Reduced Tesla Q1 Profitability: Exploring The Impact Of Elon Musk's Role

Table of Contents

Price Wars and the Impact on Margins

Aggressive Pricing Strategies

Tesla's aggressive price cuts throughout Q1 2024 significantly impacted its profit margins. This strategy, while aiming to boost sales volume and Tesla market share, resulted in a considerable decrease in profitability per vehicle.

- Examples: Significant price reductions were implemented across the Model 3, Model Y, and Model S/X lines, often exceeding those of competitors. Some reductions were as high as 20%, a dramatic shift in pricing strategy.

- Comparison: While competitors also adjusted pricing, Tesla's cuts were more drastic and widespread, potentially sparking a price war within the EV sector.

- Analysis: Initial sales volume increases did occur following the price drops, but the resulting margin compression offset much of the revenue gains, leading to the reported reduced Tesla profitability. The question remains: was the increase in sales volume sufficient to compensate for the significantly reduced profit margins?

Keyword focus: Tesla price cuts, Tesla profit margin, price war impact, Tesla sales volume, Tesla Q1 earnings.

The Justification for Price Cuts

Musk publicly justified the price reductions by emphasizing the need to increase Tesla market share and stimulate demand. He argued that higher sales volume would eventually offset the lower margins.

- Musk's Statements: Musk frequently used social media to explain these decisions, emphasizing the long-term vision of market dominance. Direct quotes need to be sourced here from credible news outlets.

- Effectiveness: The effectiveness of this strategy remains debatable. While sales did increase, the impact on Tesla's overall financial performance in Q1 suggests that the lower profit margins outweighed the volume gains.

- Counterarguments: Critics argue that the price cuts were overly aggressive, potentially eroding brand value and harming long-term profitability. A more measured approach might have been more beneficial.

Keyword focus: Elon Musk quotes, Tesla market share, demand stimulation, Tesla sales strategy, Tesla business strategy.

Diversion of Resources and Attention

Focus on SpaceX and Other Ventures

Musk's extensive involvement in SpaceX, X (formerly Twitter), and other ventures has raised concerns about potential resource diversion from Tesla's core operations.

- Significant Investments: Substantial financial and human resources are committed to SpaceX's ambitious space exploration projects and the ongoing development of X.

- Impact on Tesla: This diversion of resources could have negatively impacted Tesla's product development timelines, operational efficiency, and innovation efforts. Less focus on Tesla's core business could have contributed to slower releases of new products or delays in production.

Keyword focus: SpaceX impact on Tesla, Elon Musk distractions, Twitter effect on Tesla, Tesla resource allocation, Musk's impact on Tesla.

Leadership and Management Style

Musk's demanding and often unconventional leadership style has been a subject of both praise and criticism.

- Controversial Decisions: Examples of controversial management decisions, potentially impacting employee morale and productivity, should be included here (sourced from reputable news sources).

- Employee Morale and Turnover: Reports of high employee turnover and fluctuating employee morale within Tesla should be analyzed and linked to potential impacts on productivity and overall performance.

- Impact on Innovation: While his leadership has spurred innovation in some areas, a demanding environment might stifle creativity and efficient decision-making in others.

Keyword focus: Elon Musk leadership, Tesla management, employee morale, Tesla innovation, Tesla productivity, Tesla financial performance.

External Factors and their Interaction with Musk's Decisions

Global Economic Uncertainty

Global economic headwinds, supply chain disruptions, and rising interest rates all contributed to a challenging environment for Tesla in Q1 2024. Musk's strategic decisions interacted with these external factors.

- Economic Indicators: Relevant economic indicators (inflation rates, interest rates, consumer confidence) should be referenced to illustrate the external pressures on Tesla.

- Exacerbation or Mitigation: Analysis of how these external factors interacted with Musk's price reduction strategy is necessary. Did they exacerbate the negative impact on profit margins, or did they mitigate the effects?

- Alternative Strategies: Exploring alternative strategies Tesla could have employed in this challenging economic climate is crucial for understanding the overall picture.

Keyword focus: Global economic impact, supply chain disruption, interest rate effect, Tesla external factors, reduced Tesla profitability.

