High Stock Market Valuations: BofA's Rationale For Investor Calm

Table of Contents

BofA's Argument: Sustained Earnings Growth Justifies Current Prices

BofA's core argument rests on the foundation of strong and sustained corporate earnings growth. They contend that robust profit increases are underpinning current stock prices, even at seemingly high price-to-earnings ratios (P/E). This means that while the price of stocks might appear expensive relative to historical averages, the underlying earnings are growing at a pace that justifies these levels.

- Supporting Data: BofA cites numerous examples of strong earnings growth across various sectors, particularly in technology, healthcare, and consumer staples. Their analyses often highlight a consistent trend of exceeding profit expectations, providing a solid base for current market capitalization. While specific figures would require referencing their current reports, their consistent messaging emphasizes this trend.

- Addressing Counterarguments: BofA acknowledges that some sectors might be overvalued. However, they emphasize that this is not a uniform market phenomenon. The overall positive trend in earnings growth, according to their analysis, offsets concerns about pockets of overvaluation in specific areas. They advocate for a holistic perspective rather than focusing solely on individual high-valuation stocks.

- Keywords: earnings growth, stock valuations, price-to-earnings ratio (P/E), market capitalization, corporate profits

The Role of Low Interest Rates and Monetary Policy

Low interest rates and accommodative monetary policies play a significant role in influencing high stock market valuations. Lower interest rates reduce the discount rate used in equity valuation models. This discount rate reflects the opportunity cost of capital; lower rates make future earnings streams more valuable in present terms, thus supporting higher stock prices.

- Equities vs. Bonds: In a low-interest-rate environment, equities become a more attractive investment compared to bonds. Bonds offer lower yields, making stocks, with their potential for higher growth, a relatively more appealing option for investors seeking returns.

- BofA's Interest Rate Outlook: BofA's view on the likely trajectory of interest rates is crucial. While their specific forecasts change, their general outlook often influences their stance on valuations. Essentially, if they expect rates to remain low or gradually rise, it supports their perspective on the sustainability of current valuation levels.

- Keywords: interest rates, monetary policy, bond yields, discount rates, equity valuation models, central bank policy

Long-Term Growth Outlook Remains Positive (According to BofA)

BofA maintains a positive outlook on long-term economic growth, which forms a key pillar of their justification for current valuations. They believe sustained economic expansion can continue to support higher stock prices over the long run.

- Drivers of Growth: BofA typically points to factors such as technological innovation, global expansion, and ongoing improvements in productivity as significant contributors to long-term economic growth. These elements support their belief that corporate earnings will continue their upward trajectory, thus justifying current stock prices.

- Long-Term Investment Strategy: This positive outlook is directly linked to their recommendation for a long-term investment strategy. BofA generally advises investors to focus on the long-term potential of the market rather than reacting to short-term volatility driven by valuation concerns.

- Keywords: economic growth, long-term investment, technological innovation, global economy, future market trends

Addressing Potential Risks and Cautions (BofA's Nuances)

While presenting a generally optimistic view, BofA acknowledges that risks exist. It's crucial to understand that their position isn't entirely devoid of caveats.

- Identified Risks: BofA identifies potential risks such as inflation, geopolitical uncertainty, and sector-specific vulnerabilities. These risks, while acknowledged, are generally viewed as manageable within a diversified portfolio.

- Risk Mitigation: BofA typically suggests investors mitigate these risks through diversification, strategic asset allocation, and a careful review of their own risk tolerance. They emphasize the importance of not putting all eggs in one basket and maintaining a well-balanced portfolio.

- Keywords: market risk, inflation risk, geopolitical risk, portfolio diversification, risk management, asset allocation

Maintaining Calm in the Face of High Stock Market Valuations

In summary, BofA's rationale for investor calm in the face of high stock market valuations rests on three key pillars: sustained earnings growth, the influence of low interest rates, and a positive long-term growth outlook. While acknowledging inherent market risks, they emphasize the importance of considering the long-term perspective and employing a well-diversified investment strategy. Remember, investing always involves risk. To gain a more comprehensive understanding of BofA's analysis and develop a well-informed investment strategy that accounts for high stock market valuations, review their full report and consider consulting a financial advisor.

