Significant Drop In Tesla's Q1 Profit: The Musk Administration Backlash

Table of Contents

Aggressive Price Cuts and Their Impact on Profit Margins

Tesla's aggressive price cuts across its vehicle lineup are a primary contributor to the reduced Q1 profit. This Tesla price war, while aiming to boost sales volume, significantly impacted profit margins.

- Magnitude of Price Reductions: Tesla implemented substantial price cuts, ranging from several thousand dollars depending on the model, significantly altering the pricing strategy compared to previous quarters.

- Impact on Revenue Generation: While sales volume may have increased initially due to the lower Tesla prices, the reduction in per-unit profit significantly lowered overall revenue generation, leading to the substantial drop in Tesla Q1 profit.

- Comparison to Competitors: Compared to competitors in the EV market, Tesla's pricing strategy appears more aggressive, potentially triggering a price war that benefits consumers but hurts manufacturers’ bottom lines. This strategy also risked undermining the perception of Tesla vehicles as premium products.

- Short-Term vs. Long-Term Implications: The short-term impact is clear – a significant drop in Tesla Q1 profit. The long-term implications remain uncertain, with questions around the sustainability of this discounted pricing strategy and its effect on brand perception. The success of this approach will hinge on whether increased sales volume outweighs reduced profit margins.

- Data and Statistics: (Note: This section would ideally include specific data on price reductions, sales figures, and profit margin changes from Tesla's Q1 2024 financial report. This data is crucial for a robust analysis but unavailable for hypothetical purposes).

Increased Competition in the Electric Vehicle Market

The rapid growth of the electric vehicle (EV) market has brought increased competition, posing a significant challenge to Tesla's dominance. The rise of new EV manufacturers and the expansion of existing automotive players into the EV sector are shrinking Tesla’s market share.

- Growing Number of Competitors: The EV market is no longer Tesla's sole domain. Numerous new companies are entering the market, offering competitive products and technologies.

- Competitive Landscape and Market Share: Tesla's market share is undeniably declining as more competitors introduce compelling electric vehicles. This competition directly impacts Tesla sales and its overall market dominance.

- Impact of New Entrants: New entrants are impacting Tesla sales not just through direct competition, but also by influencing consumer perception and driving innovation in the broader EV sector.

- Specific Competitors and Strategies: (Note: This section should name specific competitors – for example, BYD, Volkswagen, Ford – and analyze their respective strategies and their impact on Tesla.)

- Government Subsidies and Incentives: Government subsidies and incentives for electric vehicle adoption influence the competitive landscape, favoring some players over others and creating further pressure on Tesla's pricing strategy.

The Impact of Elon Musk's Controversies and Distractions

Elon Musk's various controversies and distractions have undeniably affected Tesla's brand image, investor confidence, and overall operational efficiency.

- Recent Controversies: Recent controversies and public statements have generated negative publicity, impacting Tesla's reputation and potentially impacting Tesla stock value. (Specific examples of recent controversies should be cited here.)

- Effect on Investor Confidence: The negative publicity and Musk’s unpredictable behavior have undeniably shaken investor confidence, potentially influencing investment decisions and impacting the Tesla stock price.

- Musk's Focus on Other Ventures: Musk’s considerable time and resources dedicated to ventures such as Twitter are perceived by some as diverting attention and resources from Tesla's core operations.

- Long-Term Consequences of Reputational Damage: The long-term consequences of this reputational damage are difficult to quantify, but a damaged brand image and decreased consumer trust could negatively affect Tesla's long-term growth and profitability.

- Social Media Sentiment Analysis: (Note: If data is available, this section could include analysis of social media sentiment regarding Tesla and Elon Musk to quantify the impact of negative publicity.)

The Twitter Acquisition and its Ripple Effects

The Twitter acquisition represents a significant financial burden on Tesla and has raised considerable concern among investors.

- Financial Strain on Tesla: The considerable financial resources committed to the Twitter acquisition have strained Tesla's finances, diverting funds that could have been used for research, development, or marketing.

- Investor Concerns: Investors are worried about the use of Tesla resources for Twitter, potentially jeopardizing Tesla's long-term financial health and strategic priorities.

- Impact on Tesla's Financial Health: The acquisition has created a considerable debt and financial burden, potentially impacting the company's ability to invest in future growth and development.