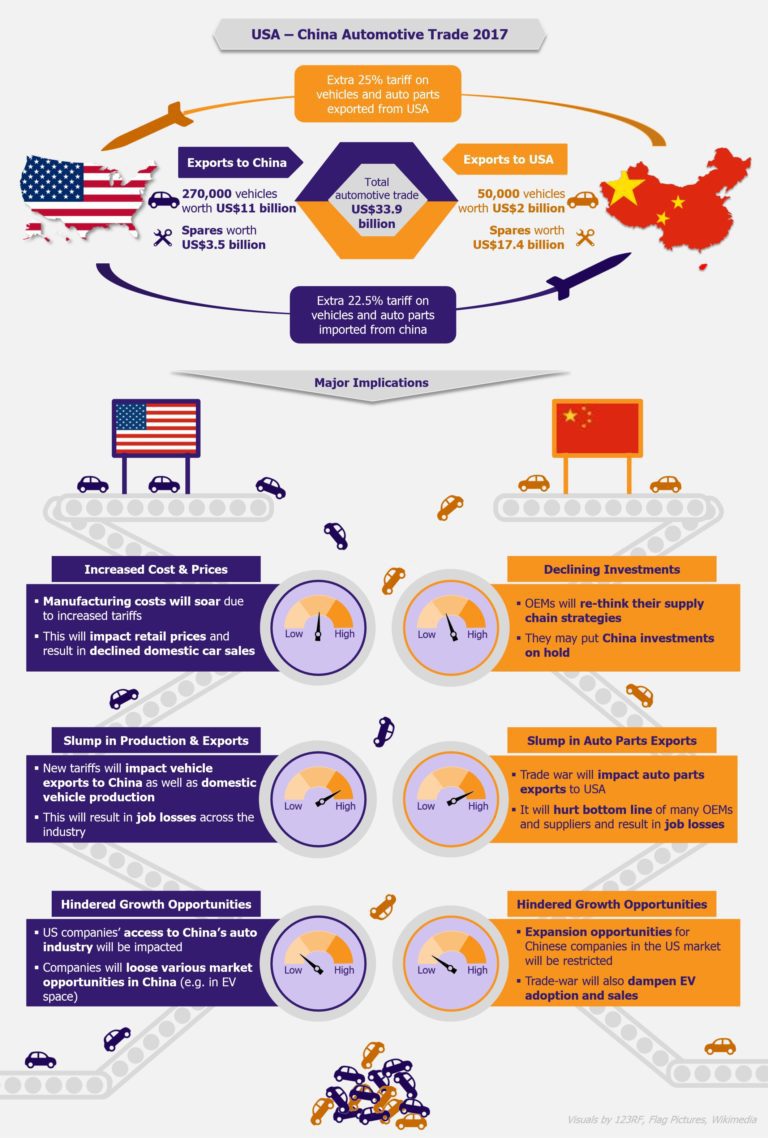

Competition and Market Dynamics

The intensifying competition in the electric vehicle market, with established automakers and new entrants, presents a significant challenge for Tesla.

- Competitor Strategies: Analyze the strategies of key competitors like Ford, GM, BYD, and others, and explain how their actions affected Tesla's position.

- Market Share Changes: Track the changes in Tesla's market share throughout Q1 and discuss the impact of increased competition.

- Tesla's Competitive Positioning: Evaluate Tesla's competitive positioning, considering the interplay of its pricing strategies and the actions of its rivals.

Keyword focus: EV competition, Tesla market share, competitive landscape, Tesla strategy, Tesla stock price.

Conclusion

Tesla's reduced Q1 profitability is a multifaceted issue. While external pressures, such as global economic uncertainty and intensified EV competition, played a role, Elon Musk's strategic decisions, notably aggressive pricing and potential resource allocation challenges, significantly impacted Tesla's financial performance. Understanding this interplay is crucial for investors and analysts. Further analysis is needed to assess the long-term effects and determine whether strategic adjustments are necessary to restore robust profitability for Tesla. To stay updated on the evolving landscape of reduced Tesla profitability and Elon Musk's influence, continue following reputable financial news and expert analyses.

Featured Posts

-

Chinese Equities Soar Hong Kong Market Responds To Trade Optimism

Apr 24, 2025

Chinese Equities Soar Hong Kong Market Responds To Trade Optimism

Apr 24, 2025 -

Facing Us Trade War Canadian Auto Dealers Release Crucial Five Point Plan

Apr 24, 2025

Facing Us Trade War Canadian Auto Dealers Release Crucial Five Point Plan

Apr 24, 2025 -

Is This Startup Airlines Reliance On Deportation Flights Ethical

Apr 24, 2025

Is This Startup Airlines Reliance On Deportation Flights Ethical

Apr 24, 2025 -

Elon Musk Doge And The Epa A Turning Point For Tesla And Space X

Apr 24, 2025

Elon Musk Doge And The Epa A Turning Point For Tesla And Space X

Apr 24, 2025 -

Us Stock Futures Surge Trumps Powell Comments Boost Markets

Apr 24, 2025

Us Stock Futures Surge Trumps Powell Comments Boost Markets

Apr 24, 2025

Latest Posts

-

Analyzing The Trump Administration A Case Study Of Day 109 May 8th 2025

May 10, 2025

Analyzing The Trump Administration A Case Study Of Day 109 May 8th 2025

May 10, 2025 -

Trump Administration Day 109 May 8th 2025 Key Events And Analysis

May 10, 2025

Trump Administration Day 109 May 8th 2025 Key Events And Analysis

May 10, 2025 -

Evaluating Ag Pam Bondis Decision A Public Vote On The Epstein Files

May 10, 2025

Evaluating Ag Pam Bondis Decision A Public Vote On The Epstein Files

May 10, 2025 -

Attorney General Uses Prop Fentanyl To Illustrate Drug Crisis

May 10, 2025

Attorney General Uses Prop Fentanyl To Illustrate Drug Crisis

May 10, 2025 -

The Jeffrey Epstein Files Should We Vote On Their Release A Look At Pam Bondis Actions

May 10, 2025

The Jeffrey Epstein Files Should We Vote On Their Release A Look At Pam Bondis Actions

May 10, 2025