Climate-Related Financial Risks And Your Home Purchase

Table of Contents

Assessing Property Vulnerability to Climate Change

Climate change significantly impacts property values and insurance costs. Before purchasing a home, it's crucial to assess its vulnerability to various climate-related events.

Flood Risk and Insurance

The frequency and severity of flood events are increasing globally, driving up flood insurance costs and impacting property values. Understanding your flood risk is paramount.

- High-risk flood zones: Many areas are designated as high-risk flood zones by the Federal Emergency Management Agency (FEMA) or equivalent agencies in other countries. These areas experience a higher probability of flooding. Check flood maps before purchasing property in any area.

- Factors influencing flood risk: Proximity to water bodies (rivers, oceans, lakes), elevation, and soil type are crucial factors determining flood risk. Properties in low-lying areas or with poor drainage are more vulnerable.

- Increasing cost of flood insurance premiums: The cost of flood insurance in high-risk areas is significantly increasing, making it a substantial ongoing expense for homeowners. You may even find it difficult to secure flood insurance in certain areas.

Wildfire Risk and Property Protection

Wildfires pose a devastating threat to homes and communities, causing widespread property damage and significant financial losses.

- Factors influencing wildfire risk: Proximity to wildlands, vegetation density, and building materials are critical factors influencing wildfire risk. Homes surrounded by dry brush or built with flammable materials are at higher risk.

- Wildfire mitigation strategies: Implementing wildfire mitigation strategies such as creating defensible space around your property (clearing brush, using fire-resistant landscaping), and using fire-resistant building materials, can significantly reduce your risk.

- Increasing cost of wildfire insurance: The cost of wildfire insurance premiums is rising dramatically in high-risk areas, reflecting the increased likelihood of claims and the severity of wildfire damage.

Extreme Heat and Energy Costs

Rising global temperatures lead to more frequent and intense heatwaves, impacting energy consumption and home maintenance.

- Rising energy bills: Extreme heat necessitates increased air conditioning use, leading to substantially higher energy bills. This adds a considerable ongoing cost to homeownership.

- Potential damage from extreme heat: Extreme heat can damage roofing materials, HVAC systems, and other home components, resulting in costly repairs.

- Importance of energy-efficient homes: Investing in energy-efficient homes with proper insulation, energy-efficient windows, and updated HVAC systems can mitigate these risks and reduce your energy consumption and expenses.

Financial Implications of Climate-Related Risks

Climate-related risks have significant financial consequences for homeowners. Understanding these implications is vital when making a home purchase.

Impact on Property Values

Climate-related risks can significantly impact property values.

- Decreased desirability of high-risk properties: Properties located in high-risk areas for floods, wildfires, or extreme heat may become less desirable, impacting their resale value.

- Potential for devaluation due to damage: Damage from climate-related events can lead to significant devaluation, even if the property is repaired.

- Importance of long-term property value considerations: Considering the long-term impact of climate change on property values is essential for making sound real estate investments.

Increased Insurance Premiums

Home insurance premiums are increasing in climate-vulnerable areas, reflecting the growing risk.

- Factors influencing insurance premiums: Risk assessment, claims history, and location all impact insurance premiums. Properties in high-risk areas will face significantly higher premiums.

- Difficulty obtaining insurance: Securing insurance coverage in high-risk areas can be challenging, with some insurers refusing to offer policies altogether.

- Potential for unaffordable insurance costs: The cost of home insurance can become unaffordable in climate-vulnerable areas, adding a major financial burden to homeowners.

Potential for Financial Loss

Climate-related events can result in significant financial losses.

- Repair costs: Repairing damage from floods, wildfires, or extreme heat can be extremely costly.

- Replacement costs: In severe cases, properties may need complete replacement, leading to catastrophic financial losses.

- Importance of adequate insurance coverage: Having adequate insurance coverage is crucial to mitigate financial losses from climate-related events. However, even with insurance, deductibles and potential coverage gaps can still lead to substantial out-of-pocket costs.

