Fiscal Responsibility: A Necessary Component Of Canada's Future Vision

Table of Contents

The Current State of Canadian Finances

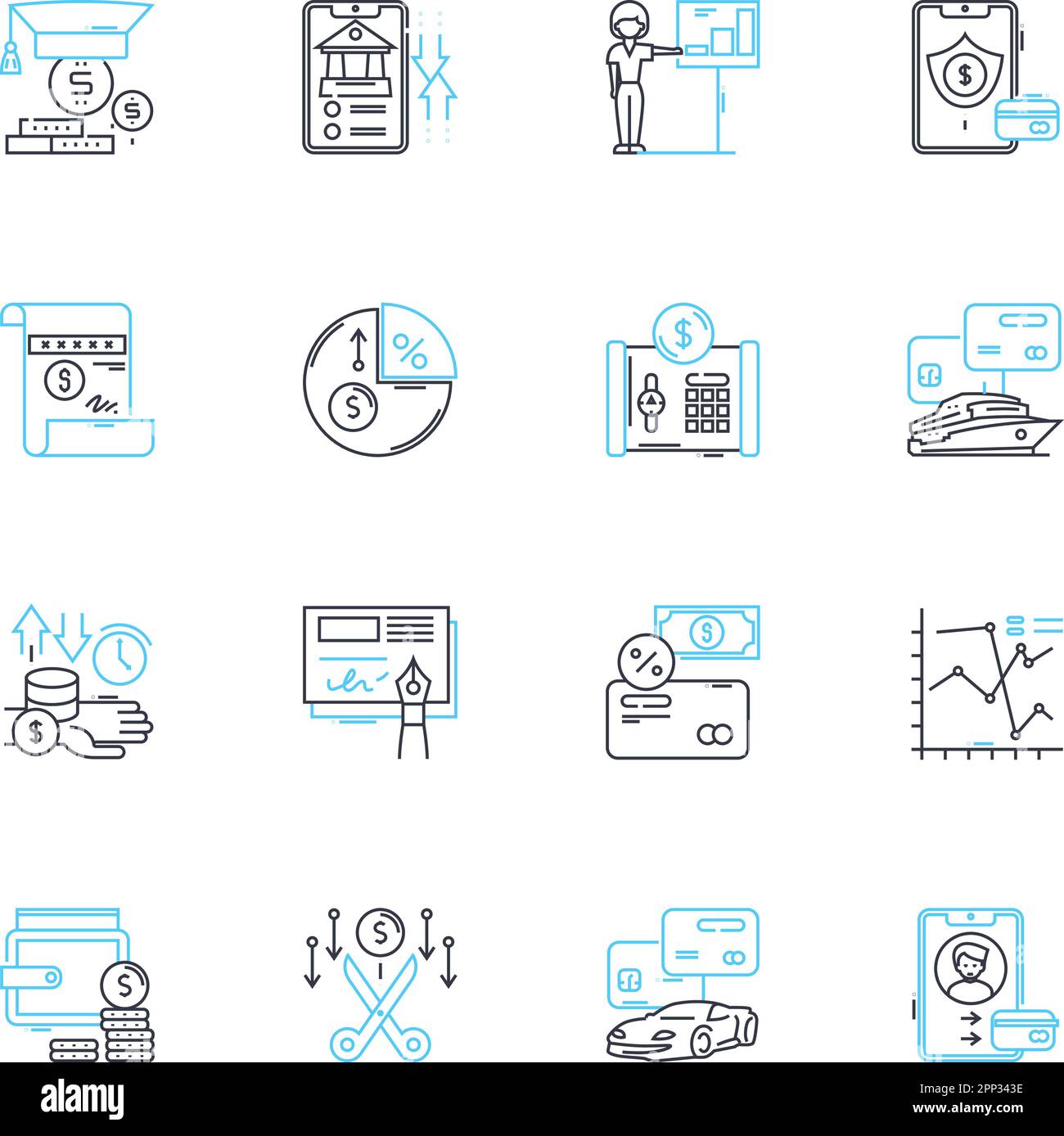

Government Debt and Deficit

Canada's government debt continues to rise, placing a strain on future budgets and limiting the government's ability to invest in essential services. The current debt-to-GDP ratio, while manageable compared to some other nations, necessitates careful management and a commitment to responsible budgeting. This situation demands a long-term strategic approach to government spending.

- Examples of current spending priorities: Healthcare, social security, and infrastructure projects represent significant portions of the budget.

- Potential risks associated with high debt levels: Increased interest payments, reduced government flexibility to respond to economic downturns, and potential credit rating downgrades.

- Comparisons with other developed nations: Benchmarking Canada's fiscal performance against other G7 countries can provide valuable insights into effective strategies for managing debt and deficits.

Impact on Social Programs

The escalating debt burden directly impacts the availability and quality of essential social programs. While these programs are vital for supporting vulnerable populations and ensuring a strong social safety net, continued unsustainable spending levels threaten their long-term viability. Careful long-term planning is essential to ensure the sustainability of these crucial initiatives.

- Specific examples of program cuts or funding limitations: Potential reductions in healthcare funding, education budgets, and social welfare benefits.

- Potential long-term consequences of underfunding: Increased health disparities, reduced educational attainment, and a widening gap between rich and poor.

- Potential solutions involving fiscal responsibility: Prioritizing high-impact programs, streamlining administrative processes, and exploring innovative funding models.

Strategies for Achieving Fiscal Responsibility in Canada

Prioritizing Spending

Effective government spending requires a strategic approach to resource allocation. This involves identifying areas where spending can be optimized or reduced without compromising essential services. Evidence-based decision-making is crucial in this process.

