Financial Fallout: Understanding The Changes At X Post-Debt Sale

Table of Contents

The Restructuring Process and its Implications

The debt sale initiated a significant restructuring process at X, aimed at reducing its substantial debt burden and improving its financial health. Understanding this process is key to assessing the long-term consequences of the financial fallout.

Debt Reduction Strategies

X employed several strategies to reduce its debt, including:

- Debt-for-equity swaps: X exchanged a portion of its debt for equity, reducing its debt obligations while increasing the number of outstanding shares. This diluted existing shareholders' ownership but reduced the immediate pressure of debt repayments.

- Asset sales: The company divested itself of non-core assets, generating cash to pay down debt. This involved a strategic assessment of its portfolio to identify assets that were not contributing significantly to its core business operations. The proceeds from these sales directly contributed to debt reduction.

- Refinancing: X renegotiated existing debt agreements with creditors, securing new loans with more favorable terms, including lower interest rates and extended repayment schedules. This reduced immediate financial pressure and improved cash flow management.

The success of these strategies in reducing X's financial risk is still being evaluated. While debt levels have decreased, the impact on long-term profitability remains to be seen. A potential drawback of these strategies, particularly the debt-for-equity swap, is the dilution of existing shareholders' equity.

Operational Changes Post-Restructuring

The restructuring at X has also led to several operational changes, impacting various aspects of the business:

- Cost-cutting measures: X has implemented significant cost-cutting measures, including streamlining operations, reducing administrative expenses, and negotiating better deals with suppliers. These changes aim to improve efficiency and profitability.

- Layoffs: Unfortunately, the restructuring also involved layoffs affecting several departments. This was a difficult but necessary step to reduce the company's overall expenses and improve its financial stability.

- Changes in strategic direction: X is reevaluating its strategic direction, focusing on its core competencies and potentially exiting less profitable segments of the market. This strategic shift aims to optimize resource allocation and enhance profitability.

These operational changes have impacted employee morale and customer satisfaction, requiring careful management to mitigate negative effects. The long-term impact on X's profitability and sustainability depends on the success of these restructuring efforts and adaptation to market dynamics.

Impact on Credit Rating and Investor Sentiment

The debt sale and subsequent restructuring have significantly impacted X's credit rating and investor sentiment.

Credit Rating Agencies' Response

Credit rating agencies have responded to the events at X:

- Moody's: Moody's downgraded X's credit rating from [Previous Rating] to [Current Rating], citing concerns about the company's increased financial leverage and potential operational challenges.

- S&P: Similar to Moody's, S&P also lowered X's credit rating, reflecting the increased financial risk associated with the debt restructuring.

- Fitch: Fitch issued a [Rating Action] following the debt sale, citing [Reasons for the Action].

These rating downgrades have increased X's borrowing costs and negatively impacted investor confidence, making it more expensive for the company to raise capital in the future.

Stock Market Performance Post-Debt Sale

X's stock price experienced significant volatility following the debt sale.

- Pre-Sale: The stock traded at [Price] on [Date].

- Post-Sale: The stock initially fell to [Price] on [Date], reflecting investor concerns about the debt restructuring. It has since [Increased/Decreased] to [Current Price] on [Date].

The fluctuations in X's stock price reflect the complex interplay of investor sentiment, market conditions, and the evolving situation at the company. Investor confidence remains fragile, and further developments will likely influence the stock's performance.

Long-Term Outlook and Future Projections

The long-term outlook for X is uncertain but depends heavily on the successful implementation of its restructuring plan.

Financial Stability and Growth Potential

Several factors will determine X's financial stability and growth potential:

- Market competition: X faces intense competition in its industry, requiring effective strategies to maintain market share and profitability.

- Industry trends: Adapting to evolving industry trends and technological advancements will be critical for X's long-term success.

- Management expertise: The effectiveness of X's management team in navigating the challenges of restructuring and adapting to market dynamics will be crucial.

Analyst forecasts vary, with some projecting a slow but steady recovery for X, while others remain cautious about the company's long-term prospects.

Implications for Stakeholders

The debt sale has had significant implications for various stakeholders:

- Employees: Layoffs and potential further restructuring have affected employee job security and morale.

