Net Asset Value (NAV) Explained: Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated?

Net Asset Value (NAV) represents the net value of an ETF's assets after deducting its liabilities. Essentially, it's the underlying value of the ETF's holdings. For the Amundi Dow Jones Industrial Average UCITS ETF, understanding its NAV is key to assessing its true worth. The fundamental formula for calculating NAV is simple:

Assets - Liabilities = NAV

Let's break down the components:

-

Assets: These are the ETF's holdings, primarily comprising:

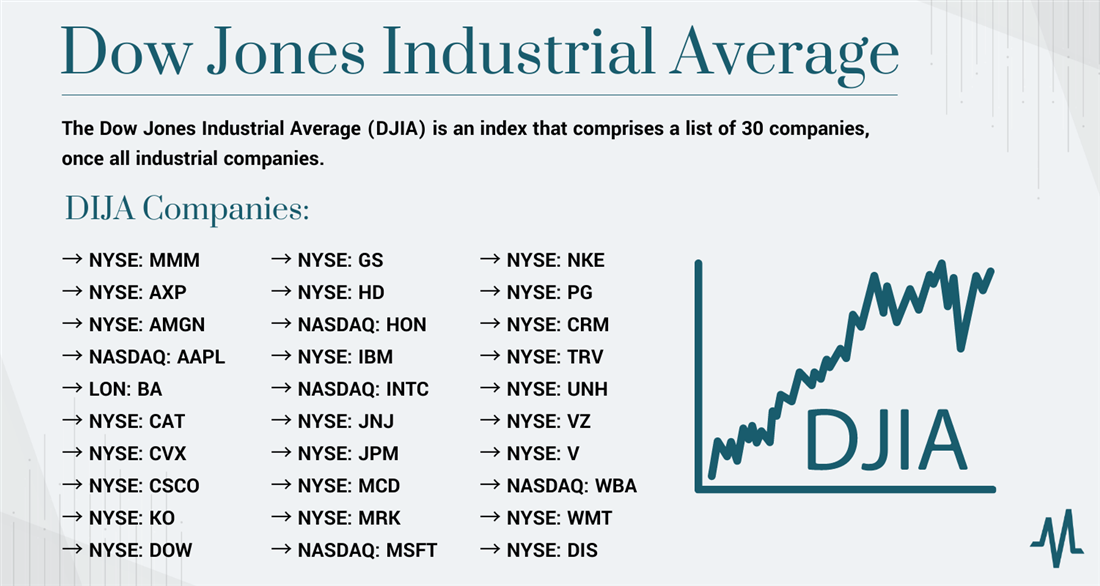

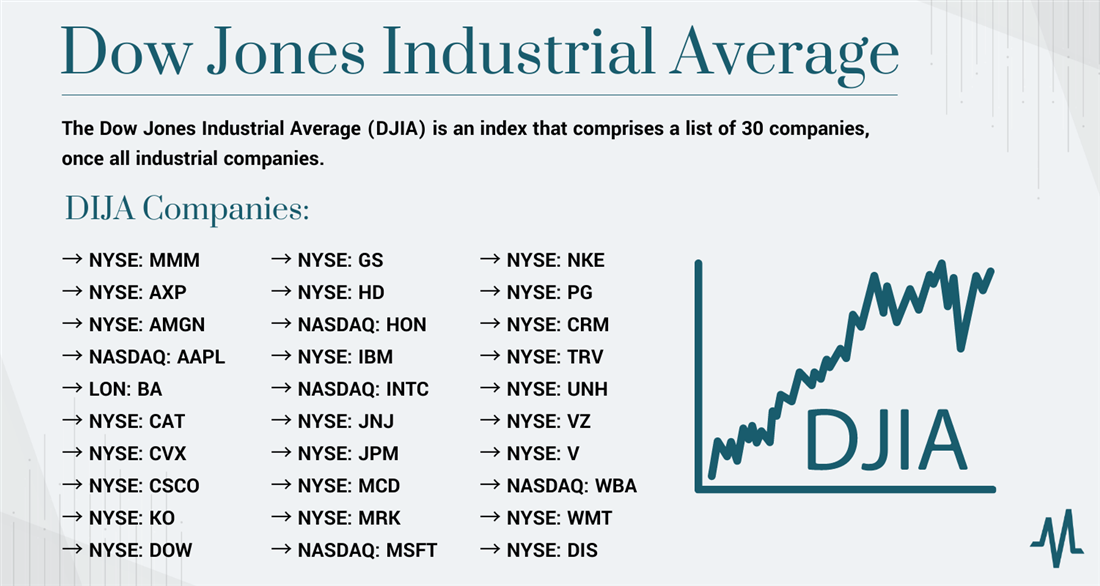

- Underlying Index Holdings: In the case of the Amundi Dow Jones Industrial Average UCITS ETF, this includes shares of the 30 companies that make up the Dow Jones Industrial Average.

- Cash: Any cash held by the ETF.

- Receivables: Amounts owed to the ETF.

-

Liabilities: These are the ETF's obligations, including:

- Expenses: Management fees, administrative costs, and other operating expenses.

- Payables: Amounts owed by the ETF to others.

The daily NAV calculation for ETFs like the Amundi Dow Jones Industrial Average UCITS ETF involves determining the market value of all assets, adding cash and receivables, subtracting liabilities, and then dividing the result by the number of outstanding shares. This process ensures a daily, up-to-date reflection of the ETF's net worth. Keywords: NAV calculation, ETF assets, ETF liabilities, daily NAV, Amundi Dow Jones Industrial Average UCITS ETF NAV.