- Examples of areas where spending could be optimized or reduced: Identifying inefficiencies within existing programs, streamlining bureaucratic processes, and prioritizing high-impact initiatives.

- Exploring alternative funding mechanisms: Public-private partnerships, user fees, and innovative financing models can help alleviate the burden on taxpayers.

- Emphasizing evidence-based decision-making: Utilizing data and analytics to inform resource allocation decisions and ensure maximum impact.

Revenue Generation

Increasing government revenue is also crucial for achieving fiscal stability. This can be achieved through responsible tax reforms that broaden the tax base without stifling economic growth.

- Potential tax reforms: Revising tax brackets, addressing tax loopholes, and considering environmental levies.

- Exploring options for broadening the tax base: Evaluating the potential for taxing digital services, carbon emissions, or luxury goods.

- Investing in economic sectors that generate higher tax revenues: Focusing on sectors with high growth potential, such as technology, clean energy, and advanced manufacturing.

Long-Term Economic Planning

Developing a comprehensive long-term economic plan is essential for fostering sustainable growth and fiscal stability. This involves strategic investments in infrastructure, innovation, and education.

- Importance of infrastructure investments: Investing in roads, bridges, public transit, and broadband infrastructure stimulates economic activity and improves productivity.

- Promoting innovation and technological advancements: Supporting research and development, fostering entrepreneurship, and attracting foreign investment in innovative industries.

- Fostering economic diversification: Reducing reliance on specific sectors and creating a resilient economy capable of weathering economic shocks.

The Benefits of Fiscal Responsibility for Canadians

Improved Credit Rating

A strong credit rating is essential for attracting foreign investment and borrowing at lower interest rates. Sound fiscal management directly contributes to a stronger credit rating.

- Positive economic impacts of a strong credit rating: Lower borrowing costs for both the government and private sector, increased investor confidence, and greater economic stability.

- Improved investor confidence: A strong credit rating signals to investors that Canada is a stable and reliable investment destination.

Enhanced Social Well-being

Responsible fiscal policies directly improve the lives of Canadians by ensuring the long-term viability of social programs. This leads to better access to healthcare, education, and other essential services, creating a more equitable and prosperous society.

- Improved access to healthcare, education, and other essential services: Stronger social safety nets and enhanced social mobility.

- Increased social security and economic stability for citizens: Greater confidence in the future, reduces stress and enhances overall well-being.

Sustainable Economic Growth

Fiscal responsibility lays the foundation for sustainable long-term economic growth. By reducing the risk of economic crises and creating a stable environment for businesses to thrive, it helps create more job opportunities and attracts investment.

- Reduced risk of economic crises: Responsible budgeting and debt management minimize the risk of future financial calamities.

- Creating a stable environment for businesses to thrive: A stable economic environment fosters business investment, job creation, and economic growth.

- Attracting investment and creating job opportunities: A financially sound government attracts foreign and domestic investment, stimulating economic growth and job creation.

Conclusion

Achieving fiscal responsibility is not merely a financial imperative; it is a crucial investment in Canada's future. By prioritizing spending, generating sufficient revenue, and implementing long-term economic plans, Canada can secure a brighter future for all its citizens. The benefits – a stronger credit rating, enhanced social well-being, and sustainable economic growth – are undeniable. We must all play a role in advocating for responsible budgeting and sustainable financial practices. Contact your elected officials, support organizations dedicated to promoting sound fiscal management, and stay informed about Canada’s fiscal situation. Let's work together to build a more prosperous and secure future for generations to come through a commitment to fiscal responsibility.

Featured Posts

-

Ella Bleu Travoltas New Look A Fashion Cover Story At 24

Apr 24, 2025

Ella Bleu Travoltas New Look A Fashion Cover Story At 24

Apr 24, 2025 -

The Bold And The Beautiful Liam Steffy Hope And Lunas Explosive Next Two Weeks

Apr 24, 2025

The Bold And The Beautiful Liam Steffy Hope And Lunas Explosive Next Two Weeks

Apr 24, 2025 -

Immigration Crackdown Trump Administration Meets Legal Resistance

Apr 24, 2025

Immigration Crackdown Trump Administration Meets Legal Resistance

Apr 24, 2025 -

Canadas Conservatives Tax Cuts And Deficit Reduction Plan

Apr 24, 2025

Canadas Conservatives Tax Cuts And Deficit Reduction Plan

Apr 24, 2025 -

Liberal Fiscal Policies A Critical Analysis

Apr 24, 2025

Liberal Fiscal Policies A Critical Analysis

Apr 24, 2025

Latest Posts

-

Young Thug Teases Uy Scuti Album Release Date

May 10, 2025

Young Thug Teases Uy Scuti Album Release Date

May 10, 2025 -

Edmontons Nordic Spa Dreams Closer To Reality Council Approves Rezoning

May 10, 2025

Edmontons Nordic Spa Dreams Closer To Reality Council Approves Rezoning

May 10, 2025 -

Young Thugs Uy Scuti Release Date Hints And Album Expectations

May 10, 2025

Young Thugs Uy Scuti Release Date Hints And Album Expectations

May 10, 2025 -

Edmonton Nordic Spa Rezoning Approved Project Moves Forward

May 10, 2025

Edmonton Nordic Spa Rezoning Approved Project Moves Forward

May 10, 2025 -

Beyonces Cowboy Carter Double The Streams Post Tour Debut

May 10, 2025

Beyonces Cowboy Carter Double The Streams Post Tour Debut

May 10, 2025