- Potential Divestment Strategies: (Note: This section should discuss potential strategies Tesla might employ to mitigate the financial burden of the Twitter acquisition.)

Conclusion

The significant drop in Tesla's Q1 profit is a complex issue resulting from a combination of factors. Aggressive price cuts aimed at increasing market share have negatively impacted profit margins. Intense competition in the rapidly expanding EV market is eroding Tesla's market dominance. Moreover, controversies and distractions surrounding Elon Musk's leadership, including the substantial financial burden of the Twitter acquisition, have negatively impacted investor confidence and brand perception. This confluence of factors presents a significant challenge for Tesla. Addressing these issues effectively will be crucial for regaining profitability and market share in the coming quarters.

Call to Action: Understanding the factors contributing to this "Musk administration" backlash is critical for investors and industry analysts. Stay informed by following further analyses of Tesla’s performance and the broader impact on the electric vehicle market. Continue to monitor the ongoing developments surrounding the Tesla Q1 profit drop and the strategic responses employed to address this significant challenge.

Featured Posts

-

Harvard Trump Administration A Looming Legal Battle And Potential For Negotiation

Apr 24, 2025

Harvard Trump Administration A Looming Legal Battle And Potential For Negotiation

Apr 24, 2025 -

Open Ai And Chat Gpt The Ftc Investigation And Future Of Ai Regulation

Apr 24, 2025

Open Ai And Chat Gpt The Ftc Investigation And Future Of Ai Regulation

Apr 24, 2025 -

Cantor Fitzgerald In Talks For 3 Billion Crypto Spac With Tether And Soft Bank

Apr 24, 2025

Cantor Fitzgerald In Talks For 3 Billion Crypto Spac With Tether And Soft Bank

Apr 24, 2025 -

The Bold And The Beautiful Wednesday April 16 Recap Liams Behavior And Bridgets Discovery

Apr 24, 2025

The Bold And The Beautiful Wednesday April 16 Recap Liams Behavior And Bridgets Discovery