NAV vs. Market Price of the Amundi Dow Jones Industrial Average UCITS ETF

While the NAV represents the intrinsic value of the Amundi Dow Jones Industrial Average UCITS ETF, the market price is the price at which the ETF is actually trading on the exchange. These two figures aren't always identical. Several factors can cause a discrepancy:

- Bid-Ask Spread: The difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask).

- Trading Volume: High trading volume generally leads to a smaller difference between NAV and market price, while low volume can increase the gap.

- Market Sentiment: Investor optimism or pessimism can influence the market price, leading to temporary deviations from the NAV.

Understanding this difference is crucial for investors. Ideally, you want to buy low (when the market price is below the NAV) and sell high (when the market price is above the NAV), maximizing your returns. Keywords: NAV vs Market Price, ETF market price, bid-ask spread, Amundi Dow Jones Industrial Average UCITS ETF price.

Importance of NAV in Investment Decisions for the Amundi Dow Jones Industrial Average UCITS ETF

NAV plays a vital role in your investment decisions regarding the Amundi Dow Jones Industrial Average UCITS ETF:

- Assessing Investment Value: The NAV provides a clear picture of the underlying value of your investment in the ETF.

- Comparing Similar ETFs: You can use the NAV to compare the Amundi Dow Jones Industrial Average UCITS ETF with other similar ETFs tracking the Dow Jones Industrial Average or other indices.

- Understanding ETF Performance and Risk: Tracking changes in NAV over time helps assess the ETF's performance and inherent risk.

- Finding Daily NAV: You can find the daily NAV for the Amundi Dow Jones Industrial Average UCITS ETF on the Amundi website or through major financial news sources.

By regularly monitoring the NAV, you can make better-informed investment choices and track the performance of your investment more accurately. Keywords: investment decisions, ETF performance, risk assessment, Amundi Dow Jones Industrial Average UCITS ETF performance, comparing ETFs.

Understanding the Amundi Dow Jones Industrial Average UCITS ETF's Holdings and their Impact on NAV

The Amundi Dow Jones Industrial Average UCITS ETF's portfolio mirrors the composition of the Dow Jones Industrial Average. This means it holds shares in 30 large, well-established US companies across various sectors.

- Impact of Underlying Stock Prices: Changes in the prices of these underlying stocks directly impact the ETF's NAV. If the Dow Jones Industrial Average rises, the NAV of the ETF will likely rise as well, and vice versa.

- Dividends and Corporate Actions: Dividends paid by the underlying companies are usually passed on to ETF investors, affecting the NAV. Corporate actions like stock splits or mergers can also influence the NAV.

Understanding these factors allows you to anticipate potential fluctuations in the ETF's NAV and make informed decisions based on your investment goals. Keywords: Amundi Dow Jones Industrial Average UCITS ETF holdings, Dow Jones Industrial Average, ETF portfolio, dividend impact on NAV, corporate actions.

Conclusion: Investing Wisely with Net Asset Value Knowledge

Understanding Net Asset Value (NAV) is essential for anyone investing in ETFs, especially the Amundi Dow Jones Industrial Average UCITS ETF. By comprehending the relationship between NAV and market price, you can make more informed investment decisions. Regularly researching the daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF and other ETFs will help you build a strong investment strategy. Remember, informed investing starts with understanding key metrics like Net Asset Value. For more information on the Amundi Dow Jones Industrial Average UCITS ETF and its NAV, visit the Amundi website [insert link here if available].

Featured Posts

-

Bbc Radio 1 Big Weekend 2025 Sefton Park Ticket Application Guide

May 24, 2025

Bbc Radio 1 Big Weekend 2025 Sefton Park Ticket Application Guide

May 24, 2025 -

Euronext Amsterdam Stocks Surge 8 After Trump Tariff Pause

May 24, 2025

Euronext Amsterdam Stocks Surge 8 After Trump Tariff Pause

May 24, 2025 -

Lauryn Goodmans Italy Move The Truth Behind The Kyle Walker Transfer Speculation

May 24, 2025

Lauryn Goodmans Italy Move The Truth Behind The Kyle Walker Transfer Speculation

May 24, 2025 -

Escape To The Country Benefits And Challenges Of Rural Life

May 24, 2025

Escape To The Country Benefits And Challenges Of Rural Life

May 24, 2025 -

Imcd N V Shareholders Approve All Resolutions At Annual General Meeting

May 24, 2025

Imcd N V Shareholders Approve All Resolutions At Annual General Meeting

May 24, 2025

Latest Posts

-

Analyse Snelle Marktverandering Europese Aandelen Een Vergelijking Met Wall Street

May 24, 2025

Analyse Snelle Marktverandering Europese Aandelen Een Vergelijking Met Wall Street

May 24, 2025 -

Amsterdam Exchange Suffers 7 Plunge Trade War Impact

May 24, 2025

Amsterdam Exchange Suffers 7 Plunge Trade War Impact

May 24, 2025 -

Important Updates Regarding Royal Philips 2025 Annual General Meeting

May 24, 2025

Important Updates Regarding Royal Philips 2025 Annual General Meeting

May 24, 2025 -

Sharp Decline In Amsterdam Stock Market Trade War Intensifies

May 24, 2025

Sharp Decline In Amsterdam Stock Market Trade War Intensifies

May 24, 2025 -

Zal De Snelle Markt Draai Van Europese Aandelen Ten Opzichte Van Wall Street Aanhouden

May 24, 2025

Zal De Snelle Markt Draai Van Europese Aandelen Ten Opzichte Van Wall Street Aanhouden

May 24, 2025