Hong Kong Chinese Stock Market Rally: Analysis And Outlook

Table of Contents

Factors Driving the Hong Kong Chinese Stock Market Rally

Several interconnected factors have contributed to the recent rally in the Hong Kong Chinese stock market. Understanding these drivers is crucial for assessing the sustainability of this upward trend.

Economic Reopening and Recovery

China's post-pandemic economic recovery has been a major catalyst for the Hong Kong market's resurgence. The easing of Covid-19 restrictions and the subsequent revival of economic activity have had a ripple effect, boosting investor confidence.

- Increased consumer spending: Pent-up demand has fueled a surge in consumer spending, benefiting retail and consumer goods companies listed on the Hong Kong Stock Exchange. Recent data shows a significant year-on-year increase in retail sales.

- Rebounding industrial production: Manufacturing activity has rebounded strongly, with factories operating at near pre-pandemic levels. This positive trend has boosted the performance of industrial and export-oriented companies.

- Government stimulus measures: The Chinese government has implemented various stimulus measures aimed at supporting economic growth, including infrastructure investment and tax cuts. These measures have provided a further boost to the market.

- Easing of Covid-19 restrictions: The significant relaxation of Covid-19 restrictions across mainland China has unleashed pent-up demand and facilitated the resumption of normal business operations, impacting positively on the Hong Kong Chinese economic outlook.

These factors combined have significantly contributed to the robust Chinese economic growth, positively influencing the Hong Kong Chinese stock market.

Technological Advancements and Innovation

The technology sector has played a significant role in the Hong Kong stock market rally. The rapid growth of Fintech companies and advancements in AI and other tech sectors have attracted substantial investment.

- Growth of Fintech companies: Hong Kong has emerged as a hub for Fintech innovation, with numerous companies developing cutting-edge financial technologies. This sector is experiencing rapid growth, attracting significant investment.

- Advancements in AI and other tech sectors: Chinese technological innovation is driving advancements in artificial intelligence, big data, and other key technologies. Companies at the forefront of these advancements are seeing strong growth and attracting investor interest.

- Government support for technological innovation: The Chinese government is actively promoting technological innovation through various initiatives, including funding research and development and creating favorable regulatory environments. This support has further fueled growth in the tech sector.

Examples of successful tech companies listed on the Hong Kong Stock Exchange, such as Tencent and Alibaba, have contributed significantly to the overall market rally. This demonstrates the impact of Hong Kong tech stocks on the broader market.

Increased Foreign Investment

The inflow of foreign capital into the Hong Kong market has been another key driver of the recent rally. Attractive valuations, an improving economic outlook, and diversification strategies have lured international investors.

- Attractive valuations: Compared to other major markets, the Hong Kong stock market has offered attractive valuations for certain stocks, making it an appealing destination for foreign investors.

- Improving economic outlook: The positive economic outlook for both Hong Kong and mainland China has increased investor confidence and attracted foreign capital.

- Diversification strategies: Many international investors view the Hong Kong market as a way to diversify their portfolios and reduce risk.

International investment funds have played a significant role in driving this inflow of foreign investment in Hong Kong, further boosting market performance and showcasing the impact of global capital flows.

Analyzing Current Market Sentiment and Volatility

While the rally has been impressive, it's crucial to analyze current market sentiment and identify potential risks.

Investor Confidence and Market Indicators

The Hang Seng Index, a key benchmark for the Hong Kong stock market, has shown significant gains recently. Trading volume has also increased, indicating heightened investor activity. Investor sentiment surveys generally reflect optimism, although some caution remains.

