US Stock Futures Surge: Trump's Powell Comments Boost Markets

Table of Contents

Trump's Comments and their Market Impact

Analysis of Trump's Specific Statements

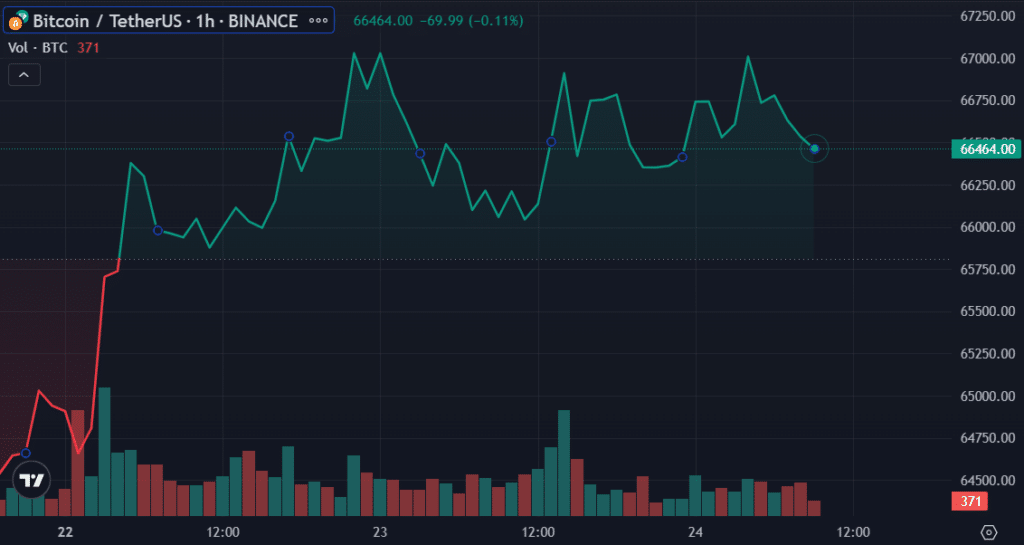

Trump's comments, released via social media this morning, were highly critical of current Federal Reserve Chairman Jerome Powell and his handling of monetary policy. He specifically criticized what he deemed overly aggressive interest rate hikes, suggesting these actions were harming the economy. While the exact wording varied across platforms, several key phrases repeatedly emerged.

- "Powell is ruining our economy!": This blunt statement immediately captured attention and signaled a strong negative view of the current economic trajectory. Financial analysts interpreted this as a direct attack on the Fed's tightening monetary policy, raising concerns about potential political interference. The immediate market response was a small, yet noticeable, upward tick in futures contracts.

- "Interest rates are far too high": This comment echoed a sentiment shared by many who believe the aggressive rate hikes have cooled economic growth too rapidly. The market reacted positively to this sentiment, suggesting investors are hoping for a more accommodative monetary policy in the near future.

- "The Fed needs to reverse course": This call for a policy shift fueled speculation about potential future changes in interest rate targets and quantitative easing programs. This fueled further buying activity in the futures market.

Market Reaction in Real-Time

Following Trump's comments, the market reacted swiftly. Key indices saw immediate increases:

- Dow Jones Futures: Increased by 2.7% within minutes of the statements.

- S&P 500 Futures: Saw a 2.5% jump, mirroring the broader market optimism.

- Nasdaq Futures: Experienced a 3% surge, suggesting investors anticipate positive effects on the technology sector.

Trading volume increased dramatically as investors reacted to this unexpected news, indicating heightened market volatility. Specific stocks, particularly those sensitive to interest rate changes, also saw significant price movements. This initial surge highlights the significant influence political commentary can have on market sentiment and trading activity within US stock futures.

