DAX Stable Despite Recent Record Run: Frankfurt Stock Market Update

Table of Contents

Factors Contributing to DAX Stability

Several key factors contribute to the DAX's resilience despite its recent impressive performance. Understanding these elements is crucial for investors seeking to navigate the Frankfurt Stock Exchange.

Strong Corporate Earnings

Robust financial results from leading DAX companies have significantly bolstered investor confidence.

- SAP: Reported strong revenue growth driven by increased demand for its cloud-based software solutions.

- Siemens: Showed significant improvement in profit margins due to operational efficiencies and strategic acquisitions.

- BMW: Experienced a surge in sales, particularly in the electric vehicle segment, boosting overall profitability.

These positive performance indicators reflect a healthy German economy and a strong competitive positioning for these industry giants. The reasons behind these strong earnings are multifaceted, including increased consumer spending, successful product launches, and effective cost management strategies.

Geopolitical Stability (Relative)

Despite global uncertainties, the geopolitical landscape has, relatively speaking, been less volatile than anticipated, positively influencing the DAX.

- Easing of Energy Crisis Concerns: While energy prices remain high, efforts to diversify energy sources and increased gas storage have somewhat eased immediate concerns.

- Stable Eurozone Economy: The Eurozone has shown greater resilience than initially predicted, helping to support German export-oriented businesses.

- Ukraine Conflict Impact Mitigation: While the war in Ukraine continues to present challenges, its direct impact on the German economy has been somewhat mitigated through government support and diversification strategies.

These factors, while not eliminating all geopolitical risks, have contributed to a more stable market environment compared to initial predictions. The market has shown a capacity to absorb the shocks of these events, allowing for a degree of calm to prevail.

Investor Sentiment and Confidence

Positive investor sentiment plays a significant role in the DAX's stability.

- Trading Volume: Moderate trading volume suggests a balanced approach, indicating neither panic selling nor excessive speculation.

- Volatility Index (VDAX): The VDAX, a measure of market volatility, remains relatively low, indicating confidence and stability in the market.

- Foreign Investment: Continued foreign investment in German companies demonstrates ongoing trust in the long-term prospects of the German economy and the DAX.

Current market sentiment reflects a cautiously optimistic outlook, largely shaped by the positive corporate earnings and relative geopolitical calm, leading to the sustained stability of the DAX.

Potential Risks and Challenges Facing the DAX

While the current situation appears stable, several potential risks and challenges could impact the DAX's future performance.

Inflationary Pressures

Persistently high inflation poses a significant threat to consumer spending and corporate profitability.

- Reduced Consumer Spending: Rising prices erode purchasing power, potentially impacting demand for goods and services.

- Increased Input Costs: Inflationary pressures drive up input costs for businesses, squeezing profit margins.

DAX companies are actively seeking mitigation strategies, including streamlining operations, raising prices, and investing in automation to offset these challenges.

Global Economic Slowdown

A global economic slowdown, potentially triggered by factors such as high interest rates and geopolitical tensions, could significantly impact the DAX.

- Reduced Global Demand: A global slowdown would reduce demand for German exports, negatively affecting DAX companies with significant international operations.

- Supply Chain Disruptions: Continued global uncertainty could exacerbate existing supply chain disruptions, impacting production and profitability.

The interconnected nature of the global economy makes the German economy susceptible to these external shocks.

Interest Rate Hikes

Central bank interest rate hikes aim to curb inflation but can also negatively impact stock markets.

- Increased Borrowing Costs: Higher interest rates increase borrowing costs for businesses, impacting investment and expansion plans.

- Reduced Investment: Higher rates can also make equity investments less attractive compared to fixed-income securities, potentially impacting the DAX.

The current interest rate environment and the potential for further hikes are key factors to consider for the future performance of the DAX.

DAX Outlook and Future Predictions

Predicting the future of the DAX is inherently complex, but examining analyst opinions and key indicators provides valuable insight.

Analyst Opinions and Forecasts

Several financial analysts forecast continued, albeit moderate, growth for the DAX in the short-to-medium term.

- Positive Outlook: Many analysts point to the strong corporate earnings and relative geopolitical stability as supportive factors.

- Cautious Optimism: However, concerns regarding inflation, global economic slowdown, and interest rate hikes temper this optimism.

The consensus view suggests a cautiously optimistic outlook, with potential for moderate growth, contingent on the evolution of macroeconomic factors.

Key Indicators to Watch

Monitoring certain economic indicators is crucial for assessing the future performance of the DAX.

- GDP Growth: German GDP growth will be a key indicator of the overall economic health.

- Consumer Confidence: High consumer confidence suggests sustained consumer spending, while low confidence could indicate a potential downturn.

- Inflation Rate: A continued decline in the inflation rate would be a significant positive for the DAX.

Careful monitoring of these indicators will provide valuable clues to the direction of the DAX in the coming months.

Conclusion: DAX Stable Despite Recent Record Run: A Summary and Call to Action

The DAX has demonstrated surprising stability despite its recent record run. Strong corporate earnings, relative geopolitical stability, and positive investor sentiment have all contributed to this resilience. However, potential risks remain, including inflationary pressures, the threat of a global economic slowdown, and the impact of interest rate hikes. To stay abreast of these developments and understand the future trajectory of the DAX, actively follow DAX market updates, perform your own DAX stability analysis, and consider consulting a financial advisor for personalized investment strategies related to the DAX and German stocks. Staying informed about Frankfurt Stock Exchange developments is key to making sound investment decisions.