- Creditors: Creditors have experienced changes in their debt obligations, depending on the terms of the restructuring agreements.

- Shareholders: Shareholders have seen fluctuations in their equity value due to the debt sale and subsequent stock market performance.

The fairness and equity of the restructuring process for all involved parties are subjects of ongoing debate and scrutiny.

Conclusion

The debt sale of X has undeniably caused a significant financial fallout, leading to operational changes, credit rating adjustments, and market volatility. While the restructuring aims to improve the company's long-term financial health, the full impact will unfold over time. Understanding the complexities of this situation is crucial for investors, stakeholders, and anyone interested in the future of X. Staying informed about the company’s progress post-debt sale is vital. Continue monitoring the financial performance of X and the wider implications of this restructuring for informed decision-making. Stay updated on the continuing financial fallout at X and its impact on the broader market.

Featured Posts

-

The Espn Crews Moving Goodbye To Cassidy Hubbarth

Apr 28, 2025

The Espn Crews Moving Goodbye To Cassidy Hubbarth

Apr 28, 2025 -

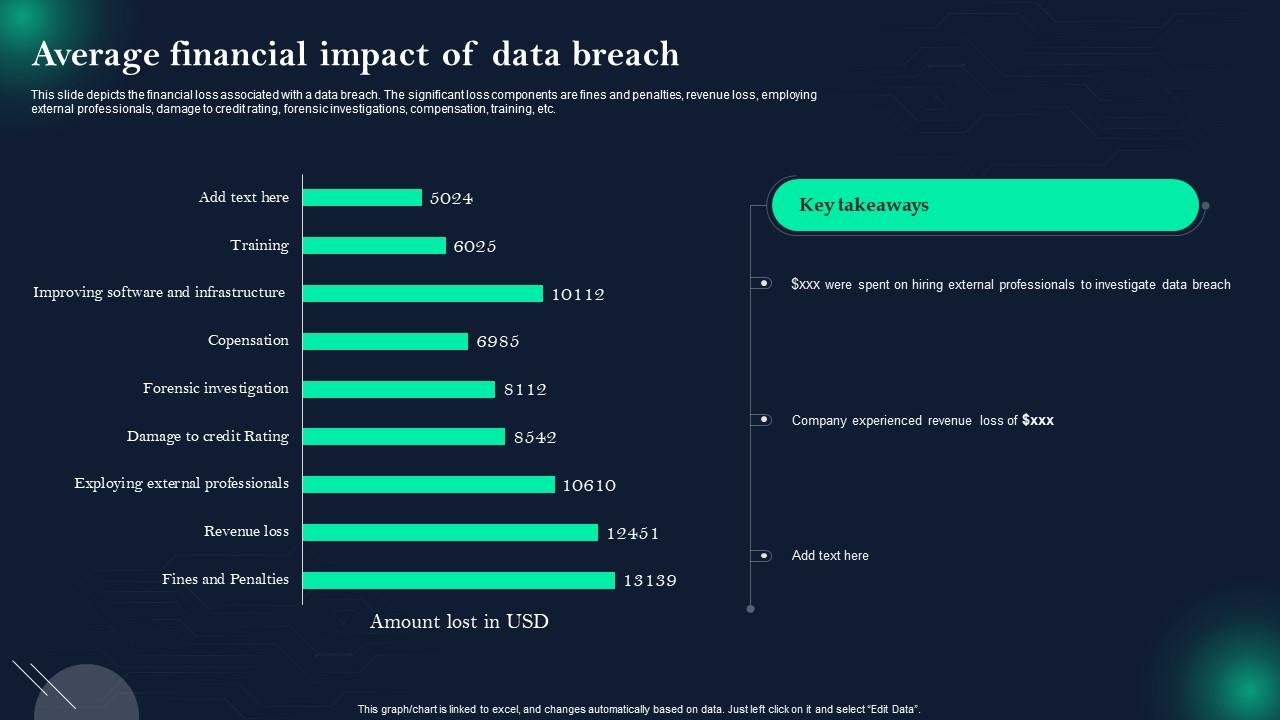

Significant Office365 Data Breach Results In Millions Of Dollars In Losses

Apr 28, 2025

Significant Office365 Data Breach Results In Millions Of Dollars In Losses

