Market Losses In Frankfurt: DAX Under 24,000 At Closing

Table of Contents

Key Factors Contributing to the DAX Decline

Several interconnected factors contributed to the DAX's dramatic fall below 24,000. Understanding these elements is crucial for navigating the current market volatility.

Inflationary Pressures and Rising Interest Rates

Rising inflation continues to plague the Eurozone, impacting investor confidence and stock valuations. The European Central Bank (ECB) has responded with interest rate hikes, aiming to curb inflation. However, these hikes also increase borrowing costs for businesses, impacting corporate profits and potentially slowing economic growth.

- Impact on Corporate Profits: Higher interest rates make it more expensive for companies to borrow money, reducing investment and potentially impacting profitability. This directly affects stock valuations.

- Inflationary Pressures: Eurozone inflation remains stubbornly high, exceeding the ECB's target significantly. This erodes purchasing power and dampens consumer spending, negatively impacting company revenues.

- Future ECB Actions: The ECB's future monetary policy decisions remain uncertain. Further interest rate increases could put additional pressure on the DAX and the broader German economy. The market is anxiously awaiting further announcements.

Geopolitical Uncertainty and Global Economic Slowdown

Geopolitical uncertainty, particularly the ongoing war in Ukraine and its impact on energy supplies, significantly contributes to market anxieties. This uncertainty fuels recession fears, impacting investor sentiment and prompting a flight to safety.

- Energy Crisis: The energy crisis, exacerbated by the war in Ukraine, is placing significant strain on German businesses and increasing production costs.

- Global Economic Slowdown: Forecasts for global economic growth have been revised downwards, increasing fears of a potential recession. This dampens investor confidence and drives capital out of riskier assets like stocks.

- Impact on German Exports: Germany's export-oriented economy is particularly vulnerable to global economic slowdowns. Reduced demand from international markets further weakens the DAX.

Sector-Specific Weaknesses within the DAX

The DAX decline isn't uniform across all sectors. Certain sectors experienced sharper losses than others, reflecting specific vulnerabilities.

- Automotive Industry: The automotive industry is facing challenges related to supply chain disruptions and the transition to electric vehicles. Several major automotive companies listed on the DAX experienced significant drops.

- Technology Sector: The tech sector, sensitive to interest rate hikes and potential economic slowdowns, also saw considerable losses. High valuations in the tech sector make it particularly vulnerable during periods of uncertainty.

- Energy Sector: While energy companies might benefit from higher energy prices in the short term, concerns about future demand and regulatory changes can impact stock performance.

Impact on Investors and the German Economy

The DAX's plunge below 24,000 has far-reaching implications for both individual investors and the German economy.

Implications for Individual Investors

The market downturn translates to potential losses in investment portfolios. Investors need to carefully assess their risk tolerance and consider strategies to mitigate potential further losses.

- Portfolio Management: Diversification is key to managing risk. Investors should consider diversifying their portfolios across different asset classes and sectors.

- Investment Strategy: A long-term investment strategy that considers risk tolerance and financial goals is crucial. Avoid impulsive reactions to short-term market fluctuations.

- Seeking Professional Advice: During periods of market volatility, seeking advice from a qualified financial advisor is highly recommended.

Broader Economic Consequences for Germany

The DAX decline is a significant indicator of wider economic concerns for Germany. A sustained downturn could lead to decreased consumer spending, job losses, and slower economic growth.

- Decreased Consumer Spending: Market uncertainty and potential job losses can lead to decreased consumer confidence and spending, further impacting the economy.

- Potential Job Losses: Companies facing reduced profits and demand may resort to layoffs or hiring freezes, impacting employment rates.

- Government Policy: The German government may need to intervene with fiscal or monetary policies to stimulate the economy and mitigate the impact of the DAX decline.

Conclusion

The DAX's fall below 24,000 signifies a significant downturn in the German stock market, driven by a combination of inflationary pressures, geopolitical uncertainty, and sector-specific weaknesses. This decline has considerable implications for both individual investors and the German economy as a whole. Staying informed about market fluctuations is crucial for navigating these challenging times. Continue to monitor the DAX index and related news to make informed investment decisions. Understand the factors impacting Market Losses in Frankfurt and develop a robust investment strategy to mitigate risk. Learn more about managing your portfolio in the face of DAX declines.

