Klarna IPO: $1 Billion Filing Expected Next Week

Table of Contents

Expected Valuation and Timing of the Klarna IPO

Klarna's upcoming IPO is generating significant buzz, with speculation centering around a valuation approaching $1 billion. While the exact figure remains unconfirmed, this valuation reflects Klarna's impressive growth and market leadership in the rapidly expanding BNPL sector. The filing is expected next week, although potential delays are always possible given the complexities of such a large-scale IPO. Several factors influence this substantial valuation:

- Market Conditions: The current market climate, characterized by volatility and uncertainty, will play a crucial role in determining the final IPO price. Investor risk appetite and overall market sentiment towards fintech investments will be key determinants.

- Klarna's Growth Trajectory: Klarna's phenomenal growth in terms of transaction volume, user base, and geographic expansion significantly contributes to its high valuation. The company's consistent expansion into new markets and its strong partnerships with major retailers have solidified its market position.

- Competition: While Klarna is a leader in the BNPL space, competition from companies like Affirm and Afterpay will inevitably influence investor perceptions and the final valuation.

Bullet Points:

- Potential IPO price range: While specifics are yet to be released, analysts predict a wide range, depending on market conditions.

- Number of shares to be offered: The exact number of shares offered will be detailed in the official filing next week.

- Expected listing exchange: The most likely exchanges are Nasdaq and the Stockholm Stock Exchange, offering broad investor access.

- Lead underwriters involved: The lead underwriters will be key players in managing the IPO process and ensuring a successful launch.

Klarna's Business Model and Market Position

Klarna's success stems from its innovative buy now pay later (BNPL) business model. This allows consumers to purchase goods and services and pay later in installments, often interest-free. This model has resonated strongly with consumers and retailers alike, driving Klarna's rapid expansion.

Klarna holds a substantial market share in the BNPL sector, enjoying several competitive advantages:

- Brand Recognition: Klarna has established a strong brand identity and enjoys high consumer trust.

- Technology: Klarna's robust technology platform facilitates seamless integration with retailers and offers a smooth user experience.

- Global Reach: Klarna operates in numerous countries, showcasing its adaptability and global ambitions.

- Retailer Partnerships: Strategic partnerships with major retailers provide Klarna with access to a vast customer base and consistent transaction volume.

Bullet Points:

- Key metrics demonstrating Klarna's growth: Klarna's growth is reflected in its impressive transaction volume, rapidly expanding user base, and increasing market penetration.

- Geographic market penetration and future expansion plans: Klarna's international presence continues to expand, with plans for further global reach.

- Comparison to competitors: While facing competition from other BNPL providers, Klarna's brand recognition and technology give it a significant advantage.

- Risk factors associated with the BNPL model: Risks include potential increases in consumer debt, evolving regulatory landscapes, and the potential for economic downturns impacting consumer spending.

Investor Sentiment and Market Outlook for the Klarna IPO

Investor sentiment towards fintech IPOs and the BNPL sector is currently mixed. While the sector has seen significant growth, recent market volatility has introduced uncertainty. Several factors will influence the success of the Klarna IPO:

- Macroeconomic Factors: Global economic conditions, inflation rates, and interest rate hikes all impact investor confidence and risk appetite.

- Regulatory Scrutiny: Increasing regulatory scrutiny of the BNPL sector poses a potential challenge for Klarna and other BNPL providers.

- Competition: The competitive landscape is dynamic, with new entrants and existing players vying for market share.

Bullet Points:

- Recent performance of similar fintech IPOs: The recent performance of other fintech IPOs will influence investor expectations for Klarna.

- Impact of macroeconomic factors on investor confidence: Economic uncertainty can dampen investor enthusiasm for high-growth, high-risk investments.

- Potential risks associated with the current economic climate: A downturn could significantly impact consumer spending and consequently affect Klarna's performance.

- Analysis of potential investor demand for Klarna shares: The level of investor demand will determine the success of the IPO and its pricing.