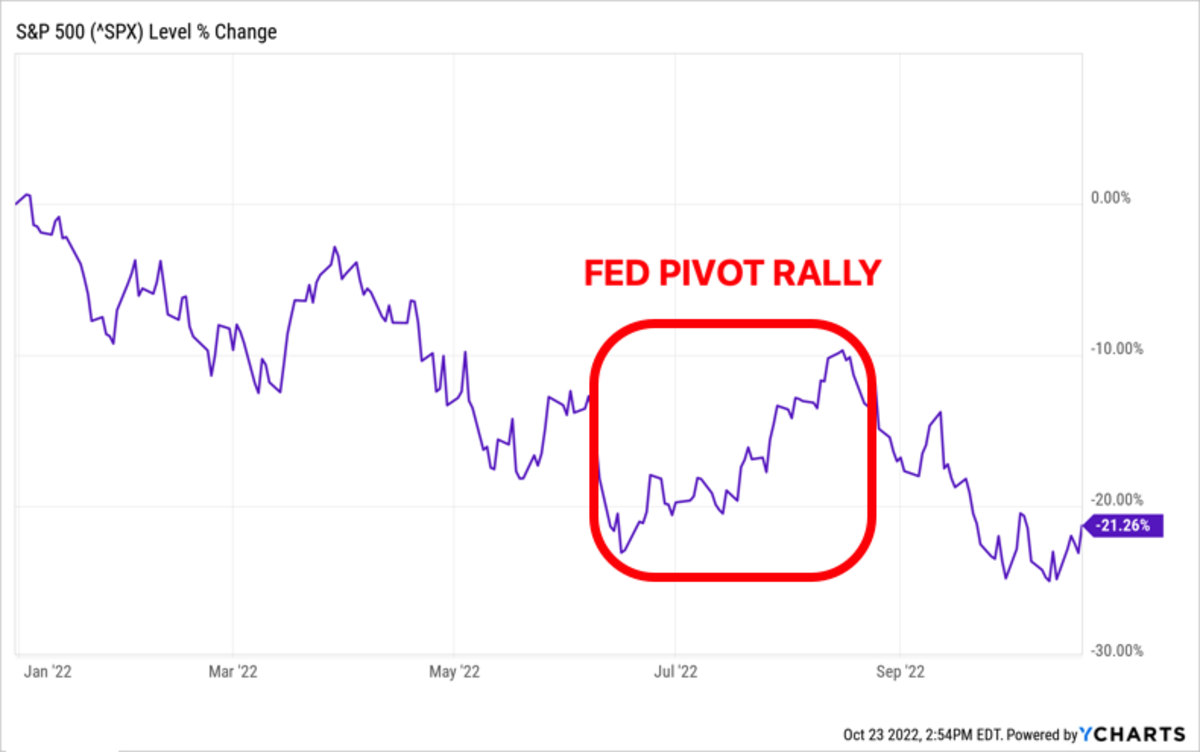

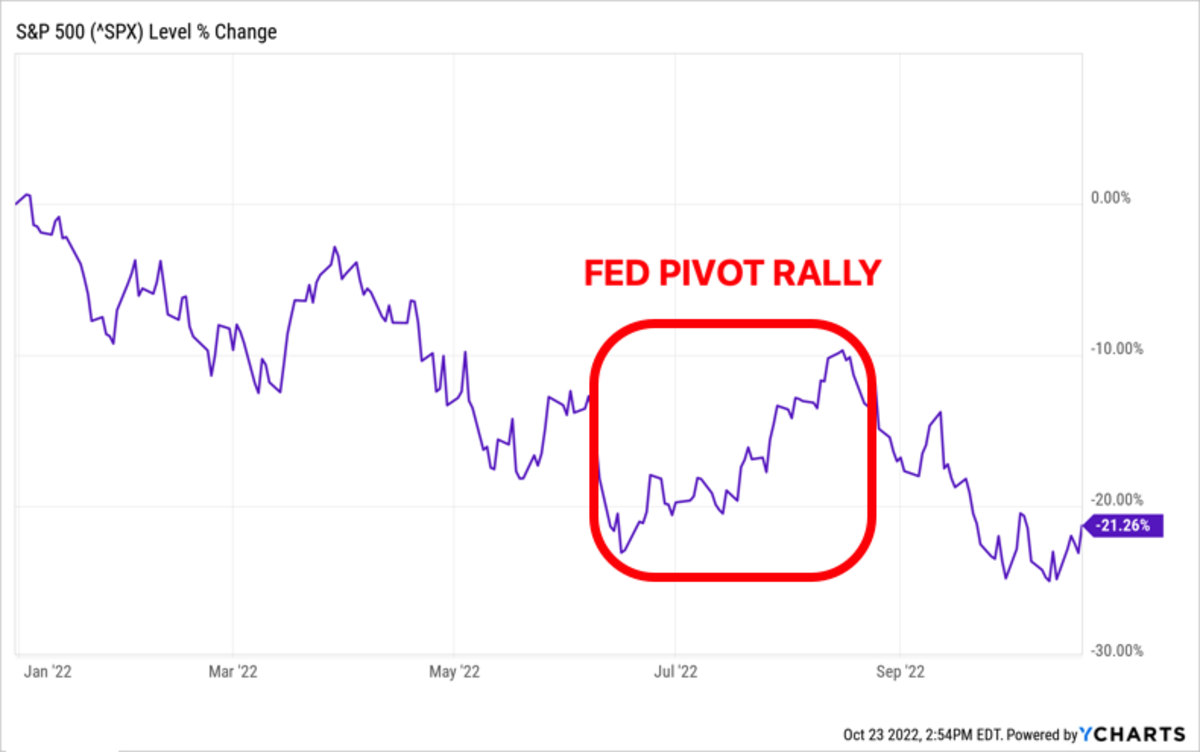

- Hang Seng Index performance: Analyzing the recent trends of the Hang Seng Index, comparing it with historical data, and considering factors that influenced past performances offer a valuable insight into the current market situation.

- Trading volume: Increased trading volumes often signify growing investor interest and participation in the market.

- Investor sentiment surveys: Regularly monitoring investor sentiment surveys helps gauge the overall confidence level and potential shifts in the market. Data visualizations such as charts and graphs can be very effective in illustrating market trends.

This analysis of market indicators, particularly the Hang Seng Index forecast, is crucial for understanding the current market dynamics and potential future movements.