Featured Posts

-

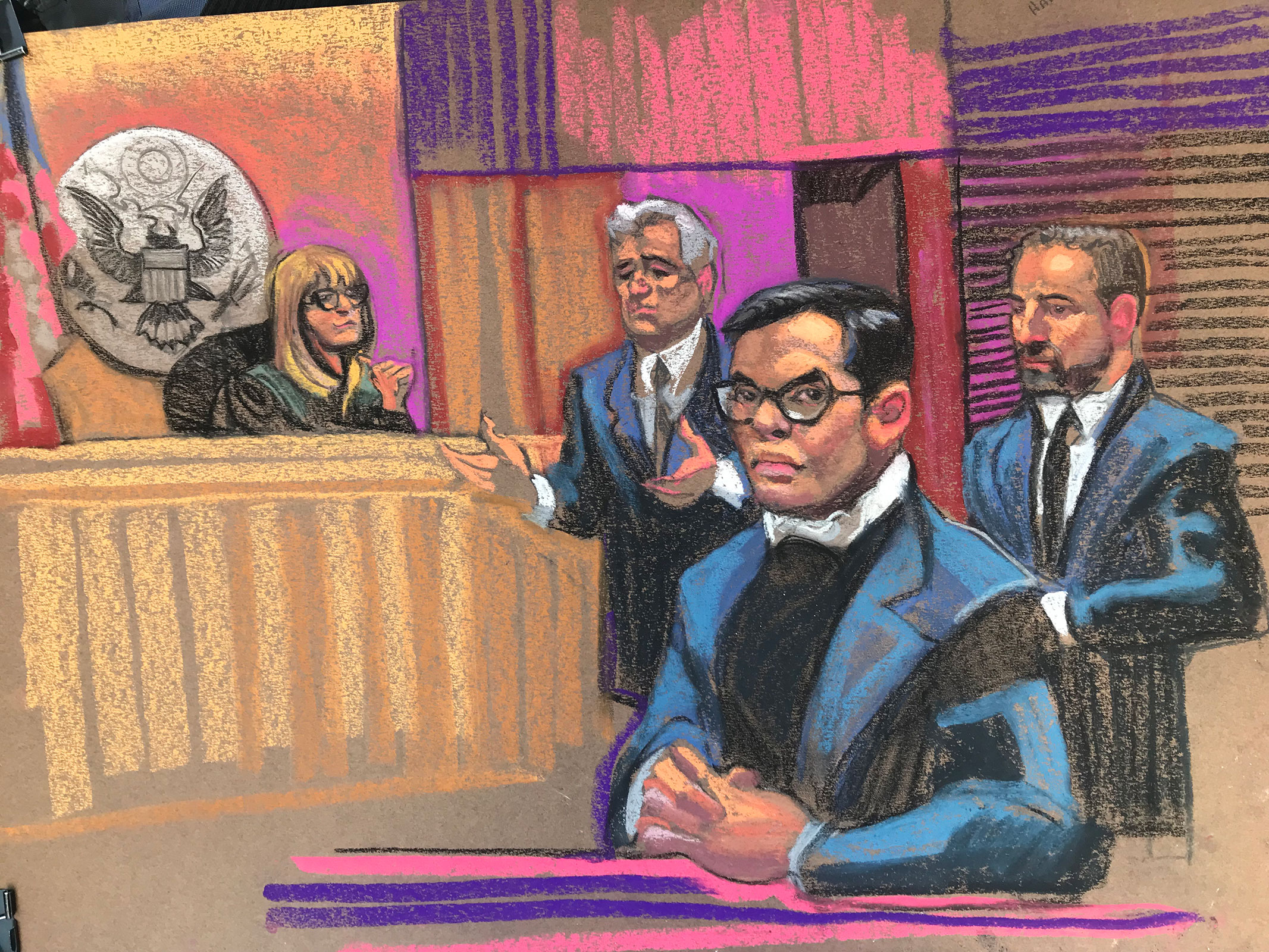

Seven Year Prison Sentence Sought For George Santos In Federal Fraud Case

Apr 26, 2025

Seven Year Prison Sentence Sought For George Santos In Federal Fraud Case

Apr 26, 2025 -

Benson Boone Antes Do Lollapalooza A Ascensao De Uma Estrela Da Musica

Apr 26, 2025

Benson Boone Antes Do Lollapalooza A Ascensao De Uma Estrela Da Musica

Apr 26, 2025 -

Stock Market Update Dow Futures Rise Positive Week End In Sight

Apr 26, 2025

Stock Market Update Dow Futures Rise Positive Week End In Sight

Apr 26, 2025 -

Microsoft Activision Deal Ftcs Appeal And Its Implications

Apr 26, 2025

Microsoft Activision Deal Ftcs Appeal And Its Implications

Apr 26, 2025 -

Construction Of Worlds Tallest Abandoned Skyscraper To Resume After A Decade

Apr 26, 2025

Construction Of Worlds Tallest Abandoned Skyscraper To Resume After A Decade

Apr 26, 2025

Latest Posts

-

Unraveling The Mystery 5 Leading Theories On Who David Is In High Potential He Morgan Brother

