India Market Buzz: Nifty's Bullish Run Fueled By Positive Trends

Table of Contents

Strong Economic Fundamentals Driving Nifty's Ascent

The impressive ascent of the Nifty 50 is firmly rooted in the robust performance of the Indian economy. Positive economic indicators paint a picture of sustained growth and increased investor confidence. The Indian economy's resilience is evident in several key areas:

- Robust GDP Growth: India's GDP growth consistently outperforms many global economies, attracting significant foreign investment. This sustained growth fuels corporate profitability and boosts investor sentiment, directly impacting the Nifty's upward trajectory.

- Increased Foreign Institutional Investor (FII) Inflows: FIIs have been pouring money into the Indian market, indicating a strong belief in the country's long-term growth potential. This influx of capital significantly boosts market liquidity and pushes prices higher.

- Government's Infrastructure Spending Initiatives: The government's focus on infrastructure development, through projects like the Bharatmala and Sagarmala programs, creates a multiplier effect, stimulating economic activity and job creation. This boosts overall economic confidence and reflects positively on the market.

- Robust Corporate Earnings: Many Indian companies are reporting strong and consistent earnings growth, demonstrating the health and vitality of the corporate sector. This positive trend reinforces investor confidence and drives further investment.

- Positive Global Economic Outlook: While global headwinds exist, a relatively positive global economic outlook enhances investor risk appetite, leading to increased investment in emerging markets like India.

These fundamental strengths translate into a compelling narrative for investors, driving increased confidence and contributing significantly to the Nifty's bullish run. The keywords "Indian economy," "GDP growth," "FII investment," and "corporate earnings" all point to this underlying strength.

Sector-Specific Performance Boosting the Nifty

The Nifty's bullish run isn't just a broad-based phenomenon; it's driven by strong performances across several key sectors:

- IT Sector's Strong Performance: The Indian IT sector continues to thrive, fueled by robust global demand for technology services. This sector's consistent growth significantly contributes to the Nifty's overall positive performance.

- Financial Services Sector Growth: The financial services sector, encompassing banking, insurance, and NBFCs, is experiencing significant growth, driven by increased lending activity and the rapid adoption of digital financial services.

- Positive Outlook for Manufacturing and Infrastructure: The government's focus on infrastructure development creates a ripple effect, boosting the manufacturing sector and associated industries. This translates into robust growth and contributes to the overall market positivity.

- Energy Sector's Contribution: Despite global energy price fluctuations, the Indian energy sector shows resilience, indicating a strong domestic demand and ongoing investment in renewable energy sources.

These sector-specific successes paint a broader picture of economic diversification and resilience, further solidifying the positive "India Market Buzz: Nifty's Bullish Run." The related keywords, "IT sector," "financial services," "manufacturing," and "infrastructure," highlight the diverse drivers of this growth.

Global Factors Contributing to the Positive Sentiment

While domestic factors are crucial, global macroeconomic trends also play a significant role in shaping the positive sentiment surrounding the Indian market:

- Easing Global Inflation Concerns: Although inflation remains a concern globally, easing inflationary pressures reduce the risk of aggressive monetary tightening, creating a more stable investment environment.

- Stable Global Financial Markets: Relatively stable global financial markets contribute to increased investor confidence, making emerging markets like India more attractive investment destinations.

- Improved Investor Risk Appetite: A generally improved investor risk appetite globally leads to increased capital flows into emerging markets, benefiting the Indian stock market.

- Geopolitical Factors and their Impact on India: While geopolitical risks always exist, the relative stability in certain global regions contributes to a more predictable investment environment for India.

These global trends positively influence investor perception of the Indian market, further fueling the Nifty's upward trajectory and adding to the overall "India Market Buzz: Nifty's Bullish Run." The keywords "global inflation," "global markets," and "geopolitical risks" are crucial in understanding the context.

Potential Risks and Challenges Ahead

While the outlook is largely positive, it's crucial to acknowledge potential headwinds that could impact the continued bullish run:

- Global Economic Slowdown Risks: A global economic slowdown could negatively impact Indian exports and investment inflows, potentially dampening the market's enthusiasm.

- Inflationary Pressures: Persistent inflationary pressures could lead to tighter monetary policy, impacting economic growth and potentially slowing the Nifty's ascent.

- Geopolitical Uncertainties: Unpredictable geopolitical events can create market volatility and impact investor sentiment.

- Regulatory Changes and their Potential Impact: Changes in government regulations could impact specific sectors and influence market dynamics.

A balanced risk assessment is crucial. While the "India Market Buzz: Nifty's Bullish Run" is currently strong, understanding potential risks like "inflationary risks" and "market volatility" is vital for informed decision-making.

Conclusion: Riding the Wave of India Market Buzz: Nifty's Bullish Run

The Nifty's impressive bullish run is a testament to India's robust economic fundamentals, strong sector-specific performances, and a generally favorable global environment. Factors like consistent GDP growth, increased FII inflows, and the positive performance of key sectors like IT and financial services have all contributed significantly. However, it's crucial to acknowledge potential risks, including global economic slowdown concerns and inflationary pressures. Staying informed about the "India Market Buzz: Nifty's Bullish Run" and understanding these nuances is vital for navigating this dynamic market. For tailored investment strategies, consult with a qualified financial professional. Continue exploring related topics to stay updated on the exciting developments in the Indian market and the continuing India Market Buzz.

