Donald Trump's Billionaire Friends: Post-Tariff Losses

Table of Contents

The Impact of Tariffs on Specific Industries

Trump's tariffs, while aiming to protect American industries, triggered unforeseen consequences. The ripple effects extended far beyond initial targets, impacting businesses owned or invested in by his billionaire friends.

Manufacturing and the Steel Industry

The steel industry, a sector Trump sought to safeguard, felt the sting of unintended consequences. Tariffs on imported steel, while initially intended to protect domestic producers, led to higher prices for steel products, reducing the competitiveness of American manufacturers both domestically and internationally. This negatively impacted companies with ties to Trump's billionaire network.

- Example 1: [Insert Example of a steel company and billionaire investor experiencing losses. Include quantifiable data if available, e.g., "XYZ Steel, partly owned by billionaire investor John Smith, reported a 15% drop in profits following the tariff increase." ]

- Example 2: [Insert another example, detailing the losses faced by another steel company and billionaire connection].

The increased cost of steel also rippled through related industries. Automotive manufacturers, for example, faced higher production costs, impacting their profitability and potentially affecting the investments of billionaire shareholders in these companies.

Retail and Consumer Goods

Tariffs on imported goods significantly impacted the retail sector. Increased costs for imported products led to higher prices for consumers, squeezing profit margins for retailers and affecting the bottom line for billionaire investors in these businesses.

- Example 1: [Insert Example of a major retail chain and billionaire investor connected to Trump, illustrating a decline in profits potentially linked to tariffs].

- Example 2: [Insert another example detailing how increased prices due to tariffs reduced consumer spending, impacting the revenue of a retail company with billionaire investors connected to Trump].

The consumer impact was significant. Reduced purchasing power due to increased prices meant lower sales volumes, which directly affected the profitability of businesses owned or invested in by Trump's billionaire friends. This created a complex economic equation where the intended protectionism ultimately hurt certain segments of the economy.

Unintended Consequences and Economic Backlash

Trump's tariffs ignited a trade war, generating unforeseen consequences that severely impacted some of his billionaire friends.

Retaliatory Tariffs

Other countries retaliated against Trump’s tariffs by imposing their own tariffs on American goods. This retaliatory action significantly harmed American businesses with investments in those foreign markets, directly affecting the financial interests of some of Trump's wealthy associates.

- Example 1: [Mention specific retaliatory tariffs imposed by a country, and how it affected a specific American company with connections to Trump's billionaire circle].

- Example 2: [Provide another example of retaliatory tariffs and their impact on an American company and its billionaire investors].

The overall economic impact of this trade war was substantial, causing significant losses for numerous American businesses and, consequentially, some of Trump's billionaire friends.

Investment Shifts and Capital Flight

The unpredictable nature of Trump's tariff policies likely led some of his billionaire friends to reconsider their investment strategies. This uncertainty may have resulted in capital flight – investments being moved out of the US or into sectors less vulnerable to tariff fluctuations.

- Example 1: [Cite an example of a billionaire shifting investments away from the US or a specific industry due to tariff uncertainty].

- Example 2: [Give another example of investment shifts or capital flight, highlighting the impact on the American economy and the relationship between the billionaire and Trump].

These actions have long-term implications for the US economy and could potentially strain relationships between Trump and some of his previously close associates.

Analyzing the Complex Relationship Between Trump and his Billionaire Network

The impact of tariffs on Trump's billionaire friends reveals a complex dynamic between personal loyalty and financial self-interest.

Loyalty vs. Financial Interests

Despite experiencing economic losses, some billionaires publicly supported Trump, highlighting the complexities of their relationships. This raises questions about the balance between personal loyalty and the stark realities of financial impacts.

- Example 1: [Name a billionaire who publicly supported Trump despite facing financial losses from tariffs].

- Example 2: [Mention another example of a billionaire navigating the conflict between loyalty and financial repercussions].

The extent to which these losses strained relationships remains a topic of ongoing speculation and analysis.

The Public Perception of the Relationship

The financial fallout from Trump's tariffs on his billionaire friends has inevitably affected public perception of their relationships and the influence of money in politics.

- Example 1: [Mention news coverage or public statements related to the financial impact of tariffs on Trump's billionaire friends].

- Example 2: [Reference an analysis or opinion piece discussing the alteration of public opinion regarding Trump’s policies and their impact on economic sectors].

This situation has fueled discussions about transparency, accountability, and the intertwined nature of politics and big business.