May 10, 2025

Unraveling The Mystery 5 Leading Theories On Who David Is In High Potential He Morgan Brother

May 10, 2025 -

Elon Musks Net Worth A Deep Dive Into The Recent 300 Billion Drop

May 10, 2025

Elon Musks Net Worth A Deep Dive Into The Recent 300 Billion Drop

May 10, 2025 -

Watch Pam Bondis Remarks On Killing American Citizens Spark Debate

May 10, 2025

Watch Pam Bondis Remarks On Killing American Citizens Spark Debate

May 10, 2025 -

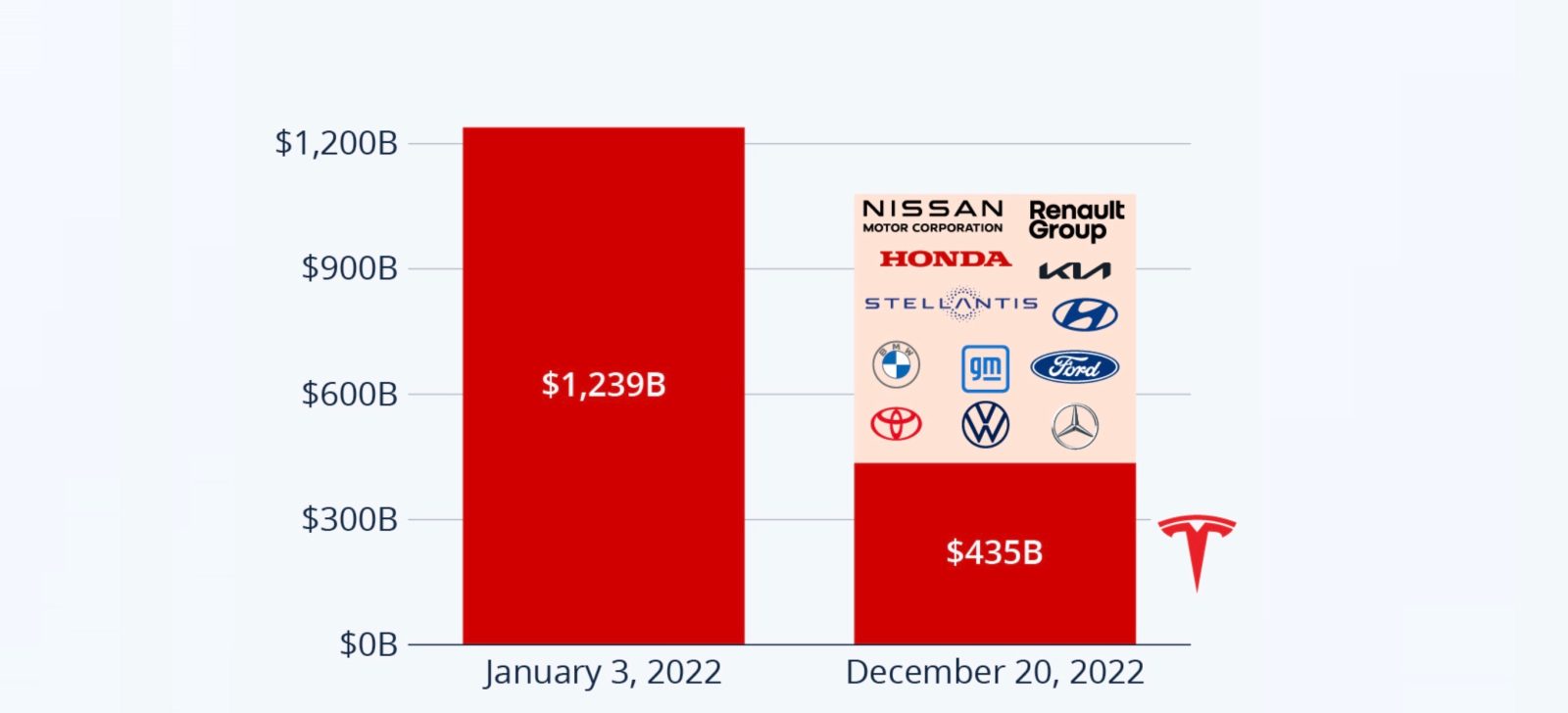

Tesla Stock Decline And Tariffs Push Elon Musks Net Worth Below 300 Billion

May 10, 2025

Tesla Stock Decline And Tariffs Push Elon Musks Net Worth Below 300 Billion

May 10, 2025 -

Elon Musks 300 Billion Net Worth Milestone Broken Analysis Of Tesla And Market Factors

May 10, 2025

Elon Musks 300 Billion Net Worth Milestone Broken Analysis Of Tesla And Market Factors

May 10, 2025