Buy-and-Hold Investing: The Long Game's Gut-Wrenching Reality

Table of Contents

The Emotional Rollercoaster of Buy-and-Hold Investing

Buy-and-hold investing demands significant emotional resilience. The market's unpredictable nature creates a psychological rollercoaster, testing even the most seasoned investors. Fear, greed, and the Fear Of Missing Out (FOMO) are constant companions.

- Market volatility and its impact on investor confidence: Sharp market drops can trigger panic selling, leading investors to abandon their long-term strategy prematurely. A successful buy-and-hold investor must learn to manage these emotions.

- The temptation to time the market and its inherent risks: Trying to predict market highs and lows is notoriously difficult and often results in losses. Buy-and-hold eliminates the need for market timing, simplifying the process and reducing stress.

- Dealing with significant portfolio drops and the urge to sell: Witnessing a substantial drop in your portfolio value can be emotionally distressing. Sticking to your buy-and-hold strategy during these times requires discipline and a clear understanding of your investment goals.

- The importance of a strong risk tolerance and long-term perspective: Buy-and-hold investing is not for everyone. You need a strong risk tolerance and the ability to withstand short-term market volatility without abandoning your long-term strategy. A long-term perspective is crucial to weathering these storms.

Navigating Market Downturns with a Buy-and-Hold Strategy

Successfully navigating market downturns is key to successful buy-and-hold investing. Diversification is your best defense against significant losses.

- Diversifying across asset classes (stocks, bonds, real estate, etc.): Spreading your investments across different asset classes reduces your portfolio's overall risk. When one asset class underperforms, others might offset those losses.

- The benefits of a well-diversified portfolio in reducing volatility: A diversified portfolio helps smooth out the bumps in the road, reducing the emotional impact of market fluctuations. This makes sticking to the buy-and-hold strategy much easier.

- Regular portfolio rebalancing to maintain the desired asset allocation: Market fluctuations can shift your asset allocation. Rebalancing periodically ensures your portfolio remains aligned with your risk tolerance and investment goals.

- Understanding your risk tolerance and adjusting your portfolio accordingly: Your risk tolerance is a personal factor. A financial advisor can help you determine your appropriate risk level and adjust your portfolio to match. This reduces the emotional stress associated with high-risk investments.