Mitigating Climate-Related Financial Risks

Proactive measures can significantly reduce your exposure to climate-related financial risks.

Due Diligence During the Home-Buying Process

Thorough research is crucial before purchasing a home.

- Checking flood maps: Review flood maps to assess the flood risk of potential properties.

- Wildfire risk assessments: Obtain wildfire risk assessments to understand the potential for wildfire damage.

- Local climate change vulnerability information: Research local climate change vulnerability information to assess the overall risk profile of the area.

Investing in Climate-Resilient Features

Investing in climate-resilient features can enhance your home's protection.

- Upgrading insulation: Improved insulation reduces energy consumption and lowers your reliance on air conditioning.

- Installing solar panels: Solar panels reduce reliance on the electricity grid and can lower energy bills.

- Improving drainage: Proper drainage systems can mitigate flood risks.

- Using fire-resistant materials: Employing fire-resistant materials during construction or renovations can help protect your home from wildfire damage.

Securing Adequate Insurance Coverage

Comprehensive insurance coverage is essential to protect yourself from financial losses.

- Reviewing policy limits and coverage: Carefully review your policy limits and coverage to ensure they are adequate for the potential risks.

- Exploring supplemental insurance options: Consider supplemental flood and wildfire insurance policies to address specific risks.

- Working with an insurance professional: Consulting with an insurance professional can help you secure appropriate and sufficient coverage.

Conclusion: Making Informed Decisions About Climate-Related Financial Risks in Your Home Purchase

Climate change presents significant financial risks to homebuyers. By understanding these risks – including flood risk, wildfire risk, and the impact of extreme heat – and taking proactive steps to mitigate them, you can protect your investment and ensure long-term financial security. Conduct thorough due diligence, invest in climate-resilient features, and secure adequate insurance coverage. Making informed decisions about climate-related financial risks is crucial for responsible and successful home buying. Seek professional advice from real estate agents, insurance brokers, and other relevant experts to reduce climate risk and protect your investment in a climate-resilient home. Remember, informed home buying means reducing your climate risk and protecting your financial future.

Featured Posts

-

Economic Zone Development Receives 545 Million Boost From Maybank

May 21, 2025

Economic Zone Development Receives 545 Million Boost From Maybank

May 21, 2025 -

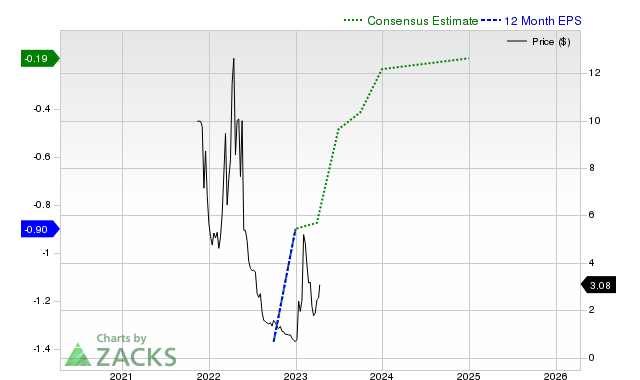

Analyzing Big Bear Ai Stock Is It Worth The Investment

May 21, 2025

Analyzing Big Bear Ai Stock Is It Worth The Investment

May 21, 2025 -

Los 5 Mejores Podcasts De Misterio Suspenso Y Terror Una Seleccion Esencial

May 21, 2025

Los 5 Mejores Podcasts De Misterio Suspenso Y Terror Una Seleccion Esencial

May 21, 2025 -

Big Bear Ai Holdings Bbai Stock Plunge In 2025 Reasons And Analysis

May 21, 2025

Big Bear Ai Holdings Bbai Stock Plunge In 2025 Reasons And Analysis

May 21, 2025 -

10 Minute Unpiloted Lufthansa Flight Investigation Reveals Co Pilot Medical Emergency

May 21, 2025

10 Minute Unpiloted Lufthansa Flight Investigation Reveals Co Pilot Medical Emergency

May 21, 2025