Conclusion: Understanding the Fallout for Donald Trump's Billionaire Friends

Trump's tariff policies, while intended to benefit American businesses, inadvertently caused significant post-tariff losses for some of his billionaire friends. This highlights the complex interplay between personal loyalty and financial realities within his network. The unforeseen consequences, including retaliatory tariffs and investment shifts, underscore the intricate and often unpredictable nature of economic policy.

Continue learning about the impact of Donald Trump's policies on his billionaire friends and the post-tariff losses experienced by some of them. Investigate the financial records of specific companies and individuals affected to gain a deeper understanding of this complex economic and political situation. The fallout from these policies serves as a potent reminder of the potentially far-reaching and unforeseen consequences of protectionist trade measures.

Featured Posts

-

Secure Your Future Identifying The Real Safe Bet In Various Asset Classes

May 09, 2025

Secure Your Future Identifying The Real Safe Bet In Various Asset Classes

May 09, 2025 -

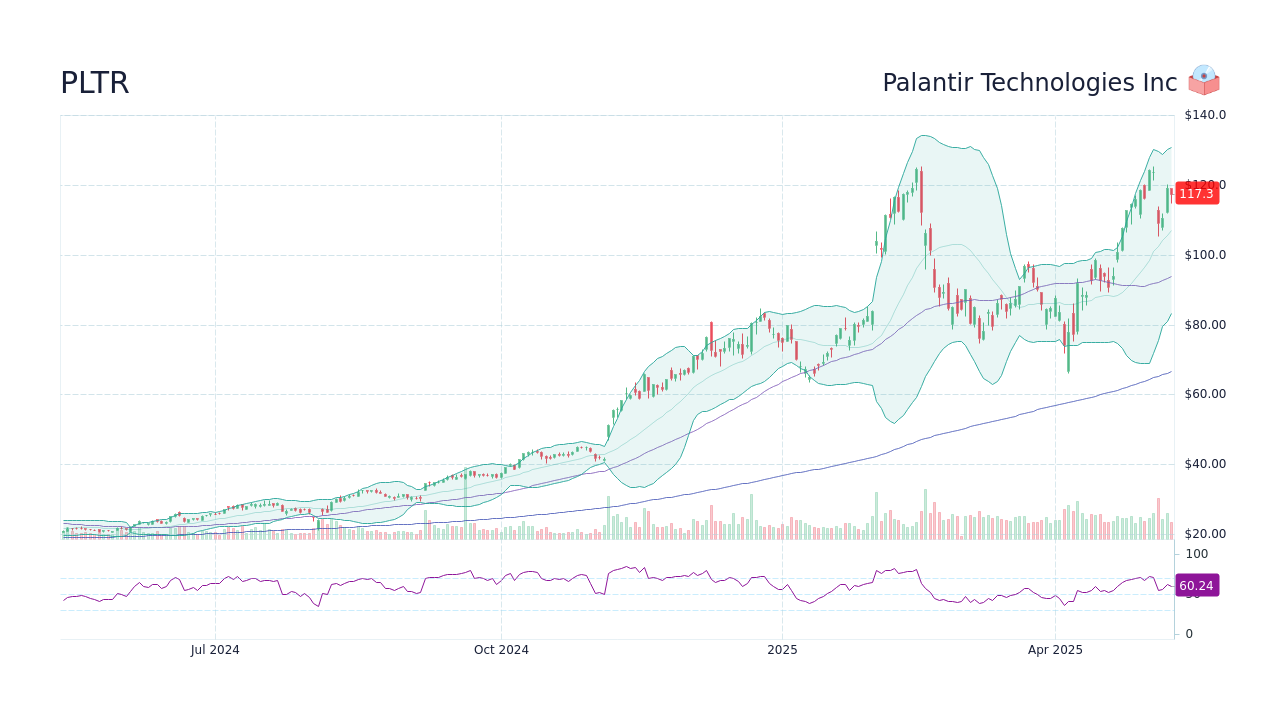

Palantir Stock Investment Weighing The Options Before May 5th

May 09, 2025

Palantir Stock Investment Weighing The Options Before May 5th

May 09, 2025 -

Palantirs Path To A Trillion Dollar Market Cap A 2030 Projection

May 09, 2025

Palantirs Path To A Trillion Dollar Market Cap A 2030 Projection

May 09, 2025 -

Bekam Nepobiten Na Dobar Na Site Vreminja

May 09, 2025

Bekam Nepobiten Na Dobar Na Site Vreminja

May 09, 2025 -

Apple And Artificial Intelligence A Competitive Assessment

May 09, 2025

Apple And Artificial Intelligence A Competitive Assessment

May 09, 2025