High Stock Market Valuations: A BofA Analysis And Investor Reassurance

Table of Contents

BofA's Analysis of Current Market Conditions

BofA's latest report on market conditions sheds light on the factors driving these high stock market valuations. Their analysis incorporates various metrics, including Price-to-Earnings (P/E) ratios and overall market capitalization, to paint a comprehensive picture. The firm attributes the elevated valuations to several key factors:

- Low Interest Rates: Historically low interest rates have fueled investment in equities, driving up demand and consequently, prices. This makes bonds less attractive, pushing more capital into stocks.

- Strong Corporate Earnings: Many companies have reported robust earnings, bolstering investor confidence and justifying higher valuations for their stocks. This positive earnings momentum contributes to higher market valuations.

- Positive Investor Sentiment: Despite concerns, general investor sentiment remains relatively optimistic, further contributing to the upward pressure on stock prices. This optimistic outlook fuels buying activity and sustains elevated valuations.

BofA's analysis also highlights specific sectors and companies. For example, their research might suggest that certain technology stocks are significantly overvalued based on their current P/E ratios compared to historical averages, while some sectors in the energy or healthcare space might be deemed undervalued, presenting potential investment opportunities.

- Specific BofA Findings (Example): BofA might report that the average P/E ratio for the S&P 500 is currently at 25, significantly above the historical average of 15. They might also note that the market capitalization of the tech sector has increased by X% year-over-year.

- Keywords: BofA, market analysis, stock valuation, P/E ratio, market capitalization, sector analysis, S&P 500, overvalued stocks, undervalued stocks.

Understanding the Risks Associated with High Valuations

Investing in a market characterized by high stock market valuations inherently carries significant risks. While potential rewards exist, it's crucial to acknowledge the potential downsides:

-

Market Corrections: High valuations often precede market corrections or even crashes. A sudden downturn could lead to substantial losses for investors. The higher the valuation, the greater the potential fall.

-

Increased Volatility: Markets with high valuations tend to experience higher volatility, meaning prices can fluctuate more dramatically in the short term. This can create uncertainty and nervousness for investors.

-

Rising Interest Rates: A future increase in interest rates could negatively impact stock valuations as investors shift their capital towards higher-yielding bonds. This could trigger a market correction.

-

Inflation: Unexpected inflation can erode the purchasing power of profits, potentially leading to lower stock valuations. Inflation is a major risk factor in any market, particularly one with high valuations.

-

Keywords: Market risk, volatility, market correction, investment risk, downside risk, inflation risk, interest rate risk.

Strategies for Investors in a High-Valuation Market

Despite the risks, there are strategies investors can employ to navigate a market with high stock market valuations successfully:

-

Diversification: Spreading investments across different asset classes (stocks, bonds, real estate, etc.) and sectors can mitigate overall portfolio risk. Don't put all your eggs in one basket.

-

Dollar-Cost Averaging: Investing a fixed amount of money at regular intervals, regardless of market fluctuations, reduces the impact of short-term volatility. This is a strategy to mitigate risk over the long term.

-

Long-Term Investment Horizon: High valuations can be weathered more easily with a long-term investment strategy. Focus on the long-term potential of your investments rather than short-term market fluctuations.

-

Value Investing: Focus on identifying undervalued companies with strong fundamentals. This strategy can be particularly effective in high-valuation markets where some stocks might be trading above their intrinsic value.

-

Keywords: Diversification, risk management, value investing, long-term investment, dollar-cost averaging, investment strategy, asset allocation.

Reassurance and Long-Term Outlook

While acknowledging the risks associated with high stock market valuations is crucial, it's equally important to maintain a balanced perspective. BofA, and other reputable financial institutions, often offer long-term positive market forecasts, highlighting the potential for continued growth even in a high-valuation environment.

- Long-Term Growth Potential: While short-term volatility is possible, many analysts anticipate continued long-term growth in the global economy, which could support stock market growth over the long run.

- Technological Advancements: Innovation and technological progress could fuel future growth and justify current valuations of certain sectors.

- Global Economic Growth: Continued growth in emerging markets presents further opportunities for long-term investment success.

Avoiding panic selling and making informed decisions based on thorough research are paramount. Don't let short-term market fluctuations dictate your long-term investment strategy.

