How To Understand The Net Asset Value Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the per-share value of an ETF's underlying assets. Unlike a company's stock which trades based on supply and demand, an ETF's NAV reflects the intrinsic value of its holdings. The NAV is different from the market price; the market price fluctuates throughout the trading day based on buy and sell orders, while the NAV is calculated at the end of the trading day.

- NAV represents the underlying asset value per share. This means it's a calculation based on the total value of all the stocks within the ETF.

- Calculated by totaling the market value of all ETF holdings, subtracting liabilities, and dividing by the number of outstanding shares. This ensures a fair representation of the ETF's worth.

- Provides a snapshot of the ETF's intrinsic value. This intrinsic value is a key metric for assessing the ETF’s performance over time, independent of short-term market fluctuations.

Factors Influencing the Amundi Dow Jones Industrial Average UCITS ETF NAV

Several factors significantly impact the Amundi Dow Jones Industrial Average UCITS ETF NAV. Understanding these factors is vital for interpreting NAV changes and making sound investment decisions.

-

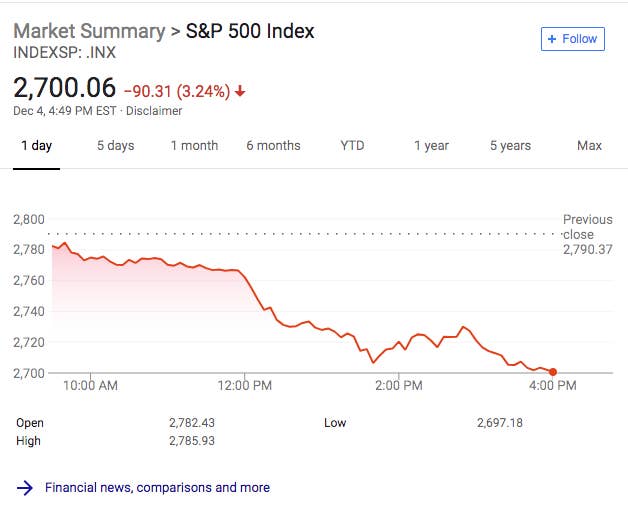

The impact of the Dow Jones Industrial Average (DJIA) performance on the ETF's NAV: This ETF tracks the DJIA, so the performance of the index directly influences the ETF's NAV. Positive movements in the DJIA generally lead to a higher NAV, and vice versa. Understanding the economic factors driving the DJIA is crucial.

-

The role of currency fluctuations: Since the ETF may hold assets denominated in various currencies, fluctuations in exchange rates can affect the NAV, particularly if the ETF's base currency is different from the currencies of its underlying assets.

-

The effect of expenses and management fees: The Amundi Dow Jones Industrial Average UCITS ETF, like all ETFs, incurs management fees and expenses. These are deducted from the total asset value before calculating the NAV, therefore impacting the final NAV figure.

-

Bullet Points Summarizing Key Influences:

- Positive DJIA movement generally leads to a higher Amundi Dow Jones Industrial Average UCITS ETF NAV.

- Negative DJIA movement generally leads to a lower Amundi Dow Jones Industrial Average UCITS ETF NAV.

- Currency exchange rate shifts can positively or negatively impact the NAV.

- Management fees and expenses reduce the total asset value, resulting in a lower NAV.

How to Find the Amundi Dow Jones Industrial Average UCITS ETF NAV

Finding the daily NAV for the Amundi Dow Jones Industrial Average UCITS ETF is straightforward. Several reliable sources provide this information.

- Check the Amundi website's dedicated ETF page: Amundi, as the ETF provider, is the most reliable source for this information. Look for a section dedicated to the ETF's factsheet or performance data.

- Consult reputable financial data providers: Websites like Bloomberg, Yahoo Finance, Google Finance, and others provide real-time or end-of-day NAV data for many ETFs, including the Amundi Dow Jones Industrial Average UCITS ETF.

- NAV is usually updated at the close of the market: Keep in mind that the NAV is typically a daily figure, reflecting the closing market values of the underlying assets.

Interpreting the NAV: What does it mean for your investment?

The Amundi Dow Jones Industrial Average UCITS ETF NAV is a crucial tool for monitoring performance and identifying potential investment opportunities.

-

Track performance over time: By monitoring NAV changes over time, you can assess the growth or decline of your investment, and compare it to your investment goals.

-

Compare NAV to the market price: While the NAV is a lagging indicator reflecting the previous day's closing prices, comparing it to the current market price can sometimes reveal potential arbitrage opportunities. However, this requires sophisticated analysis.

-

Consider other market factors: Remember that NAV is just one piece of the puzzle. Economic indicators, market sentiment, and global events also significantly influence ETF prices.

-

Bullet Points for Interpretation:

- Monitor Amundi Dow Jones Industrial Average UCITS ETF NAV changes to assess long-term growth or decline.

- A disparity between NAV and market price might indicate potential opportunities, but warrants careful examination.

- Contextualize NAV within the broader market landscape for a complete investment picture.

Conclusion

Understanding the Amundi Dow Jones Industrial Average UCITS ETF NAV is vital for successful investment. By regularly monitoring the NAV and understanding the influencing factors – DJIA performance, currency fluctuations, and expenses – you can gain valuable insights into your investment's performance and make informed decisions. Remember to consult the official Amundi website or reputable financial data providers to access the most up-to-date Amundi Dow Jones Industrial Average UCITS ETF NAV information. Start tracking your Amundi Dow Jones Industrial Average UCITS ETF NAV today and take control of your investment strategy.

Featured Posts

-

Gucci Faces Supply Chain Leadership Change With Vians Departure

May 24, 2025

Gucci Faces Supply Chain Leadership Change With Vians Departure

May 24, 2025 -

Peremozhtsi Yevrobachennya 2014 2023 De Voni Zaraz

May 24, 2025

Peremozhtsi Yevrobachennya 2014 2023 De Voni Zaraz

May 24, 2025 -

Facing Retribution The High Cost Of Challenging The Status Quo

May 24, 2025

Facing Retribution The High Cost Of Challenging The Status Quo

May 24, 2025 -

Rayakan Seni Dan Otomotif Di Porsche Indonesia Classic Art Week 2025

May 24, 2025

Rayakan Seni Dan Otomotif Di Porsche Indonesia Classic Art Week 2025

May 24, 2025 -

Egyedi Porsche Legendas F1 Motor A Koezuton

May 24, 2025

Egyedi Porsche Legendas F1 Motor A Koezuton

May 24, 2025

Latest Posts

-

Trumps Tariff Decision 8 Jump In Euronext Amsterdam Stock Trading

May 24, 2025

Trumps Tariff Decision 8 Jump In Euronext Amsterdam Stock Trading

May 24, 2025 -

Euronext Amsterdam Stocks Surge 8 After Trump Tariff Pause

May 24, 2025

Euronext Amsterdam Stocks Surge 8 After Trump Tariff Pause

May 24, 2025 -

Herstel Op Beurzen Na Uitstel Trump Alle Aex Fondsen In Het Groen

May 24, 2025

Herstel Op Beurzen Na Uitstel Trump Alle Aex Fondsen In Het Groen

May 24, 2025 -

Imcd N V Annual General Meeting Successful Vote On All Resolutions

May 24, 2025

Imcd N V Annual General Meeting Successful Vote On All Resolutions

May 24, 2025 -

Trumps Tariff Increase Sends Amsterdam Stock Exchange Down 2

May 24, 2025

Trumps Tariff Increase Sends Amsterdam Stock Exchange Down 2

May 24, 2025