Apr 28, 2025 -

Babe Ruths Yankees Record Tied By Aaron Judge

Apr 28, 2025

Babe Ruths Yankees Record Tied By Aaron Judge

Apr 28, 2025 -

Virginia Giuffres Death A Look Back At Her Accusations Against Prince Andrew

Apr 28, 2025

Virginia Giuffres Death A Look Back At Her Accusations Against Prince Andrew

Apr 28, 2025 -

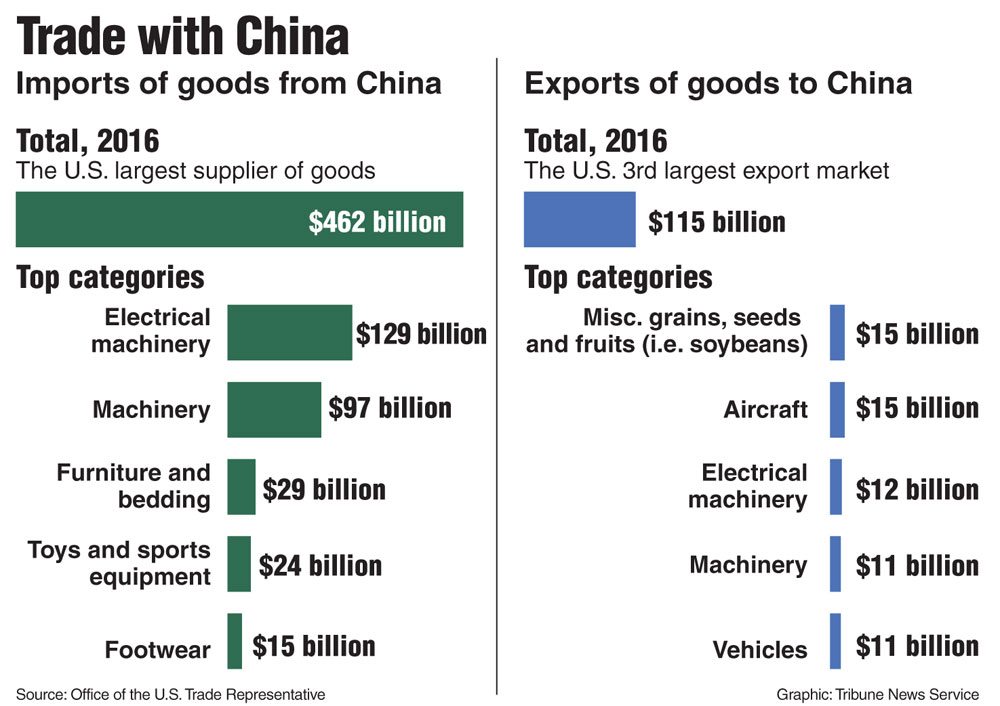

Impact Of Chinas Selective Tariff Exemptions On Us Businesses

Apr 28, 2025

Impact Of Chinas Selective Tariff Exemptions On Us Businesses

Apr 28, 2025

Latest Posts

-

From Randy Dogs To Ostrich Bites Uncovering Boris Johnsons Animal Blunders

May 12, 2025

From Randy Dogs To Ostrich Bites Uncovering Boris Johnsons Animal Blunders

May 12, 2025 -

Voyna I Mir Dzhonson I Tramp Raskhodyatsya Vo Vzglyadakh Na Uregulirovanie Konflikta

May 12, 2025

Voyna I Mir Dzhonson I Tramp Raskhodyatsya Vo Vzglyadakh Na Uregulirovanie Konflikta

May 12, 2025 -

Visita Familiar En Texas Boris Johnson Sufre Ataque De Avestruz

May 12, 2025

Visita Familiar En Texas Boris Johnson Sufre Ataque De Avestruz

May 12, 2025 -

The Carrie Snub And Beyond A Look At Boris Johnsons Animal Encounters

May 12, 2025

The Carrie Snub And Beyond A Look At Boris Johnsons Animal Encounters

May 12, 2025 -

Reaccion De Boris Johnson Ante Ataque De Avestruz En Texas Un Momento Familiar Inesperado

May 12, 2025

Reaccion De Boris Johnson Ante Ataque De Avestruz En Texas Un Momento Familiar Inesperado

May 12, 2025