Jetts Birthday

Apr 24, 2025 -

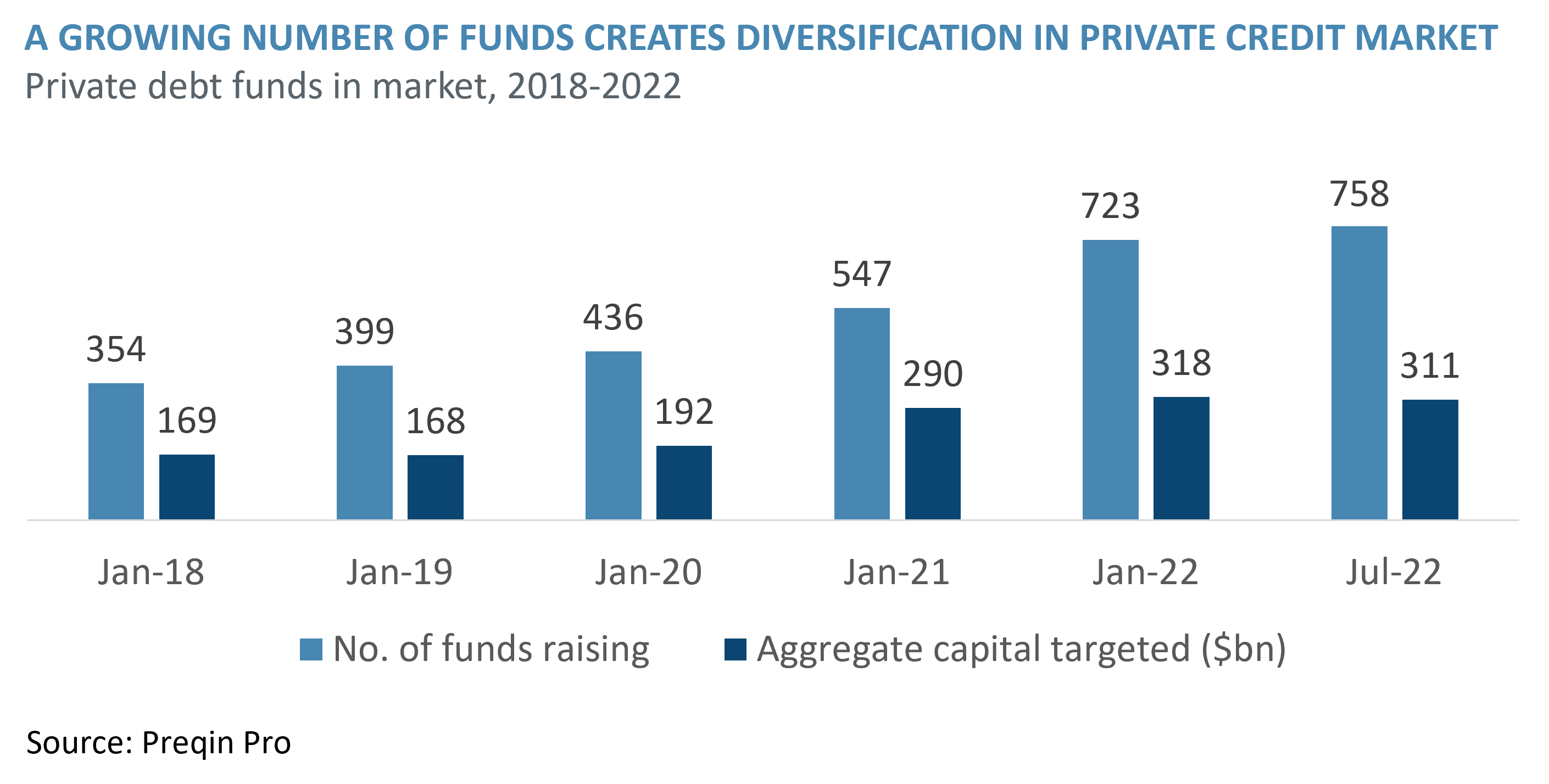

5 Essential Dos And Don Ts Succeeding In The Private Credit Market

Apr 24, 2025

5 Essential Dos And Don Ts Succeeding In The Private Credit Market

Apr 24, 2025 -

Trump Reassures Markets Stock Futures Jump On Powell Remarks

Apr 24, 2025

Trump Reassures Markets Stock Futures Jump On Powell Remarks

Apr 24, 2025 -

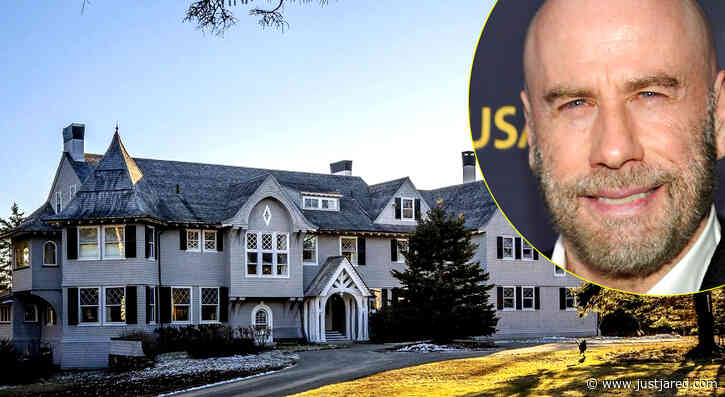

Inside John Travoltas 3 Million Home Addressing The Recent Photo

Apr 24, 2025

Inside John Travoltas 3 Million Home Addressing The Recent Photo

Apr 24, 2025 -

Lab Owner Pleads Guilty To Falsifying Covid 19 Test Results

Apr 24, 2025

Lab Owner Pleads Guilty To Falsifying Covid 19 Test Results

Apr 24, 2025

Latest Posts

-

Financial Losses Of Tech Titans Musk Bezos And Zuckerberg Post 2017

May 10, 2025

Financial Losses Of Tech Titans Musk Bezos And Zuckerberg Post 2017

May 10, 2025 -

The Impact Of Trumps Presidency On The Fortunes Of Musk Bezos And Zuckerberg

May 10, 2025

The Impact Of Trumps Presidency On The Fortunes Of Musk Bezos And Zuckerberg

May 10, 2025 -

Elon Musks Net Worth Soars Tesla Stock Surge After Stepping Back From Dogecoin

May 10, 2025

Elon Musks Net Worth Soars Tesla Stock Surge After Stepping Back From Dogecoin

May 10, 2025 -

How Many Billions Did Musk Bezos And Zuckerberg Lose Since Trumps Inauguration

May 10, 2025

How Many Billions Did Musk Bezos And Zuckerberg Lose Since Trumps Inauguration

May 10, 2025 -

2025 Hurun Report Elon Musk Still Richest Despite Massive Net Worth Decline

May 10, 2025

2025 Hurun Report Elon Musk Still Richest Despite Massive Net Worth Decline

May 10, 2025