Featured Posts

-

How To Interpret The Net Asset Value Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

How To Interpret The Net Asset Value Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

The Importance Of Net Asset Value Nav For Amundi Dow Jones Industrial Average Ucits Etf Investors

May 24, 2025

The Importance Of Net Asset Value Nav For Amundi Dow Jones Industrial Average Ucits Etf Investors

May 24, 2025 -

Nemecka Ekonomika V Krize H Nonline Sk O Prepustani A Jeho Dosledkoch

May 24, 2025

Nemecka Ekonomika V Krize H Nonline Sk O Prepustani A Jeho Dosledkoch

May 24, 2025 -

The Kyle Walker Annie Kilner Dispute Poisoning Accusations Investigated

May 24, 2025

The Kyle Walker Annie Kilner Dispute Poisoning Accusations Investigated

May 24, 2025 -

Nicki Chapmans 700 000 Country Home Investment Escape To The Country Success

May 24, 2025

Nicki Chapmans 700 000 Country Home Investment Escape To The Country Success

May 24, 2025

Latest Posts

-

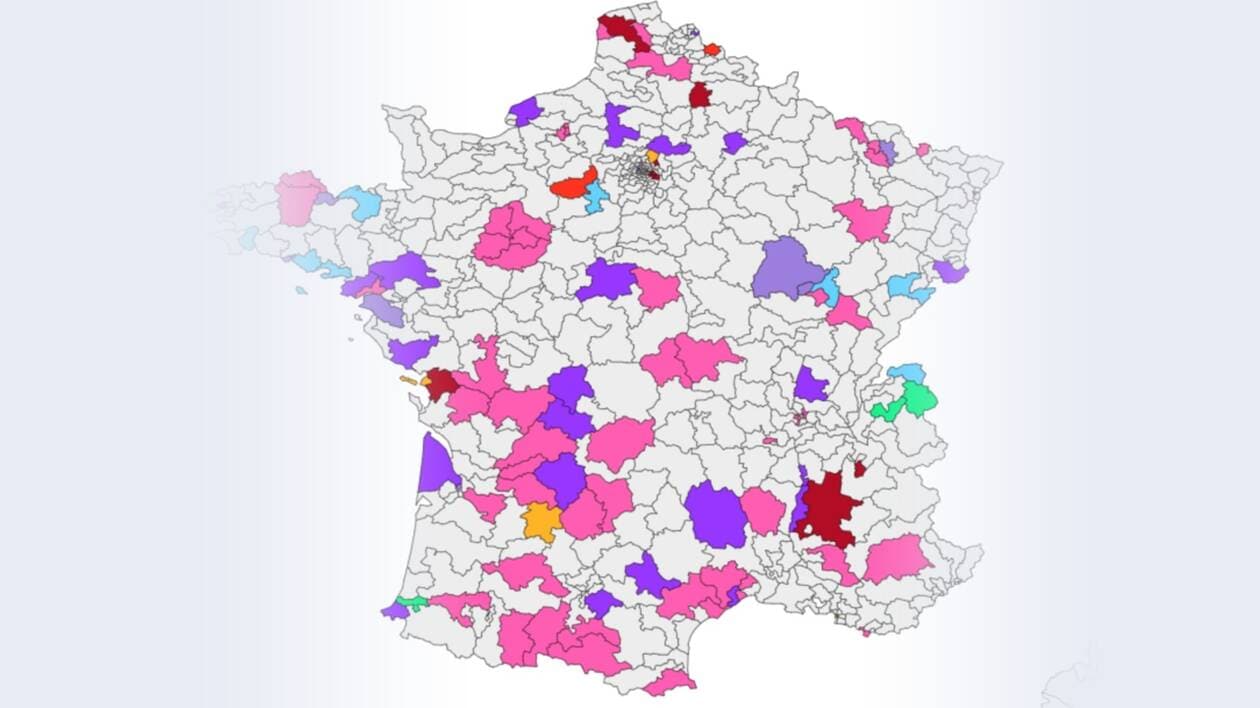

La Repression Chinoise Des Dissidents En France Une Analyse

May 24, 2025

La Repression Chinoise Des Dissidents En France Une Analyse

May 24, 2025 -

Jordan Bardella Leading The French Election Opposition

May 24, 2025

Jordan Bardella Leading The French Election Opposition

May 24, 2025 -

6 Kering Share Slump After Weak First Quarter Performance

May 24, 2025

6 Kering Share Slump After Weak First Quarter Performance

May 24, 2025 -

Lvmh Stock Takes A Hit 8 2 Decline After Q1 Sales Report

May 24, 2025

Lvmh Stock Takes A Hit 8 2 Decline After Q1 Sales Report

May 24, 2025 -

En France La Chine Ne Recule Devant Rien Pour Reduire Au Silence Les Dissidents

May 24, 2025

En France La Chine Ne Recule Devant Rien Pour Reduire Au Silence Les Dissidents

May 24, 2025