Net Asset Value (NAV) Explained: Amundi MSCI World II UCITS ETF Dist

Table of Contents

How NAV is Calculated for the Amundi MSCI World II UCITS ETF Dist

The Net Asset Value (NAV) of the Amundi MSCI World II UCITS ETF Dist represents the net value of its underlying assets minus its liabilities, all divided by the number of outstanding shares. This UCITS ETF holds a diversified portfolio of global equities, mirroring the MSCI World Index. Calculating the NAV involves several steps:

- Identify all assets held by the ETF: This includes the market value of each individual stock held within the Amundi MSCI World II UCITS ETF Dist portfolio. The ETF's holdings are publicly available and usually updated regularly.

- Determine the market value of each asset: The market value is typically determined by the closing price of each stock on the relevant exchange.

- Sum the market values of all assets: This provides the total market value of the ETF's portfolio.

- Subtract any liabilities (expenses, debts): This includes management fees, administrative expenses, and any other outstanding liabilities.

- Divide the result by the number of outstanding shares: This final calculation yields the Net Asset Value per share.

The NAV is typically calculated daily, providing investors with a snapshot of the ETF's value at the end of each trading day. The fund manager, Amundi, is responsible for ensuring the accuracy of the NAV calculation.

The Importance of NAV for Amundi MSCI World II UCITS ETF Dist Investors

Understanding the NAV of your Amundi MSCI World II UCITS ETF Dist investment is crucial for several reasons:

-

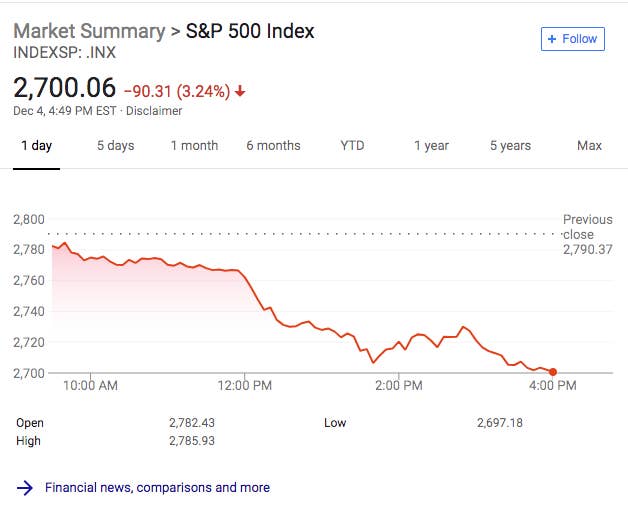

Track ETF performance: By comparing NAV changes over time, you can easily assess the performance of your investment. Consistent monitoring allows you to track returns and make informed decisions about your investment strategy.

-

Determine purchase and sale prices: The NAV provides a benchmark for the price at which you buy or sell your ETF shares. While the market price might fluctuate, the NAV gives you a clearer picture of the intrinsic value.

-

Assess fund value: NAV reflects the true net asset value of the underlying investments within the ETF, providing a transparent view of your holdings' worth.

-

NAV helps compare the ETF to benchmarks: By comparing the NAV to the benchmark index (MSCI World Index), you can evaluate the fund manager’s performance.

-

NAV reflects the true value of your investment: Unlike the market price which can be influenced by market sentiment, NAV provides a more stable indicator of the underlying assets’ value.

-

Monitoring NAV helps identify potential under or overvaluation: Significant discrepancies between the NAV and market price might signal opportunities or risks.

NAV vs. Market Price of Amundi MSCI World II UCITS ETF Dist

While the NAV represents the underlying asset value, the market price is the price at which the ETF shares are actually traded on the exchange. Several factors can cause discrepancies:

- Supply and demand: High demand can drive the market price above the NAV (a premium), while low demand can push it below (a discount).

- Trading costs: Brokerage commissions and other trading fees can also influence the market price.

Understanding this difference is essential. A premium suggests the market is optimistic about the ETF's future performance, while a discount might indicate a pessimistic outlook or temporary market conditions.

Where to Find the NAV for Amundi MSCI World II UCITS ETF Dist

Finding the daily NAV for the Amundi MSCI World II UCITS ETF Dist is straightforward:

- Amundi's website: The ETF provider's website is the most reliable source for official NAV data.

- Financial news websites: Many financial news sources provide real-time or delayed NAV quotes for ETFs.

- Brokerage platforms: Your brokerage account will display the NAV (and market price) of your ETF holdings.

Always ensure you are interpreting the data correctly. Pay close attention to the date and time the NAV was calculated.

Conclusion: Making Informed Investment Decisions with Amundi MSCI World II UCITS ETF Dist NAV

Understanding Net Asset Value is crucial for evaluating the performance and value of your investment in the Amundi MSCI World II UCITS ETF Dist. Regularly monitoring the NAV, in conjunction with understanding market prices and the factors that influence them, allows for more informed investment decisions. By understanding and regularly checking the Net Asset Value, you can confidently manage your investment in the Amundi MSCI World II UCITS ETF Dist and achieve your financial goals. Remember to use multiple sources to confirm the NAV and always consider the broader market context when interpreting this important metric.

Featured Posts

-

Proverte Svoi Znaniya Roli Olega Basilashvili V Kino

May 24, 2025

Proverte Svoi Znaniya Roli Olega Basilashvili V Kino

May 24, 2025 -

Amsterdam Residents Take Legal Action Against City Over Tik Tok Fueled Crowds At Popular Snack Bar

May 24, 2025

Amsterdam Residents Take Legal Action Against City Over Tik Tok Fueled Crowds At Popular Snack Bar

May 24, 2025 -

Planning Your Country Escape Location Lifestyle And Logistics

May 24, 2025

Planning Your Country Escape Location Lifestyle And Logistics

May 24, 2025 -

Drapers Maiden Atp Masters 1000 Triumph In Indian Wells

May 24, 2025

Drapers Maiden Atp Masters 1000 Triumph In Indian Wells

May 24, 2025 -

89 Svadeb V Krasivuyu Datu Kharkovschina Bet Rekordy

May 24, 2025

89 Svadeb V Krasivuyu Datu Kharkovschina Bet Rekordy

May 24, 2025

Latest Posts

-

Euronext Amsterdam Stocks Surge 8 After Trump Tariff Pause

May 24, 2025

Euronext Amsterdam Stocks Surge 8 After Trump Tariff Pause

May 24, 2025 -

Herstel Op Beurzen Na Uitstel Trump Alle Aex Fondsen In Het Groen

May 24, 2025

Herstel Op Beurzen Na Uitstel Trump Alle Aex Fondsen In Het Groen

May 24, 2025 -

Imcd N V Annual General Meeting Successful Vote On All Resolutions

May 24, 2025

Imcd N V Annual General Meeting Successful Vote On All Resolutions

May 24, 2025 -

Trumps Tariff Increase Sends Amsterdam Stock Exchange Down 2

May 24, 2025

Trumps Tariff Increase Sends Amsterdam Stock Exchange Down 2

May 24, 2025 -

Shareholders Approve All Resolutions At Imcd N V Annual General Meeting

May 24, 2025

Shareholders Approve All Resolutions At Imcd N V Annual General Meeting

May 24, 2025