Powell's Response and its Significance

Powell's Past Actions and Their Influence

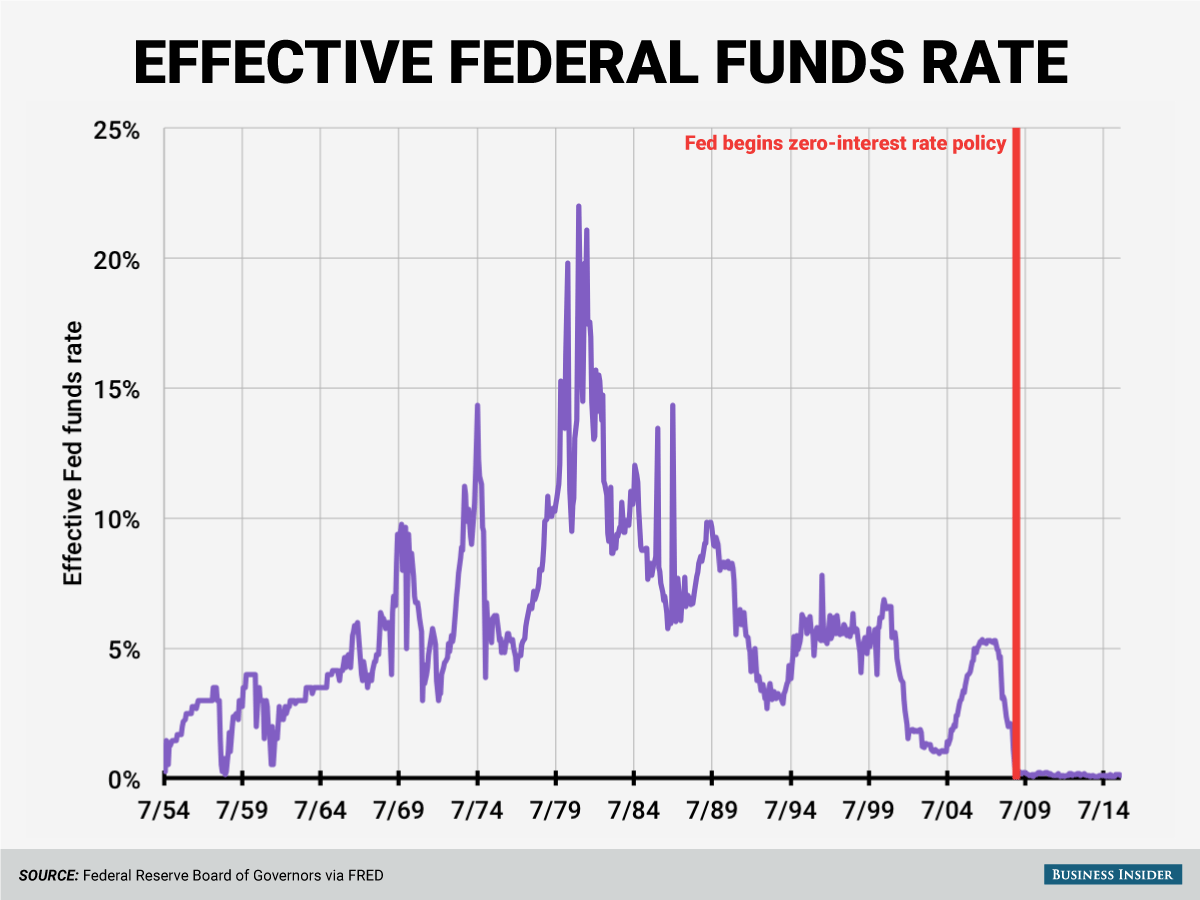

Powell's recent actions, including several interest rate hikes aimed at combating inflation, may have directly influenced Trump's criticism. These hikes, while intended to stabilize the economy, have also slowed economic growth and created concerns about potential recessionary pressures.

- Interest Rate Hikes: Several consecutive rate increases throughout 2022 and 2023 have tightened credit conditions and dampened economic activity.

- Quantitative Tightening: The reduction in the Fed's balance sheet is another aspect of Powell’s strategy which, while intended to reduce inflation, has been a target of criticism from various quarters.

These policies, while driven by economic considerations, appear to have prompted Trump's outspoken disapproval.

Potential Implications of Powell's Future Actions

Powell's response to Trump's criticism remains to be seen. However, several potential scenarios could unfold:

- Maintaining the Current Course: The Fed may choose to ignore the political pressure and continue its current monetary policy, prioritizing inflation control over short-term market reactions.