- Keywords: Long-term outlook, market forecast, investor confidence, informed decision-making, global economic growth, technological innovation.

Conclusion: Addressing High Stock Market Valuations – A Path Forward

BofA's analysis provides valuable insight into the current market conditions, highlighting the factors driving high stock market valuations and the associated risks. While these elevated valuations present potential challenges, they also offer opportunities for savvy investors. By employing effective strategies such as diversification, dollar-cost averaging, and a long-term investment horizon, investors can navigate this environment successfully. Remember to conduct thorough research, seek professional financial advice if needed, and develop a well-informed investment strategy to effectively manage high stock valuations and capitalize on potential growth opportunities. Understanding high stock market valuations is key to making sound investment decisions in today's market.

Featured Posts

-

Planirajte Svoju Uskrsnju Kupnju Radno Vrijeme Trgovina

Apr 23, 2025

Planirajte Svoju Uskrsnju Kupnju Radno Vrijeme Trgovina

Apr 23, 2025 -

Analyse Du Portefeuille Bfm Decisions D Arbitrage Du 17 02

Apr 23, 2025

Analyse Du Portefeuille Bfm Decisions D Arbitrage Du 17 02

Apr 23, 2025 -

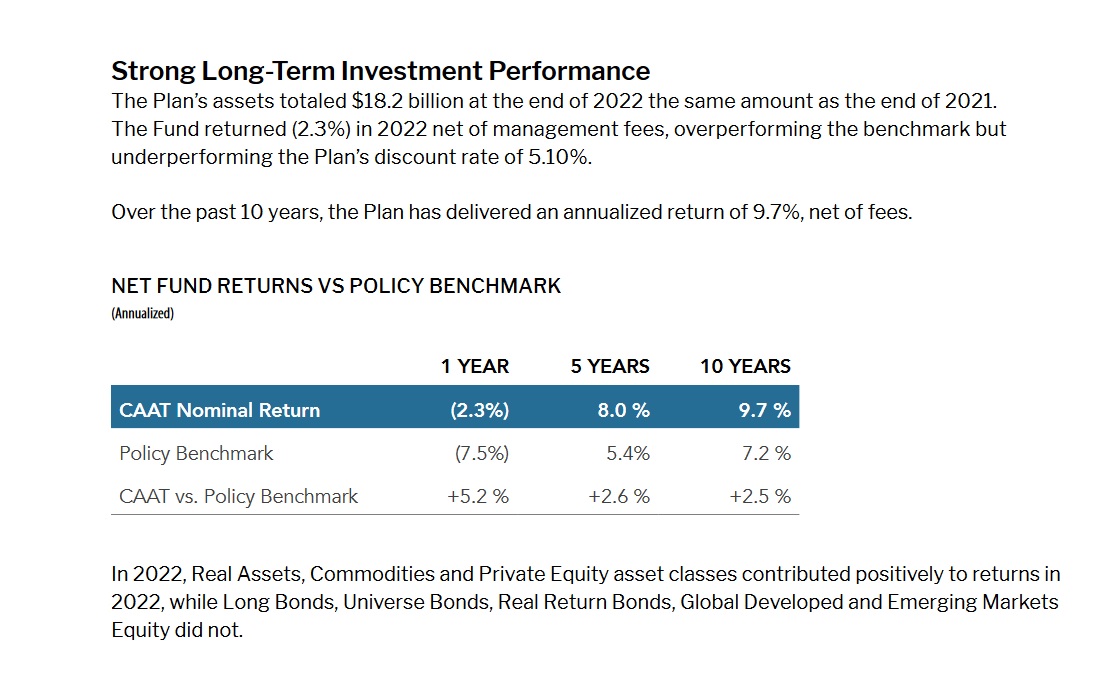

Caat Pension Plan Expands Search For Canadian Private Investments

Apr 23, 2025

Caat Pension Plan Expands Search For Canadian Private Investments

Apr 23, 2025 -

Gold Etfs And Cash Equivalents The Current Market Trend

Apr 23, 2025

Gold Etfs And Cash Equivalents The Current Market Trend

Apr 23, 2025 -

Ftc To Appeal Microsoft Activision Merger Ruling

Apr 23, 2025

Ftc To Appeal Microsoft Activision Merger Ruling

Apr 23, 2025