Apr 24, 2025 -

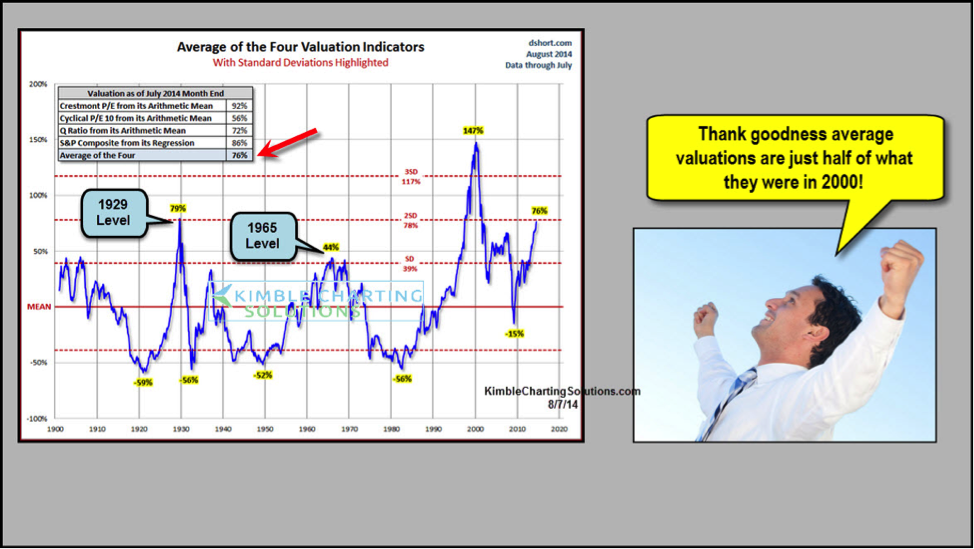

Stock Market Valuations Bof As Reassuring View For Investors

Apr 24, 2025

Stock Market Valuations Bof As Reassuring View For Investors

Apr 24, 2025

Latest Posts

-

Will The Oilers Eliminate The Kings A Look At The Betting Lines

May 10, 2025

Will The Oilers Eliminate The Kings A Look At The Betting Lines

May 10, 2025 -

Betting On The Oilers Kings Series Odds And Expert Analysis

May 10, 2025

Betting On The Oilers Kings Series Odds And Expert Analysis

May 10, 2025 -

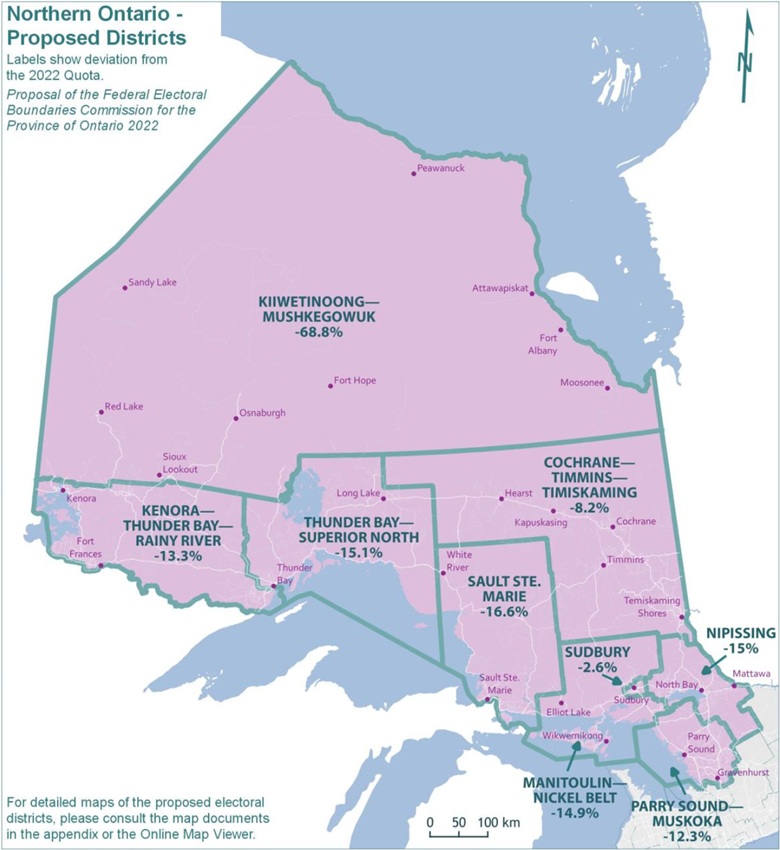

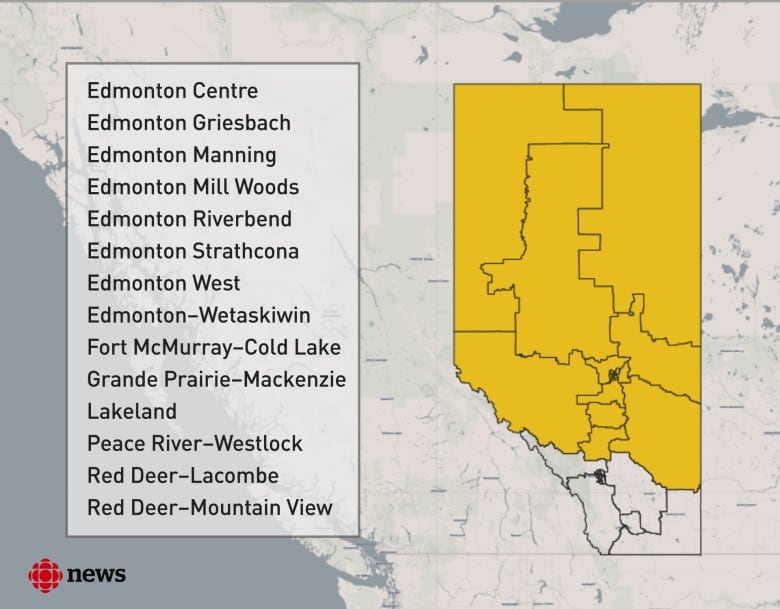

Federal Electoral Boundaries Understanding The Changes In Edmonton

May 10, 2025

Federal Electoral Boundaries Understanding The Changes In Edmonton

May 10, 2025 -

Edmonton Oilers To Sweep Kings Analyzing The Series Odds

May 10, 2025

Edmonton Oilers To Sweep Kings Analyzing The Series Odds

May 10, 2025 -

Greater Edmontons New Federal Ridings A Voters Guide

May 10, 2025

Greater Edmontons New Federal Ridings A Voters Guide

May 10, 2025