Gold Price Record Rally: Bullion As A Safe Haven During Trade Wars

Table of Contents

Understanding the Gold Price Rally and its Correlation with Trade Wars

The gold market often exhibits an inverse relationship with the US dollar. When the dollar weakens, gold prices typically rise, as investors seek alternative stores of value. Trade wars introduce significant uncertainty into global markets. This uncertainty stems from unpredictable tariffs, retaliatory measures, and disruptions to global supply chains. As a result, investors often look to "safe-haven" assets—assets that maintain or increase their value during times of economic turmoil. Gold, with its inherent value and historical stability, perfectly fits this profile.

- Increased geopolitical risks: Trade wars heighten international tensions, making gold a desirable asset.

- Currency devaluation concerns: Economic instability caused by trade wars can lead to currency devaluation, pushing investors towards gold as a hedge.

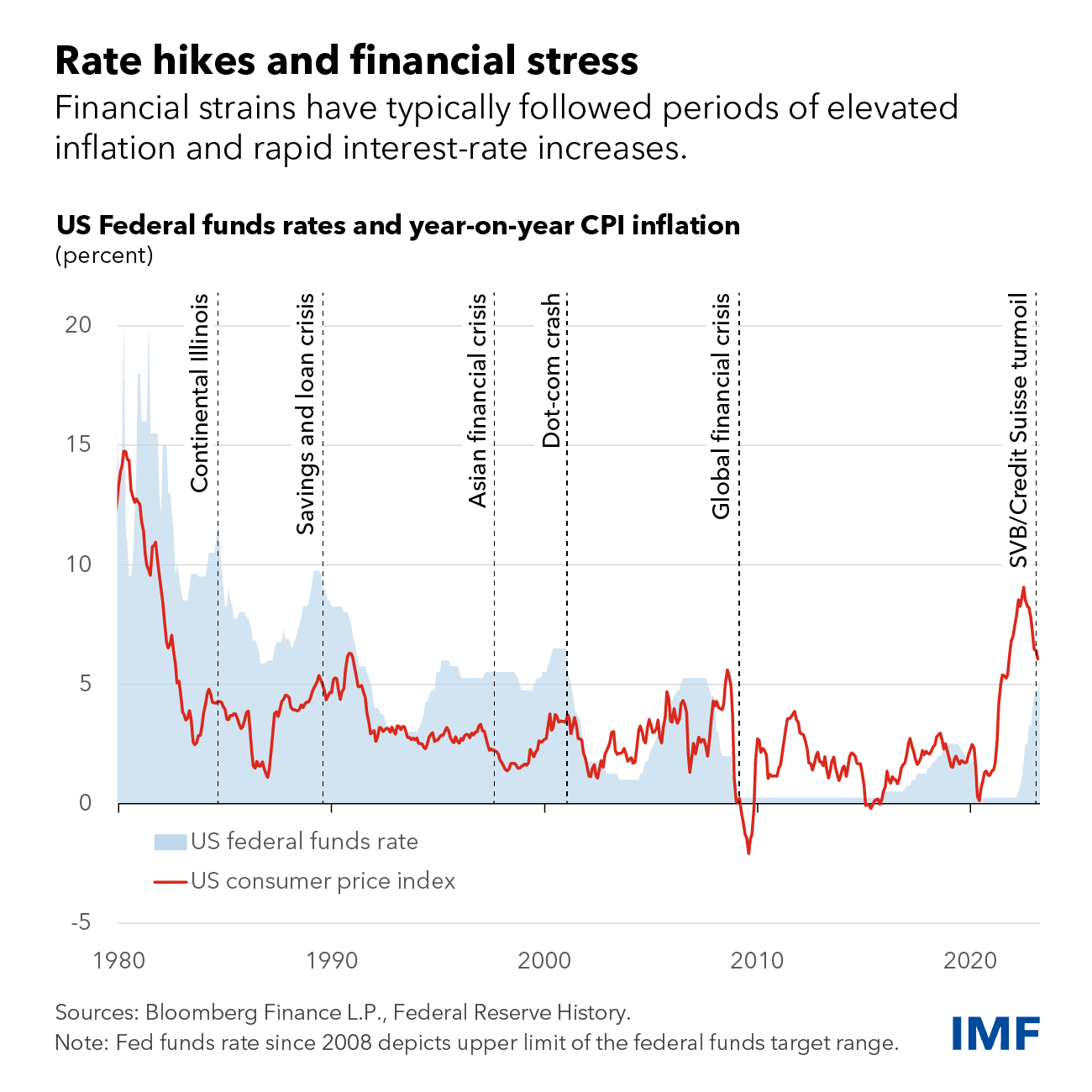

- Inflationary pressures: Trade wars can contribute to inflation, as tariffs increase the cost of goods. Gold traditionally acts as an inflation hedge.

- Decreased investor confidence in stocks and bonds: During periods of uncertainty, investors often move away from riskier assets like stocks and bonds, opting for the perceived safety of gold.

Gold as a Hedge Against Inflation

Inflation erodes the purchasing power of fiat currencies. A dollar today buys less than a dollar yesterday if inflation is positive. Gold, however, retains its intrinsic value. It's a tangible asset, unlike stocks or bonds, and its limited supply makes it a robust hedge against inflation. Historically, gold has performed well during inflationary periods, demonstrating its ability to preserve wealth.