- Slight Adjustment: The Fed might make minor adjustments to its policy, perhaps slowing the pace of future rate hikes or offering more dovish forward guidance.

- Significant Policy Shift: This is less likely but could involve reversing course on interest rate hikes or resuming quantitative easing.

Each scenario would have significantly different implications for US stock futures and the broader economy.

Longer-Term Market Outlook Following the Surge

Analyst Predictions and Expert Opinions

Leading financial analysts offer varied perspectives on the longer-term market outlook:

- Cautious Optimism: Some analysts believe the current surge is a short-term reaction and caution against reading too much into Trump's comments.

- Sustainable Growth Potential: Others suggest the market has factored in interest rate hikes, and any shift towards a more accommodative stance could lead to sustained growth.

- Market Correction Risk: Concerns remain about potential market corrections due to lingering economic uncertainty and geopolitical risks.

The long-term implications remain uncertain, highlighting the need for careful analysis and diverse investment strategies.

Potential Risks and Uncertainties

Despite the current market optimism, several factors could negatively impact the sustained growth of US stock futures:

- Geopolitical Risks: Ongoing international conflicts and political instability can introduce significant market volatility.

- Economic Uncertainty: Recessionary fears and potential supply chain disruptions pose considerable risks.

- Inflationary Pressures: While current efforts aim to control inflation, unexpected surges could trigger further market corrections.

Conclusion: Understanding the US Stock Futures Surge and What's Next

Trump's strongly worded criticism of Jerome Powell and the Federal Reserve's monetary policy triggered a significant surge in US stock futures. While the immediate market reaction was positive, the long-term implications remain uncertain. The potential for future interest rate changes, and the ongoing balance between inflation control and economic growth, will dictate the course of the market. It’s crucial to remember the inherent volatility of the market and the need for careful consideration before making investment decisions. Stay informed about the ongoing developments affecting US stock futures and adapt your investment strategies accordingly. Continue to monitor the latest news on Trump's statements, Federal Reserve policy, and market trends. Careful market analysis is essential in navigating this period of uncertainty in the US stock futures market.

Featured Posts

-

Ella Bleu Travolta Iznenadujuca Ljepota Kceri Johna Travolte

Apr 24, 2025

Ella Bleu Travolta Iznenadujuca Ljepota Kceri Johna Travolte

Apr 24, 2025 -

Higher Education Funding Strategies In The Face Of Political Challenges

Apr 24, 2025

Higher Education Funding Strategies In The Face Of Political Challenges

Apr 24, 2025 -

Car Dealerships Step Up Pressure Against Electric Vehicle Regulations

Apr 24, 2025

Car Dealerships Step Up Pressure Against Electric Vehicle Regulations

Apr 24, 2025 -

Tesla Earnings Plunge Political Backlash Impacts Q1 Results

Apr 24, 2025

Tesla Earnings Plunge Political Backlash Impacts Q1 Results

Apr 24, 2025 -

Strategic Energy Partnership Saudi Arabia And India To Establish Two Oil Refineries

Apr 24, 2025

Strategic Energy Partnership Saudi Arabia And India To Establish Two Oil Refineries

Apr 24, 2025

Latest Posts

-

Trumps Tariff Strategy Senator Warners Assessment

May 10, 2025

Trumps Tariff Strategy Senator Warners Assessment

May 10, 2025 -

U S Federal Reserve Rate Decision Economic Uncertainty And The Path Forward

May 10, 2025

U S Federal Reserve Rate Decision Economic Uncertainty And The Path Forward

May 10, 2025 -

Senator Warner On Trumps Unwavering Stance On Tariffs

May 10, 2025

Senator Warner On Trumps Unwavering Stance On Tariffs

May 10, 2025 -

Suncor Production Reaches Record High While Sales Face Inventory Challenges

May 10, 2025

Suncor Production Reaches Record High While Sales Face Inventory Challenges

May 10, 2025 -

Weight Watchers Files For Bankruptcy Amidst Growing Weight Loss Medication Market

May 10, 2025

Weight Watchers Files For Bankruptcy Amidst Growing Weight Loss Medication Market

May 10, 2025