Potential Risks and Challenges

Despite the positive momentum, several risks could impact the Hong Kong stock market rally.

- Geopolitical tensions: Geopolitical uncertainties, particularly concerning US-China relations, could create volatility in the market.

- Inflation: Rising inflation could erode corporate profits and dampen investor enthusiasm, leading to a market correction.

- Interest rate hikes: Interest rate hikes by central banks could increase borrowing costs for companies and potentially cool down economic growth.

Understanding these geopolitical risks, the impact of inflation on the stock market, and the effect of interest rate hikes is paramount for mitigating potential downsides and managing investment portfolios effectively. Strategies such as diversification and hedging can be employed to lessen these risks.

Outlook and Investment Strategies for the Hong Kong Chinese Stock Market

Predicting market movements with certainty is impossible, but analyzing current trends and potential risks allows for a more informed outlook.

Short-Term and Long-Term Predictions

The short-term outlook for the Hong Kong Chinese stock market appears positive, driven by continued economic recovery and positive investor sentiment. However, volatility is expected, given the inherent uncertainties in the global economic environment. In the long term, the market's growth potential is substantial, driven by China's continuing economic development and technological advancements.

- Short-term market expectations: While the short-term outlook is positive, investors should be prepared for potential fluctuations and corrections.

- Long-term growth potential: Despite the short-term volatility, the long-term growth potential of the Hong Kong stock market remains strong.

- Factors influencing future performance: Geopolitical factors, economic data, and regulatory changes will significantly influence the market's future performance.

It is vital to remember that all market predictions carry inherent uncertainty.

Investment Opportunities and Sector-Specific Analysis

Specific sectors within the Hong Kong market offer attractive investment opportunities.

- Technology: The technology sector remains a significant growth area, with numerous innovative companies poised for expansion.

- Consumer goods: The revival of consumer spending presents opportunities in the consumer goods sector.

- Finance: The financial sector, while cyclical, offers potential returns for long-term investors.

Identifying undervalued stocks requires thorough due diligence and analysis. While the Hong Kong stock market offers potential investment opportunities, investors should exercise caution and perform thorough research before investing. Sector-specific analysis, alongside risk management and diversification strategies, are crucial for successful investing.

Conclusion

The recent rally in the Hong Kong Chinese stock market presents both opportunities and challenges for investors. While factors like economic recovery and technological advancements are driving growth, it is crucial to be aware of potential risks and volatility. By carefully analyzing market indicators, understanding investor sentiment, and adopting a diversified investment strategy, investors can navigate this dynamic market effectively. Further research into specific sectors and companies is recommended before making any investment decisions. Stay informed about the evolving landscape of the Hong Kong Chinese stock market to make sound and informed investment choices. Consider consulting with a financial advisor before making any significant investment decisions in the Hong Kong stock market or any other market.

Featured Posts

-

The Bold And The Beautiful Spoilers Liams Medical Crisis And Potential Demise

Apr 24, 2025

The Bold And The Beautiful Spoilers Liams Medical Crisis And Potential Demise

Apr 24, 2025 -

Instagrams Tik Tok Competitor A New Video Editing App

Apr 24, 2025

Instagrams Tik Tok Competitor A New Video Editing App

Apr 24, 2025 -

Usd Strengthens Dollar Gains Against Major Currencies As Trumps Fed Criticism Eases

Apr 24, 2025

Usd Strengthens Dollar Gains Against Major Currencies As Trumps Fed Criticism Eases

Apr 24, 2025 -

Alterya Acquired By Chainalysis Implications For The Future Of Blockchain Technology

Apr 24, 2025

Alterya Acquired By Chainalysis Implications For The Future Of Blockchain Technology

Apr 24, 2025 -

Canadian Conservative Platform Tax Cuts And Fiscal Responsibility

Apr 24, 2025

Canadian Conservative Platform Tax Cuts And Fiscal Responsibility

Apr 24, 2025

Latest Posts

-

Geopolitical Shifts Trumps Role In Greenlands Relationship With Denmark

May 10, 2025

Geopolitical Shifts Trumps Role In Greenlands Relationship With Denmark

May 10, 2025 -

Trumps Surgeon General Pick Casey Means And The Rise Of The Maha Movement

May 10, 2025

Trumps Surgeon General Pick Casey Means And The Rise Of The Maha Movement

May 10, 2025 -

Greenlands Proximity To Denmark A Consequence Of Trumps Policies

May 10, 2025

Greenlands Proximity To Denmark A Consequence Of Trumps Policies

May 10, 2025 -

Analyzing The Impact Of Trumps Actions On Greenland Denmark Relations

May 10, 2025

Analyzing The Impact Of Trumps Actions On Greenland Denmark Relations

May 10, 2025 -

The Trump Factor How Threats Reshaped Greenlands Relationship With Denmark

May 10, 2025

The Trump Factor How Threats Reshaped Greenlands Relationship With Denmark

May 10, 2025