Regulatory Landscape and Future Implications

The regulatory landscape for BNPL services is evolving rapidly, with various countries implementing new rules and guidelines. This evolving regulatory landscape presents both challenges and opportunities for Klarna:

Bullet Points:

- Key regulatory bodies impacting BNPL: Regulatory bodies like the FCA in the UK and the CFPB in the US are actively shaping the BNPL regulatory environment.

- Potential changes in consumer protection laws: Increased consumer protection measures may impact Klarna's operations and profitability.

- Impact of stricter lending regulations: More stringent lending regulations could affect Klarna's ability to offer its services to certain customer segments.

Conclusion

The upcoming Klarna IPO represents a significant event for the fintech sector and the buy now pay later market. While the expected $1 billion valuation highlights Klarna's impressive growth and market position, investors should carefully consider the potential risks and challenges inherent in the BNPL model and the broader economic environment. Understanding Klarna's business model, market position, and the regulatory landscape will be crucial for making informed investment decisions. Stay tuned for further updates on the Klarna IPO and prepare for a potentially transformative moment in the world of fintech. Learn more about the anticipated Klarna IPO and its implications for the BNPL market by following our future updates and research on the Klarna Initial Public Offering.

Featured Posts

-

Klarna Ipo 1 Billion Filing Expected Next Week

May 14, 2025

Klarna Ipo 1 Billion Filing Expected Next Week

May 14, 2025 -

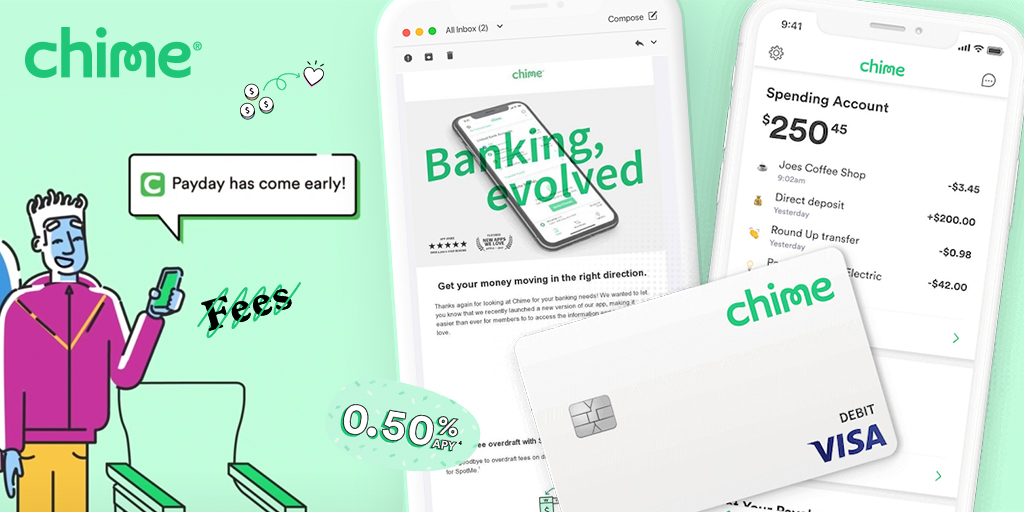

Chime Ipo Digital Banking Startup Reveals Rising Revenue Ahead Of Public Offering

May 14, 2025

Chime Ipo Digital Banking Startup Reveals Rising Revenue Ahead Of Public Offering

May 14, 2025 -

Alqfzt Alkbra Ywrwfyjn Wsylyn Dywn

May 14, 2025

Alqfzt Alkbra Ywrwfyjn Wsylyn Dywn

May 14, 2025 -

Budapesten Tert Vissza Tommy Fury Jake Paulnak Szolt Fotok

May 14, 2025

Budapesten Tert Vissza Tommy Fury Jake Paulnak Szolt Fotok

May 14, 2025 -

Mlb Season 2025 Evaluating The Top Performers And Underachievers At The 30 Game Mark

May 14, 2025

Mlb Season 2025 Evaluating The Top Performers And Underachievers At The 30 Game Mark

May 14, 2025