Featured Posts

-

Green Spaces And Mental Well Being A Seattle Case Study From The Pandemic

May 24, 2025

Green Spaces And Mental Well Being A Seattle Case Study From The Pandemic

May 24, 2025 -

Avrupa Hisse Senedi Piyasalarinda Gerileme Stoxx Europe 600 Ve Dax 40 Analizi 16 Nisan 2025

May 24, 2025

Avrupa Hisse Senedi Piyasalarinda Gerileme Stoxx Europe 600 Ve Dax 40 Analizi 16 Nisan 2025

May 24, 2025 -

Lady Gaga And Michael Polansky At Snl Afterparty

May 24, 2025

Lady Gaga And Michael Polansky At Snl Afterparty

May 24, 2025 -

Kyle Walkers Milan Party Details Emerge Following Wifes Uk Trip

May 24, 2025

Kyle Walkers Milan Party Details Emerge Following Wifes Uk Trip

May 24, 2025 -

Picture This Prime Video Every Song Featured In The Soundtrack

May 24, 2025

Picture This Prime Video Every Song Featured In The Soundtrack

May 24, 2025

Latest Posts

-

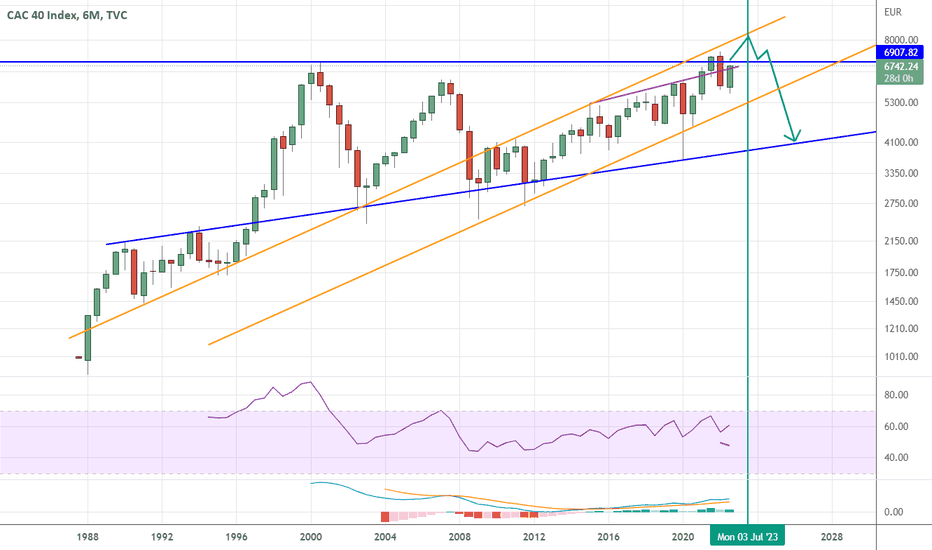

French Cac 40 Index Mixed Performance For The Week Ending March 7 2025

May 24, 2025

French Cac 40 Index Mixed Performance For The Week Ending March 7 2025

May 24, 2025 -

Slight Cac 40 Dip At Weeks End Remains Steady Overall March 7 2025

May 24, 2025

Slight Cac 40 Dip At Weeks End Remains Steady Overall March 7 2025

May 24, 2025 -

Cac 40 Index Finishes Week Lower But Shows Weekly Resilience March 7 2025

May 24, 2025

Cac 40 Index Finishes Week Lower But Shows Weekly Resilience March 7 2025

May 24, 2025 -

Cac 40 Weekly Close In Negative Territory Despite Overall Stability March 7 2025

May 24, 2025

Cac 40 Weekly Close In Negative Territory Despite Overall Stability March 7 2025

May 24, 2025 -

Crisi Moda Come I Dazi Di Trump Hanno Colpito Nike Lululemon E Il Mercato Europeo

May 24, 2025

Crisi Moda Come I Dazi Di Trump Hanno Colpito Nike Lululemon E Il Mercato Europeo

May 24, 2025