- Gold's limited supply: Unlike fiat currencies, which can be printed at will, gold's supply is naturally constrained, limiting its availability and supporting its value.

- Gold's inherent value: Gold's inherent value transcends economic fluctuations, making it a dependable store of value across different economic climates.

- Historical data showing gold's performance during inflationary periods: Numerous historical examples demonstrate gold's positive correlation with periods of high inflation, showcasing its effectiveness as an inflation hedge.

- Central bank gold reserves as a testament to gold's value: Central banks around the world hold substantial gold reserves, reinforcing its importance as a safe and stable asset.

The Role of Central Bank Actions in Influencing Gold Prices

Central bank policies significantly impact gold prices. Interest rate cuts and quantitative easing (QE) measures, designed to stimulate economic growth, can lead to increased gold demand. QE increases the money supply, potentially leading to inflation, which benefits gold. Furthermore, central bank purchases of gold directly influence market prices.

- Impact of interest rate cuts on gold prices: Lower interest rates reduce the opportunity cost of holding non-interest-bearing assets like gold, making it more attractive.

- The effect of quantitative easing on inflation and gold demand: QE can fuel inflation, increasing the demand for gold as an inflation hedge.

- Examples of central banks increasing their gold reserves: Many central banks have been actively increasing their gold reserves in recent years, reflecting their confidence in gold as a safe-haven asset.

- Geopolitical implications of central bank gold policies: Central bank gold purchases can also have geopolitical implications, signaling their perspectives on global economic stability.

Investing in Gold During a Trade War: Strategies and Considerations

There are several ways to invest in gold, each with its own set of risks and rewards.

- Physical gold: Owning physical gold offers tangible ownership but involves storage and security considerations.

- Gold ETFs (Exchange Traded Funds): Gold ETFs offer a convenient and liquid way to invest in gold without the hassles of physical storage.

- Gold mining stocks: Investing in gold mining companies offers leveraged exposure to gold prices but carries higher risk.

Diversification is crucial. Don't put all your eggs in one basket. Consider a diversified portfolio that includes other asset classes to mitigate risks.

- Pros and cons of physical gold ownership: Pros include tangible ownership and security; cons include storage costs and security risks.

- Advantages and disadvantages of gold ETFs: Pros include liquidity and convenience; cons include potential management fees and indirect exposure to gold.

- Analyzing gold mining stocks as an investment option: Pros include leveraged exposure; cons include higher risk and dependence on company performance.

- Importance of diversification in investment portfolios: Diversification reduces overall portfolio risk and protects against significant losses in any one asset class.

Conclusion: Capitalizing on the Gold Price Record Rally

This gold price record rally highlights gold's enduring role as a safe haven during times of economic uncertainty, particularly during trade wars. Its correlation with inflation and central bank actions further underscores its importance in a diversified investment portfolio. Understanding the nuances of the gold market and employing appropriate investment strategies are essential during periods of economic instability. Don't miss out on the potential of this gold price record rally; explore your options for investing in gold today and consider adding this valuable asset to your portfolio to mitigate the risks associated with trade war uncertainty and broader economic instability. Further research into gold investment options will help you navigate this potentially lucrative market.

Featured Posts

-

The Smelliest Member Of Congress George Santoss Explosive Statement

Apr 26, 2025

The Smelliest Member Of Congress George Santoss Explosive Statement

Apr 26, 2025 -

The China Factor Analyzing The Automotive Markets Difficulties

Apr 26, 2025

The China Factor Analyzing The Automotive Markets Difficulties

Apr 26, 2025 -

La Landlord Price Gouging A Selling Sunset Stars Perspective On The Fire Aftermath

Apr 26, 2025

La Landlord Price Gouging A Selling Sunset Stars Perspective On The Fire Aftermath

Apr 26, 2025 -

Thaksins Return Implications For Thai Us Trade And Tariff Negotiations

Apr 26, 2025

Thaksins Return Implications For Thai Us Trade And Tariff Negotiations

Apr 26, 2025 -

Fusions Newest Gem Dong Duong Hotel In Hue

Apr 26, 2025

Fusions Newest Gem Dong Duong Hotel In Hue

Apr 26, 2025

Latest Posts

-

Fed Holds Interest Rates Balancing Inflation And Job Market Risks

May 10, 2025

Fed Holds Interest Rates Balancing Inflation And Job Market Risks

May 10, 2025 -

Section 230 And The Sale Of Banned Chemicals On E Bay A Legal Ruling

May 10, 2025

Section 230 And The Sale Of Banned Chemicals On E Bay A Legal Ruling

May 10, 2025 -

Resistance Grows Car Dealerships Challenge Ev Mandate

May 10, 2025

Resistance Grows Car Dealerships Challenge Ev Mandate

May 10, 2025 -

Broadcoms V Mware Acquisition At And T Exposes A 1 050 Price Increase

May 10, 2025

Broadcoms V Mware Acquisition At And T Exposes A 1 050 Price Increase

May 10, 2025 -

1 050 V Mware Price Hike At And T Highlights Broadcoms Extreme Pricing Proposal

May 10, 2025

1 050 V Mware Price Hike At And T Highlights Broadcoms Extreme Pricing Proposal

May 10, 2025