Featured Posts

-

The Complexities Of The Chinese Market A Look At Bmw And Porsches Challenges

Apr 24, 2025

The Complexities Of The Chinese Market A Look At Bmw And Porsches Challenges

Apr 24, 2025 -

Ray Epps V Fox News A Deep Dive Into The Jan 6th Defamation Lawsuit

Apr 24, 2025

Ray Epps V Fox News A Deep Dive Into The Jan 6th Defamation Lawsuit

Apr 24, 2025 -

The China Factor Assessing Risks And Opportunities For Premium Car Brands

Apr 24, 2025

The China Factor Assessing Risks And Opportunities For Premium Car Brands

Apr 24, 2025 -

The Power Of Middle Management Driving Performance And Fostering A Positive Work Environment

Apr 24, 2025

The Power Of Middle Management Driving Performance And Fostering A Positive Work Environment

Apr 24, 2025 -

60 Minutes Producers Resignation Loss Of Independence Cited After Trump Lawsuit

Apr 24, 2025

60 Minutes Producers Resignation Loss Of Independence Cited After Trump Lawsuit

Apr 24, 2025

Latest Posts

-

Regulatory Changes Sought By Indian Insurers For Bond Forwards

May 10, 2025

Regulatory Changes Sought By Indian Insurers For Bond Forwards

May 10, 2025 -

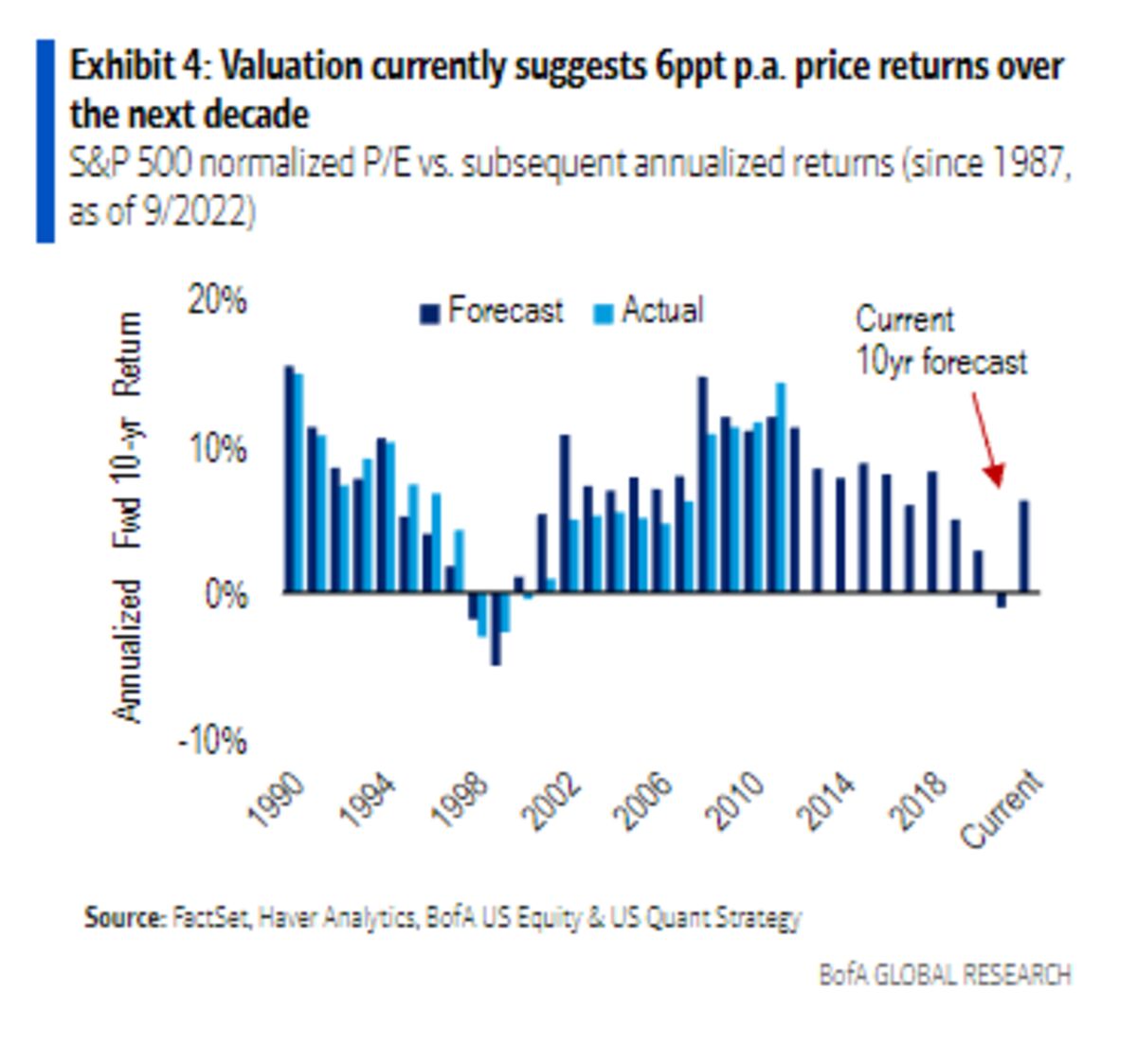

Should Investors Worry About Current Stock Market Valuations Bof As Answer

May 10, 2025

Should Investors Worry About Current Stock Market Valuations Bof As Answer

May 10, 2025 -

Indian Insurance Sector Seeks Simplification Of Bond Forward Regulations

May 10, 2025

Indian Insurance Sector Seeks Simplification Of Bond Forward Regulations

May 10, 2025 -

Call For Regulatory Reform Indian Insurers And Bond Forwards

May 10, 2025

Call For Regulatory Reform Indian Insurers And Bond Forwards

May 10, 2025 -

Indian Insurers Seek Regulatory Easing On Bond Forwards

May 10, 2025

Indian Insurers Seek Regulatory Easing On Bond Forwards

May 10, 2025