The Power of Long-Term Growth in Buy-and-Hold Investing

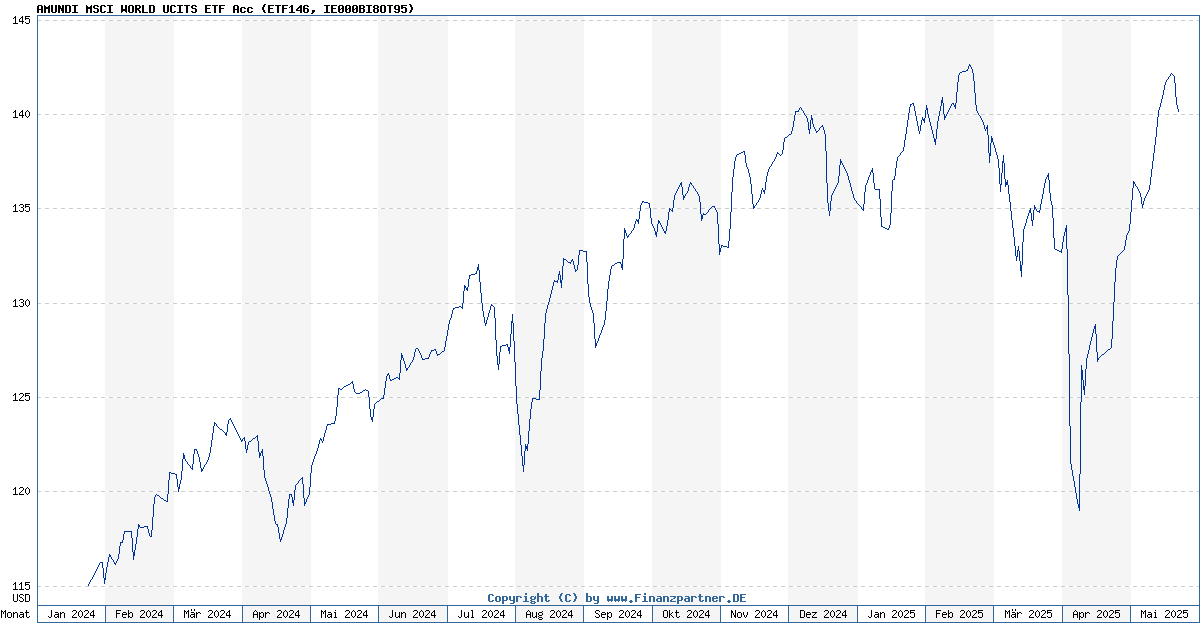

Despite the emotional challenges, the historical evidence overwhelmingly supports the power of long-term growth through buy-and-hold investing.

- Illustrative examples of long-term market returns: Over the long term, the stock market has consistently delivered positive returns, even after accounting for periods of significant decline. Historical data clearly demonstrates this.

- The compounding effect of reinvesting dividends and capital gains: Reinvesting dividends and capital gains allows your investments to grow exponentially over time. This compounding effect is a major driver of long-term wealth creation in buy-and-hold strategies.

- The importance of patience and discipline in achieving long-term goals: Buy-and-hold investing requires patience and discipline. The rewards are reaped over the long term, not overnight.

- Showcasing the benefits of dollar-cost averaging to mitigate risk: Dollar-cost averaging, a strategy of investing a fixed amount at regular intervals, helps mitigate the risk of investing a lump sum at a market peak. This strategy reduces the impact of short-term market volatility.

Tax Implications of Buy-and-Hold Investing

Understanding the tax implications of your investment strategy is crucial for maximizing your returns.

- Comparison of short-term vs. long-term capital gains tax rates: Long-term capital gains (assets held for more than one year) are typically taxed at lower rates than short-term capital gains. This is a significant advantage of buy-and-hold investing.

- Tax-efficient investing strategies for buy-and-hold portfolios: Strategies like tax-loss harvesting can help minimize your tax liability.

- The importance of consulting a financial advisor for tax planning: A financial advisor can help you develop a tax-efficient investment strategy tailored to your specific circumstances.

Conclusion

Buy-and-hold investing, while offering significant long-term potential, presents significant emotional challenges. Navigating market downturns requires discipline, a well-diversified portfolio, and a long-term perspective. Understanding the tax implications and utilizing strategies like dollar-cost averaging can further enhance your success. Remember, while the ride can be gut-wrenching, the potential rewards of buy-and-hold investing are substantial. Start planning your long-term investment strategy with a buy-and-hold approach today, and consult with a financial advisor to create a personalized plan that suits your risk tolerance and financial goals. Learn more about the benefits of buy and hold strategies and how to mitigate risks associated with long-term investing.

Featured Posts

-

Investing In Amundi Msci World Ex Us Ucits Etf Acc A Nav Guide

May 25, 2025

Investing In Amundi Msci World Ex Us Ucits Etf Acc A Nav Guide

May 25, 2025 -

Luxury And Controversy Examining Presidential Seals High End Watches And Exclusive Events

May 25, 2025

Luxury And Controversy Examining Presidential Seals High End Watches And Exclusive Events

May 25, 2025 -

Marks And Spencer Suffers 300 Million Loss Due To Cyberattack

May 25, 2025

Marks And Spencer Suffers 300 Million Loss Due To Cyberattack

May 25, 2025 -

The Thames Water Case Executive Bonuses And Corporate Responsibility

May 25, 2025

The Thames Water Case Executive Bonuses And Corporate Responsibility

May 25, 2025 -

Iga Swiatek Triumphs In Madrid Keys Defeated In Straight Sets

May 25, 2025

Iga Swiatek Triumphs In Madrid Keys Defeated In Straight Sets

May 25, 2025